Gold Digger: The early mail on ASX gold miners for 2025

This week's gold reports show not all news is good news. Pic: Getty Images

- Gold prices are near record highs, but not all gold equities are made equal

- Early December quarter reports from ASX gold producers have been mixed

- We checked out the numbers from nine mid-tier gold miners

With prices circling record highs it’d be tempting to assume any bet on an ASX gold miner is a safe one right now.

But the numbers filing early out of the sector this year show that conclusion is a fallacy.

Any number of factors influence the performance of a gold mine, from stripping ratio to grade to capital requirements and exploration spend. And then there’s the impact of hedges, which can be cut well below the prevailing spot gold price.

And at the end of the day, prices of $4250/oz should mean big margins and large free cash flows. It doesn’t always.

Miners often drop production and cash figures ahead of their quarterly reports so they can turn the attention away from past performance onto future plans by the time their late January quarterly calls, especially if they need to get bad news out of the way first.

We’ve scoured the ASX for the good, bad and the curious of the ASX gold sector’s December quarter reporting so far.

Regis Resources (ASX:RRL)

Regis Resources has finally come back in vogue with investors after clearing its hedges and moving to cash generation mode despite regulatory struggles (cf McPhillamys) and a declining production profile.

In the end it’s not how much you produce but how much money you make off it. Regis generated a record cash and bullion build of $149 million from its 100% owned Duketon gold mine and 30% owned Tropicana to boast a record cash balance of $529m including gold on hand.

Duketon produced 58,300oz in the December quarter, up from 57,500oz in September, putting the mine on track to deliver guidance of 220,000-240,0000oz for the financial year.

Tropicana, meanwhile, outperformed at 43,000oz, up from 37,000oz in September. RRL’s 101,300oz total was up from 94,500oz, placing it well on track to hit guidance of 350,000-380,000oz for FY25.

The result and cash build places Regis, like many other gold miners, on M&A watch, with a focus also to turn to whether it delivers potential returns via a buyback, though it still had $300m of debt to pay down as of early December.

Regis shares are 53% higher in the past six months.

Bellevue Gold (ASX:BGL)

From good to bad and Bellevue Gold disappointed with just 26,230oz in gold sales at an average price of $3339/oz.

Production is weighted to the back half, but already guidance for FY25 has been trimmed from 165,000-180,000oz to 150,000-165,000oz. All-in sustaining costs are also up for review ahead of the quarterly.

Consensus forecasts had been 38,000oz, making the quarter a 30% miss. Canaccord Genuity analyst Tim McCormack estimated all-in sustaining costs of $2600/oz against the broker’s pre-report forecast of $1989/oz.

Slower than expected development rates have played a role, with development in the main area of the mine averaging 270m per month in the December quarter, delaying access to higher grade stopes.

BGL finished the quarter with $81m in cash, down from $109m pro-forma at September 30, with $100m of debt but no repayments due until CY27 after cutting its liabilities to banker Macquarie as part of a surprise capital raising in August.

Canaccord cut its price target from $2.25 to $2.10 on the announcement, with BGL down 45% over the past six months.

Gold Road Resources (ASX:GOR)

Happier times for Gold Road, which saw its 50% owned Gruyere gold mine produce a record 91,631oz in the December quarter.

That saw the Gold Fields managed operation produce 287,270oz for 2024, just below its annual guidance of 290,000-305,000oz (bearing in mind it had originally been set at 300,000-335,000oz before a rain affected start to 2024.)

Gold Road, unhedged, made the most of the record gold price in the quarter, selling 47,745oz at an average sale price of $4093/oz, with cash lifting from $109.2m to $173.9m.

Its listed investments were worth $740.6m, largely its 17% stake in De Grey Mining (ASX:DEG). There’s a standing watch on there from market observers to see if it sells out early to realise immediate value from De Grey’s $5bn scrip sale to Northern Star Resources (ASX:NST) or trades out to a potential interloper in the deal that will net Stu Tonkin and his team the 11.5Moz Hemi gold mine.

Perspectives on Gold Road are mixed. Euroz has a $2.65 price target and buy recommendation on the company, saying its undervalued relative to peers, while RBC has an underperform and $2.30 target on GOR.

The gold miner, which is under pressure to use its cash for an acquisition or shareholder returns, is up 22% in the past six months at $2.16, having traded at $1.87 before the NST-DEG agreement was announced.

Westgold Resources (ASX:WGX)

RBC has a $4.20 price target on WGX, hard to justify with cash generation stagnating in the December quarter.

Westgold is unhedged as well, announcing a QoQ lift from 77,369oz to 80,886oz in the December quarter.

It says first half production of 158,255oz is consistent with guidance, assuming a big second half loading will get the company to 400,000-420,000oz, but the concern for investors who sold off 8% of WGX on Thursday was the lack of cash build.

Its cash, bullion and liquid investments were collectively up from $103m to $152m between September 30 and December 31, but that included the drawing of $50m from a $300m corporate debt facility announced in October.

The focus is now on the development of additional mining fronts and infrastructure, with the Great Fingall mine in the Murchison to enter production late in the financial year and plant expansion studies underway for Higginsville, Bluebird and Fortnum to structurally reduce unit costs.

“Investment to support increased and sustainable production from our principal mines was the key focus of our activities over H1, with multiple growth projects advancing in parallel across the expanded group. Bluebird-South Junction and Beta Hunt are our key drivers of growth in H2, FY25 with operational changes being implemented to see outputs lift and become more consistent into H2, FY25,” MD Wayne Bramwell also said.

$2.5bn capped WGX is up 6% over the past six months, a period following its merger with TSX-listed Beta Hunt gold mine owner Karora Resources.

Catalyst Metals (ASX:CYL)

Up a massive 8% on announcing its December quarter production on Thursday, CYL produced 28,400oz in the three months to December 31.

