Gold Digger: US$3000/oz? Analysts are still predicting a fairytale 2024 for the prettiest commodity of them all

Pic via Getty Images

- ING downgrades Q4 gold price forecasts, but expects prices to move higher again in Q1 “on the assumption that the Fed will start cutting rates”

- Bloomberg commodities guru Mike McGlone: $US3000/oz may be “rendezvous point”

- ASX gold stock of the week: S2 Resources

The dark forces of Macro have been suppressing the price of gold lately (although not in China), keeping the short sighted amongst us slightly anxious and sweaty.

BREAKING NEWS

CHINESE INVESTORS LIFT GOLD PRICE PREMIUM OVER WORLD MARKET TO RECORD LEVEL

The worlds biggest producer of gold.

What a show.

— Gold Telegraph ⚡ (@GoldTelegraph_) September 27, 2023

That said, today at least, there’s been something of a reprieve with the yellow metal trading back up a tad (+0.22%) at US$1,824 an ounce. That’s about $2,865/oz in Aussie terms.

And zooming out, more than one prominent banking institution and analyst (in fact several of the latter from what we’re seeing) is still predicting a fairytale 2024 for the prettiest commodity of them all.

Maybe that’s overstating it, but a better year than this one is being foretold by gold bugs as well as more impartial observers, based partly on the idea the US Federal Reserve will once again need to money print the US economy out of deep doo-doo.

Froth-ING for 2024

ING is one of those prominent institutional forecasters and they’ve just released a think piece titled: “Higher for longer takes the shine off gold”, dated October 5.

Yeah, that doesn’t sound positive, but it refers to the here and now. What do top investors tend to trade? Not so much the here and now, but what they believe is coming down the line. We’ll get to that momentarily.

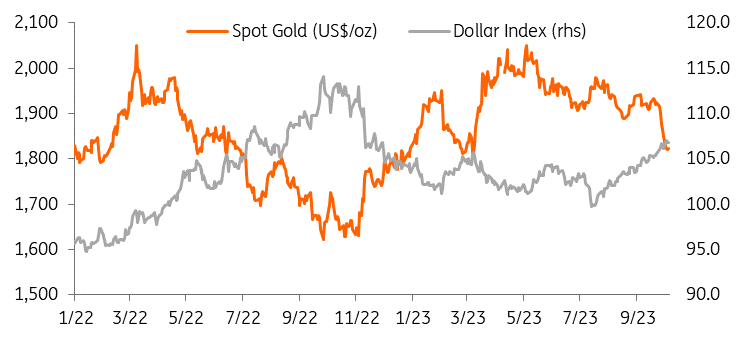

For now, ING’s Ewa Manthey notes, gold has plunged to its lowest levels since March as US Treasury yields move higher and the US Dollar strengthens.

Still, ING is seeing things largely through golden-tinted glasses.

That dipping spot gold worm you can see in the chart above is seeing ING revise its fourth-quarter gold price forecast to an average of US$1,900 an ounce, which is down from the bank’s commodity strategists’ previous estimate of US$1,950 an ounce.

ING is also now factoring in an annual price forecast for 2023 of US$1,924 an ounce, which is a decent round of drinks down from the US$2,000 an ounce it was predicting at the start of the year.

“In the short term, we believe the threat of further action from the Fed will continue to keep the lid on gold prices,” wrote ING’s commodities expert.

So, can we look forward to the bull goose over at the Fed (that’d be Jerome Powell) to start laying us some golden eggs in the form of rate cuts?

You bet, says Manthey:

“Our US economist believes that the Fed is done hiking rates with cuts starting from spring 2024 as challenges continue to mount. Real household disposable income is slowing, student loan repayments are due to restart, credit availability is drying up and pandemic-era accrued savings have been exhausted by many households.

“We expect prices to move higher again in the first quarter of 2024 to average $1,950/oz on the assumption that the Fed will start cutting rates in the first quarter of next year, the dollar weakens, safe haven demand picks up amid global economic uncertainty and central bank buying remains at high levels.”

Gold to go “higher for longer” next year, then? Supporting this possibility is Bloomberg’s commodities guru Mike McGlone:

“If the US has a recession worthy of the most aggressive Fed tightening from zero ever, the S&P 500’s pre-pandemic level of around $3,000 may be a rendezvous point for the index and gold.”

