Guy on Rocks: Gold Price Forecast — APE versus the CFA

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Despite US bond yields dropping to their lowest point since mid-February of this year, which should be bullish for gold, the yellow metal has continued to trade in a tight range around US$1,800/ounce, closing at US$1,812 for the week.

Those that consider gold is driven by US$, inflation and interest rate moves are now seeing a divergence in views between the Federal Reserve and the European Central Bank regarding inflationary outlooks with the ECB stating it wouldn’t raise interest rates unless inflation reaches its 2% target.

The Federal Reserve however appears to be talking more about tapering its monthly bond-purchases.

I tend to agree with Anna Golubova from Kitco News who considers that gold will be a critical safe-haven asset in the light of real inflation threats. I believe that inflation together with impending market meltdowns (according to some of our level-headed doomsday prepper friends mentioned last week) will ultimately determine gold’s fate in the longer term.

This, in my view, will be up.

Of note was Brazil’s central bank Banco Central do Brazil buying 41.8 tonnes of gold last month which amounts to a 50% increase in their gold reserves this year. Given that Brazil spends most of its waking hours in chaos, I think this is a wise move.

Elsewhere palladium closed at US$2,608/ounce, down 6.5% for the week after a stellar 2021 while Pt was also off 3.3% for the week closing at US$1,055 /ounce.