That included 21,800oz at Plutonic in WA’s Mid West and 6600oz at Henty in Tasmania, with cash and bullion up $26m to $84m at the end of the quarter.

CYL says it is on track to meet guidance of 105,000-120,000oz of gold at AISC of $2300-2500/oz in FY25, with a second mine at Plutonic East to open this quarter and the company quadrupling its active drill fleet to eight in order to increase resources and reserves.

The K2 and Trident mines will come online over the next 12 months, providing additional feed for the Plutonic plant, MD James Champion de Crespigny said.

Emerald Resources (ASX:EMR)

Emerald produced 31,388oz at the Okvau mine in Cambodia, beating its 25,000-30,000oz production guidance with gold recoveries of 85.4% far exceeding historical plant performance of around 80% and higher mill availability enabling Okvau to run 17% above nameplate capacity. That took the plant’s scale from 2Mtpa to 2.3Mtpa thanks to throughout improvements since July 2024.

All-in sustaining costs are expected to come in towards the bottom end of the cost curve, within previously disclosed guidance of US$810-880/oz. EMR closed the quarter with $243m in cash, up from $180.8m at the end of September.

Canaccord upped its price target on Emerald from $4.60 to $5. EMR shares have traded 12% lower over the past siz months to $3.39.

Ramelius Resources (ASX:RMS)

Ramelius raked in $174.5m of underlying free cash flow after boosting gold production from 62,444oz to 85,311oz, 67,050oz of that from its flagship Mt Magnet hub.

The company is sitting on cash and gold of $501.7m, making it a serious player in M&A if it chooses to push the button. There could now be guidance upgrades, with ore from the newly opened Cue operations exceeding its grade expectations.

Euroz’s Michael Scantlebury reiterated comments this week from a note to clients in November that the high grades at Break of Day could outperform.

“As we have previously flagged on our site visit note published on the 1st of November “We believe there is a good chance of grade overcalling on the Break of Day ore, given the top-cut applied,” he said.

“We believe this is playing out and will become evident once in the full quarterly report and presents a potential upside risk to the FY25 guidance of 270-300,000oz at AISC of A$1500-1700/oz.”

Euroz maintained a $2.80 price target and buy recommendation, pointing to strong FY25 cash flows and an organic growth pipeline following studies on the Eridanus deposit at Mt Magnet and Rebecca/Roe project near Kalgoorlie. RMS shares are up 13.5% over the past six months to $2.19.

West African Resources (ASX:WAF)

WAF has the eternal overhang of its location in politically fraught Burkina Faso, but hit the upper end of guidance at the Sanbrado mine, producing 206,622oz for 2024.

That included 51,178oz in the December quarter, with 47,953oz sold at an average price of US$2690.oz.

199,500oz were sold at US$2391/oz across calendar 2024, powered by the high grade M1 South underground mine.

Mining is also expected to begin at the similarly sized Kiaka project in Q1 2025.

WAF shares are up 11.7% in the past six months to $1.58, despite ructions in October when the Burkina Faso government flagged the proposition of taking back mining permits. WAF righted the ship after telling the market its licences remained in good standing and the government, a military junta led by 36-year-old officer Ibrahim Traore, remains supportive of the Aussie gold miner.

Capricorn Metals (ASX:CMM)

Mark Clark’s Capricorn also says it’s on track to hit the mid-point of its FY25 guidance of between 110,000-120,000oz after producing 28,702oz in the December quarter at the Karlawinda gold mine and 54,261oz for the half year.

AISC for the quarter is expected to be within the FY25 cost guidance range of $1370-1470/oz.

CMM finished the quarter with $363.1m in cash, including $193.4m from a capital raising and $31.2m of cash build from operations, but will be spending the bulk of its cash bringing to $260m Mt Gibson gold mine in WA’s Mid West back into production.

Capricorn shares are up over 30% in the past six months to $6.72 for a market cap of $2.8bn, having closed on a record $7 in December.

Where are prices heading?

