Gold: Capricorn locks down $100m financing package for Karlawinda development

More money? Pic: Getty

After repeated management shuffles, failed takeover bids and a major financial restructuring exercise, it looks like Capricorn Metals (ASX:CMM) will finally develop its flagship 1.5-million-ounce Karlawinda gold project in WA.

As foreshadowed by our very own Tim Treadgold, of course.

Today, the company announced that $100m in debt financing via Macquarie Bank was in the bag.

The rest of the expected $155m development costs will be covered by equity raisings completed in July (~$15m) and August (~$65m) this year.

The developer, which is up almost 190 per cent over the past six months, was steady at $1.18 per share in early trade.

There are a number of remaining conditions before it can draw down the bank facilities, Capricorn says, “the finalisation of which are in progress”.

“The execution of the debt financing facilities with Macquarie Bank completes the funding requirements for Karlawinda and is another major step towards the development of the project,” Capricorn exec chairman Mark Clark says.

“The preliminary update of DFS [definitive feasibility study] capital and operating cost estimates suggest that Karlawinda should be a very profitable gold mining operation for Capricorn.”

Full scale construction of the 105,000oz-120,000oz per year operation will kick off next year — but dont forget about the exploration upside.

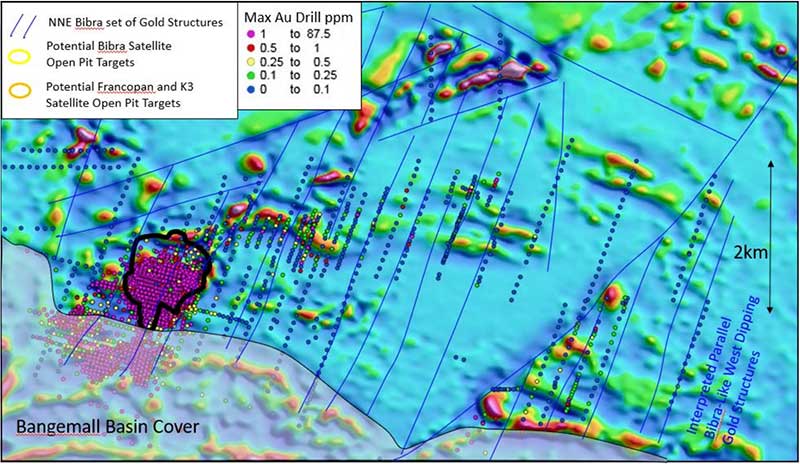

Around 267,000m of drilling has been completed at Karlawinda to date, the company says.

Of this drilling, 97 per cent has been in the 50sqkm area covering the main 1.5-million-ounce Bibra deposit area, and 3 per cent has been on the remaining 1,992sqkm area:

“In conjunction with development of the project in 2020, we look forward to a concerted exploration effort on the largely unexplored greenstone belts across the project area,” Clark says.

READ MORE about Capricorn:

Money Talks: The key to picking small cap resources stocks in a volatile market

Capricorn knocks back another suitor

In other ASX gold news today:

Lachlan Fold gold-copper porphyry hunter Godolphin Resources (ASX:GRL) begins trading on the ASX today, after the IPO — which raised $7.4m — closed early. The action is due to kick off at 1pm AEDT.

Like other explorers in the region, the Ardea Resources (ASX:ARL) spinout has benefited from the buzz surrounding Alkane Resources’ massive porphyry discovery at Boda.

READ: Ardea will launch IPO spin-out of NSW assets

$3m market cap explorer Raiden Resources (ASX:RDN) has signed an agreement to buy the 105sqkm Iglika project in Bulgaria, where it will hunt for large porphyry copper and epithermal gold deposits.

“The Iglika project is hosted within the Cretaceous volcanic belt of rocks, that is host to most of the large copper porphyry and epithermal gold deposits in the region,” Raiden MD Dusko Ljubojevic says.

“This segment of the Tethyan [copper belt] is attracting interest from many international explorers and major mining companies.

“The company believes that the permit is highly prospective for further discoveries, including porphyry and epithermal styles of mineralisation.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.