These ASX explorers say ‘company makers’ still lurk in one of WA’s oldest, richest gold provinces

Mining

Mining

Australian explorers continue to prove that there are still new treasures to be found in historic goldfields. There is one region in particular that is extremely fertile but has not been as closely looked at as others — the Murchison in WA.

“What we’ve seen over the past decade is that many exploration companies have ventured back to long-overlooked historic Western Australian goldfields, armed with a new level of geological understanding and interpretation,” MineLife analyst Gavin Wendt told Stockhead.

“A very good example of this is Gold Road Resources (ASX:GOR) at Yamarna, but there are lots of others. (You can read more about Gold Road’s ‘rags to riches’ story here.)

“The key is to find a large acreage position, or province, where regional-scale exploration can be applied. If the new interpretation proves valid, then a company has a potentially company-making discovery on its hands.”

This is where the Murchison region in the Yilgarn Craton ticks all the boxes for uncovering a major new discovery.

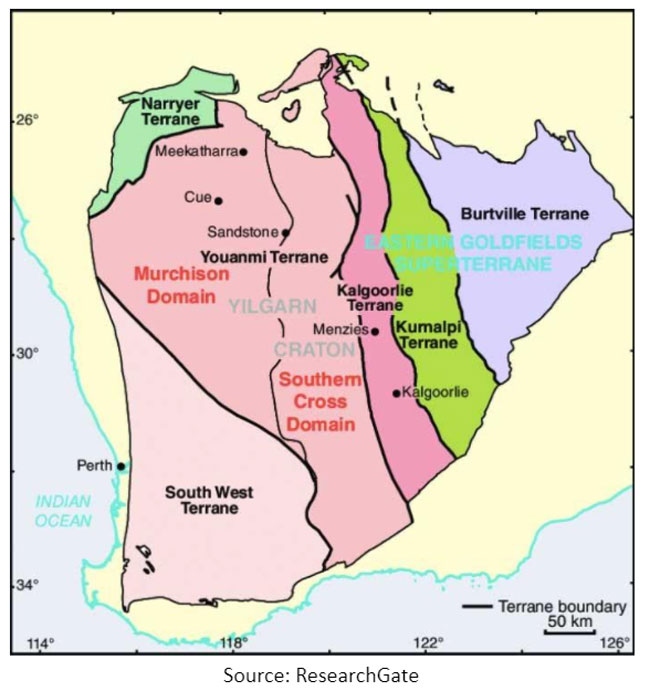

The Yilgarn Craton has spawned numerous major mines and is sometimes described as “Australia’s premier gold and nickel province”.

It accounts for the bulk of WA’s land mass and is not just one single prospective area. It actually covers several different “terranes”, which in turn have their own “belts”.

“In the case of the Murchison Province in the Archaean Yilgarn Craton, it’s a relatively unknown greenstone belt and has not received the same level of exploration attention as other WA gold-bearing greenstone belts,” Wendt explained.

“Geologically, it’s highly prospective as it’s comprised of various greenstone belts surrounded by several generations of granitoid intrusions.”

One belt in particular that is proving to be quite gold rich is the 190km-long Yalgoo-Singleton greenstone belt (YSGB), which extends in a north-northwest direction from Mount Gibson in the south, to north of Yalgootown and hosts significant gold deposits.

This belt in particular hosts the Mt Gibson gold mine, which previously produced 867,000oz, and the 1.1-million-oz Minjar gold project.

“It’s not a bad place to be exploring for gold,” Wendt said.

“At the same time, the YSGB also hosts world-class volcanogenic massive sulphide (VMS) deposits, including the Cu-Pb-Zn-Ag-Au Golden Grove mine.

“The source(s) and timing of the mineralising fluids are still not that well understood, so this is where the upside lies.”

The EMR Capital-owned Golden Grove mine has been in production for nearly three decades.

There are a number of ASX-listed juniors that are proving up potentially major finds in the Murchison region.

Investors latched onto Surefire Resources (ASX:SRN) late last year after maiden drilling at the Yidby gold project delivered better results than the company could have hoped for.

Drilling intersected wide zones of mineralisation that included high-grade sections close to surface and that were better than historic drilling results.

The first eight of 20 holes returned top hits like 56m at 1.97 grams per tonne (g/t) gold from 44m, including 4m at 14.47g/t from 76m; and 40m at 3.01g/t from 24m, including 4m at 26.57g/t from 52m.

To put that into context, anything above 5g/t is generally considered high-grade, but even at the current high gold price, grades of 1-2g/t can also be economic, particularly if the mineralisation is hosted within wide zones close to surface.

Surefire is currently drill testing extensions to those thick gold mineralised zones which remain open down dip and along strike/down plunge to the north and south.