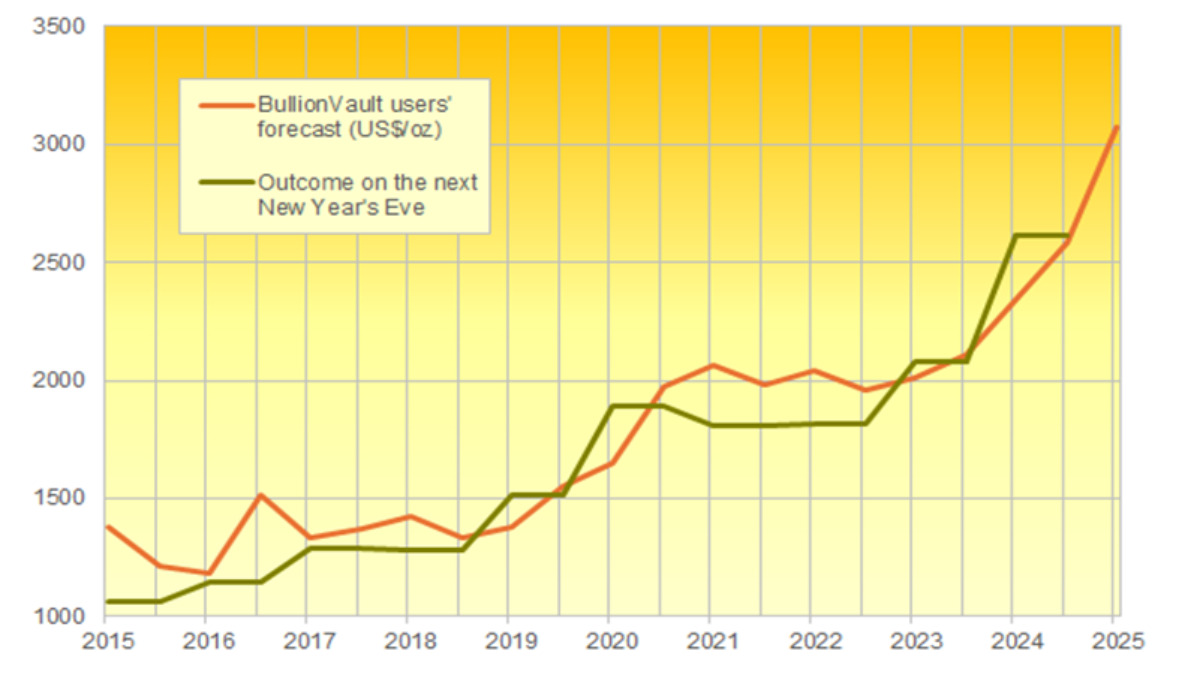

There is some positive news for those miners sitting on thin margins. Users of precious metals trading marketplace BullionVault in its December survey predicted gold prices would move, on average, 17.6% higher to US$3070/oz this year. Silver has been tipped by its customers to rise over 27% to US$36.90/oz.

Sprott says BullionVault’s predictions have, on average, been higher than those from the London Bullion Markets Association survey, which have undershot over the past couple years.

Winners & losers

Here’s how ASX-listed precious metals stocks are performing:

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.009 | 20% | 13% | 0% | -40% | 29% | $ 9,763,807.53 |

| NPM | Newpeak Metals | 0.013 | 18% | 30% | 0% | -23% | 18% | $ 4,186,932.50 |

| ASO | Aston Minerals Ltd | 0.01 | 0% | 11% | 0% | -57% | 11% | $ 12,950,642.69 |

| MTC | Metalstech Ltd | 0.1425 | 2% | 24% | -41% | -34% | 2% | $ 28,643,225.04 |

| GED | Golden Deeps | 0.025 | 0% | -4% | -24% | -44% | 0% | $ 3,788,058.73 |

| G88 | Golden Mile Res Ltd | 0.009 | 0% | -10% | -18% | -53% | 0% | $ 4,255,405.70 |

| LAT | Latitude 66 Limited | 0.046 | 7% | -34% | -68% | -77% | 21% | $ 6,596,432.43 |

| NMR | Native Mineral Res | 0.04 | 3% | 25% | 100% | 100% | 3% | $ 19,883,622.61 |

| AQX | Alice Queen Ltd | 0.008 | 0% | 14% | 14% | 45% | 0% | $ 9,175,120.54 |

| SLZ | Sultan Resources Ltd | 0.006 | 0% | -14% | -25% | -68% | 0% | $ 1,388,819.46 |

| MKG | Mako Gold | 0.014 | 8% | 0% | 56% | 40% | 8% | $ 13,812,667.05 |

| KSN | Kingston Resources | 0.074 | -1% | -8% | -4% | -1% | 4% | $ 57,158,473.32 |

| AMI | Aurelia Metals Ltd | 0.18 | 3% | 6% | -14% | 64% | 6% | $ 304,481,624.76 |

| GIB | Gibb River Diamonds | 0.04 | 0% | 3% | 8% | 38% | 0% | $ 8,794,887.25 |

| KCN | Kingsgate Consolid. | 1.32 | 2% | -7% | -15% | 3% | 3% | $ 340,232,233.44 |

| TMX | Terrain Minerals | 0.0035 | 17% | -13% | 0% | -22% | 17% | $ 6,337,434.14 |

| BNR | Bulletin Res Ltd | 0.039 | 5% | 3% | -13% | -72% | 0% | $ 11,157,306.27 |

| NXM | Nexus Minerals Ltd | 0.046 | 2% | -12% | 18% | 10% | 2% | $ 23,425,207.68 |

| SKY | SKY Metals Ltd | 0.051 | -6% | -6% | 46% | 42% | -6% | $ 36,245,861.47 |

| LM8 | Lunnonmetalslimited | 0.21 | -16% | -16% | 11% | -64% | -16% | $ 46,331,916.54 |

| CST | Castile Resources | 0.07 | -1% | -13% | 3% | -13% | -13% | $ 20,698,575.15 |

| YRL | Yandal Resources | 0.18 | 3% | -25% | 38% | 38% | 3% | $ 54,116,121.85 |

| FAU | First Au Ltd | 0.002 | 0% | -33% | 0% | -50% | 0% | $ 4,143,986.55 |

| ARL | Ardea Resources Ltd | 0.32 | -2% | -2% | -30% | -32% | -3% | $ 63,898,532.80 |

| GWR | GWR Group Ltd | 0.079 | -4% | -10% | -7% | -14% | -1% | $ 25,376,115.75 |

| IVR | Investigator Res Ltd | 0.021 | 0% | -43% | -56% | -40% | 5% | $ 33,366,471.05 |

| IPT | Impact Minerals | 0.011 | 10% | -4% | -27% | -15% | 10% | $ 36,713,204.62 |

| BNZ | Benzmining | 0.37 | 7% | 0% | 222% | 64% | 7% | $ 45,068,955.42 |

| MOH | Moho Resources | 0.005 | 25% | 11% | 0% | -50% | 0% | $ 3,582,372.87 |

| PUA | Peak Minerals Ltd | 0.009 | 13% | 29% | 117% | 262% | 13% | $ 20,416,882.11 |

| MRZ | Mont Royal Resources | 0.03 | -30% | -25% | -50% | -77% | -30% | $ 2,550,893.79 |

| SMS | Starmineralslimited | 0.034 | -6% | -11% | 21% | -9% | -6% | $ 4,141,426.20 |

| MVL | Marvel Gold Limited | 0.009 | 0% | -10% | 29% | -18% | 0% | $ 7,774,116.33 |

| PRX | Prodigy Gold NL | 0.002 | 0% | 0% | -25% | -63% | 0% | $ 6,350,111.10 |

| AAU | Antilles Gold Ltd | 0.004 | 0% | -20% | 33% | -81% | 33% | $ 7,431,504.23 |

