Tim Treadgold: Pantoro is trying to solve the puzzle at one of Australia’s richest goldfields

Pic: Schroptschop / E+ via Getty Images

Few Australian goldfields have offered more promise than Norseman in WA, but it’s equally true to say that few goldfields have proved more difficult to tame, with the combination of complexity and potential making Pantoro (ASX:PNR) a stock to watch.

A deal earlier this year saw Pantoro acquire a 50 per cent stake in Norseman with the other half held by Tulla Resources, the mining investments arm of wealthy Sydney businessman Kevin Maloney.

Work on reviving Norseman started in earnest last month with a resource definition drilling program which should lead to a two-phase mining process – first by targeting quick cash flow from near-surface material, and then by underground development.

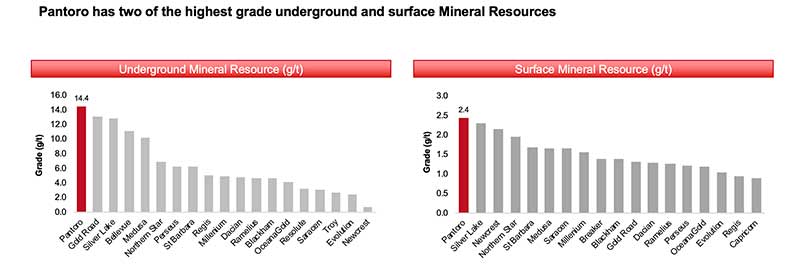

Located 200 kilometres south of Kalgoorlie, the home of WA’s gold industry, the Norseman region contains one of Australia’s richest gold endowments, boasting among the highest grades of underground and surface mineralisation.

And then there’s the history which dates back to the time of WA’s original gold rush in the 1890s when a series of small discoveries were made, followed by consolidation under the management of a once-great Australian company, Western Mining Corporation in 1935.

No-one familiar with the Norseman goldfields doubts the fabulous nature of the orebodies, but they’re also aware that of some of Norseman’s gold is “nuggety”.

This means it is hard to plan mine development, and even harder to drill out a resource because narrow drill holes can miss nuggets, or hit a few and create a false impression.

It was the nugget effect at Norseman, coupled with a low gold price through the 1990s which saw WMC sell one of its birthrights to Kalgoorlie-based Croesus Mining in 2002, only for Croesus itself to collapse a few years later thanks to a misjudged forward-selling arrangement when the gold price rose.

READ: Which stocks are among Bell Potter’s hot tips for FY 2020?

Modern exploration and mining technology should play an important role in mastering the geology of Norseman, while a much higher gold price should take care of the financial side of the business.

But if it was so simple there might have been a more enthusiastic reaction by investors who have not rushed to embrace Pantoro’s Norseman adventure – perhaps because of the history of the region, perhaps because they know a full-scale development will be expensive, perhaps because Pantoro only has a 50 per cent stake in the project, or perhaps because of a big share placement which raised $43 million following the Norseman deal.

There is also some concern over production costs at Pantoro’s other gold project, the Nicolsons mine near Halls Creek in the north of WA where a decline in output during the June quarter to 9557 ounces compared with 11,280oz in the March quarter lifted the cost per ounce to $1670/oz from $1217/oz.

For newcomers to Pantoro, perhaps the best way to see the stock is as an exploration play with its foot on what could become a high-class redevelopment of a goldfield which was once world-class.

The company’s managing director, Paul Cmrlec, was reported last month to have told delegates to the Denver Gold Forum in the US that Norseman had not been systematically explored for 25 years and not mined effectively for 15 years.

Near-term development would target about 1.3 million ounces of gold in a series of old workings, including the Gladstone, Everlasting, Maybelle, and Princess Royal open pits as well as the OK and Scotia underground mines.

One of the theories being pursued is that WMC, when it managed the Norseman assets, was focussed on the high-grade underground resource leaving undeveloped a number of near-surface deposits. These could represent easy starter pits for Pantoro.

Processing the ore will be another challenge for Pantoro with the old 720,000 tonne-a-year plant at the project requiring an estimated $25 million to be refurbished, while each small pit will have a price tag of between $10-to-$15 million.

Toll treating ore has been mentioned as a possibility to generate quick cash flow with a number of nearby processing plants owned by other companies potentially available.

What happens next at Norseman will be closely watched – and not just by investors – because the project has such a chequered history on many levels, including production challenges in the mines and at the processing plant.

Over the past few years, a number of workers have died at Norseman, most recently when a corroded gantry bridge collapsed. This led to a $150,000 fine in the Kalgoorlie Magistrates Court where, as the ABC reported, a safety inspector blamed the accident on old equipment in poor condition.

The challenge of refurbishing the old plant could be a reason for Pantoro to consider a toll-treating start so it can focus on exploration and early production, which is where the immediate value lies before moving on to something bigger.

Whatever the challenges at Norseman, Pantoro has one enormous advantage that eluded earlier owners – a local gold price of more than $2100/oz, four times higher than the $500/oz when WMC sold in 2002.

It’s the red-hot gold price which should underwrite Pantoro’s work at Norseman and why it is a stock with an interesting future built on even more interesting history.

NOW READ: More than 4 million oz says Pantoro could be running with the big boys very soon

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.