Recession Tilt Toward $3,000 $Gold and S&P, $3 #Copper, 3% 10-Year. #Recession outlooks from the Conference Board and Bloomberg Economics have remained resolute, as has the #FederalReserve, which may imply inevitability. We see reversion leaning toward $3 a pound copper, which… pic.twitter.com/WbQIn6KZu1

— Mike McGlone (@mikemcglone11) September 26, 2023

Here’s another major financial institution – UBS – re-adjusting its gold price expectations for this year (and next). It’s not as positive as ING’s…

🔸 UBS SAYS CUTS END-2023 GOLD PRICE FORECAST TO USD 1,850/OZ (FROM 1,950) AND JUNE 2024 TO USD 1,950/OZ (FROM 2,100)

— *Walter Bloomberg (@DeItaone) October 4, 2023

Canadian mining financier Frank Giustra (below) has begrudgingly acknowledged that Bitcoin has played a role in suppressing the gold price, which he puts down to the, er, “Bitcoin marketing guys”. He does realise that Bitcoin is not a company, doesn’t he?

In any case, he thinks gold spruikers could take a leaf out of Bitcoin enthusiasts’ book…

"I think #Bitcoin did have a role in suppressing the #gold price for so long when it was popular," says @Frank_Giustra. "The #btc guys did a great job marketing…they hyped #btc to $65k on these ideas it would replace gold," he tells @DanielaCambone ➡️ https://t.co/XCFnfnpLnK pic.twitter.com/ZDPFc4Uevu

— Stansberry Research (@Stansberry) September 30, 2023

… maybe like this? Good ol’ Peter “I Get Up Early So I can Hate Bitcoin a Little Longer” Schiff, eh? Gotta respect the effort.

I'm expecting a significant reversal of the downtrend in #gold to begin soon. When it happens it'll be violent, with the gold price rising at a blistering pace. Don't get left behind standing on the platform as the gold train leaves the station without you. Call @SchiffGold now!

— Peter Schiff (@PeterSchiff) October 3, 2023

Meanwhile, central bankers have been stockpiling

The World Gold Council yesterday shared its latest blog/info on central bank demand for gold – based on August activity.

And the survey (it wasn’t a survey) says? Central bankers the world over have been continuing to stockpile the precious metal for the third consecutive month, reportedly adding 77t of gold to global reserves in August. That’s a 38% up-tick from July’s buying.

China, Poland and Turkey were again strong buyers and there were no notable sales during the month.

“This recent buying suggests that we have now firmly moved past the net selling we saw in April and May, which was primarily driven by heavy, non-strategic selling from Turkey,” wrote the Council.

“We are therefore confident that the long-term trend of healthy central bank demand remains in place.”

And yeah, no surprises here really, but Russia’s buying, too…

Russia's Finance Ministry to allocate nearly 400 billion rubles (US$ 4 billion) to purchase currency/gold between now and 7th November.

This is a 10 fold increase on the US$ 400 million which the Ministry allocated during August to buy currency/gold.https://t.co/I9cjDJz5Qe pic.twitter.com/CaMt3Og43d

— BullionStar (@BullionStar) October 5, 2023

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % Year | % YTD | Market Cap |

|---|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.015 | 0% | 0% | -66% | -2% | $16,273,013 |

| NPM | Newpeak Metals | 0.001 | 0% | 0% | 0% | 0% | $9,995,579 |

| ASO | Aston Minerals Ltd | 0.034 | 6% | -21% | -59% | -5% | $43,366,352 |

| MTC | Metalstech Ltd | 0.225 | 5% | 5% | -49% | -30% | $42,436,033 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.052 | -5% | -12% | -68% | -4% | $6,007,162 |

| G88 | Golden Mile Res Ltd | 0.023 | -23% | -32% | -15% | 0% | $7,575,959 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | -43% | 0% | $6,605,136 |