| CWX | Carawine Resources | 0.1 | 0% | 5% | 14% | -5% | 0% | $ 23,612,544.90 |

| RND | Rand Mining Ltd | 1.4 | -3% | -13% | -6% | 2% | -8% | $ 79,626,345.40 |

| CAZ | Cazaly Resources | 0.014 | 8% | -18% | -30% | -52% | 0% | $ 6,458,241.87 |

| BMR | Ballymore Resources | 0.12 | 0% | -27% | -23% | -8% | 0% | $ 21,207,670.20 |

| DRE | Dreadnought Resources Ltd | 0.0115 | 5% | -12% | -48% | -57% | -4% | $ 41,445,800.00 |

| ZNC | Zenith Minerals Ltd | 0.037 | -8% | -10% | -21% | -70% | -8% | $ 15,075,332.61 |

| REZ | Resourc & En Grp Ltd | 0.026 | 4% | 4% | 86% | 108% | 13% | $ 15,447,699.81 |

| LEX | Lefroy Exploration | 0.068 | -4% | -4% | -31% | -60% | -3% | $ 17,119,409.51 |

| ERM | Emmerson Resources | 0.078 | -1% | 37% | 24% | 44% | 1% | $ 50,213,891.44 |

| AM7 | Arcadia Minerals | 0.02 | -5% | -9% | -43% | -71% | 5% | $ 2,347,668.66 |

| ADT | Adriatic Metals | 3.835 | -3% | -6% | 3% | 8% | -2% | $ 1,076,345,755.40 |

| AS1 | Asara Resources Ltd | 0.018 | 0% | -22% | 80% | 38% | -5% | $ 17,939,885.53 |

| CYL | Catalyst Metals | 3.01 | 16% | 13% | 163% | 382% | 17% | $ 641,793,264.96 |

| CHN | Chalice Mining Ltd | 1.0825 | -4% | -13% | -17% | -17% | -2% | $ 414,313,529.22 |

| KAL | Kalgoorliegoldmining | 0.018 | -5% | -25% | -38% | -38% | 0% | $ 4,915,951.24 |

| MLS | Metals Australia | 0.022 | -8% | -4% | 10% | -35% | -4% | $ 15,998,829.53 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | -14% | -60% | -73% | -14% | $ 22,286,729.98 |

| MEI | Meteoric Resources | 0.0895 | 3% | 3% | -31% | -69% | 5% | $ 188,834,748.12 |

| SRN | Surefire Rescs NL | 0.003 | 0% | -25% | -63% | -67% | -14% | $ 8,457,077.35 |

| WA8 | Warriedarresourltd | 0.046 | 0% | -23% | -23% | -12% | 5% | $ 43,961,372.41 |

| HMX | Hammer Metals Ltd | 0.034 | -6% | -3% | -8% | -29% | 3% | $ 29,296,037.10 |

| WCN | White Cliff Min Ltd | 0.018 | 13% | 13% | 20% | 80% | 13% | $ 34,028,473.46 |

| AVM | Advance Metals Ltd | 0.036 | 6% | 6% | 38% | 9% | 6% | $ 6,234,469.44 |

| ASR | Asra Minerals Ltd | 0.003 | -25% | -25% | -40% | -50% | 0% | $ 6,937,890.37 |

| ARI | Arika Resources | 0.032 | 23% | 14% | 60% | 7% | 19% | $ 19,005,259.14 |

| CTO | Citigold Corp Ltd | 0.0035 | -13% | -13% | -13% | -30% | -13% | $ 10,500,000.00 |

| SMI | Santana Minerals Ltd | 0.47 | 2% | -1% | 19% | 42% | -3% | $ 302,749,798.76 |

| M2R | Miramar | 0.0045 | 13% | 13% | -44% | -81% | 50% | $ 1,785,704.78 |

| MHC | Manhattan Corp Ltd | 0.025 | 32% | 9% | -25% | -62% | 32% | $ 5,872,472.45 |

| GRL | Godolphin Resources | 0.014 | 0% | 0% | -18% | -67% | -3% | $ 4,668,282.45 |

| SVG | Savannah Goldfields | 0.025 | 19% | 19% | 32% | -43% | 19% | $ 7,308,207.82 |

| EMC | Everest Metals Corp | 0.14 | 0% | 0% | 8% | 65% | 4% | $ 30,210,817.86 |

| GUL | Gullewa Limited | 0.057 | 2% | -3% | -22% | 4% | 2% | $ 12,427,263.80 |

| CY5 | Cygnus Metals Ltd | 0.125 | 9% | 14% | 191% | 9% | 25% | $ 110,281,554.50 |

| G50 | G50Corp Ltd | 0.15 | -9% | -29% | -17% | 15% | -3% | $ 23,112,060.90 |

| ADV | Ardiden Ltd | 0.135 | 0% | 4% | -4% | -25% | 0% | $ 8,439,863.31 |

| AAR | Astral Resources NL | 0.1425 | 10% | -5% | 76% | 110% | 6% | $ 174,041,713.72 |

| VMC | Venus Metals Cor Ltd | 0.07 | 4% | 0% | -5% | -33% | 4% | $ 13,140,621.76 |

| NAE | New Age Exploration | 0.003 | -14% | -33% | -25% | -40% | -14% | $ 6,431,696.73 |

| VKA | Viking Mines Ltd | 0.008 | 0% | -11% | 0% | -47% | 0% | $ 10,625,178.56 |

| LCL | LCL Resources Ltd | 0.009 | 13% | -10% | 0% | -44% | -10% | $ 10,753,314.36 |

| MTH | Mithril Silver Gold | 0.45 | 15% | 34% | 150% | 125% | 13% | $ 63,843,349.68 |

