Gold Digger: Aussie gold miners produce one of their best ever quarters

Pic: Getty Images.

- Producers are making bank from all-time gold price highs

- Regis, Ora Banda, Rox, Regis and Catalyst post record production/sales

- Poor $A supports gold this week in the markets

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

Quarterlies have started pouring out of Australian goldies and it’s not surprising record sales have been posted as the bullion spot price pushed to all-time highs of US$2483.63 across Q2 this year.

A weak AUD keeps prices up and we take a look at a few gold producers that are laughing all the way to the bank after releasing record Q2 production and sales results.

To the markets

Analyst Market Matters is bullish on the shiny, fingering over the week’s ructions and it’s “another poor session for the $A and a firm gold market left the precious metal within striking distance of fresh all-time highs in terms of the local currency”, says MM.

“Several subscribers have questioned the solid performance of the ASX gold names this week, even when gold tumbled over $US50/oz last Friday.”

Market Matters puts the strength down to a few factors:

“A weakening $A has supported the gold price in local currency terms and are embracing lower interest rates into 2025, a tailwind for precious metals.”

Rox Resources (ASX:RXL)

Stockhead Barry Fitzgerald’s interest has piqued towards Rox Resources this week, with its work on the historical Youanmi gold project in WA’s Murchison region.

“Rox this week released a pre-feasibility study into bringing Youanmi back to life as a 103,000oz producer over an initial life of 7.7 years, with all-in sustaining costs using Glencore’s Albion process to deal with refractory ore estimated at $1677/oz,” Says Fitzgerald.

“Using a conservative gold price assumption of $3100/oz, or more than $500/oz below the spot price, the NPV (pre-tax) was estimated at $486m and the IRR at 42% on a pre-production capital cost of $245m.

He notes that Canaccord has a 51c price target on the stock.

“Given the lack of WA gold development assets outside established producers, it is pleasing to see Rox deliver a low-cost, high-margin study,” says the analyst in a review of the company’s PFS for Youanmi.

“With average life of mine production of 103,000oz pa, the project has sufficient scale, in our view.”

Ora Banda (ASX:OBM)

WA gold digger Ora Banda Mining dropped earnings this week, upping Q4 production by 11% (a total of 19,271oz) on the previous quarter, at an AISC of $2878/oz.

The goldie’s FY24 total ounce production of 69,932oz at an AISC of $2767/oz was in line with guidance (between 67-73koz) a handy 46% improvement on FY23.

The Company has several projects in the Central Davyhurst region, which are hosted by two principal mineralisation trends: the eastern trend, which includes the Golden Eagle deposit, and the western trend, which hosts the Waihi deposit

This contribution of high grade ore from the co’s first underground project at Riverina was a key driver for a record month in June, delivering more than 7koz at an AISC of A$2157/oz, despite poor weather constraining output.

The period was also marked by progressing preparations for development of the Sand King Underground mine. The mine, expected to cost ~$39m to develop (from operating cash flows and existing cash), will have a steady state production of ~60koz p.a. commencing in the June 2025 quarter, the co said in its release.

Regis Resources (ASX:RRL)

Regis delivered record cash and bullion build of $109 million in the last quarter and $141 million since the hedge book was closed out in December 2023.

“We continue work on delivering ongoing cash build into the future. As well as delivering a strong cash build during the quarter.”

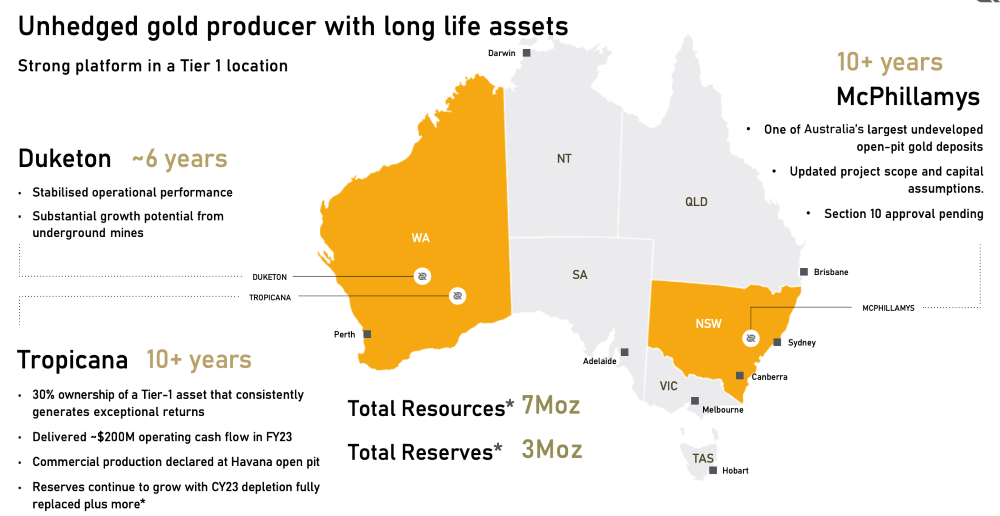

At Duketon, Regis continues to build on its underground-centric strategy, targeting four to five sustainable operating underground mines.

Work is now underway on the development of a third mine, Garden Well Main and significant life extension at Rosemont with Stage 3.