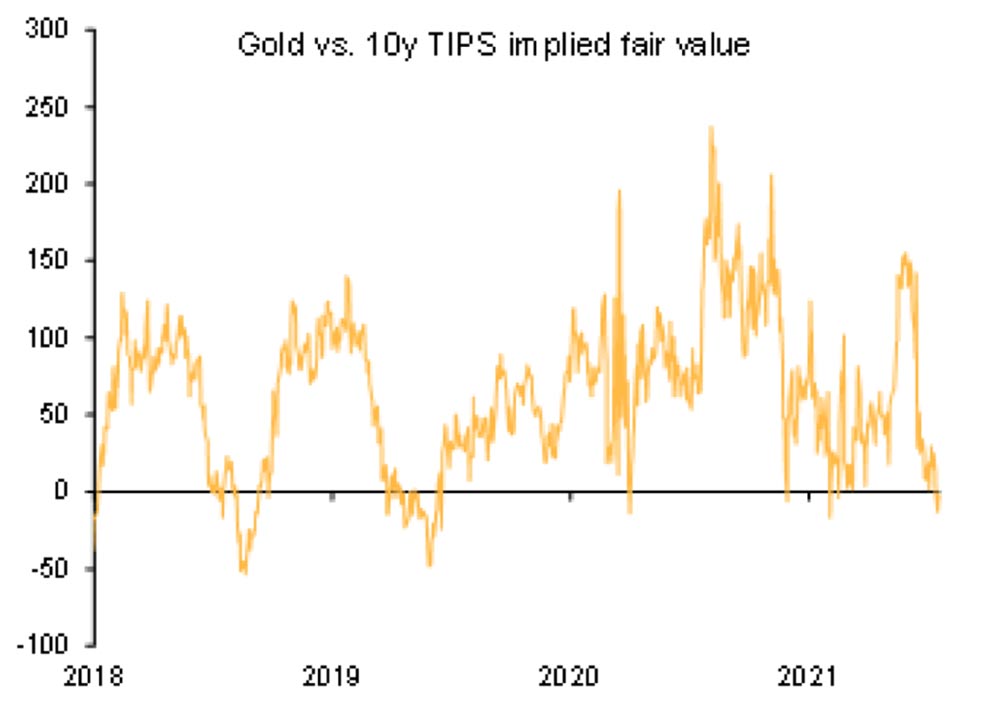

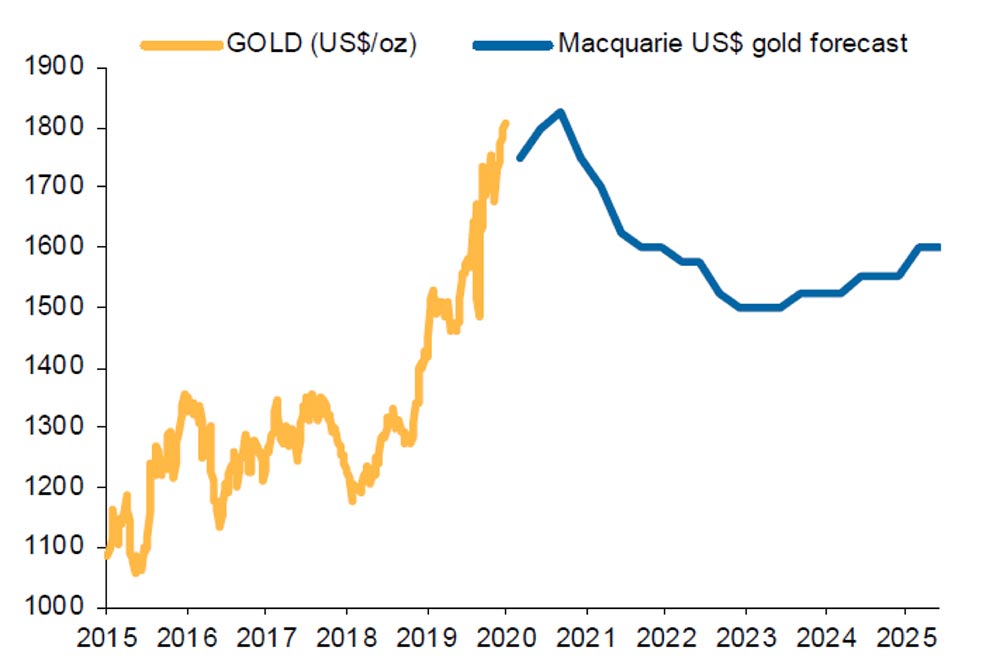

Just a quick look at how Macquarie is tracking (who think gold is trading at fair value based on US treasuries – figure 1) with its forecasts going back to July 2020 which was projecting a gold price of circa US$1,750, not far off its actual price circa US$1,800. So that is a good effort (compared to their iron ore forecasts) and implies that interest rates/inflation outlook have been driving moves in gold over the last 12 months or so.

I know there are plenty of smart CFAs (Certified Financial Apes) at Macquarie, but it looks like their forward projections are drawn by someone who has been to one of our extended sessions at Cigar Social in West Perth.

Anyway, if they keep on talking the gold price down, I’ll have them arrested if they attempt to cross the WA border….

