Gold M&A fires up in the Murchison near Surefire’s Yidby discovery

Pic: Schroptschop / E+ via Getty Images

Interest in prospective gold ground in the Murchison region of Western Australia is hotting up, placing explorers in the region squarely on the radar of potential buyers.

News last week of Capricorn Metals’ (ASX:CMM) planned $40m acquisition of the 2.1-million-ounce Mt Gibson gold mine for just under $20 an ounce has placed the region back in the spotlight.

The Murchison is one of the oldest and richest gold provinces in WA, but it has not been explored to the same extent as other goldfields in the state.

The reason the Murchison is so prospective is it lies in the Yilgarn Craton that has spawned numerous major mines and is sometimes described as “Australia’s premier gold and nickel province”.

It accounts for the bulk of WA’s land mass and is not just one single prospective area. It actually covers several different “terranes”, which in turn have their own “belts”.

Capricorn executive chairman Mark Clark said last week the Mt Gibson gold project was an “outstanding opportunity” for the company to grow beyond the now operational Karlawinda project.

“The project has a proven gold endowment, is located in the world class mining jurisdiction of WA and has been subject to very limited modern exploration,” he said.

“There is every reason to be optimistic about the opportunity with last gold production over 30 years ago from very shallow open pits when the gold price was around A$450 per ounce.”

The Aussie dollar gold price is over 5x what it was back then, sitting around $2,400 an ounce.

It may have pulled back from the record highs of over $2,800 it reached in August last year, but some gold industry commentators are banking on the price going back up again.

Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, said in his weekly Stockhead column last week that he agreed with Anna Golubova from Kitco News who considered that gold would be a critical safe-haven asset in light of real inflation threats.

“I believe that inflation together with impending market meltdowns (according to some of our level-headed doomsday prepper friends mentioned last week) will ultimately determine gold’s fate in the longer term,” he said.

“This, in my view, will be up.”

While Macquarie is very conservative with its gold price predictions, Le Page is a lot more bullish, forecasting the price will hit $US2,100 ($2,843) an ounce in 2023, rising even further to $US2,200 an ounce in 2025.

The high gold price is likely to be another catalyst that spurs M&A activity in regions like the Murchison that haven’t been thoroughly picked over and still have plenty of riches in the ground to find.

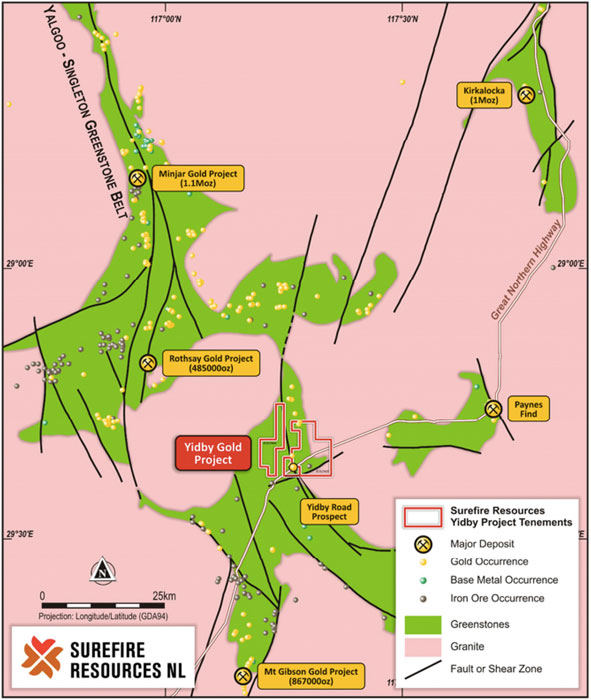

Surefire Resources’ (ASX:SRN) Yidby gold project is located just 30km to the north of the Mount Gibson project.

The Yidby project spans 114sqkm of prospective greenstone terrain within the extremely fertile Yalgoo-Singleton Greenstone Belt.

It is located 40km from the mining centre of Payne’s Find (71,000oz) and is surrounded by major mines and deposits such as Golden Grove, Rothsay (485,000oz), Kirkalocka (1 million oz) and Minjar (1.1 million oz).

Surefire’s drilling so far has been successful, returning up to 100m wide intersections that have extended the discovery at depth and along strike.

Top intercepts returned so far comprised 100m at 0.53 grams per tonne (g/t) from 96m, including higher-grade intervals of 1m at 23.13g/t from 113m.

“Drilling to date has continued to generate very thick intersections of gold mineralisation that also includes high-grade intervals,” managing director Vladimir Nikolaenko told Stockhead.

“Together with mobile metal ions (MMI) geochemistry surveys suggests a significant extent to the 2020 gold discovery, with up to 1.5km and 400m of width yet to be tested.

“Yidby Road is an exciting new and developing gold discovery.”

From the outset Yidby has been delivering for Surefire, with maiden drilling last year yielding wide zones of mineralisation that included high-grade sections close to surface and that were better than historic drilling results.

The initial hit that was the catalyst for a massive 2150 per cent share price surge late in 2020 measured 56m at 1.97g/t gold from 44m, including 4m at 14.47g/t from 76m.

The regional scale structural corridor that hosts the Yidby Road prospect mineralisation has now been identified over a greater than 5km strike length within Surefire’s tenements, offering considerable potential for the discovery of a major gold mineralised system.

This article was developed in collaboration with Surefire Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.