| NMR | Native Mineral Res | 0.042 | -5% | -16% | -68% | -7% | $8,464,496 |

| AQX | Alice Queen Ltd | 0.014 | 0% | 8% | -77% | -3% | $1,771,208 |

| SLZ | Sultan Resources Ltd | 0.018 | -14% | -33% | -79% | -7% | $2,667,421 |

| MKG | Mako Gold | 0.015 | 7% | -29% | -69% | -3% | $8,640,123 |

| KSN | Kingston Resources | 0.085 | 6% | 2% | -7% | 0% | $42,326,756 |

| AMI | Aurelia Metals Ltd | 0.085 | 0% | -12% | -59% | -3% | $143,245,673 |

| PNX | PNX Metals Limited | 0.0025 | 0% | -17% | -41% | 0% | $13,451,562 |

| GIB | Gibb River Diamonds | 0.025 | -7% | -17% | -57% | -4% | $5,287,736 |

| KCN | Kingsgate Consolid. | 1.165 | 0% | -16% | -26% | -56% | $300,280,721 |

| TMX | Terrain Minerals | 0.005 | 25% | -9% | -29% | 0% | $6,288,219 |

| BNR | Bulletin Res Ltd | 0.105 | 40% | 94% | -13% | 1% | $30,827,066 |

| NXM | Nexus Minerals Ltd | 0.046 | -10% | -14% | -76% | -15% | $17,758,766 |

| SKY | SKY Metals Ltd | 0.041 | -5% | -2% | -18% | -1% | $18,917,322 |

| LM8 | Lunnonmetalslimited | 0.745 | -4% | -14% | -11% | -15% | $160,833,304 |

| CST | Castile Resources | 0.05 | -2% | -21% | -55% | -5% | $12,095,121 |

| YRL | Yandal Resources | 0.045 | -8% | -18% | -69% | -5% | $7,101,139 |

| FAU | First Au Ltd | 0.003 | 20% | -25% | -40% | 0% | $4,355,980 |

| ARL | Ardea Resources Ltd | 0.605 | 0% | -11% | -34% | -11% | $117,770,459 |

| GWR | GWR Group Ltd | 0.084 | 0% | -7% | 12% | 3% | $26,982,199 |

| IVR | Investigator Res Ltd | 0.04 | 0% | -7% | -15% | 0% | $57,486,801 |

| GTR | Gti Energy Ltd | 0.009 | -10% | 13% | -39% | 0% | $18,404,524 |

| IPT | Impact Minerals | 0.012 | -8% | -8% | 71% | 1% | $34,376,447 |

| BNZ | Benzmining | 0.38 | -14% | -12% | -14% | -3% | $42,169,920 |

| MOH | Moho Resources | 0.006 | -33% | -33% | -78% | -2% | $1,632,213 |

| BBX | BBX Minerals Ltd | 0.026 | -4% | -28% | -57% | -8% | $16,386,548 |

| PUA | Peak Minerals Ltd | 0.005 | 67% | 100% | -38% | 0% | $5,206,883 |

| MRZ | Mont Royal Resources | 0.18 | 0% | -25% | -22% | 1% | $14,813,088 |

| SMS | Starmineralslimited | 0.04 | 0% | 0% | -56% | -3% | $1,450,112 |

| MVL | Marvel Gold Limited | 0.011 | 10% | -8% | -59% | -2% | $9,501,698 |

| PRX | Prodigy Gold NL | 0.008 | -11% | 33% | -20% | 0% | $14,008,863 |

| AAU | Antilles Gold Ltd | 0.024 | 0% | -17% | -48% | -1% | $18,741,769 |

| CWX | Carawine Resources | 0.13 | -13% | 8% | 37% | 3% | $25,586,271 |

| RND | Rand Mining Ltd | 1.345 | 3% | -3% | -6% | -2% | $76,498,168 |

| CAZ | Cazaly Resources | 0.035 | 3% | -15% | 0% | 0% | $13,825,105 |

| BMR | Ballymore Resources | 0.096 | -13% | -17% | -55% | -5% | $14,034,937 |

| DRE | Dreadnought Resources Ltd | 0.046 | -12% | -19% | -53% | -6% | $154,529,098 |

| ZNC | Zenith Minerals Ltd | 0.13 | 35% | 18% | -57% | -14% | $45,809,515 |

| REZ | Resourc & En Grp Ltd | 0.0135 | -10% | -21% | -33% | 0% | $6,747,378 |

| LEX | Lefroy Exploration | 0.17 | -6% | -17% | -41% | -9% | $33,371,298 |

| ERM | Emmerson Resources | 0.063 | -2% | -7% | -18% | -1% | $34,316,717 |

| AM7 | Arcadia Minerals | 0.1 | -5% | -5% | -68% | -11% | $10,473,760 |

| ADT | Adriatic Metals | 3.52 | -2% | -6% | 62% | 37% | $838,613,090 |

| GMR | Golden Rim Resources | 0.021 | -19% | -30% | -52% | -1% | $12,423,356 |

| CYL | Catalyst Metals | 0.61 | 9% | 9% | -51% | -57% | $134,253,402 |

| CHN | Chalice Mining Ltd | 2.26 | 2% | -22% | -47% | -404% | $879,057,067 |

| KAL | Kalgoorliegoldmining | 0.029 | -3% | 4% | -78% | -5% | $4,304,587 |

| MLS | Metals Australia | 0.033 | -3% | -8% | -27% | -1% | $20,593,194 |

| ADN | Andromeda Metals Ltd | 0.019 | 0% | -32% | -57% | -3% | $59,090,160 |

| MEI | Meteoric Resources | 0.225 | -2% | -2% | 1631% | 17% | $436,647,853 |

| SRN | Surefire Rescs NL | 0.014 | 0% | -13% | 8% | 0% | $23,119,089 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 0% | 0% | 0% | $24,408,512 |

| WA8 | Warriedarresourltd | 0.067 | -4% | -16% | -55% | -10% | $32,630,069 |

| HMX | Hammer Metals Ltd | 0.046 | 0% | -16% | -8% | -2% | $40,774,738 |

| WCN | White Cliff Min Ltd | 0.012 | 0% | 50% | -43% | 0% | $15,084,223 |

| AVM | Advance Metals Ltd | 0.005 | -17% | -17% | -55% | -1% | $2,942,794 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | -25% | 0% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.008 | 0% | -11% | -67% | -1% | $11,523,097 |

