Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Ho, ho… whoa! (Pic via Getty Images)

- Central banks will drive the price of gold higher in 2024, believe various analysts

- Spot gold prices seem stable to strong as we close out the year

- The week’s top ASX gold-related stocks led by: KCC, EMU, MTC

- The year’s top ASX goldies led by: SPR, OBM, BEZ

Before we delve into another gold article hook for one last week this year, let’s get a bead on the latest gold pricings.

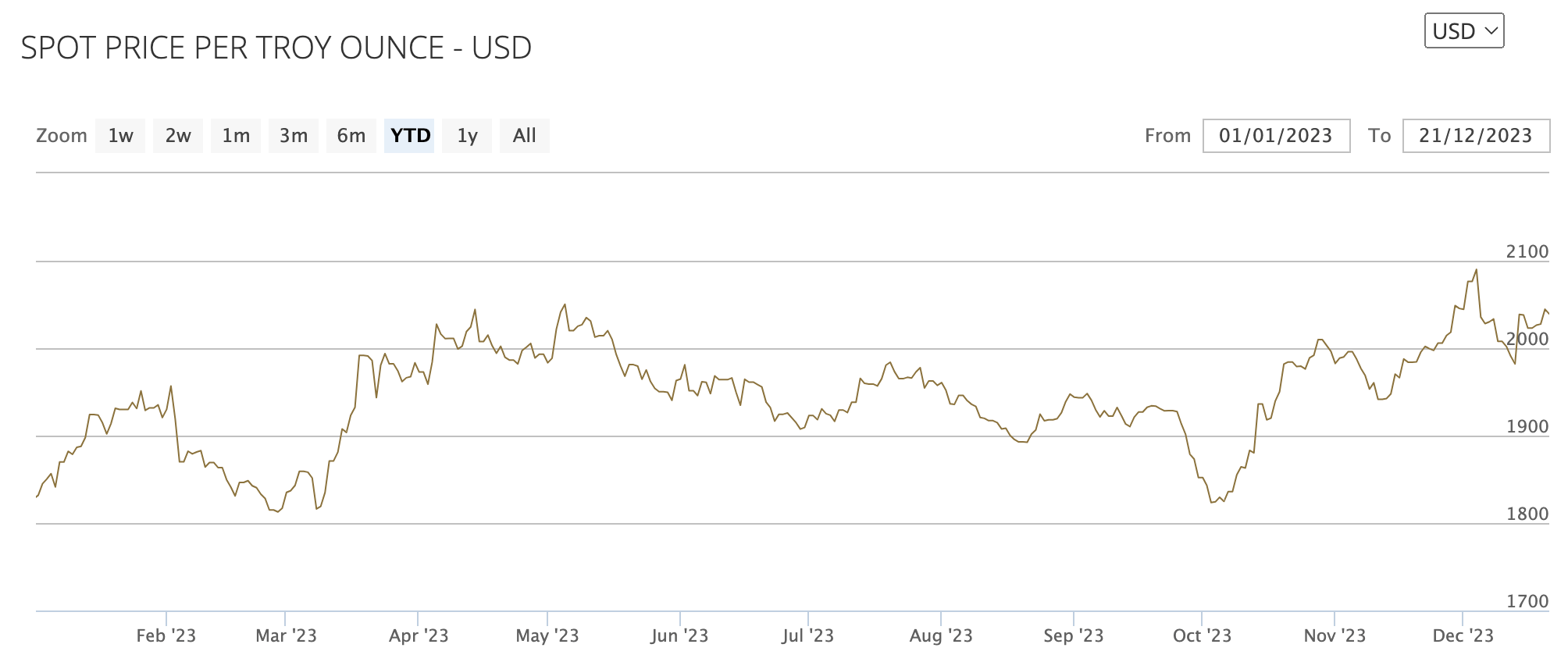

First up, US of Larry Finkin’ A. Spot gold in USD is currently doing just fine at $2,053 per ounce.

In Aussie plastic bucks, it’s also not too far from all-time highs again, changing hands for $3,028.

Sporting roughly 11.6% YTD performance, it’s been a pretty decent year for the prettiest commodity of all.

That said some of you might think this > ![]() , and its 163% YTD gain is even prettier. (Is Bitcoin a commodity, though? SEC chair Gary Gensler can’t give a straight answer, but it very likely is. It can’t really be a security. There’s literally no one tangible, no governing body, to pin it to. We digress…)

, and its 163% YTD gain is even prettier. (Is Bitcoin a commodity, though? SEC chair Gary Gensler can’t give a straight answer, but it very likely is. It can’t really be a security. There’s literally no one tangible, no governing body, to pin it to. We digress…)