“In-line with our underground growth strategy, for a third consecutive year, we delivered underground Ore Reserve growth at Duketon and Tropicana, with growth outpacing depletion.

“We believe that this underground Reserves growth trend will continue, and while we continue to drill for high-value, open pit ounces, we are confident we can add further value by identifying additional underground mines.”

After the end of the quarter, Regis delivered the McPhillamys DFS, with Beyer confirming the project as “a value accretive, long-life, expandable, low operating cost open pit that delivers robust financial metrics.

“McPhillamys is one of Australia’s largest undeveloped open pit gold projects and we are very pleased to have such significant growth optionality in our portfolio. McPhillamys, along with our underground projects at Duketon and Tropicana, gives us a strong growth pipeline,” Beyer added.

Catalyst Metals (ASX:CYL)

Catalyst Metals dropped quarterlies this week too, and produces circa 110koz of gold annually across three highly prospective gold belts as part of its multi-asset strategy.

It owns the 40km long Plutonic Gold Belt in WA, hosting the Plutonic gold mine and neighbouring underexplored, high-grade resources, with a substantial mineral endowment of 10Moz.

It also owns and operates the high-grade Henty Gold Mine in Tasmania which lies within the 25km Henty gold belt. Production to date is 1.4Moz @ 8.9g/t.

Catalyst also controls +75km of strike length immediately north of the +22Moz Bendigo goldfield and home to high-grade, greenfield resources of 26g/t Au at Four Eagles, with further discoveries expected.

Quarterly production totalled 31,502oz at an average AISC of A$2338 made up of 24,576oz gold produced at Plutonic – at an AISC of A$2291/oz as well as 6926oz gold produced at Henty that shoulders an AISC of A$2469/oz – its highest on record.

MD James Champion de Crespigny was particularly pleased with the quarterly turnaround at the flagship Plutonic project .

“This turnaround was shown not only in the 40% increase in gold production, but in the considerable reduction in the company’s debt. After 12 months, this is a pleasing accomplishment,” he says.

“With 12 months of operating success behind us, we have begun turning our attention to organic growth over the next 12 months to provide additional ore feed for the under-utilised Plutonic mill in 2025.

“We are pleased with the faster-than-expected dewatering at Plutonic East. It’s existing permits and infrastructure allow for a rapid and low-cost restart. Similarly, the shallow high-grade results from drilling at Trident have allowed a revised open pit development approach for the deposit, which will have a more manageable upfront capital profile than previously expected.”

Cash flows from operations allowed the miner to end Q2 with $37m in cash and bullion, $45m liquidity and only $8m debt in the form of a 2220oz gold loan repayable in six monthly instalments.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | YTD | Market Cap |