| MCT | Metalicity Limited | 0.0025 | 25% | 25% | -29% | 0% | $9,340,215 |

| AME | Alto Metals Limited | 0.045 | -2% | -10% | -33% | -2% | $32,139,004 |

| CTO | Citigold Corp Ltd | 0.004 | 0% | 0% | -20% | 0% | $11,494,636 |

| TIE | Tietto Minerals | 0.315 | -5% | -15% | -42% | -39% | $342,571,159 |

| SMI | Santana Minerals Ltd | 0.55 | 3% | -15% | -13% | -11% | $97,180,159 |

| M2R | Miramar | 0.043 | 5% | -9% | -55% | -3% | $6,401,390 |

| MHC | Manhattan Corp Ltd | 0.006 | -25% | -33% | -14% | 0% | $17,621,879 |

| GRL | Godolphin Resources | 0.037 | 3% | 9% | -58% | -5% | $6,261,955 |

| TRY | Troy Resources Ltd | 0 | -100% | -100% | -100% | -3% | $62,920,961 |

| SVG | Savannah Goldfields | 0.063 | -3% | -11% | -74% | -13% | $12,627,734 |

| EMC | Everest Metals Corp | 0.135 | 17% | 8% | 35% | 6% | $17,993,220 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -19% | -1% | $10,767,521 |

| CY5 | Cygnus Metals Ltd | 0.16 | 3% | -24% | -56% | -22% | $46,406,822 |

| G50 | Gold50Limited | 0.14 | 12% | -3% | 17% | -11% | $14,980,100 |

| ADV | Ardiden Ltd | 0.005 | 0% | -17% | -17% | 0% | $13,441,677 |

| AAR | Astral Resources NL | 0.085 | 12% | 25% | 2% | 1% | $67,142,411 |

| MGV | Musgrave Minerals | 0.39 | -1% | 15% | 59% | 18% | $230,571,100 |

| VMC | Venus Metals Cor Ltd | 0.125 | 0% | 4% | 43% | 5% | $23,716,085 |

| NAE | New Age Exploration | 0.006 | -14% | 20% | -33% | 0% | $10,763,393 |

| VKA | Viking Mines Ltd | 0.01 | -5% | 11% | 43% | 0% | $10,252,584 |

| LCL | LCL Resources Ltd | 0.026 | -4% | -24% | -6% | -3% | $20,651,916 |

| MTH | Mithril Resources | 0.002 | 0% | 100% | -60% | 0% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.007 | 0% | -13% | -53% | 0% | $4,174,256 |

| RMX | Red Mount Min Ltd | 0.005 | 25% | 25% | -17% | 0% | $13,367,880 |

| PRS | Prospech Limited | 0.026 | -4% | -10% | -15% | 0% | $5,713,759 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | -79% | 0% | $17,528,005 |

| TTM | Titan Minerals | 0.035 | -3% | -19% | -53% | -3% | $53,180,864 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -62% | -2% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.05 | 0% | -9% | -48% | -7% | $15,771,702 |