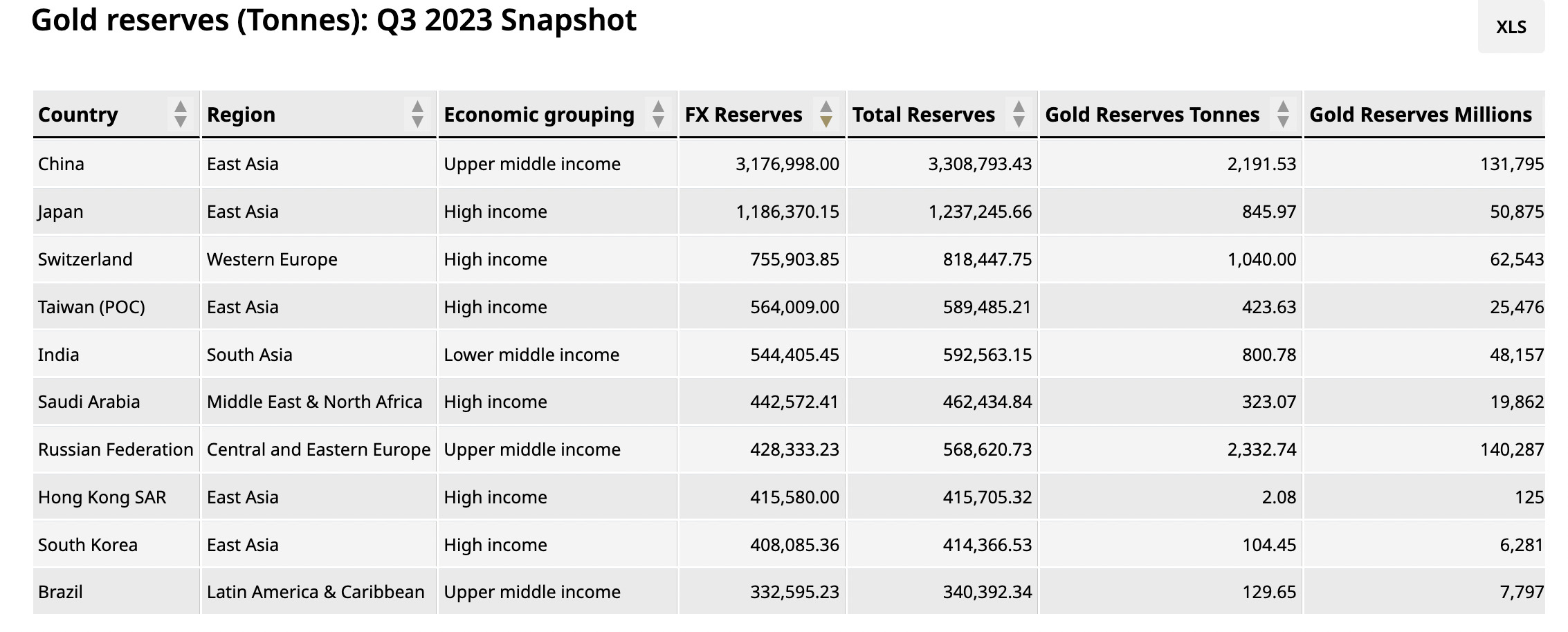

So, who’s been the biggest buyer of actual, physical gold this year? Yep, you guessed it – it’s the world’s central banks. No surprise there.

And also no real surprise, it’s been led by the most centralised of all central banks – the People’s Bank of China (PBoC). And by a considerable margin.

China reaches ‘lucky 13th’ month of buying

The PBoC recently disclosed it had bought yet more gold in November, its 13th consecutive month.

Luckily, 13 is not an unlucky number in China. In fact, it’s generally associated with “assured growth”.

Perhaps the bank ought to leave it there, then, because 14 translates to something more like “assured shrinkage”.

There’s every chance it and other major world central banks have remained in full Smaug mode (gathering and hoarding the yellow metal) in December and will likely do so into 2024.

Why’s that, then?

The World Gold Council has some reasons, as do various analysts such as Sprott Asset Management and deVere Group’s Nigel Green and others.

Let’s run through a few of the main factors…

Helping the case for gold in 2024

• De-dollarisation – you’ll notice in that chart above that (along with Japan, Switzerland, Thailand, Hong Kong and South Korea) BRICS nations’ central banks are prominent in the top 10 buyers of gold this year.

The move to reduce exposure risk to the US dollar has been a big part of gold’s good year, sending it to all-time highs recently.

A Sprott Asset Management report this month suggested that fears about assets being vulnerable, following the US seizure of Russia’s foreign exchange reserves of US$650 billion in February last year, have spurred central banks to “diversify away from USD and USD-based assets” and to buy more gold.

“In Q3 2023, central banks resumed their torrid gold purchasing pace, buying 337 tonnes of gold to bring the average of the last five quarters to 328 tonnes per quarter.”

As we nearly close off 2023,

China is now accumulating gold and reducing exposure to US treasuries as they secure partnerships worldwide for minerals.

How can anyone ignore this?

This is a very powerful strategy.

— Gold Telegraph ⚡ (@GoldTelegraph_) December 20, 2023

• The US Federal Reserve and remaining recession risk – The Fed’s actions play into the thesis above for many a global counterpart central bank.

Jerome Powell and mates raised interest rates 11 times since March 2022, which pushed the US federal funds rate to the highest levels in 22 years. The Fed has now signalled at least three rate cuts next year.