|---|---|---|---|---|---|---|

| A1G | African Gold Ltd. | 0.022 | -12.0 | 4.8 | -51.3 | $5,980,393 |

| A8G | Australasian Metals | 0.085 | 21.4 | 6.3 | -43.3 | $4,378,121 |

| AAJ | Aruma Resources Ltd | 0.012 | -7.7 | 0.0 | -71.4 | $2,362,698 |

| AAM | Aumegametals | 0.045 | -16.7 | -11.8 | -22.4 | $25,765,882 |

| AAR | Astral Resources NL | 0.077 | -8.3 | -7.2 | -3.8 | $68,269,420 |

| AAU | Antilles Gold Ltd | 0.0035 | -12.5 | -12.5 | -89.1 | $5,114,997 |

| ADG | Adelong Gold Limited | 0.004 | 0.0 | -33.3 | -50.0 | $4,471,956 |

| ADN | Andromeda Metals Ltd | 0.02 | -13.0 | 17.6 | -41.2 | $59,095,148 |

| ADT | Adriatic Metals | 3.21 | -3.0 | -19.1 | -8.8 | $884,024,829 |

| ADV | Ardiden Ltd | 0.135 | 0.0 | 8.0 | -55.1 | $8,439,863 |

| AGC | AGC Ltd | 0.26 | -17.5 | -8.8 | 381.5 | $66,553,472 |

| AL8 | Alderan Resource Ltd | 0.004 | 0.0 | 33.3 | -50.0 | $4,427,445 |

| ALK | Alkane Resources Ltd | 0.4825 | -12.3 | -9.0 | -36.9 | $301,745,244 |

| ALY | Alchemy Resource Ltd | 0.009 | 28.6 | 50.0 | -30.8 | $10,602,686 |

| AM7 | Arcadia Minerals | 0.033 | -13.2 | -19.5 | -70.0 | $3,862,653 |

| AME | Alto Metals Limited | 0.031 | -16.2 | -6.1 | -44.6 | $23,810,265 |

| AMI | Aurelia Metals Ltd | 0.18 | -16.3 | -2.7 | 97.8 | $312,939,448 |

| ANL | Amani Gold Ltd | 0.001 | 0.0 | 0.0 | 0.0 | $25,743,441 |

| ANX | Anax Metals Ltd | 0.026 | 0.0 | 13.0 | -57.4 | $18,013,245 |

| ANX | Anax Metals Ltd | 0.026 | 0.0 | 13.0 | -57.4 | $18,013,245 |

| AQI | Alicanto Min Ltd | 0.023 | 9.5 | 15.0 | -45.5 | $15,389,670 |

| AQX | Alice Queen Ltd | 0.008 | 0.0 | 33.3 | -48.1 | $10,322,011 |

| ARD | Argent Minerals | 0.016 | -5.9 | 0.0 | 45.5 | $24,368,236 |

| ARL | Ardea Resources Ltd | 0.465 | 1.1 | -4.1 | -35.0 | $92,852,555 |

| ARN | Aldoro Resources | 0.088 | 4.8 | 18.9 | -48.2 | $11,443,018 |

| ARV | Artemis Resources | 0.0095 | -5.0 | -20.8 | -44.1 | $17,251,942 |

| AS1 | Asara Resources Ltd | 0.01 | 11.1 | 0.0 | -65.5 | $8,821,754 |

| ASO | Aston Minerals Ltd | 0.01 | 11.1 | 11.1 | -83.1 | $11,655,578 |

| ASR | Asra Minerals Ltd | 0.006 | 0.0 | 50.0 | -36.8 | $12,216,476 |

| AUC | Ausgold Limited | 0.034 | -17.1 | -5.6 | -17.1 | $96,674,942 |

| AUC | Ausgold Limited | 0.034 | -17.1 | -5.6 | -17.1 | $96,674,942 |

| AUN | Aurumin | 0.039 | -4.9 | 8.3 | 69.6 | $17,772,838 |

| AVM | Advance Metals Ltd | 0.026 | -10.3 | 13.0 | -79.8 | $3,520,724 |

| AVW | Avira Resources Ltd | 0.001 | 0.0 | 0.0 | -50.0 | $2,938,790 |

| AWJ | Auric Mining | 0.225 | -2.2 | 32.4 | 324.5 | $33,424,508 |

| AYM | Australia United Min | 0.003 | 0.0 | 50.0 | -25.0 | $5,527,732 |

| AZS | Azure Minerals | 0 | -100.0 | -100.0 | -100.0 | $1,692,527,632 |

| AZY | Antipa Minerals Ltd | 0.011 | -8.3 | -4.3 | -26.7 | $51,810,544 |

| BC8 | Black Cat Syndicate | 0.35 | -5.4 | 16.7 | -10.3 | $132,386,190 |

| BCM | Brazilian Critical | 0.016 | 0.0 | -5.9 | -68.6 | $13,291,831 |

| BCN | Beacon Minerals | 0.025 | -3.8 | -3.8 | -10.7 | $93,919,204 |

| BEZ | Besragoldinc | 0.063 | -4.5 | -36.4 | -79.7 | $22,577,449 |

| BGD | Bartongoldholdings | 0.2425 | -3.0 | -16.4 | -6.7 | $52,478,141 |

| BGL | Bellevue Gold Ltd | 1.445 | -21.7 | -18.4 | -0.7 | $2,154,535,587 |

| BM8 | Battery Age Minerals | 0.135 | -3.6 | 3.8 | -65.8 | $12,093,138 |

| BMO | Bastion Minerals | 0.006 | 0.0 | 0.0 | -80.0 | $2,610,503 |