| ADG | Adelong Gold Limited | 0.005 | 0% | 0% | -17% | 0% | 11% | $ 5,589,944.79 |

| RMX | Red Mount Min Ltd | 0.009 | 0% | 0% | -10% | -66% | 0% | $ 4,184,620.16 |

| PRS | Prospech Limited | 0.029 | 0% | 0% | -19% | -9% | 0% | $ 9,535,950.72 |

| TTM | Titan Minerals | 0.38 | 0% | -4% | -7% | 52% | 0% | $ 89,995,689.41 |

| AKA | Aureka Limited | 0.175 | 17% | 52% | -98% | -98% | 30% | $ 17,413,932.32 |

| AAM | Aumegametals | 0.044 | 16% | -2% | -27% | 16% | 5% | $ 26,580,973.85 |

| KZR | Kalamazoo Resources | 0.082 | 12% | 0% | -4% | -41% | 11% | $ 16,262,684.96 |

| BCN | Beacon Minerals | 0.023 | 5% | 5% | -8% | -8% | 5% | $ 97,206,376.42 |

| MAU | Magnetic Resources | 1.125 | 0% | -9% | -7% | 14% | 2% | $ 297,438,682.25 |

| BC8 | Black Cat Syndicate | 0.685 | 19% | -4% | 88% | 198% | 21% | $ 379,990,823.08 |

| EM2 | Eagle Mountain | 0.009 | -10% | -27% | -82% | -85% | 0% | $ 3,605,919.98 |

| EMR | Emerald Res NL | 3.38 | 3% | -8% | -12% | 9% | 4% | $ 2,207,672,564.16 |

| BYH | Bryah Resources Ltd | 0.004 | 33% | 0% | -20% | -71% | 33% | $ 2,013,147.42 |

| HCH | Hot Chili Ltd | 0.7 | -1% | -10% | -29% | -28% | 0% | $ 103,723,008.25 |

| WAF | West African Res Ltd | 1.585 | 8% | -1% | 12% | 69% | 10% | $ 1,806,546,297.74 |

| MEU | Marmota Limited | 0.046 | 18% | 21% | 5% | 15% | 18% | $ 49,982,604.19 |

| NVA | Nova Minerals Ltd | 0.38 | 1% | 49% | 77% | 12% | 3% | $ 116,118,997.07 |

| SVL | Silver Mines Limited | 0.073 | -6% | -37% | -56% | -54% | -6% | $ 126,364,052.83 |

| PGD | Peregrine Gold | 0.155 | 19% | 3% | -18% | -52% | 11% | $ 8,824,194.73 |

| ICL | Iceni Gold | 0.085 | 12% | 37% | 2% | 31% | 20% | $ 26,170,265.72 |

| FG1 | Flynngold | 0.025 | -4% | -11% | 0% | -46% | 0% | $ 6,532,911.75 |

| WWI | West Wits Mining Ltd | 0.014 | 0% | -7% | -7% | 27% | 0% | $ 38,140,902.21 |

| RML | Resolution Minerals | 0.011 | -8% | -15% | -54% | -61% | -8% | $ 2,479,280.39 |

| AAJ | Aruma Resources Ltd | 0.01 | -17% | -23% | -9% | -62% | -17% | $ 2,442,639.89 |

| HWK | Hawk Resources. | 0.024 | 9% | -4% | -40% | -46% | 9% | $ 5,710,306.78 |

| GMN | Gold Mountain Ltd | 0.003 | 0% | -25% | 0% | -40% | 0% | $ 13,737,669.55 |

| MEG | Megado Minerals Ltd | 0.015 | 0% | 7% | 57% | -37% | -12% | $ 6,295,248.93 |

| HMG | Hamelingoldlimited | 0.059 | -8% | -20% | -26% | -21% | -8% | $ 9,327,900.00 |

| BM8 | Battery Age Minerals | 0.097 | -3% | -19% | -33% | -56% | -8% | $ 10,017,591.58 |

| TBR | Tribune Res Ltd | 4.2 | -2% | -7% | 24% | 47% | -2% | $ 220,365,923.40 |

| FML | Focus Minerals Ltd | 0.21 | 24% | 17% | 40% | 24% | 24% | $ 60,177,315.45 |

| VRC | Volt Resources Ltd | 0.003 | -14% | -14% | -25% | -50% | 0% | $ 12,639,718.57 |

| ARV | Artemis Resources | 0.0085 | 0% | -15% | -29% | -55% | 6% | $ 19,848,441.83 |

| HRN | Horizon Gold Ltd | 0.48 | -3% | 20% | 71% | 78% | 0% | $ 69,523,163.04 |

| CLA | Celsius Resource Ltd | 0.009 | -14% | -18% | -36% | -25% | -18% | $ 24,023,146.07 |

| QML | Qmines Limited | 0.048 | -14% | -21% | -19% | -39% | -11% | $ 16,497,846.86 |

| RDN | Raiden Resources Ltd | 0.015 | 50% | 25% | -46% | -58% | 36% | $ 51,763,371.63 |

| TCG | Turaco Gold Limited | 0.295 | 16% | -5% | 44% | 136% | 16% | $ 255,493,515.93 |

| KCC | Kincora Copper | 0.03 | 11% | -9% | -30% | -27% | 11% | $ 7,136,290.47 |

| GBZ | GBM Rsources Ltd | 0.007 | -13% | -13% | -30% | -7% | -13% | $ 8,096,822.22 |

| DTM | Dart Mining NL | 0.009 | 0% | -25% | -48% | -39% | 0% | $ 5,382,500.19 |

| MKR | Manuka Resources. | 0.027 | 0% | -13% | -22% | -61% | -4% | $ 21,079,959.39 |

| AUC | Ausgold Limited | 0.415 | -1% | 4% | 22% | 54% | -1% | $ 155,127,438.87 |

| ANX | Anax Metals Ltd | 0.011 | -8% | 0% | -54% | -61% | -8% | $ 9,640,969.16 |