Take this next commentary with a grain of salt, as it comes from a state-owned Chinese propaganda pamphlet, but China Daily notes: “The decline in the credit of dollar assets, as well as the risk of asset impairment caused by the US’ rate cuts, has also caused other central banks to sell dollars and buy gold.” Proposed 2024 rate cuts, that is.

Meanwhile, Robin Tsui, gold strategist for SPDRS ETFs in Asia Pacific at State Street Global Advisors (takes breath) said the following, in conversation with AsianInvestor:

“A shift to a more dovish Fed supports gold’s prospects, while the US dollar’s outlook in 2024 is lukewarm as a scenario of interest rate cuts may spur demand for non-dollar currencies as interest rate spreads narrow globally.”

https://twitter.com/LavrionMining/status/1737086439865622638

By the way, Bloomberg’s commodities expert Mike McGlone reckons gold has the upper-hand advantage over its digital rival Bitcoin, in the event of US recession.

#Gold May Have an Upper Hand vs. #Bitcoin in 2024 If US Recession – The Bitcoin-to-gold cross rate appears to be gaining underpinnings from a rising stock market, with implications for a typical risk-asset drawdown in a recession. pic.twitter.com/BxNN51aZtb

— Mike McGlone (@mikemcglone11) December 17, 2023

• Geopolitcal turmoil – Yep, feeding the classic gold bug safe-haven schtick.

Geopolitics as a general narrative added about 3 to 6% to gold’s performance in 2023, the World Gold Council recently noted.

“Since the Russia-Ukraine war, central banks have been buying at 2.58 times the prior quarterly average of the preceding decade,” said Sprott, which believes global conflicts and de-dollarisation diversification factors have “put a floor under gold prices”.

Obviously ongoing conflict in Gaza and Israel is another contributing factor at play in gold’s age-old flight to safety, store-of-value narrative.

As deVere’s Nigel Green noted in his breakdown of risk factors for global markets in 2024: “Diversification and risk management strategies will be crucial for investors to navigate potential geopolitical shocks emanating from the Middle East.”

• A big election year globally – An addendum to the geopolitical turmoil above, “2024 is marked by decisive elections in over 40 countries, representing more than 50% of the world’s GDP,” noted Green.

“Investors are likely to face increased volatility in the lead-up to and aftermath of elections. Shifts in political landscapes typically result in policy changes that impact various sectors, prompting investors to reassess their portfolios.”

Regarding this, The World Gold Council reckons: “In a year with major elections taking place globally, including the US, EU, India and Taiwan, investors’ need for portfolio hedges will likely be higher than normal.”

WGC strategist Joseph Catavoni also suggested to The Australian recently that:

“There are a lot of elections to be held in 2024 and this creates a very uncertain outlook that could provide uplift to gold markets and other risk assets. Markets are likely to react very differently to a Republican or Democrat outcome in the US.”

Re central bank buying, though – a caveat

Per the South China Morning Post, The World Gold Council’s Shaokai Fan noted and caveated:

“On the whole, we expect central banks to continue buying gold in 2024 but the levels may not reach the record amounts of buying that we have witnessed recently.”

And that’s because, while the central bank buying helps to push the price of gold higher, banks are ultimately likely to slow down when prices rise, then wait for a price dip.

And, gotta love a bullish price prediction…

… although, we have seen at least one forecast that’s quite a bit higher not so long ago.

But this one comes from that SCMP article mentioned above:

“Central bank purchases may stumble as gold prices are expected to rise as and when the Federal Reserve starts cutting rates next year. Prices could rise to US$2,400-US$2,500 per ounce by the middle of next year,” said Gnanasekhar Thiagarajan, director of Commtrendz Risk Management in India.

Not bad. We’ll take it.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.0165 | 3% | -3% | -48% | $17,900,314 |

| NPM | Newpeak Metals | 0.023 | 35% | 15% | -77% | $1,999,035 |

| ASO | Aston Minerals Ltd | 0.022 | -4% | -29% | -74% | $31,081,542 |

| MTC | Metalstech Ltd | 0.26 | 33% | 79% | -45% | $44,404,329 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.045 | 0% | -6% | -55% | $5,198,506 |

| G88 | Golden Mile Res Ltd | 0.02 | 0% | -5% | -2% | $6,587,790 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -33% | $6,605,136 |