| KZR | Kalamazoo Resources | 0.094 | 0% | -22% | -57% | -12% | $15,940,873 |

| BCN | Beacon Minerals | 0.024 | 0% | -4% | -8% | 0% | $90,162,436 |

| MAU | Magnetic Resources | 0.83 | 4% | -8% | -17% | -3% | $202,207,903 |

| BC8 | Black Cat Syndicate | 0.185 | -12% | -14% | -46% | -17% | $55,637,477 |

| EM2 | Eagle Mountain | 0.076 | 0% | -17% | -64% | -9% | $23,177,482 |

| EMR | Emerald Res NL | 2.56 | -3% | -2% | 125% | 138% | $1,527,764,314 |

| BYH | Bryah Resources Ltd | 0.013 | -13% | -19% | -49% | -1% | $4,661,869 |

| HCH | Hot Chili Ltd | 1.11 | -3% | -16% | 21% | 24% | $132,584,179 |

| WAF | West African Res Ltd | 0.68 | -7% | -17% | -36% | -50% | $697,756,892 |

| MEU | Marmota Limited | 0.034 | -3% | 13% | -31% | -1% | $35,999,220 |

| NVA | Nova Minerals Ltd | 0.23 | -4% | -15% | -67% | -45% | $48,504,691 |

| DCN | Dacian Gold Ltd | 0.11 | -8% | -4% | 17% | 1% | $133,848,103 |

| SVL | Silver Mines Limited | 0.16 | -6% | -9% | -14% | -4% | $224,693,143 |

| PGD | Peregrine Gold | 0.27 | 0% | -13% | -53% | -12% | $15,167,955 |

| ICL | Iceni Gold | 0.075 | 1% | -15% | -21% | -1% | $17,989,286 |

| FG1 | Flynngold | 0.055 | -8% | -20% | -52% | -5% | $7,501,042 |

| WWI | West Wits Mining Ltd | 0.013 | -7% | -19% | -24% | 0% | $30,176,910 |

| RML | Resolution Minerals | 0.007 | 0% | 40% | -30% | 0% | $8,801,043 |

| AAJ | Aruma Resources Ltd | 0.034 | 6% | 3% | -53% | -2% | $6,694,311 |

| AL8 | Alderan Resource Ltd | 0.014 | 47% | 100% | 75% | 1% | $8,633,725 |

| GMN | Gold Mountain Ltd | 0.006 | -8% | -14% | -25% | 0% | $13,614,472 |

| MEG | Megado Minerals Ltd | 0.042 | 8% | 2% | -46% | 0% | $10,687,133 |

| HMG | Hamelingoldlimited | 0.086 | 2% | -1% | -41% | -6% | $13,545,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | -26% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.25 | -11% | -23% | -50% | -25% | $22,221,722 |

| TBR | Tribune Res Ltd | 3.05 | -6% | -10% | -12% | -98% | $160,027,635 |

| FML | Focus Minerals Ltd | 0.17 | 0% | -15% | 31% | -9% | $48,714,970 |

| GSR | Greenstone Resources | 0.01 | 0% | -9% | -85% | -2% | $13,654,163 |

| VRC | Volt Resources Ltd | 0.0085 | 6% | 0% | -65% | -1% | $33,485,103 |

| ARV | Artemis Resources | 0.022 | -21% | -42% | -61% | 0% | $34,648,204 |

| HRN | Horizon Gold Ltd | 0.312511 | -5% | -5% | 7% | 0% | $39,120,702 |

| CLA | Celsius Resource Ltd | 0.011 | 0% | 0% | -27% | -1% | $24,706,568 |

| QML | Qmines Limited | 0.099 | -1% | 0% | -36% | -7% | $20,505,336 |

| RDN | Raiden Resources Ltd | 0.029 | 4% | 4% | 239% | 2% | $67,740,090 |

| TCG | Turaco Gold Limited | 0.049 | -4% | -8% | 2% | -1% | $24,633,117 |

| KCC | Kincora Copper | 0.031 | -14% | -23% | -50% | -4% | $4,967,039 |

| GBZ | GBM Rsources Ltd | 0.015 | 0% | -17% | -62% | -3% | $9,304,827 |

| DTM | Dart Mining NL | 0.022 | 16% | -27% | -73% | -3% | $3,806,269 |

| MKR | Manuka Resources. | 0.049 | 7% | 4% | -65% | -4% | $27,563,483 |

| AUC | Ausgold Limited | 0.029 | -9% | -24% | -33% | -2% | $66,588,095 |

| ANX | Anax Metals Ltd | 0.034 | -8% | -32% | -47% | -2% | $14,616,733 |

| EMU | EMU NL | 0.0025 | -17% | 0% | -55% | 0% | $3,625,053 |

| SFM | Santa Fe Minerals | 0.044 | 2% | 0% | -48% | -4% | $3,204,027 |

| SSR | SSR Mining Inc. | 19.8 | -3% | -13% | -15% | -325% | $416,091,397 |

| PNR | Pantoro Limited | 0.038 | 6% | -16% | -79% | -6% | $197,753,160 |

| CMM | Capricorn Metals | 4.1 | 0% | -9% | 13% | -50% | $1,541,428,518 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -10% | -7% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.007 | -13% | 40% | 40% | 0% | $13,957,016 |

| HAW | Hawthorn Resources | 0.105 | 5% | -9% | 18% | -1% | $35,176,639 |

| BGD | Bartongoldholdings | 0.215 | 5% | 2% | 43% | 2% | $42,035,466 |

| SVY | Stavely Minerals Ltd | 0.075 | 7% | -4% | -55% | -17% | $28,309,711 |

| AGC | AGC Ltd | 0.062 | -5% | 5% | -14% | 0% | $6,200,000 |

| RVR | Red River Resources | 0 | -100% | -100% | -100% | -7% | $37,847,908 |

| RGL | Riversgold | 0.0135 | 4% | 13% | -61% | -2% | $12,842,030 |

| TSO | Tesoro Gold Ltd | 0.02 | 5% | -5% | -42% | -2% | $21,072,251 |

| OKR | Okapi Resources | 0.135 | -18% | 35% | -46% | -2% | $28,361,612 |

| CPM | Coopermetalslimited | 0.125 | 4% | -4% | -58% | -11% | $6,652,206 |

| MM8 | Medallion Metals. | 0.07 | 3% | -5% | -54% | -8% | $21,526,978 |

| AUT | Auteco Minerals | 0.027 | -18% | -10% | -27% | -2% | $71,814,475 |

| CBY | Canterbury Resources | 0.027 | 0% | 0% | -39% | -1% | $3,902,135 |

| LYN | Lycaonresources | 0.21 | -28% | -9% | -29% | -7% | $8,414,438 |

| SFR | Sandfire Resources | 6.02 | -1% | -7% | 48% | 58% | $2,751,094,272 |

| NCM | Newcrest Mining | 24.29 | -1% | -6% | 36% | 365% | $21,720,864,480 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -77% | -1% | $4,881,018 |