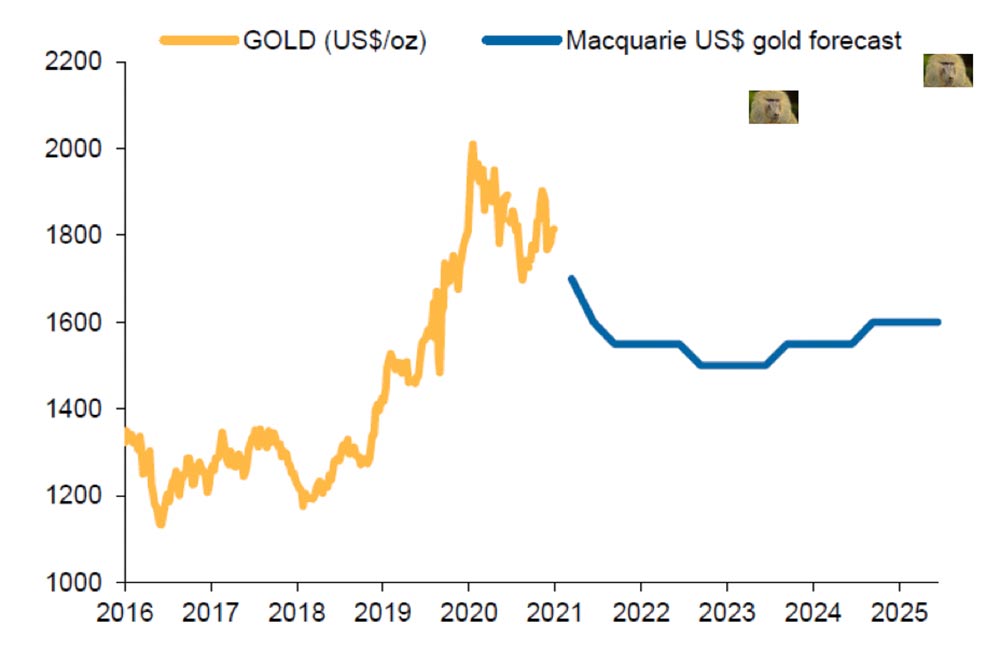

In the interests of fair play, I have put my friendly baboon (who doesn’t have a CFA) on figure 3 to mark where I think gold should land in 2023 and 2025. These projections, of course, are based entirely on science.

Finally, Elon Musk had a brainwave regarding the mining of Bitcoin suggesting that uranium would be a good energy source.

This statement unfortunately wasn’t enough to budge uranium (figure 4) which seems stuck around US$32/pound for the seventh straight week, but I think he has a good point. That of course will depend on whether Bitcoin will be around long enough to see it plugged into a nuclear reactor.