| NMR | Native Mineral Res | 0.019 | -5% | -30% | -83% | $3,985,260 |

| AQX | Alice Queen Ltd | 0.0055 | 10% | -8% | -84% | $3,800,413 |

| SLZ | Sultan Resources Ltd | 0.02 | -13% | 25% | -76% | $2,963,801 |

| MKG | Mako Gold | 0.011 | 10% | 10% | -73% | $6,624,094 |

| KSN | Kingston Resources | 0.078 | -3% | -15% | -6% | $38,841,023 |

| AMI | Aurelia Metals Ltd | 0.11 | 0% | -4% | -8% | $185,874,414 |

| PNX | PNX Metals Limited | 0.003 | -25% | -25% | -29% | $16,141,874 |

| GIB | Gibb River Diamonds | 0.03 | 7% | 0% | -53% | $6,345,283 |

| KCN | Kingsgate Consolid. | 1.26 | -11% | -13% | -30% | $324,767,132 |

| TMX | Terrain Minerals | 0.005 | 25% | 0% | -17% | $6,767,139 |

| BNR | Bulletin Res Ltd | 0.14 | 0% | 8% | 40% | $39,637,799 |

| NXM | Nexus Minerals Ltd | 0.042 | -11% | -29% | -79% | $17,507,706 |

| SKY | SKY Metals Ltd | 0.039 | 8% | 8% | -24% | $17,994,526 |

| LM8 | Lunnonmetalslimited | 0.58 | -3% | -11% | -33% | $130,233,745 |

| CST | Castile Resources | 0.08 | -4% | 21% | -17% | $19,352,194 |

| YRL | Yandal Resources | 0.091 | 15% | 1% | -8% | $20,655,902 |

| FAU | First Au Ltd | 0.004 | 0% | 100% | 0% | $6,647,973 |

| ARL | Ardea Resources Ltd | 0.47 | -4% | 8% | -36% | $94,568,119 |

| GWR | GWR Group Ltd | 0.094 | 1% | 12% | 66% | $30,194,366 |

| IVR | Investigator Res Ltd | 0.036 | -5% | -29% | -14% | $55,430,428 |

| GTR | Gti Energy Ltd | 0.0095 | 19% | 19% | -12% | $20,499,471 |

| IPT | Impact Minerals | 0.013 | 18% | 24% | 86% | $31,511,743 |

| BNZ | Benzmining | 0.23 | -4% | -22% | -43% | $25,693,639 |

| MOH | Moho Resources | 0.01 | 0% | 11% | -52% | $5,359,412 |

| BCM | Brazilian Critical | 0.026 | 0% | 8% | -74% | $17,758,964 |

| PUA | Peak Minerals Ltd | 0.0035 | 17% | 17% | -30% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.145 | -3% | -9% | -17% | $12,329,320 |

| SMS | Starmineralslimited | 0.038 | 9% | 3% | -45% | $2,885,066 |

| MVL | Marvel Gold Limited | 0.012 | 0% | 14% | -54% | $10,365,488 |

| PRX | Prodigy Gold NL | 0.006 | 0% | -33% | -54% | $12,257,755 |

| AAU | Antilles Gold Ltd | 0.023 | 0% | 0% | -28% | $18,884,459 |

| CWX | Carawine Resources | 0.11 | 0% | 0% | 12% | $25,973,799 |

| RND | Rand Mining Ltd | 1.37 | 0% | 7% | 1% | $77,920,067 |

| CAZ | Cazaly Resources | 0.03 | 3% | -17% | -3% | $13,639,090 |

| BMR | Ballymore Resources | 0.13 | 8% | -13% | -16% | $22,041,323 |

| DRE | Dreadnought Resources Ltd | 0.029 | -3% | -12% | -70% | $100,893,116 |

| ZNC | Zenith Minerals Ltd | 0.14 | -13% | 0% | -45% | $49,333,324 |

| REZ | Resourc & En Grp Ltd | 0.012 | 0% | -25% | -25% | $5,997,669 |

| LEX | Lefroy Exploration | 0.175 | 3% | 3% | -34% | $35,952,714 |

| ERM | Emmerson Resources | 0.054 | -2% | -8% | -29% | $29,959,038 |

| AM7 | Arcadia Minerals | 0.069 | -5% | -19% | -64% | $7,524,457 |

| ADT | Adriatic Metals | 3.65 | -11% | 12% | 16% | $874,807,240 |

| AS1 | Asara Resources Ltd | 0.011 | 10% | -8% | -63% | $8,720,040 |

| CYL | Catalyst Metals | 0.7 | -10% | -33% | -42% | $159,614,219 |

| CHN | Chalice Mining Ltd | 1.4325 | -19% | -8% | -77% | $575,665,690 |

| KAL | Kalgoorliegoldmining | 0.029 | 16% | 16% | -65% | $4,596,521 |

| MLS | Metals Australia | 0.036 | 3% | 0% | -23% | $22,465,303 |

| ADN | Andromeda Metals Ltd | 0.023 | -4% | 5% | -48% | $71,530,194 |

| MEI | Meteoric Resources | 0.295 | 13% | 44% | 368% | $567,184,156 |

| SRN | Surefire Rescs NL | 0.0085 | 0% | -11% | -23% | $15,705,263 |

| SIH | Sihayo Gold Limited | 0.0015 | 0% | -25% | -25% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.055 | 2% | -13% | -66% | $26,031,517 |

| HMX | Hammer Metals Ltd | 0.046 | -10% | -19% | -32% | $42,547,553 |

| WCN | White Cliff Min Ltd | 0.009 | 0% | -25% | -36% | $11,489,034 |

| AVMDC | Advance Metals Ltd | 0.036 | -10% | -40% | -78% | $1,300,224 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -10% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.007 | 0% | 0% | -67% | $11,455,470 |

| MCT | Metalicity Limited | 0.002 | 0% | 0% | -33% | $8,970,108 |

| AME | Alto Metals Limited | 0.043 | 0% | -2% | -37% | $31,025,496 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 0% | 0% | $14,368,295 |