| TAM | Tanami Gold NL | 0.038 | 3% | 0% | -5% | 0% | $44,653,688 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.029 | -12% | -22% | -29% | -3% | $8,339,516 |

| ALK | Alkane Resources Ltd | 0.585 | -3% | -10% | -19% | 5% | $352,557,907 |

| BMO | Bastion Minerals | 0.02 | -5% | -20% | -72% | -1% | $4,013,105 |

| IDA | Indiana Resources | 0.059 | 0% | 0% | -2% | 0% | $31,604,888 |

| GSM | Golden State Mining | 0.038 | 6% | -16% | -7% | -1% | $7,261,355 |

| NSM | Northstaw | 0.034 | 0% | -31% | -75% | -12% | $4,084,318 |

| GSN | Great Southern | 0.024 | 9% | 14% | -40% | -1% | $17,188,168 |

| RED | Red 5 Limited | 0.265 | 2% | 0% | 47% | 6% | $917,480,151 |

| DEG | De Grey Mining | 1.08 | -3% | -20% | -1% | -21% | $1,939,753,762 |

| THR | Thor Energy PLC | 0.031 | -11% | -18% | -66% | -3% | $5,466,432 |

| CDR | Codrus Minerals Ltd | 0.06 | -5% | -26% | -21% | -7% | $5,235,000 |

| MDI | Middle Island Res | 0.02 | -9% | 0% | -70% | -2% | $2,813,164 |

| BAT | Battery Minerals Ltd | 0.029 | -3% | -40% | -79% | -9% | $3,468,530 |

| POL | Polymetals Resources | 0.31 | -9% | 3% | 82% | 7% | $46,087,149 |

| RDS | Redstone Resources | 0.009 | 13% | 50% | 20% | 0% | $7,842,406 |

| NAG | Nagambie Resources | 0.02 | 0% | -31% | -75% | -5% | $11,634,526 |

| BGL | Bellevue Gold Ltd | 1.375 | 0% | -14% | 70% | 25% | $1,573,889,560 |

| GBR | Greatbould Resources | 0.054 | 4% | -21% | -48% | -4% | $27,286,717 |

| KAI | Kairos Minerals Ltd | 0.02 | 0% | -20% | -37% | 0% | $52,418,244 |

| KAU | Kaiser Reef | 0.165 | -8% | -6% | -8% | 0% | $24,399,742 |

| HRZ | Horizon | 0.038 | 9% | 9% | -41% | -2% | $26,485,380 |

| CAI | Calidus Resources | 0.125 | -22% | -24% | -78% | -15% | $75,984,983 |

| CDT | Castle Minerals | 0.01 | 0% | 0% | -60% | -1% | $11,244,930 |

| RSG | Resolute Mining | 0.335 | 2% | -3% | 63% | 14% | $713,217,201 |

| MXR | Maximus Resources | 0.03 | 3% | 0% | -40% | -1% | $9,607,673 |

| EVN | Evolution Mining Ltd | 3.26 | 0% | -8% | 55% | 28% | $5,989,219,410 |

| CXU | Cauldron Energy Ltd | 0.011 | -8% | 57% | -5% | 0% | $10,467,255 |

| DLI | Delta Lithium | 0.695 | -7% | -7% | 22% | 22% | $370,197,774 |

| ALY | Alchemy Resource Ltd | 0.01 | -17% | -9% | -62% | -1% | $11,780,763 |

| HXG | Hexagon Energy | 0.009 | 0% | -10% | -44% | -1% | $4,616,243 |

| OBM | Ora Banda Mining Ltd | 0.1 | 0% | 1% | 33% | 2% | $170,205,227 |

| SLR | Silver Lake Resource | 0.865 | 6% | -7% | -32% | -32% | $808,553,848 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | -33% | 0% | $4,267,580 |