| EMU | EMU NL | 0.025 | -7% | -14% | 0% | -9% | -7% | $ 4,809,479.68 |

| SFM | Santa Fe Minerals | 0.032 | 3% | 10% | 0% | -26% | 3% | $ 2,330,201.25 |

| SSR | SSR Mining Inc. | 12.11 | 8% | 24% | 74% | -22% | 11% | $ 44,579,283.48 |

| PNR | Pantoro Limited | 0.1 | 10% | 6% | 2% | 117% | 11% | $ 632,494,990.37 |

| CMM | Capricorn Metals | 6.73 | 7% | -4% | 33% | 52% | 7% | $ 2,762,483,478.90 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | 0% | 0% | 0% | $ 129,844,903.32 |

| VRL | Verity Resources | 0.021 | 11% | 17% | -65% | -79% | 5% | $ 3,113,576.89 |

| HAW | Hawthorn Resources | 0.041 | -2% | 3% | -32% | -59% | 0% | $ 13,735,640.13 |

| BGD | Bartongoldholdings | 0.24 | -4% | -8% | -2% | -6% | -2% | $ 52,518,028.80 |

| SVY | Stavely Minerals Ltd | 0.023 | 5% | 10% | -12% | -48% | 35% | $ 12,512,968.14 |

| AGC | AGC Ltd | 0.14 | -7% | -20% | -56% | 100% | -10% | $ 35,923,611.08 |

| RGL | Riversgold | 0.003 | -25% | 0% | -40% | -75% | -25% | $ 6,734,850.37 |

| TSO | Tesoro Gold Ltd | 0.02 | 5% | -13% | -39% | -23% | 0% | $ 31,068,280.82 |

| GUE | Global Uranium | 0.077 | 31% | 24% | -9% | -23% | 28% | $ 20,192,229.86 |

| CPM | Coopermetalslimited | 0.041 | -5% | -9% | -36% | -88% | -11% | $ 3,369,292.95 |

| MM8 | Medallion Metals. | 0.135 | 13% | 52% | 155% | 111% | 13% | $ 51,177,045.88 |

| FFM | Firefly Metals Ltd | 0.965 | 9% | -4% | 16% | 57% | 4% | $ 541,273,845.12 |

| CBY | Canterbury Resources | 0.023 | 5% | 10% | -49% | -8% | 5% | $ 4,541,140.61 |

| LYN | Lycaonresources | 0.16 | 0% | -16% | -45% | -26% | 78% | $ 8,477,571.68 |

| SFR | Sandfire Resources | 9.72 | 4% | -4% | 6% | 44% | 5% | $ 4,362,286,385.43 |

| SMG | Silvermetalgroupltd | 0.06 | 0% | 0% | 0% | 0% | 0% | $ 4,881,135.48 |

| TAM | Tanami Gold NL | 0.03 | -3% | 7% | -6% | -14% | 0% | $ 34,077,814.33 |

| NWM | Norwest Minerals | 0.015 | 7% | -29% | -53% | -56% | 7% | $ 7,761,912.16 |

| ALK | Alkane Resources Ltd | 0.52 | -2% | 5% | 1% | -19% | 2% | $ 320,937,202.76 |

| BMO | Bastion Minerals | 0.004 | -11% | 0% | -33% | -75% | 0% | $ 3,378,898.66 |

| IDA | Indiana Resources | 0.064 | 3% | 3% | 38% | 44% | 5% | $ 41,134,877.31 |

| GSM | Golden State Mining | 0.008 | 0% | -11% | -20% | -38% | 0% | $ 2,234,965.04 |

| NSM | Northstaw | 0.016 | 0% | -16% | 78% | -60% | 0% | $ 4,362,824.00 |

| GSN | Great Southern | 0.016 | 0% | 7% | -6% | -20% | 7% | $ 15,805,151.01 |

| VAU | Vault Minerals Ltd | 0.3425 | 4% | -2% | -14% | 18% | 4% | $ 2,312,840,949.88 |

| DEG | De Grey Mining | 1.92 | 7% | 0% | 66% | 53% | 9% | $ 4,577,806,834.55 |

| CDR | Codrus Minerals Ltd | 0.017 | 0% | 6% | -58% | -73% | 0% | $ 2,811,587.57 |

| MDI | Middle Island Res | 0.012 | 0% | -20% | -20% | -25% | 0% | $ 3,277,112.70 |

| WTM | Waratah Minerals Ltd | 0.15 | -6% | -3% | -50% | 55% | -3% | $ 30,358,124.85 |

| POL | Polymetals Resources | 0.86 | 9% | -3% | 207% | 187% | 8% | $ 173,924,471.60 |

| RDS | Redstone Resources | 0.003 | 0% | 0% | -40% | -40% | 20% | $ 2,776,135.38 |

| NAG | Nagambie Resources | 0.0185 | 3% | -26% | 85% | -34% | 3% | $ 14,861,093.36 |

| BGL | Bellevue Gold Ltd | 1.0675 | -6% | -20% | -46% | -31% | -5% | $ 1,382,398,905.96 |

| GBR | Greatbould Resources | 0.047 | 12% | 4% | -11% | -29% | 9% | $ 35,677,715.70 |

| KAI | Kairos Minerals Ltd | 0.013 | 0% | -19% | 44% | -7% | 8% | $ 34,201,858.46 |

| KAU | Kaiser Reef | 0.165 | 0% | 0% | 3% | 10% | 3% | $ 41,433,242.40 |

| HRZ | Horizon | 0.045 | 5% | 15% | 15% | 22% | 13% | $ 65,764,829.80 |

| CDT | Castle Minerals | 0.002 | 0% | -20% | -50% | -75% | 0% | $ 4,742,035.27 |

| RSG | Resolute Mining | 0.4075 | 1% | 1% | -33% | -2% | 3% | $ 862,265,255.27 |