| TIE | Tietto Minerals | 0.5975 | -4% | -4% | -23% | $677,934,271 |

| SMI | Santana Minerals Ltd | 0.965 | -4% | 19% | 46% | $178,720,666 |

| M2R | Miramar | 0.023 | 10% | 21% | -70% | $3,126,260 |

| MHC | Manhattan Corp Ltd | 0.003 | -25% | -25% | -50% | $8,810,939 |

| GRL | Godolphin Resources | 0.04 | 5% | 5% | -46% | $7,615,891 |

| SVG | Savannah Goldfields | 0.044 | -12% | -20% | -73% | $8,834,037 |

| EMC | Everest Metals Corp | 0.079 | -2% | -9% | -12% | $13,552,498 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -8% | $11,262,521 |

| CY5 | Cygnus Metals Ltd | 0.12 | -4% | -20% | -69% | $33,529,301 |

| G50 | Gold50Limited | 0.135 | 0% | 13% | -44% | $14,754,150 |

| ADV | Ardiden Ltd | 0.17 | -3% | -6% | -51% | $10,940,564 |

| AAR | Astral Resources NL | 0.074 | 1% | -8% | -1% | $59,482,315 |

| VMC | Venus Metals Cor Ltd | 0.1 | -5% | -5% | 27% | $18,972,868 |

| NAE | New Age Exploration | 0.005 | -17% | -29% | -29% | $9,866,444 |

| VKA | Viking Mines Ltd | 0.014 | 8% | 8% | 56% | $14,353,618 |

| LCL | LCL Resources Ltd | 0.0165 | 3% | -25% | -68% | $16,169,492 |

| MTH | Mithril Resources | 0.002 | 0% | 0% | -43% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.0055 | 10% | -8% | -8% | $3,848,106 |

| RMX | Red Mount Min Ltd | 0.003 | 0% | 0% | -33% | $8,020,728 |

| PRS | Prospech Limited | 0.03 | -6% | -6% | 12% | $8,104,462 |

| XTC | XTC Lithium Limited | 0.2 | 19900% | 0% | -67% | $17,528,272 |

| TTM | Titan Minerals | 0.025 | -11% | -14% | -65% | $42,281,734 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -57% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.044 | -6% | -27% | -63% | $22,576,405 |

| KZR | Kalamazoo Resources | 0.135 | 23% | 4% | -45% | $18,850,642 |

| BCN | Beacon Minerals | 0.025 | -4% | -17% | -11% | $93,919,204 |

| MAU | Magnetic Resources | 1 | -2% | -7% | 18% | $244,667,260 |

| BC8 | Black Cat Syndicate | 0.23 | -8% | -22% | -41% | $71,384,856 |

| EM2 | Eagle Mountain | 0.076 | 3% | 36% | -54% | $23,177,482 |

| EMR | Emerald Res NL | 2.975 | -4% | 3% | 149% | $1,828,261,292 |

| BYH | Bryah Resources Ltd | 0.013 | 0% | -13% | -46% | $5,636,894 |

| HCH | Hot Chili Ltd | 1 | -1% | -7% | 12% | $119,445,206 |

| WAF | West African Res Ltd | 0.9275 | -6% | -5% | -23% | $933,762,900 |

| MEU | Marmota Limited | 0.042 | 2% | 0% | -9% | $43,410,824 |

| NVA | Nova Minerals Ltd | 0.36 | -1% | 29% | -45% | $78,029,286 |

| SVL | Silver Mines Limited | 0.165 | -3% | -15% | -20% | $224,693,143 |

| PGD | Peregrine Gold | 0.27 | 6% | 0% | -27% | $18,759,015 |

| ICL | Iceni Gold | 0.058 | 12% | -6% | -30% | $13,684,000 |

| FG1 | Flynngold | 0.05 | -4% | -34% | -49% | $7,286,213 |

| WWI | West Wits Mining Ltd | 0.012 | 9% | 0% | -20% | $29,164,700 |

| RML | Resolution Minerals | 0.0035 | 17% | 17% | -50% | $4,409,989 |

| AAJ | Aruma Resources Ltd | 0.027 | 0% | -16% | -47% | $5,316,071 |

| AL8 | Alderan Resource Ltd | 0.005 | 0% | -23% | -38% | $6,641,168 |

| GMN | Gold Mountain Ltd | 0.0055 | 10% | 10% | -21% | $11,345,393 |

| MEG | Megado Minerals Ltd | 0.03 | -17% | 20% | -27% | $7,633,667 |

| HMG | Hamelingoldlimited | 0.08 | 1% | -2% | -45% | $12,600,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.225 | 22% | 7% | -55% | $17,827,378 |