Company news

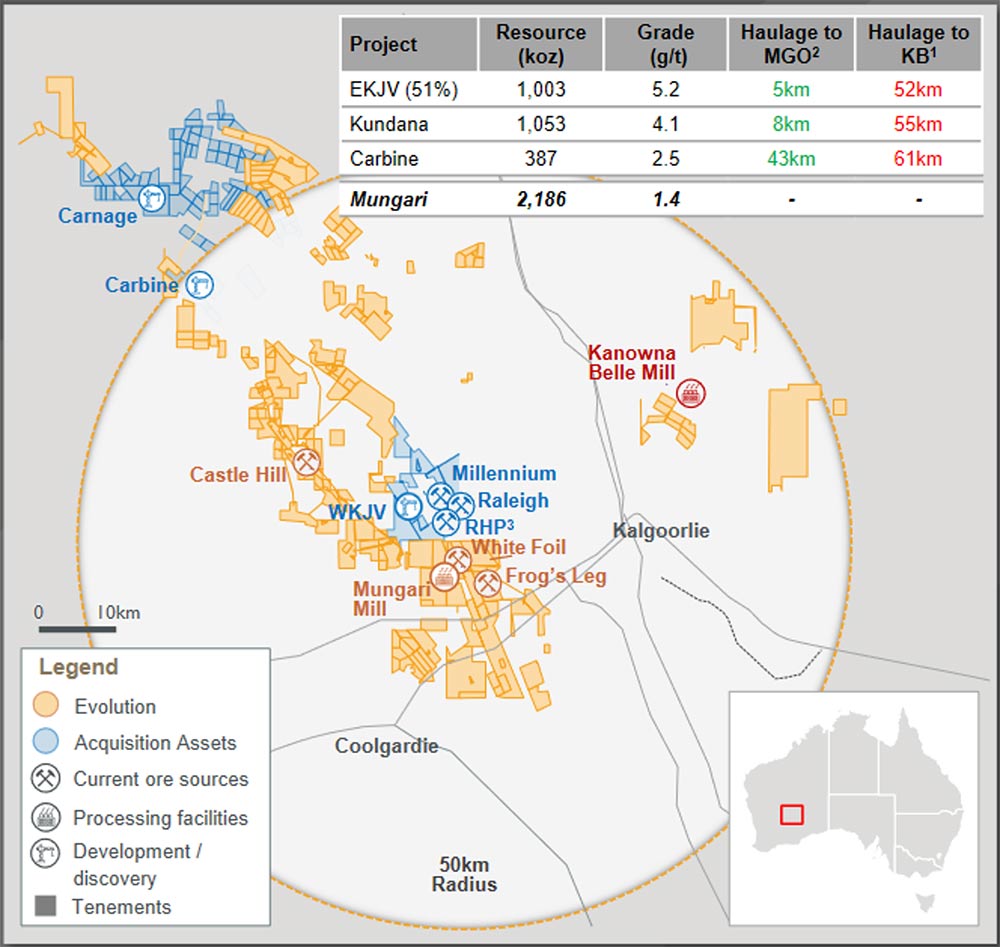

Evolution Mining Limited (ASX:EVN) announced (22nd July 2021) that it had agreed to acquire the Kundana and Carbine assets for A$400 million from Northern Star Resources Ltd (ASX: NST).

The assets include:

‒ 100% interest in the Kundana Operations through the acquisition of Kundana Gold Pty Ltd;

‒ 51% interest in the East Kundana JV through the acquisition of Gilt-Edge Mining Pty Ltd;

‒ 75% interest in the West Kundana JV through the acquisition of Gilt-Edge Mining Pty Ltd; and

‒ 100% interest in certain tenements comprising the Carbine Project.

A smart move for EVN who can now consolidate their existing Mungari operations and adds 579,000 ounces of JORC Reserves and 2.4Moz of JORC Resources (figure 6) to their balance sheet. The acquisition is also supported by an underwritten $400 million placement at $3.85 in EVN.

This is also good news for Tribune Resources Ltd (ASX:TBR) (figure 7) who now have a new running mate after a fairly volatile relationship with NST which unfortunately ended up in litigation.

The majority of the value is in my view assigned to the EKJV of which TBR owns 36.75% putting an implied value of $294 million on their interest or $5.65/Share.

This values TBR’s Philippine, Ghanaian assets (1.8Moz JORC Resources) at zero not to mention around 100,000 ounces of gold in the vault….

Viking Mines Limited (ASX:VKA) saw some good volume on Friday closing up 28% to finish at 2.3c after a 20 cm quartz vein containing visible gold was identified 58m deep in a step out hole VDD016 situated 165 metres north of their 100% owned First Hit mine (WA).

Another company receiving some investor interest late in the week was Dreadnought Resources Limited (ASX:DRE) (figure 8) that closed up another 19% to close the week at 6.2c on heavy volume after a positive announcement on high-grade REE assays covering ~2.5kms of ironstone outcrops at the Yin prospect (Yangibana REE project, WA).

Highlights from surface sampling included 7.50% TREO including 2.73% Nd2O3+Pr6O11 (rare earths). The mineralisation shows many similarities to Hastings Technology Metals Ltd’s (ASX:HAS) nearby (15 km south-west) Yangibana REE Project which is currently under construction.