| BMR | Ballymore Resources | 0.14 | -12.5 | -12.5 | -6.7 | $24,742,282 |

| BNR | Bulletin Res Ltd | 0.047 | 0.0 | 2.2 | -14.5 | $14,680,666 |

| BNZ | Benzmining | 0.115 | -11.5 | -11.5 | -71.3 | $12,407,169 |

| BTR | Brightstar Resources | 0.015 | -11.8 | -16.7 | 25.0 | $70,833,354 |

| BYH | Bryah Resources Ltd | 0.005 | 0.0 | -28.6 | -70.6 | $2,516,434 |

| CAI | Calidus Resources | 0.115 | 0.0 | 9.5 | -36.1 | $93,678,206 |

| CAZ | Cazaly Resources | 0.022 | 4.8 | 22.2 | -37.1 | $10,609,969 |

| CBY | Canterbury Resources | 0.048 | 11.6 | 9.1 | 84.6 | $8,243,563 |

| CDR | Codrus Minerals Ltd | 0.03 | -18.9 | -25.0 | -62.5 | $4,134,688 |

| CDT | Castle Minerals | 0.004 | 0.0 | 0.0 | -69.2 | $5,311,305 |

| CEL | Challenger Gold Ltd | 0.049 | -9.3 | -15.5 | -46.2 | $68,785,439 |

| CHN | Chalice Mining Ltd | 1.075 | -8.5 | -23.2 | -81.7 | $400,632,203 |

| CLA | Celsius Resource Ltd | 0.013 | -7.1 | 0.0 | -45.8 | $31,562,866 |

| CLZ | Classic Min Ltd | 0.001 | 0.0 | -50.0 | -98.0 | $1,253,842 |

| CMM | Capricorn Metals | 5.29 | -2.8 | 7.7 | 12.6 | $1,982,022,163 |

| CPM | Coopermetalslimited | 0.067 | -2.9 | 0.0 | -55.3 | $5,249,829 |

| CST | Castile Resources | 0.08 | -1.2 | 9.6 | 14.3 | $19,352,194 |

| CTO | Citigold Corp Ltd | 0.005 | 25.0 | 11.1 | 0.0 | $13,500,000 |

| CWX | Carawine Resources | 0.091 | 5.8 | -3.2 | -28.9 | $20,306,789 |

| CXU | Cauldron Energy Ltd | 0.027 | 3.8 | 12.5 | 356.5 | $31,889,796 |

| CY5 | Cygnus Metals Ltd | 0.065 | 8.3 | 44.4 | -75.9 | $23,447,719 |

| CYL | Catalyst Metals | 1.9 | 8.0 | 74.3 | 183.6 | $419,969,357 |

| DEG | De Grey Mining | 1.185 | -4.0 | 8.7 | -11.9 | $2,852,042,666 |

| DLI | Delta Lithium | 0.22 | -4.3 | 0.0 | -74.2 | $153,382,536 |

| DRE | Dreadnought Resources Ltd | 0.022 | 0.0 | -4.3 | -60.7 | $75,531,069 |

| DTM | Dart Mining NL | 0.02 | 5.3 | 0.0 | -40.4 | $5,427,090 |

| DTM | Dart Mining NL | 0.02 | 5.3 | 0.0 | -40.4 | $5,427,090 |

| DTR | Dateline Resources | 0.006 | 0.0 | -33.3 | -76.0 | $8,745,282 |

| EM2 | Eagle Mountain | 0.056 | -6.7 | 7.7 | -56.6 | $21,608,121 |

| EMC | Everest Metals Corp | 0.125 | -7.4 | 4.2 | -19.4 | $22,353,973 |

| EMR | Emerald Res NL | 3.75 | -7.2 | 8.4 | 65.2 | $2,506,350,361 |

| EMU | EMU NL | 0.023 | -11.5 | -11.5 | -58.2 | $2,886,481 |

| EMU | EMU NL | 0.023 | -11.5 | -11.5 | -58.2 | $2,886,481 |

| ENR | Encounter Resources | 0.605 | -8.3 | 8.0 | 28.7 | $275,005,113 |

| ERM | Emmerson Resources | 0.057 | -8.1 | 3.6 | -24.0 | $29,414,329 |

| EVN | Evolution Mining Ltd | 3.9 | -4.6 | 11.4 | 7.4 | $7,864,075,922 |

| FAL | Falconmetalsltd | 0.31 | -10.1 | 19.2 | 47.6 | $55,755,000 |

| FAU | First Au Ltd | 0.002 | 0.0 | -33.3 | -42.9 | $3,323,987 |

| FEG | Far East Gold | 0.18 | -7.7 | 80.0 | -41.9 | $43,789,762 |

| FFM | Firefly Metals Ltd | 0.84 | 0.0 | 12.0 | 60.0 | $389,373,449 |

| FFX | Firefinch Ltd | 0 | -100.0 | -100.0 | -100.0 | $236,569,315 |

| FG1 | Flynngold | 0.026 | 0.0 | 8.3 | -46.0 | $7,127,252 |

| FML | Focus Minerals Ltd | 0.125 | -10.7 | -16.7 | -35.9 | $39,401,814 |

| FXG | Felix Gold Limited | 0.046 | 15.0 | 2.2 | -61.7 | $11,519,733 |

| G50 | G50Corp Ltd | 0.17 | -5.6 | 13.3 | -10.5 | $20,384,700 |

| G88 | Golden Mile Res Ltd | 0.01 | -9.1 | -9.1 | -76.2 | $4,112,229 |

| GAL | Galileo Mining Ltd | 0.18 | 2.9 | -10.0 | -67.0 | $35,572,487 |