| TBR | Tribune Res Ltd | 2.87 | 0% | 0% | -27% | $154,256,146 |

| FML | Focus Minerals Ltd | 0.18 | 3% | 3% | -16% | $50,147,763 |

| GSR | Greenstone Resources | 0.008 | 0% | -11% | -75% | $10,944,908 |

| VRC | Volt Resources Ltd | 0.006 | -8% | -14% | -57% | $26,845,694 |

| ARV | Artemis Resources | 0.019 | -5% | -17% | -21% | $32,132,727 |

| HRN | Horizon Gold Ltd | 0.25 | -17% | -12% | -19% | $43,451,977 |

| CLA | Celsius Resource Ltd | 0.012 | 0% | -8% | -33% | $29,198,672 |

| QML | Qmines Limited | 0.078 | -1% | -8% | -53% | $16,452,232 |

| RDN | Raiden Resources Ltd | 0.038 | -12% | -12% | 567% | $100,881,924 |

| TCG | Turaco Gold Limited | 0.13 | 4% | 4% | 124% | $76,336,000 |

| KCC | Kincora Copper | 0.044 | -2% | 52% | -37% | $9,143,192 |

| GBZ | GBM Rsources Ltd | 0.009 | 0% | -33% | -78% | $6,582,896 |

| DTM | Dart Mining NL | 0.016 | -6% | 0% | -71% | $3,641,274 |

| MKR | Manuka Resources. | 0.075 | -5% | 50% | -12% | $42,949,125 |

| AUC | Ausgold Limited | 0.028 | -13% | -18% | -42% | $68,884,236 |

| ANX | Anax Metals Ltd | 0.029 | -3% | 7% | -45% | $13,946,611 |

| EMU | EMU NL | 0.001 | 0% | 0% | -80% | $2,024,771 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -46% | $3,131,208 |

| SSR | SSR Mining Inc. | 15.75 | -4% | -13% | -35% | $100,767,340 |

| PNR | Pantoro Limited | 0.052 | -9% | -5% | -42% | $265,405,556 |

| CMM | Capricorn Metals | 4.445 | -8% | -9% | -9% | $1,641,342,052 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -12% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.005 | 0% | -17% | -17% | $7,975,438 |

| HAW | Hawthorn Resources | 0.095 | 2% | 19% | -17% | $33,166,546 |

| BGD | Bartongoldholdings | 0.265 | 0% | 8% | 8% | $52,795,056 |

| SVY | Stavely Minerals Ltd | 0.044 | -6% | -25% | -80% | $16,423,424 |

| AGC | AGC Ltd | 0.072 | -1% | 4% | 22% | $15,333,333 |

| RGL | Riversgold | 0.013 | 8% | -19% | -54% | $12,579,599 |

| TSO | Tesoro Gold Ltd | 0.027 | 0% | 0% | -29% | $33,378,720 |

| GUE | Global Uranium | 0.098 | -1% | 1% | -37% | $19,311,016 |

| CPM | Coopermetalslimited | 0.38 | 7% | -1% | 58% | $24,455,147 |

| MM8 | Medallion Metals. | 0.062 | -5% | -6% | -59% | $19,997,357 |

| FFM | Firefly Metals Ltd | 0.575 | -8% | 0% | -35% | $215,803,073 |

| CBY | Canterbury Resources | 0.025 | -7% | -11% | -39% | $4,293,522 |

| LYN | Lycaonresources | 0.19 | -5% | 23% | -31% | $7,049,000 |

| SFR | Sandfire Resources | 7.03 | -4% | 11% | 25% | $3,317,764,853 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -72% | $4,881,018 |

| TAM | Tanami Gold NL | 0.035 | 0% | -8% | -10% | $41,128,397 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.032 | 19% | 7% | -33% | $9,202,224 |

