Getting Lith: Maiden drilling has kicked off at Raiden’s Andover South

Lithium believers rejoice, Raiden has kicked off a drill program to get excited about in the Pilbara. Pic: Getty Images.

- Highly anticipated drilling of Andover South lithium project has commenced

- 5000m to be drilled with an election to double to 10,000m

- Performance rights for board members on Raiden’s VWAP and market cap proposed

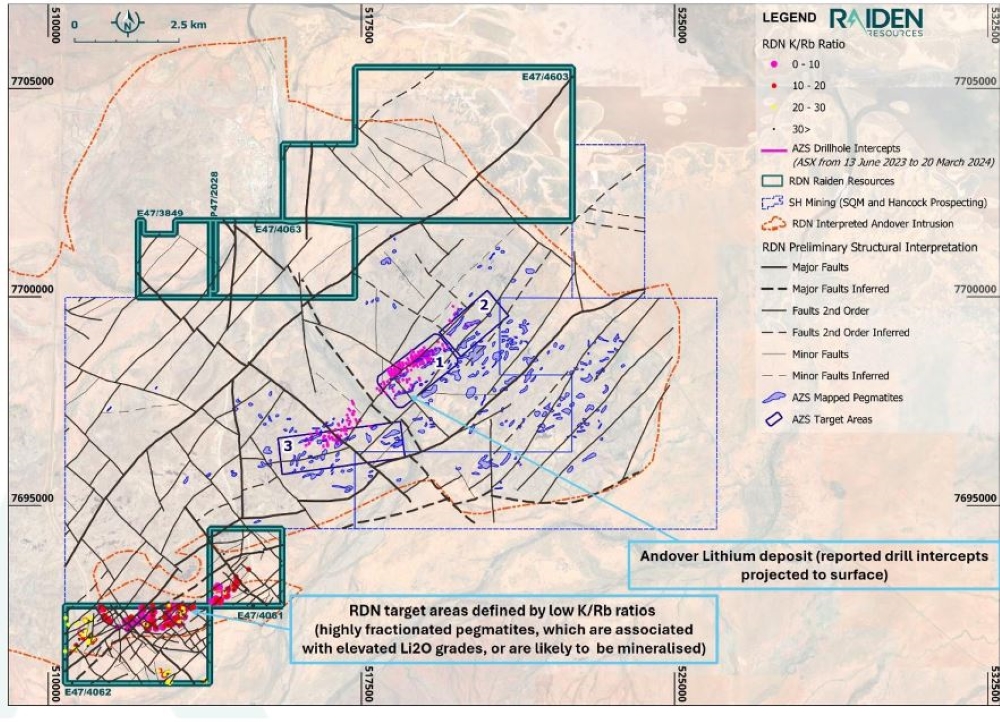

Special Report: Timely maiden drilling of Raiden Resources’ Andover South lithium has kicked off right on the heels of completing a district-scale interpretation of the project’s lithium endowment.

Raiden Resources’ (ASX:RDN) much anticipated drill program began over the weekend with a single rig and will contain an initial 5000m of diamond drilling.

But it’s leveraged to success, with the explorer boasting the option to double it to 10,000m. That could well happen with a new high-priority target zone recently identified at the tenure.

A second rig will be mobilised to site shortly.

Andover South is directly adjacent the mighty Andover discovery, held by mining heavyweights Mark Creasy, Gina Rinehart and Chile’s SQM.

One of the largest lithium deposits in Australia, home to over 50% of the world’s lithium raw materials production, it sparked a $1.7bn takeover by Rinehart and SQM of 60% owner Azure Minerals earlier this year.

Drilling plans

The first 5000m should be completed in November and focus on the highly-prospective Target Area 1, which is defined by high-grade lithium mineralisation and wide, outcropping pegmatites.

“Further field mapping and target evaluation is ongoing to define more potential drill targets on tenements E47/4061 and E47/4062 (Andover South),” RDN MD Dusko Ljubojevic says.

“The initial program is underway with a single drill rig, with a second rig scheduled to mobilise to site shortly and the planned drill holes will assist us in defining the dip and dip directions of the outcropping pegmatites, which will lead to further drill confirmation at depth.

“We look forward to receiving initial results and will inform the market of the results as soon as they are received and interpreted.”

Inventives to hit performances markers

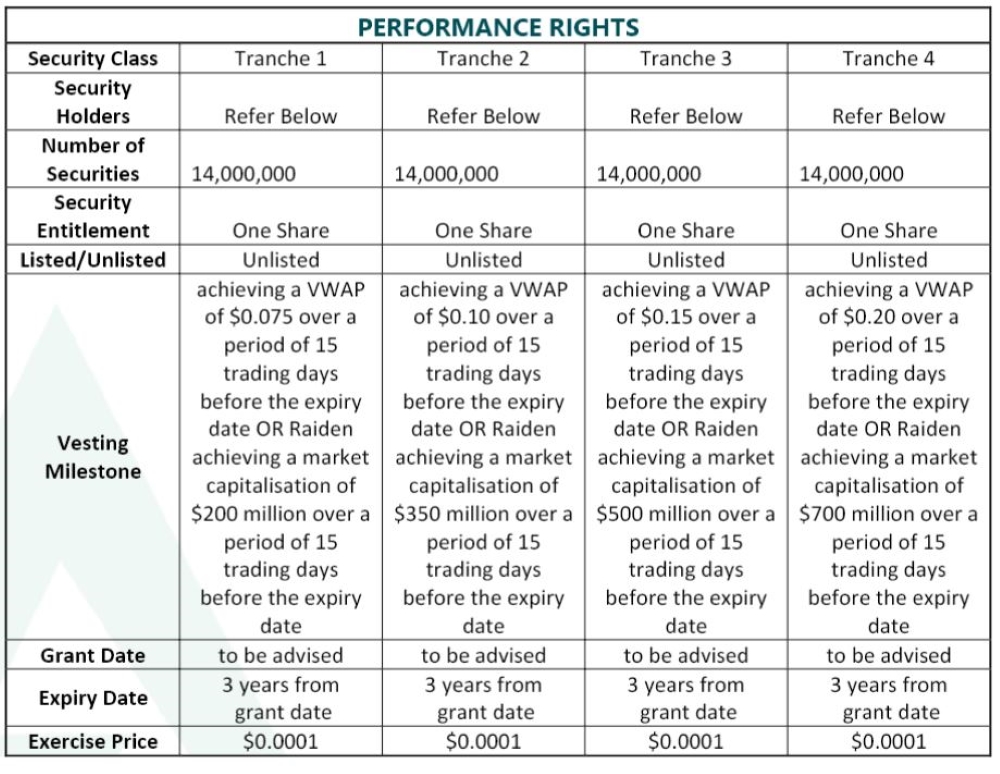

RDN has proposed to put forward a performance share incentive plan for the board of directors at the next AGM, subject to shareholder approval.

The performance share incentives are to incentivise and remunerate the board for exploration and development efforts at its flagship Andover South and as the company “moves into a very exciting six months”, with four of the company’s projects expected to be drilled this year.

The junior has proposed performance rights be staged across four meaningful milestones to align the board’s interests with investors.

The key terms of the performance rights proposed include volume weighted average price and market capitalisation goals.

The directors participating include MD Dusko Ljubojevic, non-exec chair Michael Davy, non-exec director Dale Ginn and CFO Kyla Garic.

Full details of the proposed performance rights will be detailed in the upcoming notice of meeting to be lodged after relevant regulatory reviews.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.