Gold: Battery metals play Ardea just made a very interesting gold discovery near Goongarrie

Pic: Getty

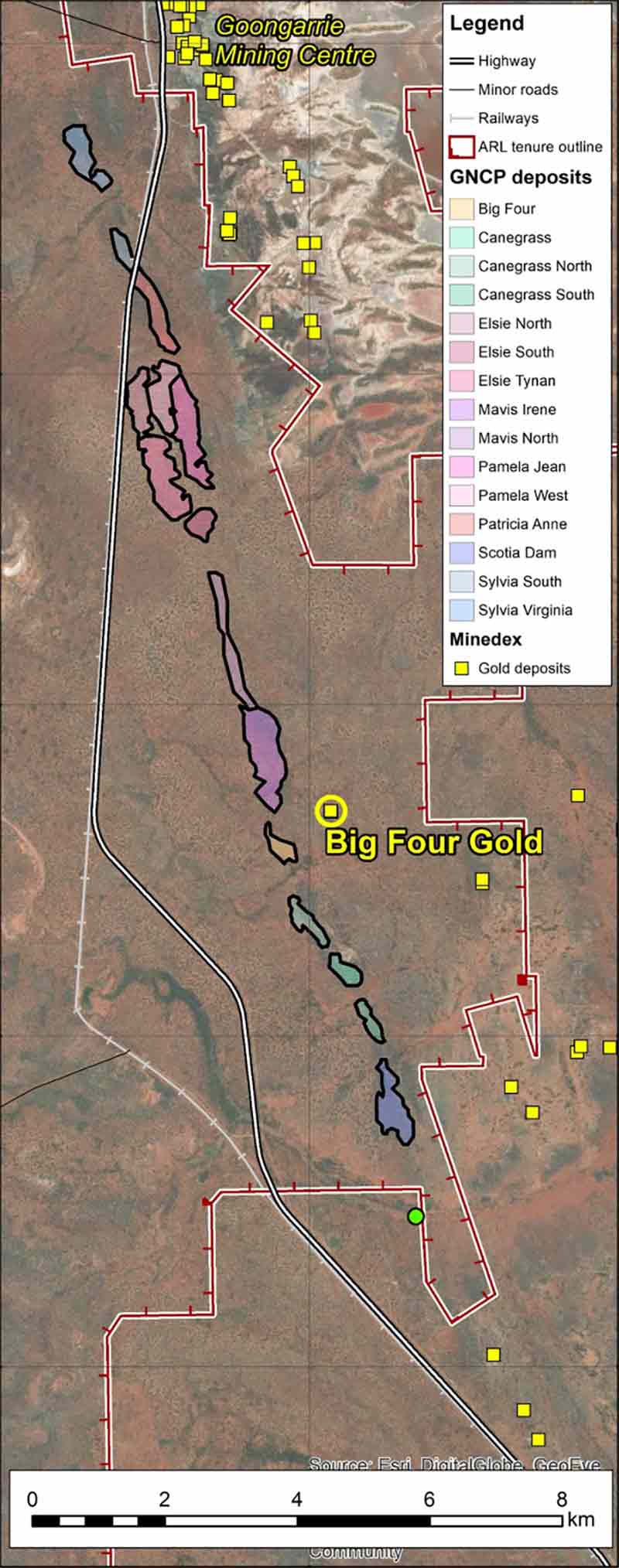

Shallow gold hits up to 13 grams per tonne (g/t) near Ardea’s (ASX:ARL) flagship Goongarrie nickel cobalt development could point to big deposits in the underlying fresh rock.

The company says this could be an “opportunity to enhance overall project economics”.

While discussions are active to develop the advanced Goongarrie project, near Kalgoorlie in WA, locking in battery metals offtake and financing is always a slow process. This is additionally hampered by weak cobalt and nickel prices.

Which is why the gold prospectivity of Ardea’s wider Kalgoorlie landholding is important.

The explorer reckons that strong, coherent, and extensive gold anomalism — associated with the surface lateritic (weathered) nickel-cobalt mineralisation — could be a ‘signpost’ to gold systems in the untested fresh rock deeper down.

The recently completed 11-hole program at the historic ‘Big Four’ gold mine, just south of Goongarrie, is very promising.

Results include 6m at 6.03g/t, inside a larger 18m section grading 3.38g/t, 18m from surface.

This gold is shallow, thick, and high grade (anything above 5g/t is generally considered high grade). Every hole “contained significant gold intercepts”, the company says.

Importantly, the results of this program provide confidence in historic drill results. This historic data can now be combined into any new resource modelling with increased certainty “and should assist in defining a new resource to JORC Code (2012) guidelines”.

Big Four also appears to have low levels of silver, antimony and arsenic – metals that can make gold recovery difficult at high levels. Bonus.

These results from Big Four are being used to help refine the geological ‘controls’ on gold mineralisation and define additional targets.

“The fact that all planned holes intersected significant gold mineralisation confirms the geological model,” managing director Andrew Penkethman says.

“Mineralisation is still open at depth and a possible fault off-set structural repetition has been modelled along strike to the north and will now be tested to define the extent of this mineralised system,” he says.

“Ardea will continue to test the prospectivity of its large Eastern Goldfields land holding for gold and nickel sulphides, in parallel to de-risking the nickel-cobalt resources within the broader Kalgoorlie nickel project.”

Ardea is cashed up, with $10.7m in the bank at the end of the December quarter.

READ: Ardea has found a ‘Pandora’s Box’ of hot commodities, from gold to rare earths

In more ASX gold news today:

Minnow Enterprise Metals (ASX:ENT) is doing its due diligence on exploration ground which covers part of the prolific 10 million ounce Southern Cross Greenstone Belt in WA. Enterprise is looking at ground north of this historic production which, although it contains many high-grade gold occurrences, has received very little modern exploration, the company says.

“Reported historical production from the Bullfinch North project area indicates the presence of a number of high-grade gold systems, which have not been adequately drill tested,” the company says.

“Re-evaluation and careful drill testing of known shallow high-grade gold systems can produce substantial high-grade economic resources at depth [like] Bellevue and Penny West.”

Near-term producer Nusantara Resources (ASX:NUS) plans to sell 40 per cent of its flagship 2-million-ounce Awak Mas project to local Indonesian company Indika Group for $US40m ($60.7m) to help fund the ~$US162m development. The remaining development funding will come from project debt, the company says.

“The company is ticking off critical milestones towards the development of the Awak Mas gold project at a perfect time for gold with high and rising gold prices,” exec chairman Greg Foulis says.

READ: Nusantara is looking for funding to develop Indonesia’s ‘next gold mine’

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.