| MXR | Maximus Resources | 0.06 | 3% | 43% | 94% | 81% | 3% | $ 25,675,661.46 |

| EVN | Evolution Mining Ltd | 5.135 | 6% | 2% | 38% | 35% | 7% | $ 10,165,541,401.40 |

| CXU | Cauldron Energy Ltd | 0.013 | 0% | 0% | -42% | -57% | 8% | $ 18,998,259.92 |

| DLI | Delta Lithium | 0.175 | 3% | 6% | -31% | -51% | 3% | $ 121,812,104.64 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 0% | -14% | -40% | -14% | $ 8,246,533.79 |

| OBM | Ora Banda Mining Ltd | 0.735 | 11% | 11% | 116% | 206% | 13% | $ 1,344,761,151.31 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | -50% | 0% | $ 2,938,790.00 |

| LCY | Legacy Iron Ore | 0.009 | 0% | 0% | -33% | -45% | -10% | $ 87,858,383.26 |

| PDI | Predictive Disc Ltd | 0.255 | 6% | 2% | 38% | 28% | 11% | $ 587,725,495.75 |

| MAT | Matsa Resources | 0.042 | 20% | -2% | 68% | 40% | 20% | $ 26,653,587.62 |

| ZAG | Zuleika Gold Ltd | 0.012 | -8% | -25% | -20% | -37% | -8% | $ 8,902,559.12 |

| GML | Gateway Mining | 0.022 | 5% | -15% | -8% | 10% | 5% | $ 8,994,046.49 |

| SBM | St Barbara Limited | 0.265 | 13% | -18% | 23% | 33% | 18% | $ 270,711,585.25 |

| SBR | Sabre Resources | 0.009 | 0% | -10% | -40% | -69% | -10% | $ 3,536,657.40 |

| STK | Strickland Metals | 0.08 | -8% | -10% | -15% | -36% | -6% | $ 181,008,008.84 |

| CEL | Challenger Gold Ltd | 0.048 | 12% | 0% | -13% | -34% | 2% | $ 68,949,056.07 |

| LRL | Labyrinth Resources | 0.25 | -2% | 4% | 611% | 408% | -4% | $ 139,848,780.50 |

| NST | Northern Star | 16.565 | 7% | 0% | 28% | 29% | 7% | $ 18,916,890,493.17 |

| OZM | Ozaurum Resources | 0.026 | -13% | -16% | -54% | -78% | -13% | $ 5,127,500.01 |

| TG1 | Techgen Metals Ltd | 0.034 | 3% | 0% | -3% | -55% | -3% | $ 5,394,634.14 |

| XAM | Xanadu Mines Ltd | 0.049 | 2% | -6% | -14% | -6% | 0% | $ 93,697,680.24 |

| AQI | Alicanto Min Ltd | 0.037 | -3% | -8% | 95% | 22% | 0% | $ 31,177,790.04 |

| KTA | Krakatoa Resources | 0.009 | 0% | -10% | -40% | -73% | -5% | $ 5,311,206.23 |

| WGX | Westgold Resources. | 2.575 | -11% | -12% | 1% | 32% | -9% | $ 2,386,067,515.70 |

| MBK | Metal Bank Ltd | 0.015 | 0% | -6% | -39% | -44% | 0% | $ 7,461,884.97 |

| A8G | Australasian Metals | 0.079 | 5% | -8% | 20% | -47% | 0% | $ 4,117,519.03 |

| TAR | Taruga Minerals | 0.01 | 0% | -9% | 43% | -9% | 0% | $ 7,060,267.85 |

| DTR | Dateline Resources | 0.003 | -14% | 0% | -50% | -70% | -14% | $ 7,548,781.41 |

| GOR | Gold Road Res Ltd | 2.145 | 4% | 2% | 21% | 27% | 5% | $ 2,330,645,343.50 |

| S2R | S2 Resources | 0.077 | 15% | 20% | -30% | -50% | 15% | $ 33,058,633.49 |

| NES | Nelson Resources. | 0.003 | 0% | 0% | 20% | -40% | 0% | $ 6,515,782.98 |

| TLM | Talisman Mining | 0.205 | -5% | -13% | -21% | -20% | 0% | $ 38,605,671.55 |

| BEZ | Besragoldinc | 0.082 | -6% | 21% | -17% | -39% | -9% | $ 34,070,093.98 |

| PRU | Perseus Mining Ltd | 2.615 | 0% | -4% | 7% | 49% | 2% | $ 3,613,366,607.39 |

| SPQ | Superior Resources | 0.008 | 14% | 33% | -19% | -42% | 33% | $ 17,358,910.38 |

| PUR | Pursuit Minerals | 0.094 | -1% | -30% | -37% | -77% | -2% | $ 8,091,594.91 |

| RMS | Ramelius Resources | 2.165 | 3% | -6% | 12% | 34% | 5% | $ 2,483,299,557.50 |

| PKO | Peako Limited | 0.003 | 0% | 50% | 30% | -22% | 0% | $ 3,285,424.60 |

| ICG | Inca Minerals Ltd | 0.007 | 40% | 17% | 17% | -33% | 40% | $ 7,187,057.73 |

| A1G | African Gold Ltd. | 0.06 | 3% | 3% | 161% | 96% | 9% | $ 23,283,518.22 |

| NMG | New Murchison Gold | 0.009 | 0% | -18% | 80% | 29% | 0% | $ 66,862,772.62 |

| GNM | Great Northern | 0.0125 | -4% | -22% | 4% | -34% | -11% | $ 1,932,863.46 |

| KRM | Kingsrose Mining Ltd | 0.035 | 3% | -8% | -19% | -15% | 0% | $ 27,126,954.68 |

| BTR | Brightstar Resources | 0.02 | -5% | -20% | 11% | 43% | 0% | $ 216,527,145.83 |