| GBR | Greatbould Resources | 0.051 | -8.9 | -12.1 | -37.0 | $29,112,350 |

| GBZ | GBM Rsources Ltd | 0.009 | 0.0 | 0.0 | -60.9 | $10,410,200 |

| GBZ | GBM Rsources Ltd | 0.009 | 0.0 | 0.0 | -60.9 | $10,410,200 |

| GED | Golden Deeps | 0.034 | -2.9 | -2.9 | -62.2 | $4,123,260 |

| GIB | Gibb River Diamonds | 0.037 | -7.5 | -19.6 | 8.8 | $7,614,340 |

| GMD | Genesis Minerals | 2.065 | -4.0 | 12.8 | 42.9 | $2,378,632,391 |

| GML | Gateway Mining | 0.023 | -11.5 | -4.2 | -42.5 | $9,491,026 |

| GMN | Gold Mountain Ltd | 0.0035 | 16.7 | 16.7 | -56.3 | $9,533,230 |

| GNM | Great Northern | 0.011 | -8.3 | -8.3 | -68.6 | $1,700,920 |

| GOR | Gold Road Res Ltd | 1.74 | -4.9 | 4.8 | 9.4 | $1,922,936,599 |

| GPR | Geopacific Resources | 0.021 | -8.7 | 0.0 | 31.3 | $19,152,125 |

| GRL | Godolphin Resources | 0.0145 | -9.4 | -23.7 | -66.3 | $3,208,368 |

| GSM | Golden State Mining | 0.011 | -8.3 | 10.0 | -67.6 | $3,352,448 |

| GSN | Great Southern | 0.018 | -10.0 | 20.0 | -25.0 | $15,220,507 |

| GSR | Greenstone Resources | 0 | -100.0 | -100.0 | -100.0 | $15,761,980 |

| GTR | Gti Energy Ltd | 0.004 | 0.0 | -11.1 | -42.9 | $10,199,788 |

| GUE | Global Uranium | 0.069 | -14.8 | -15.9 | -34.3 | $16,738,296 |

| GUL | Gullewa Limited | 0.07 | -4.1 | -1.4 | 27.3 | $14,334,117 |

| GWR | GWR Group Ltd | 0.077 | -3.8 | -11.5 | -4.9 | $25,376,116 |

| HAV | Havilah Resources | 0.195 | -18.8 | 11.4 | -22.0 | $63,327,842 |

| HAW | Hawthorn Resources | 0.071 | 1.4 | 14.5 | -45.4 | $23,786,109 |

| HCH | Hot Chili Ltd | 0.915 | -1.6 | -4.7 | -37.8 | $140,751,042 |

| HMG | Hamelingoldlimited | 0.095 | -5.0 | 20.3 | -2.1 | $15,750,000 |

| HMX | Hammer Metals Ltd | 0.039 | -4.9 | 11.4 | -41.8 | $34,569,887 |

| HRN | Horizon Gold Ltd | 0.28 | 0.0 | -1.8 | -19.4 | $40,555,178 |

| HRZ | Horizon | 0.036 | 2.9 | 9.1 | -2.7 | $40,268,128 |

| HXG | Hexagon Energy | 0.013 | 0.0 | 8.3 | 18.2 | $6,667,907 |

| ICG | Inca Minerals Ltd | 0.004 | -20.0 | -42.9 | -87.2 | $4,052,682 |

| ICL | Iceni Gold | 0.065 | -7.1 | 1.6 | -43.5 | $17,183,946 |

| IDA | Indiana Resources | 0.085 | 0.0 | 7.6 | 20.1 | $53,921,558 |

| IGO | IGO Limited | 5.685 | -3.2 | -1.0 | -60.0 | $4,210,409,040 |

| ILT | Iltani Resources Lim | 0.205 | -10.9 | -31.7 | -2.4 | $6,802,101 |

| ION | Iondrive Limited | 0.009 | 0.0 | -10.0 | -52.6 | $5,443,709 |

| IPT | Impact Minerals | 0.016 | 0.0 | 6.7 | 0.0 | $45,891,506 |

| IVR | Investigator Res Ltd | 0.0455 | -9.0 | -5.2 | -10.8 | $71,274,581 |

| KAI | Kairos Minerals Ltd | 0.009 | -10.0 | -10.0 | -59.1 | $20,967,298 |

| KAL | Kalgoorliegoldmining | 0.029 | -3.3 | -9.4 | -12.1 | $4,596,521 |

| KAU | Kaiser Reef | 0.165 | -2.9 | 3.1 | -19.5 | $32,711,023 |

| KCC | Kincora Copper | 0.047 | -17.5 | -2.1 | -23.0 | $9,640,286 |

| KCC | Kincora Copper | 0.047 | -17.5 | -2.1 | -23.0 | $9,640,286 |

| KCN | Kingsgate Consolid. | 1.4975 | -10.9 | -3.7 | 11.8 | $395,648,847 |

| KIN | KIN Min NL | 0.058 | -1.7 | 7.4 | 65.7 | $68,332,732 |

| KNB | Koonenberrygold | 0.015 | -11.8 | 0.0 | -41.5 | $4,604,600 |

| KRM | Kingsrose Mining Ltd | 0.045 | 2.3 | 12.5 | -31.8 | $35,368,746 |

| KSN | Kingston Resources | 0.075 | -6.3 | -5.1 | -3.6 | $53,026,498 |

| KTA | Krakatoa Resources | 0.01 | -25.9 | -16.7 | -67.7 | $4,721,072 |

| KZR | Kalamazoo Resources | 0.073 | -8.8 | -14.1 | -51.3 | $12,410,811 |