| LCY | Legacy Iron Ore | 0.018 | 20% | 13% | -10% | 0% | $115,322,872 |

| PDI | Predictive Disc Ltd | 0.2 | 0% | 0% | 5% | 2% | $413,648,818 |

| MAT | Matsa Resources | 0.029 | 7% | -3% | -24% | -1% | $13,794,547 |

| ZAG | Zuleika Gold Ltd | 0.011 | -8% | -15% | -39% | -1% | $5,753,557 |

| GML | Gateway Mining | 0.03 | 3% | -17% | -66% | -3% | $7,990,006 |

| SBM | St Barbara Limited | 0.175 | 0% | -3% | -48% | -16% | $143,144,817 |

| SBR | Sabre Resources | 0.038 | 6% | -37% | -37% | 0% | $11,076,475 |

| STK | Strickland Metals | 0.074 | 21% | 72% | 85% | 3% | $118,417,834 |

| SAU | Southern Gold | 0.014 | 8% | 12% | -56% | -1% | $6,807,994 |

| CEL | Challenger Gold Ltd | 0.079 | -1% | 4% | -51% | -10% | $94,526,024 |

| LRL | Labyrinth Resources | 0.007 | 17% | 17% | -65% | -1% | $8,312,806 |

| NST | Northern Star | 10.66 | 4% | -5% | 26% | -25% | $12,237,818,356 |

| OZM | Ozaurum Resources | 0.098 | -11% | 133% | 31% | 3% | $15,557,500 |

| TG1 | Techgen Metals Ltd | 0.02 | -26% | -44% | -87% | -6% | $1,543,366 |

| XAM | Xanadu Mines Ltd | 0.064 | -6% | -34% | 121% | 4% | $104,820,748 |

| CHZ | Chesser Resources | 0.105 | 0% | -5% | 33% | 2% | $65,818,414 |

| AQI | Alicanto Min Ltd | 0.046 | 10% | 28% | 5% | 0% | $28,190,493 |

| KTA | Krakatoa Resources | 0.02 | -20% | -23% | -70% | -2% | $8,697,958 |

| ARN | Aldoro Resources | 0.09 | 5% | -25% | -59% | -7% | $12,116,137 |

| WGX | Westgold Resources. | 1.615 | -4% | 3% | 77% | 74% | $764,900,709 |

| MBK | Metal Bank Ltd | 0.04 | 3% | 10% | 1% | 1% | $12,416,598 |

| A8G | Australasian Metals | 0.2 | 8% | 38% | -32% | 1% | $10,424,099 |

| TAR | Taruga Minerals | 0.01 | 11% | 0% | -64% | -1% | $7,060,268 |

| DTR | Dateline Resources | 0.013 | -7% | -24% | -84% | -2% | $11,510,757 |

| GOR | Gold Road Res Ltd | 1.645 | 2% | -3% | 19% | -5% | $1,774,003,188 |

| S2R | S2 Resources | 0.21 | 24% | 20% | 56% | 4% | $86,119,220 |

| NES | Nelson Resources. | 0.005 | -9% | -29% | -57% | 0% | $3,067,972 |

| TLM | Talisman Mining | 0.13 | 0% | -10% | -7% | -1% | $24,481,645 |

| BEZ | Besragoldinc | 0.135 | -7% | -18% | 280% | 8% | $49,271,355 |

| PRU | Perseus Mining Ltd | 1.53 | -7% | -17% | -8% | -58% | $2,100,729,598 |

| SPQ | Superior Resources | 0.022 | -12% | -31% | -54% | -3% | $40,360,183 |

| PUR | Pursuit Minerals | 0.009 | 0% | 0% | -31% | -1% | $26,495,743 |

| RMS | Ramelius Resources | 1.495 | 6% | 14% | 118% | 57% | $1,674,070,167 |

| PKO | Peako Limited | 0.006 | 0% | 0% | -70% | -1% | $2,824,389 |

| ICG | Inca Minerals Ltd | 0.018 | 20% | -14% | -55% | -1% | $8,863,195 |

| A1G | African Gold Ltd. | 0.035 | -15% | -19% | -42% | -5% | $5,925,892 |

| OAU | Ora Gold Limited | 0.008 | 0% | 0% | 60% | 0% | $38,251,405 |

| GNM | Great Northern | 0.027 | 13% | 13% | -55% | -3% | $4,174,985 |

| KRM | Kingsrose Mining Ltd | 0.05 | 2% | -11% | -4% | -2% | $37,626,326 |

| BTR | Brightstar Resources | 0.01 | -9% | -23% | -44% | -1% | $18,840,152 |

| RRL | Regis Resources | 1.515 | 4% | -4% | -12% | -55% | $1,144,338,294 |

| M24 | Mamba Exploration | 0.05 | 6% | -7% | -66% | -10% | $3,049,167 |

| TRM | Truscott Mining Corp | 0.058 | 0% | 35% | 76% | 2% | $10,055,289 |

| TNC | True North Copper | 0.175 | -8% | -15% | 257% | 12% | $45,472,254 |

| MOM | Moab Minerals Ltd | 0.008 | -20% | -11% | -38% | 0% | $5,695,708 |

| KNB | Koonenberrygold | 0.04 | -11% | -11% | -41% | -2% | $4,789,964 |

| AWJ | Auric Mining | 0.04 | -5% | -15% | -47% | -2% | $5,234,384 |