| ALK | Alkane Resources Ltd | 0.65 | -3% | -10% | 13% | $386,199,883 |

| BMO | Bastion Minerals | 0.016 | -16% | 7% | -47% | $4,983,105 |

| IDA | Indiana Resources | 0.083 | 12% | 38% | 43% | $51,679,913 |

| GSM | Golden State Mining | 0.015 | 0% | -21% | -70% | $4,050,874 |

| NSM | Northstaw | 0.049 | -2% | -26% | -71% | $6,853,913 |

| GSN | Great Southern | 0.02 | 0% | -5% | -33% | $15,092,704 |

| RED | Red 5 Limited | 0.2875 | -9% | -24% | 22% | $1,004,502,159 |

| DEG | De Grey Mining | 1.1975 | -5% | -15% | -15% | $2,193,749,647 |

| THR | Thor Energy PLC | 0.03 | 3% | 0% | -50% | $5,395,054 |

| CDR | Codrus Minerals Ltd | 0.062 | 9% | 11% | -50% | $5,436,625 |

| MDI | Middle Island Res | 0.016 | 0% | 7% | -58% | $3,482,464 |

| WTM | Waratah Minerals Ltd | 0.11 | -8% | 197% | -27% | $16,430,095 |

| POL | Polymetals Resources | 0.305 | -2% | 11% | 27% | $46,411,308 |

| RDS | Redstone Resources | 0.005 | 0% | -17% | -38% | $5,528,271 |

| NAG | Nagambie Resources | 0.028 | -3% | -7% | -56% | $23,027,094 |

| BGL | Bellevue Gold Ltd | 1.48 | -13% | -18% | 27% | $1,694,783,210 |

| GBR | Greatbould Resources | 0.064 | 0% | -11% | -32% | $38,315,981 |

| KAI | Kairos Minerals Ltd | 0.0145 | -6% | -3% | -28% | $38,003,227 |

| KAU | Kaiser Reef | 0.145 | -12% | -17% | -17% | $24,801,365 |

| HRZ | Horizon | 0.038 | -5% | -5% | -38% | $28,039,347 |

| CAI | Calidus Resources | 0.205 | -7% | 5% | -27% | $131,530,839 |

| CDT | Castle Minerals | 0.009 | 0% | -10% | -59% | $11,020,437 |

| RSG | Resolute Mining | 0.415 | -11% | -9% | 102% | $904,846,256 |

| MXR | Maximus Resources | 0.034 | -3% | -32% | -15% | $10,900,596 |

| EVN | Evolution Mining Ltd | 3.805 | -5% | -8% | 21% | $7,487,169,749 |

| CXU | Cauldron Energy Ltd | 0.031 | 29% | 107% | 424% | $30,586,655 |

| DLI | Delta Lithium | 0.415 | -12% | -11% | -5% | $320,147,052 |

| ALY | Alchemy Resource Ltd | 0.01 | 0% | 0% | -60% | $11,780,763 |

| HXG | Hexagon Energy | 0.012 | -8% | 33% | -29% | $6,154,991 |

| OBM | Ora Banda Mining Ltd | 0.245 | 7% | 0% | 172% | $409,624,769 |

| SLR | Silver Lake Resource | 1.13 | -8% | -2% | -10% | $1,042,239,931 |

| AVW | Avira Resources Ltd | 0.0015 | 0% | 0% | -40% | $3,200,685 |

| LCY | Legacy Iron Ore | 0.018 | 6% | 13% | -5% | $115,322,872 |

| PDI | Predictive Disc Ltd | 0.2075 | -1% | -14% | 5% | $415,248,818 |

| MAT | Matsa Resources | 0.028 | 8% | 8% | -20% | $13,402,873 |

| ZAG | Zuleika Gold Ltd | 0.018 | 0% | 6% | -14% | $13,249,539 |

| GML | Gateway Mining | 0.02 | -20% | -9% | -68% | $7,829,565 |

| SBM | St Barbara Limited | 0.205 | 0% | -5% | -41% | $163,594,076 |

| SBR | Sabre Resources | 0.03 | -6% | -14% | -29% | $11,224,752 |

| STK | Strickland Metals | 0.125 | 39% | -31% | 213% | $195,886,577 |

| ION | Iondrive Limited | 0.012 | 0% | 0% | -54% | $5,835,423 |

| CEL | Challenger Gold Ltd | 0.072 | 6% | 0% | -59% | $89,542,955 |

| LRL | Labyrinth Resources | 0.007 | 0% | 17% | -55% | $8,312,806 |

| NST | Northern Star | 12.95 | -6% | 0% | 13% | $14,710,030,285 |

| OZM | Ozaurum Resources | 0.14 | -3% | 22% | 112% | $22,225,000 |

| TG1 | Techgen Metals Ltd | 0.084 | 17% | 1% | -2% | $7,977,801 |

| XAM | Xanadu Mines Ltd | 0.055 | 2% | 4% | 90% | $96,946,779 |

| AQI | Alicanto Min Ltd | 0.034 | -6% | -24% | -32% | $20,921,451 |

| KTA | Krakatoa Resources | 0.04 | 18% | -7% | -5% | $18,884,289 |

| ARN | Aldoro Resources | 0.12 | -8% | 45% | -37% | $16,154,849 |

| WGX | Westgold Resources. | 1.9825 | -10% | -9% | 111% | $961,454,142 |

| MBK | Metal Bank Ltd | 0.028 | 4% | -7% | -17% | $10,932,860 |

| A8G | Australasian Metals | 0.15 | -12% | -12% | -21% | $7,818,074 |

| TAR | Taruga Minerals | 0.013 | 18% | 18% | -43% | $8,825,335 |

| DTR | Dateline Resources | 0.01 | 0% | 0% | -71% | $13,129,455 |

| GOR | Gold Road Res Ltd | 1.725 | -15% | -13% | -3% | $1,859,666,133 |

| S2R | S2 Resources | 0.155 | -3% | -23% | -11% | $72,297,279 |

| NES | Nelson Resources. | 0.004 | 14% | 0% | -43% | $2,454,377 |

| TLM | Talisman Mining | 0.285 | 21% | 39% | 111% | $56,496,105 |

| BEZ | Besragoldinc | 0.135 | -10% | -18% | 160% | $56,443,622 |

| PRU | Perseus Mining Ltd | 1.77 | -8% | -13% | -19% | $2,410,604,743 |

| SPQ | Superior Resources | 0.0125 | -4% | -34% | -77% | $24,014,645 |

| PUR | Pursuit Minerals | 0.008 | 0% | 0% | -50% | $26,495,743 |

| RMS | Ramelius Resources | 1.655 | -4% | -5% | 67% | $1,875,685,315 |

| PKO | Peako Limited | 0.005 | 0% | 0% | -62% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.012 | 20% | 9% | -50% | $7,013,226 |