| LAT | Latitude 66 Limited | 0.12 | -17.2 | 5900.0 | -40.0 | $17,113,929 |

| LCL | LCL Resources Ltd | 0.008 | 0.0 | -11.1 | -78.9 | $7,719,024 |

| LCY | Legacy Iron Ore | 0.017 | 0.0 | 30.8 | -5.6 | $131,130,320 |

| LEX | Lefroy Exploration | 0.072 | -10.0 | -27.3 | -64.0 | $14,433,011 |

| LM8 | Lunnonmetalslimited | 0.16 | 3.2 | -17.9 | -82.2 | $33,765,722 |

| LRL | Labyrinth Resources | 0.014 | 0.0 | 250.0 | 75.0 | $15,438,068 |

| LYN | Lycaonresources | 0.285 | -8.1 | 26.7 | -1.7 | $15,100,675 |

| M24 | Mamba Exploration | 0.011 | -21.4 | -31.3 | -83.1 | $2,024,905 |

| M2R | Miramar | 0.007 | -46.2 | -17.6 | -79.4 | $2,763,457 |

| MAT | Matsa Resources | 0.025 | 0.0 | 0.0 | -26.5 | $13,761,879 |

| MAU | Magnetic Resources | 1.27 | 5.8 | 26.4 | 80.1 | $314,760,723 |

| MBK | Metal Bank Ltd | 0.019 | -13.6 | -17.4 | -39.8 | $7,418,727 |

| MCT | Metalicity Limited | 0.003 | 50.0 | 20.0 | 50.0 | $8,971,705 |

| MDI | Middle Island Res | 0.016 | -5.9 | 33.3 | -23.0 | $3,711,678 |

| MEG | Megado Minerals Ltd | 0.01 | 25.0 | 25.0 | -82.5 | $2,544,556 |

| MEI | Meteoric Resources | 0.105 | -25.0 | -34.4 | -55.3 | $238,814,381 |

| MEK | Meeka Metals Limited | 0.041 | 0.0 | 20.6 | 17.1 | $46,918,939 |

| MEU | Marmota Limited | 0.043 | -2.3 | -4.4 | 16.2 | $46,722,869 |

| MHC | Manhattan Corp Ltd | 0.0015 | 0.0 | 0.0 | -83.3 | $4,405,470 |

| MI6 | Minerals260Limited | 0.155 | 6.9 | 19.2 | -77.4 | $37,440,000 |

| MKG | Mako Gold | 0.01 | -9.1 | 0.0 | -64.3 | $9,760,082 |

| MKR | Manuka Resources. | 0.035 | -2.8 | -2.8 | -41.7 | $28,071,636 |

| MKR | Manuka Resources. | 0.035 | -2.8 | -2.8 | -41.7 | $28,071,636 |

| MLS | Metals Australia | 0.019 | 0.0 | -5.0 | -40.6 | $13,788,671 |

| MM8 | Medallion Metals. | 0.059 | -9.2 | 13.5 | -15.7 | $16,922,628 |

| MOH | Moho Resources | 0.006 | 0.0 | 50.0 | -45.5 | $3,235,069 |

| MOM | Moab Minerals Ltd | 0.005 | -16.7 | 66.7 | -44.4 | $3,969,071 |

| MRR | Minrex Resources Ltd | 0.009 | -5.3 | 0.0 | -40.0 | $9,763,808 |

| MRZ | Mont Royal Resources | 0.06 | -9.1 | -7.7 | -68.4 | $5,101,788 |

| MTC | Metalstech Ltd | 0.225 | -4.3 | 4.7 | 7.1 | $45,217,628 |

| MTH | Mithril Resources | 0.145 | -12.1 | -6.5 | -27.5 | $14,360,671 |

| MVL | Marvel Gold Limited | 0.008 | 33.3 | 0.0 | -33.3 | $6,910,326 |

| MXR | Maximus Resources | 0.03 | -3.2 | 7.1 | -7.0 | $12,837,831 |

| NAE | New Age Exploration | 0.004 | 0.0 | 33.3 | -33.3 | $5,381,697 |

| NAG | Nagambie Resources | 0.008 | -11.1 | -33.3 | -78.9 | $6,373,085 |

| NES | Nelson Resources. | 0.003 | 0.0 | 0.0 | -50.0 | $1,840,783 |

| NML | Navarre Minerals Ltd | 0.019 | 0.0 | 0.0 | 0.0 | $28,555,654 |

| NMR | Native Mineral Res | 0.02 | 0.0 | -20.0 | -42.9 | $4,197,010 |

| NPM | Newpeak Metals | 0.014 | -12.5 | -22.2 | -84.3 | $4,166,938 |

| NSM | Northstaw | 0.018 | -10.0 | 12.5 | -78.7 | $2,797,516 |

| NST | Northern Star | 13.74 | -5.4 | 2.5 | 18.2 | $16,421,805,293 |

| NVA | Nova Minerals Ltd | 0.15 | -31.0 | -21.1 | -54.5 | $41,404,670 |

| NWM | Norwest Minerals | 0.0265 | -30.3 | -17.2 | -56.6 | $13,098,227 |

| NXM | Nexus Minerals Ltd | 0.039 | 2.6 | 0.0 | -47.4 | $15,562,405 |

| OAU | Ora Gold Limited | 0.0055 | 0.0 | 10.0 | -8.3 | $42,846,958 |

| OBM | Ora Banda Mining Ltd | 0.43 | -3.4 | 19.4 | 273.9 | $798,786,788 |

| ORN | Orion Minerals Ltd | 0.015 | 0.0 | 0.0 | -25.0 | $105,095,706 |