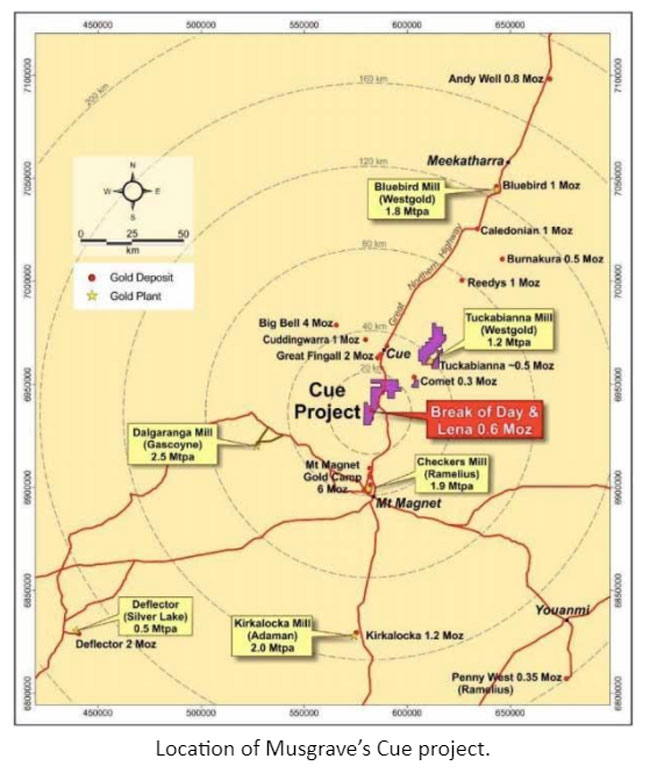

Meanwhile, Musgrave Minerals’ (ASX:MGV) Break of Day discovery, part of the Cue project in Western Australia’s Murchison region, is shaping up as one of the highest-grade undeveloped gold deposits in the country.

The project is surrounded by significant gold producers like Ramelius Resources (ASX:RMS), Westgold Resources (ASX:WGX) and Silver Lake Resources (ASX:SLR).

Drilling at the Cue project continues to deliver high-grade, near-surface hits.

Recent drilling at the White Heat prospect, which sits 300m south of Break of Day, returned peak hits of 11m at 19.6g/t gold from 48m, including 2m at 94g/t from 48m, and 21m at 7.4g/t from 64m, including 1m at 35.9g/t from 64m, 12m at 9.9g/t from 73m and 1m at 84.5g/t from 83m.

The mineralisation remains open down plunge and Musgrave is undertaking further drilling to further define the limits and plunge of the mineralisation.

Firefly Resources (ASX:FFR) has also just recently kicked off an aggressive drilling campaign in the Murchison, at its Yalgoo gold project in WA.

The company is undertaking 30,000m of drilling with the goal of defining resources for a further seven prospects.

Earlier in March, Firefly delivered a 196,000oz maiden resource for its Melville prospect, which the company wanted to establish as its key surface gold asset.

But that is just the tip of the iceberg. Firefly has over 100 gold targets, 30 or so untested historical workings with recorded gold production and at least 10 advanced ‘pre-resource’ gold prospects.

“The current resource footprint covers just 0.9km of the 5km-plus strike length of the Melville/Oakford gold trend and, with the resource extending to a depth of just 200m, that leaves a lot of real estate along-strike and at depth for further growth,” managing director Simon Lawson said recently.

“Unlike most other gold deposits in the WA’s historic goldfields, Melville is a ‘virgin’ deposit which has never been mined. This untouched status, as well as the thick, folded banded-iron formation host and steeply dipping geometry creates a very favourable scenario for open pit mining.

“The recently completed independent pit optimisation study on the current resource certainly suggests we have several attractive options available to us.”

Terrain Minerals (ASX:TMX) will soon start a phase two drilling program at its 80 per cent owned Smokebush gold project that sits 65km west of the former gold rush settlement of Payne’s Find.

A previous review of historic data identified extensive untested surface gold geochemical anomalies as well as highlighted significant gold intersections from sparse first pass drilling.

Notable results from Terrain’s initial drilling at the Monza prospect were 4m at 4.46g/t gold, including 1m at 10.3g/t, from 51m; 7m at 2.72g/t, including 1m at 11.1g/t, from 25m; and 6m at 2.12g/t, including 1m at 7.2g/t, from 80m.

Terrain is planning to undertake a 17-hole, 2100m follow-up drilling program at the Monza and Paradise City prospects.

While not quite a junior, Silver Lake Resources also has operations in the Murchison, expanding its portfolio over the past couple of years with the acquisitions of Doray Minerals (ASX:DRM) and its Deflector mine and Egan Street Resources (ASX:EGA) and its high-grade Rothsay project.

In the first half of the 2021 financial year, Deflector produced 55,416oz of gold and 931 tonnes of copper at an all-in-sustaining cost of $1202 an oz.

Since Silver Lake acquired the mine, it has reported two consecutive years of record production and grown the resources to 1.3 million oz at 13.2g/t and reserves to 446,000oz at 6.2g/t.

Meanwhile, underground development is ramping up at Rothsay with site infrastructure, including an air strip, now completed.

At Stockhead, we tell it like it is. While Surefire Resources and Musgrave Minerals are Stockhead advertisers, they did not sponsor this article.