| A1G | African Gold Ltd. | 0.036 | 33% | 6% | -55% | $6,095,204 |

| OAU | Ora Gold Limited | 0.006 | -8% | -8% | 20% | $34,136,928 |

| GNM | Great Northern | 0.019 | 0% | -5% | -64% | $3,247,211 |

| KRM | Kingsrose Mining Ltd | 0.04 | -5% | -9% | -43% | $30,101,061 |

| BTR | Brightstar Resources | 0.015 | -6% | 7% | -6% | $35,555,683 |

| RRL | Regis Resources | 2.11 | -5% | 7% | 0% | $1,586,211,497 |

| M24 | Mamba Exploration | 0.06 | 20% | 100% | -61% | $3,524,525 |

| TRM | Truscott Mining Corp | 0.055 | 0% | -10% | 12% | $9,535,188 |

| TNC | True North Copper | 0.105 | -5% | -13% | 98% | $33,067,478 |

| MOM | Moab Minerals Ltd | 0.008 | 14% | 33% | -11% | $5,695,708 |

| KNB | Koonenberrygold | 0.054 | 13% | 69% | -10% | $6,586,200 |

| AWJ | Auric Mining | 0.125 | 9% | 81% | 95% | $17,011,747 |

| AZS | Azure Minerals | 3.7 | 1% | 0% | 1474% | $1,683,354,040 |

| ENR | Encounter Resources | 0.355 | 15% | 18% | 97% | $134,754,012 |

| SNG | Siren Gold | 0.07 | 8% | 37% | -60% | $11,101,075 |

| STN | Saturn Metals | 0.22 | 22% | 52% | 33% | $40,195,477 |

| USL | Unico Silver Limited | 0.11 | -12% | -12% | -29% | $34,045,933 |

| PNM | Pacific Nickel Mines | 0.083 | 0% | -1% | 2% | $34,715,008 |

| AYM | Australia United Min | 0.003 | 0% | 50% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.19 | 0% | -31% | -40% | $60,161,450 |

| SPR | Spartan Resources | 0.495 | -7% | 0% | 196% | $477,031,573 |

| PNT | Panthermetalsltd | 0.06 | 0% | 9% | -68% | $5,101,500 |

| MEK | Meeka Metals Limited | 0.037 | -8% | -16% | -40% | $46,918,939 |

| GMD | Genesis Minerals | 1.625 | -12% | -14% | 29% | $1,787,276,663 |

| PGO | Pacgold | 0.19 | -5% | -10% | -46% | $16,829,088 |

| FEG | Far East Gold | 0.15 | 0% | -6% | -68% | $25,284,869 |

| MI6 | Minerals260Limited | 0.33 | 3% | 10% | 0% | $78,390,000 |

| IGO | IGO Limited | 8.69 | -5% | 8% | -36% | $6,580,657,295 |

| GAL | Galileo Mining Ltd | 0.27 | -2% | 2% | -70% | $50,394,356 |

| RXL | Rox Resources | 0.185 | 0% | -16% | 3% | $66,483,767 |

| KIN | KIN Min NL | 0.064 | -2% | -3% | 0% | $77,757,936 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -88% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.115 | 5% | -8% | 69% | $84,849,001 |

| FAL | Falconmetalsltd | 0.125 | -14% | -17% | -56% | $22,125,000 |

| SXG | Southern Cross Gold | 1.15 | -12% | 10% | 60% | $104,014,245 |

| SPD | Southernpalladium | 0.365 | -3% | 9% | -57% | $15,077,414 |

| ORN | Orion Minerals Ltd | 0.015 | 7% | 7% | 0% | $87,675,520 |

| TMB | Tambourahmetals | 0.12 | 4% | -23% | 14% | $9,952,842 |

| TMS | Tennant Minerals Ltd | 0.033 | -3% | -6% | 10% | $24,456,424 |

| AZY | Antipa Minerals Ltd | 0.017 | -11% | 21% | -23% | $70,291,735 |

| PXX | Polarx Limited | 0.009 | 29% | 20% | -63% | $11,477,317 |

| TRE | Toubaniresourcesinc | 0.14 | -3% | -10% | -13% | $19,410,522 |

| AUN | Aurumin | 0.028 | 17% | 17% | -55% | $9,319,520 |

| GPR | Geopacific Resources | 0.016 | -6% | -20% | -49% | $13,147,478 |

| FXG | Felix Gold Limited | 0.049 | 2% | -2% | -59% | $5,816,614 |

| ILT | Iltani Resources Lim | 0.165 | 18% | 14% | 0% | $5,611,733 |

| ARD | Argent Minerals | 0.01 | 0% | -23% | -33% | $12,917,590 |

Best-performing goldies over the past week

The week’s biggest gainers

Emu (ASX:EMU) +50%

MetalsTech (ASX:MTC) +44%

Sultan Resources (ASX:SLZ) +38%

Bastion Minerals (ASX:BMO) +38%

Best-performing goldies over the past year

The year’s biggest gainers

Spartan Resources (ASX:SPR) 178%

Ora Banda (ASX:OBM) 162%

Besra Gold (ASX:BEZ) 160%

Emerald Resources (ASX:EMR) 148%

Westgold Resources (ASX:WGX) 142%

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.