| OZM | Ozaurum Resources | 0.048 | -26.2 | -9.4 | 33.3 | $8,255,000 |

| PDI | Predictive Disc Ltd | 0.185 | -9.8 | 5.7 | 12.1 | $445,911,377 |

| PGD | Peregrine Gold | 0.195 | -2.5 | -15.2 | -27.8 | $12,896,900 |

| PGO | Pacgold | 0.135 | -3.6 | 35.0 | -55.7 | $11,359,634 |

| PKO | Peako Limited | 0.004 | -25.9 | 29.6 | -48.1 | $2,108,339 |

| PNM | Pacific Nickel Mines | 0.024 | 0.0 | -14.3 | -74.5 | $10,038,075 |

| PNR | Pantoro Limited | 0.084 | -6.7 | -8.7 | 1.2 | $542,138,563 |

| PNT | Panthermetalsltd | 0.036 | 0.0 | 38.5 | -54.4 | $3,137,982 |

| PNX | PNX Metals Limited | 0.004 | 0.0 | 0.0 | 33.3 | $23,880,859 |

| POL | Polymetals Resources | 0.265 | -7.0 | 6.0 | -8.6 | $53,284,183 |

| PRS | Prospech Limited | 0.037 | -2.6 | 23.3 | 32.1 | $11,197,227 |

| PRU | Perseus Mining Ltd | 2.5 | -8.4 | 5.9 | 43.3 | $3,549,369,932 |

| PRX | Prodigy Gold NL | 0.0025 | -16.7 | 25.0 | -64.3 | $6,353,323 |

| PUA | Peak Minerals Ltd | 0.003 | -27.6 | 20.7 | 3.4 | $4,789,506 |

| PUR | Pursuit Minerals | 0.003 | 0.0 | 0.0 | -78.6 | $10,906,200 |

| PXX | Polarx Limited | 0.013 | 8.3 | -7.1 | 21.7 | $26,656,272 |

| QML | Qmines Limited | 0.046 | -17.9 | -19.3 | -65.9 | $9,015,721 |

| RDN | Raiden Resources Ltd | 0.023 | -11.5 | -25.8 | 228.6 | $65,252,699 |

| RDS | Redstone Resources | 0.0045 | -10.0 | 12.5 | -35.7 | $4,164,203 |

| RED | Red 5 Limited | 0.37 | -10.8 | -3.9 | 100.0 | $2,686,976,986 |

| REZ | Resourc & En Grp Ltd | 0.02 | 14.3 | 66.7 | 17.6 | $14,872,700 |

| RGL | Riversgold | 0.006 | -7.7 | 0.0 | -52.0 | $7,964,776 |

| RML | Resolution Minerals | 0.003 | 50.0 | 50.0 | -50.0 | $4,830,065 |

| RMS | Ramelius Resources | 1.89 | -5.5 | -2.6 | 44.8 | $2,214,031,665 |

| RMX | Red Mount Min Ltd | 0.002 | 100.0 | 100.0 | -54.3 | $6,847,155 |

| RND | Rand Mining Ltd | 1.485 | 0.0 | 3.1 | 15.1 | $84,460,802 |

| RRL | Regis Resources | 1.67 | -14.6 | -6.2 | -19.3 | $1,302,959,444 |

| RSG | Resolute Mining | 0.61 | -6.9 | 11.9 | 38.6 | $1,309,365,758 |

| RXL | Rox Resources | 0.145 | -6.5 | 20.8 | -39.2 | $53,959,597 |

| S2R | S2 Resources | 0.115 | -4.2 | 23.7 | -34.3 | $54,342,959 |

| SBM | St Barbara Limited | 0.21 | -12.5 | 5.0 | -19.2 | $175,863,632 |

| SBR | Sabre Resources | 0.0145 | 3.6 | -19.4 | -48.2 | $5,501,467 |

| SFM | Santa Fe Minerals | 0.032 | 0.0 | -13.5 | -28.9 | $2,330,201 |

| SFM | Santa Fe Minerals | 0.032 | 0.0 | -13.5 | -28.9 | $2,330,201 |

| SFR | Sandfire Resources | 8.3 | -3.8 | -6.3 | 38.1 | $3,732,103,582 |

| SI6 | SI6 Metals Limited | 0.002 | 0.0 | 0.0 | -75.0 | $4,737,719 |

| SIH | Sihayo Gold Limited | 0.002 | -20.0 | 0.0 | 33.3 | $24,408,512 |

| SKY | SKY Metals Ltd | 0.031 | -11.4 | -6.1 | -31.1 | $18,865,701 |

| SLR | Silver Lake Resource | 0 | -100.0 | -100.0 | -100.0 | $1,496,968,932 |

| SLZ | Sultan Resources Ltd | 0.006 | -25.0 | -25.0 | -84.7 | $1,185,519 |

| SMI | Santana Minerals Ltd | 1.175 | -0.8 | 15.2 | 115.6 | $232,277,552 |

| SMS | Starmineralslimited | 0.031 | 3.3 | 6.9 | -27.9 | $2,841,684 |

| SNG | Siren Gold | 0.067 | -6.9 | -26.4 | -36.2 | $13,842,702 |

| SPD | Southernpalladium | 0.38 | 2.7 | -5.0 | 7.0 | $34,105,000 |

| SPQ | Superior Resources | 0.01 | 0.0 | 42.9 | -65.5 | $20,012,204 |

| SPR | Spartan Resources | 1.27 | 18.7 | 38.8 | 455.7 | $1,416,778,094 |

| SRN | Surefire Rescs NL | 0.007 | 0.0 | -12.5 | -56.3 | $13,904,155 |