| AZS | Azure Minerals | 2.63 | -4% | -4% | 1183% | 241% | $1,147,449,375 |

| ENR | Encounter Resources | 0.25 | -17% | -38% | 108% | 7% | $98,881,445 |

| SNG | Siren Gold | 0.07 | 1% | -22% | -65% | -11% | $11,126,626 |

| STN | Saturn Metals | 0.16 | 14% | 7% | -34% | -2% | $25,846,177 |

| USL | Unico Silver Limited | 0.084 | -2% | -14% | -40% | -9% | $24,868,334 |

| PNM | Pacific Nickel Mines | 0.088 | -4% | -1% | -2% | 1% | $36,806,273 |

| AYM | Australia United Min | 0.003 | 0% | 0% | -25% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.245 | 0% | -4% | -20% | -9% | $77,576,606 |

| SPR | Spartan Resources | 0.41 | 9% | 24% | 77% | 24% | $359,824,214 |

| PNT | Panthermetalsltd | 0.08 | 14% | 23% | -55% | -11% | $4,892,000 |

| MEK | Meeka Metals Limited | 0.037 | -20% | -21% | -39% | -3% | $40,781,730 |

| GMD | Genesis Minerals | 1.38 | 0% | -14% | 38% | 13% | $1,432,175,727 |

| PGO | Pacgold | 0.18 | -8% | -27% | -63% | -18% | $15,075,127 |

| FEG | Far East Gold | 0.155 | -11% | -30% | -78% | -33% | $27,993,963 |

| MI6 | Minerals260Limited | 0.435 | -5% | -10% | 43% | 10% | $101,790,000 |

| IGO | IGO Limited | 11.57 | -6% | -21% | -23% | -189% | $8,761,588,596 |

| GAL | Galileo Mining Ltd | 0.36 | 18% | 3% | -74% | -52% | $71,144,974 |

| RXL | Rox Resources | 0.225 | 0% | 10% | -12% | 5% | $81,007,214 |

| KIN | KIN Min NL | 0.041 | 3% | 11% | -45% | -2% | $48,304,172 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -94% | -1% | $12,046,242 |

| TGM | Theta Gold Mines Ltd | 0.15 | 0% | 3% | 121% | 8% | $105,761,251 |

| FAL | Falconmetalsltd | 0.15 | 11% | -12% | -25% | -13% | $26,550,000 |

| SXG | Southern Cross Gold | 0.795 | 2% | 5% | 134% | -1% | $71,594,220 |

| SPD | Southernpalladium | 0.42 | 2% | 31% | -54% | -39% | $18,092,897 |

| ORN | Orion Minerals Ltd | 0.017 | -11% | -15% | 13% | 0% | $96,673,923 |

| TMB | Tambourahmetals | 0.17 | -15% | -15% | 13% | 7% | $14,099,860 |

| TMS | Tennant Minerals Ltd | 0.029 | -3% | -6% | -6% | 0% | $22,023,569 |

| AZY | Antipa Minerals Ltd | 0.012 | 9% | 0% | -54% | -1% | $47,780,003 |

| PXX | Polarx Limited | 0.009 | 0% | 0% | 0% | -1% | $14,036,551 |

| TRE | Toubaniresourcesinc | 0.1 | -5% | -26% | 0% | -6% | $11,752,885 |

| AUN | Aurumin | 0.027 | 0% | 42% | -70% | -3% | $8,057,963 |

| GPR | Geopacific Resources | 0.016 | 14% | -16% | -74% | -2% | $13,139,058 |

Who turned heads this week?

S2 Resources (ASX:S2R)

As reported by Josh Chiat this week, the Greater Fosterville exploration licence that the Mark Bennett-led S2R’s been targeting has finally been granted.

The right-to-apply pick-up for the licence, in Victorian gold rush territory near Bendigo was a new dawn for the explorer back in October 21, wrote Josh, adding:

“The lease presents among the best opportunities of any explorer to make a discovery that follows up Kirkland Lake (and now Agnico-Eagle’s) Swan Zone find at the Fosterville gold mine back in 2016.”

The licence – EL7795 – covers some 394km2, it extends for a massive 55km north to south, with S2 planning to spend a minimum amount of $10.4m over the first five-year term.

“A minimum $2.1m has to be spent in the first two years,” wrote Josh. “Diamond drilling sites have already been identified along roadsides, with heritage clearance already obtained from the Dja Dja Wurrung traditional owners and drilling approval from the City of Greater Bendigo Council.”

A contractor is expected to begin drilling in around three weeks.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.