| RRL | Regis Resources | 2.745 | 6% | 2% | 50% | 26% | 8% | $ 2,092,673,323.18 |

| M24 | Mamba Exploration | 0.013 | 8% | 8% | -13% | -68% | 8% | $ 3,054,444.59 |

| TRM | Truscott Mining Corp | 0.078 | 1% | 0% | 30% | 43% | 0% | $ 14,932,987.68 |

| TNC | True North Copper | 3 | 0% | 0% | -42% | -67% | 0% | $ 377,517,048.00 |

| MOM | Moab Minerals Ltd | 0.003 | 50% | 50% | -50% | -57% | 50% | $ 4,700,998.10 |

| KNB | Koonenberrygold | 0.015 | 0% | 15% | 0% | -54% | 25% | $ 13,114,312.11 |

| AWJ | Auric Mining | 0.325 | -4% | -6% | 41% | 195% | -4% | $ 49,154,612.43 |

| ENR | Encounter Resources | 0.3 | -6% | -12% | -65% | -6% | -8% | $ 149,637,695.70 |

| SNG | Siren Gold | 0.058 | -13% | -15% | -23% | -11% | -11% | $ 12,919,265.93 |

| STN | Saturn Metals | 0.18 | -15% | -16% | -3% | -5% | -12% | $ 58,688,127.96 |

| USL | Unico Silver Limited | 0.205 | 5% | 3% | 24% | 86% | 5% | $ 85,399,032.23 |

| PNM | Pacific Nickel Mines | 0.024 | 0% | 0% | -14% | -69% | 0% | $ 10,103,834.52 |

| AYM | Australia United Min | 0.002 | -50% | 0% | 0% | -50% | -50% | $ 3,685,154.97 |

| HAV | Havilah Resources | 0.215 | -2% | -9% | 0% | 16% | -4% | $ 72,940,103.64 |

| SPR | Spartan Resources | 1.57 | 6% | 1% | 68% | 229% | 11% | $ 2,067,021,928.49 |

| PNT | Panthermetalsltd | 0.01 | -9% | -29% | -54% | -76% | -9% | $ 2,481,707.63 |

| MEK | Meeka Metals Limited | 0.099 | 18% | 21% | 183% | 161% | 29% | $ 242,622,842.91 |

| GMD | Genesis Minerals | 2.74 | 10% | 3% | 45% | 71% | 11% | $ 3,047,395,346.10 |

| PGO | Pacgold | 0.075 | 0% | -5% | -38% | -61% | 0% | $ 9,859,075.35 |

| FEG | Far East Gold | 0.165 | -8% | -3% | 43% | 14% | -8% | $ 56,613,183.83 |

| MI6 | Minerals260Limited | 0.13 | 0% | 8% | -19% | -56% | 0% | $ 30,420,000.00 |

| RXL | Rox Resources | 0.24 | 23% | 26% | 71% | 34% | 20% | $ 123,582,289.20 |

| PTN | Patronus Resources | 0.053 | 7% | 0% | -10% | -21% | 8% | $ 88,419,481.42 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | 0% | -98% | 0% | $ 1,544,025.56 |

| TGM | Theta Gold Mines Ltd | 0.175 | -3% | -5% | 0% | 46% | -3% | $ 148,650,009.55 |

| FAL | Falconmetalsltd | 0.13 | 13% | -16% | -50% | 4% | 13% | $ 23,010,000.00 |

| SXG | Southern Cross Gold | 3.59 | 5% | 3% | 42% | 211% | 4% | $ 782,900,222.70 |

| SPD | Southernpalladium | 0.54 | -10% | -14% | 59% | 54% | -10% | $ 49,113,000.00 |

| ORN | Orion Minerals Ltd | 0.015 | 0% | 7% | -12% | 7% | 0% | $ 102,574,202.22 |

| TMB | Tambourahmetals | 0.026 | 18% | 0% | -47% | -77% | 24% | $ 2,654,161.10 |

| TMS | Tennant Minerals Ltd | 0.011 | 22% | 10% | -48% | -66% | 22% | $ 10,514,794.57 |

| AZY | Antipa Minerals Ltd | 0.03 | 11% | 20% | 200% | 88% | 15% | $ 153,840,314.10 |

| PXX | Polarx Limited | 0.006 | 0% | -25% | -54% | -23% | -8% | $ 14,253,005.87 |

| TRE | Toubani Res Ltd | 0.145 | -15% | -17% | -17% | 16% | -15% | $ 34,343,993.85 |

| AUN | Aurumin | 0.066 | 0% | -8% | 78% | 144% | 0% | $ 31,907,849.22 |

| GPR | Geopacific Resources | 0.0205 | 3% | -8% | 1% | 24% | 3% | $ 23,661,448.42 |

| FXG | Felix Gold Limited | 0.11 | 26% | 22% | 144% | 156% | 31% | $ 34,508,860.68 |

| ILT | Iltani Resources Lim | 0.185 | -5% | 19% | -14% | 9% | -10% | $ 7,986,176.28 |

| BRX | Belararoxlimited | 0.16 | -11% | -11% | -43% | -45% | -9% | $ 22,301,048.31 |

| TM1 | Terra Metals Limited | 0.03 | 15% | 3% | -59% | -35% | 7% | $ 9,136,080.93 |

| TOR | Torque Met | 0.052 | 2% | 6% | -61% | -78% | -2% | $ 12,982,524.15 |

| ARD | Argent Minerals | 0.019 | 9% | -14% | 12% | 100% | 12% | $ 26,021,528.64 |

| LM1 | Leeuwin Metals Ltd | 0.12 | 0% | 100% | 135% | -4% | -14% | $ 5,153,683.81 |

| GAL | Galileo Mining Ltd | 0.15 | 25% | 36% | -25% | -46% | 20% | $ 32,608,112.96 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.