| SSR | SSR Mining Inc. | 8.22 | 2.0 | 19.3 | -61.9 | $34,521,302 |

| SSR | SSR Mining Inc. | 8.22 | 2.0 | 19.3 | -61.9 | $34,521,302 |

| STK | Strickland Metals | 0.085 | -12.4 | -19.0 | 102.4 | $201,426,156 |

| STN | Saturn Metals | 0.1825 | 4.3 | -6.4 | -1.4 | $50,335,021 |

| SVG | Savannah Goldfields | 0.032 | -11.1 | 60.0 | -63.3 | $8,994,717 |

| SVL | Silver Mines Limited | 0.15 | -3.2 | -6.3 | -21.1 | $218,665,257 |

| SVY | Stavely Minerals Ltd | 0.027 | -6.9 | -18.2 | -69.3 | $13,001,591 |

| SXG | Southern Cross Gold | 2.16 | -4.0 | -2.3 | 408.5 | $435,042,529 |

| TAM | Tanami Gold NL | 0.028 | -12.5 | -15.2 | -26.3 | $34,077,814 |

| TAR | Taruga Minerals | 0.009 | 0.0 | 28.6 | -18.2 | $6,354,241 |

| TBA | Tombola Gold Ltd | 0.026 | 0.0 | 0.0 | 0.0 | $33,129,243 |

| TBR | Tribune Res Ltd | 3.8 | -2.8 | 12.1 | 12.1 | $199,378,693 |

| TCG | Turaco Gold Limited | 0.205 | -14.6 | 5.1 | 286.8 | $153,440,223 |

| TG1 | Techgen Metals Ltd | 0.034 | 21.4 | 21.4 | -43.3 | $3,843,977 |

| TGM | Theta Gold Mines Ltd | 0.13 | 0.0 | -10.3 | 23.8 | $96,057,878 |

| THR | Thor Energy PLC | 0.017 | -5.6 | 13.3 | -57.5 | $3,995,417 |

| TIE | Tietto Minerals | 0 | -100.0 | -100.0 | -100.0 | $773,881,054 |

| TLM | Talisman Mining | 0.255 | -12.1 | 0.0 | 75.9 | $49,904,892 |

| TMB | Tambourahmetals | 0.045 | -8.2 | -11.8 | -79.5 | $3,732,316 |

| TMS | Tennant Minerals Ltd | 0.02 | -9.1 | -9.1 | -39.4 | $18,161,918 |

| TMX | Terrain Minerals | 0.004 | 33.3 | 33.3 | -33.3 | $5,726,683 |

| TMZ | Thomson Res Ltd | 0.005 | 0.0 | 0.0 | 0.0 | $4,881,018 |

| TNC | True North Copper | 0.047 | -6.0 | -6.0 | -79.9 | $41,148,039 |

| TRE | Toubani Res Ltd | 0.205 | 2.5 | 17.1 | 7.9 | $33,506,416 |

| TRM | Truscott Mining Corp | 0.06 | -6.3 | 0.0 | 47.0 | $10,470,960 |

| TSO | Tesoro Gold Ltd | 0.028 | -9.7 | -3.4 | 16.7 | $42,380,260 |

| TTMDD | Deferred Settlement | 0.47 | 2.2 | 11.9 | -26.7 | $83,613,296 |

| USL | Unico Silver Limited | 0.16 | -15.8 | 3.2 | 39.1 | $48,648,255 |

| VKA | Viking Mines Ltd | 0.009 | 0.0 | 12.5 | -25.0 | $7,176,809 |

| VMC | Venus Metals Cor Ltd | 0.087 | 8.8 | 24.3 | -24.3 | $16,506,395 |

| VRC | Volt Resources Ltd | 0.0045 | 12.5 | -10.0 | -62.5 | $20,793,391 |

| WA8 | Warriedarresourltd | 0.07 | -9.1 | 20.7 | -9.1 | $48,467,719 |

| WAF | West African Res Ltd | 1.385 | -7.0 | -13.4 | 51.4 | $1,586,527,818 |

| WCN | White Cliff Min Ltd | 0.018 | 38.5 | 20.0 | 80.0 | $27,699,586 |

| WGX | Westgold Resources. | 2.57 | -5.9 | 0.0 | 59.6 | $1,242,412,533 |

| WMC | Wiluna Mining Corp | 0 | -100.0 | -100.0 | -100.0 | $74,238,031 |

| WRM | White Rock Min Ltd | 0 | -100.0 | -100.0 | -100.0 | $17,508,200 |

| WTM | Waratah Minerals Ltd | 0.335 | 19.6 | 191.3 | 148.1 | $58,293,462 |

| WWI | West Wits Mining Ltd | 0.0145 | -3.3 | 11.5 | -19.4 | $38,125,902 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0.0 | 0.0 | 0.0 | $130,184,182 |

| XAM | Xanadu Mines Ltd | 0.057 | -5.0 | 3.6 | -38.0 | $96,096,337 |

| YRL | Yandal Resources | 0.14 | -9.7 | 0.0 | 169.2 | $41,510,180 |

| ZAG | Zuleika Gold Ltd | 0.017 | -5.6 | 6.3 | 13.3 | $12,594,959 |

| ZNC | Zenith Minerals Ltd | 0.052 | -5.5 | -3.7 | -43.5 | $19,380,949 |

At Stockhead we tell it like it is. While Ora Banda Mining is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.