New ideas

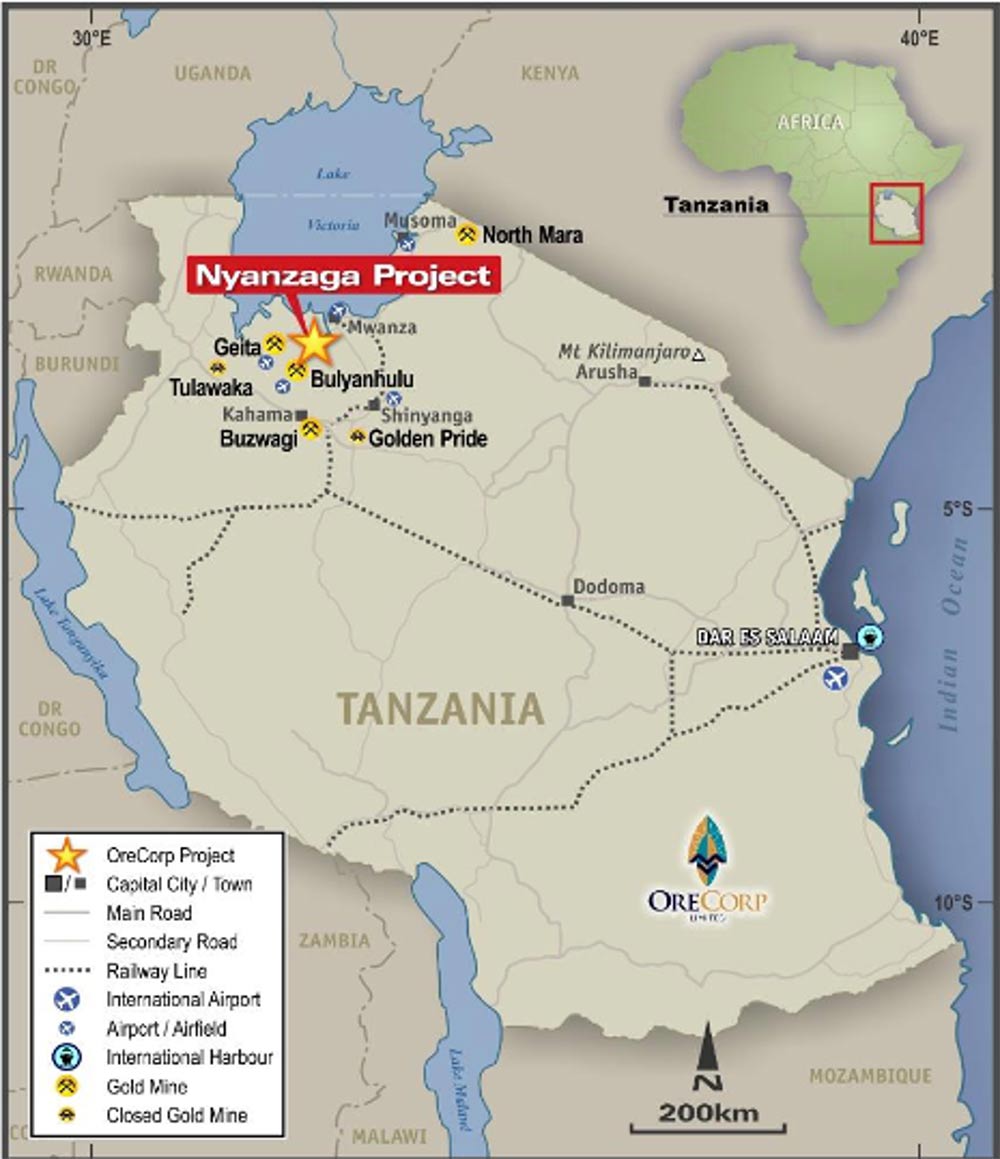

OreCorp Limited (ASX:ORR) (figure 9) recently completed a $56 million placement at 80 cents (ORR ASX Announcement 25 June 2021) with funds to be applied towards a Definitive Feasibility Study at its 100% owned Nyanzaga Gold Project (figure 10) in Tanzania containing JORC Resources of 23.7Mt @ 4 g/t gold for a total of 3.1Moz (1.5 g/t cut-off) (Table 1).

Note the Tanzanian Government will have a 15% free carry through production.

The project boasts an impressive set of financial metrics with LOM open cut and underground production of 213oz per annum over 12 years (for 1.75 Moz) based on a US$287 million CAPEX. Gold recoveries (PFS) are 88% through a conventional 4Mtpa Carbon in Leach with all in sustaining costs at a very competitive US$838 per ounce.

A significant milestone was the granting of cabinet approval on 2 June 2021 for the Special Mining Lease.

Euroz are valuing the company at around $1.14 which incorporates a 35% discount on the Nyanzaga Project NPV of A$552 million (i.e., $365 million) which I’m inclined to agree with.

Tanzania has experienced some headwinds in recent years however I believe the recent swearing-in of new President Samia Suluhu Hassan in March 2021 could see a turnaround in investor sentiment and should see the valuation gap for ORR close over time.

With some very capable management such as Craig Williams and Alistair Morrison (who despite being from NZ is a very capable geologist that I have previously worked with) I think ORR, with a high-quality gold project and associated compelling financial metrics, is a must-have in a gold portfolio.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.