Gold is good, but which miners are offering the best returns?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

A rising tide lifts all ships, as the old saying goes. But does it apply to gold miners and explorers?

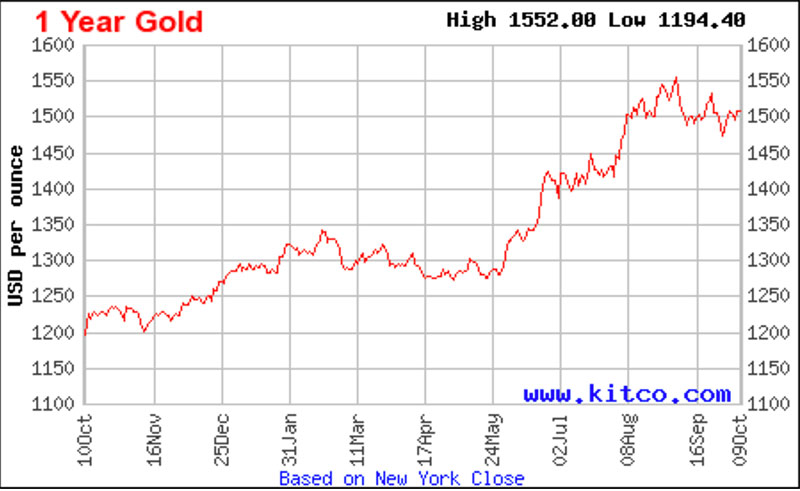

Against the background of a see-sawing global market, the rising gold price has provided solace for gold sector investors.

And with analysts raising their price forecasts, the gains could have further to run.

Analysts at Citi, for example, recently increased their price forecast to $US2,000 an ounce, arguing it will “trade stronger for longer” based on the host of geopolitical risks (for example U.S.-China trade tension), the prospects for weaker global economic growth, and continued loose monetary policy, with rates in major economies now expected to be ‘lower for longer’.

“We now expect spot gold prices to trade stronger for longer, possibly exceeding $US2000/oz and posting new cyclical highs in the next year or two,” Citi told clients in a note.

With gold trading at around $US1500 an ounce, there is the prospect for significant gains if analysts bullish gold price forecasts are on the money.

Bigger is better

But not all gold mining shares are benefitting equally so far.

Rather than blindly buying any miner that produces the precious metal, analysts at Bell Potter reckon you should focus on producers operating more than one mine.

In a recent detailed report, it pointed to the divergence among gold mining stocks, with multi-asset gold producers enjoying sizeable share price gains when compared with single mine stocks.

It found that the share prices of multi-mine producers have risen around 85 per cent on average over the past year (with additional cream on top flowing from dividend payments), compared with a bare 1 per cent gain for miners with a single asset.

This has meant share price gains for the likes of Red 5 (ASX:RED) and Silver Lake Resources (ASX:SLR), as they transition from single mine operators to multi asset producers.

“There are good reasons for the outperformance and the market giving recognition to this thematic – primarily the diversification of production and jurisdiction risk, the smoothing of operational performance and cashflows and typically lower cost of capital,” Bell Potter analyst David Coates wrote in his note.

“There is no secret and was the strategic foundation of Evolution Mining (just ten years ago), which has been one of the most successful exponents of this model.”

A decade ago, Evolution’s (ASX:EVN) share price was around $1.50. It now stands at $4.70 giving the company an $8 billion market capitalisation.

Bell Potter’s Top Picks

Bell Potter’s favourite pick in the sector is Regis Resources (ASX:RRL).

Even though it has a ‘hold’ recommendation, the broker argues the market is undervaluing the prospects for the McPhillamys development prospects in central western NSW, where it bought out Alkane’s stake a few years ago. Bell Potter has a $5.27 price target on Regis, ahead of its $5.03 share price.

It is wary of other producers such as Dacian (ASX:DCN), which has run into problems with its Mount Morgan project.

Others, such as Alkane Resources (ASX:ALK) have enjoyed a surge in its share price thanks both to exploration success at its acreage in the central west of NSW, as well as its efforts to broaden its base by buying into Genesis Minerals (ASX:GMD) and Calidus Resources (ASX:CAI) where it holds a respective 15 per cent and 13 per cent holding.

Bell Potter also has outright buy recommendations on three tiddlers of the sector – Pantoro (ASX:PNR), Xanadu (ASX:XAM) and Breaker Resources (ASX:BRB).

READ MORE:

Pantoro is trying to solve the puzzle at one of Australia’s richest goldfields

Shallow gold could hold the key to unlocking bigger returns for Xanadu

Breaker says ‘brb, just trying to find the end of our monster gold deposit’

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.