Eye on Lithium: Lithium prices have tripled in the last year and is anyone even surprised

Pic: Geraint Rowland Photography / Moment via Getty Images

- Prices for lithium carbonate hit around US$71,315 on Friday

- Gold Mountain Mining picks up four Brazilian lithium projects

- Lake Resources says don’t worry the direct lithium extraction (DLE) tech will be successful

All your ASX lithium news for Monday, September 19

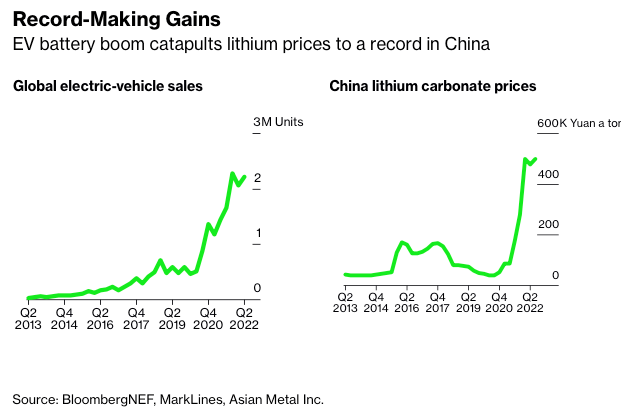

Lithium prices have tripled over the last year according to Bloomberg, with lithium carbonate prices smashing the 500,000 Yuan barrier for the first time in China.

That was around US$71,315/t on Friday, according to Asian Metal.

And research firm Rystad Energy reckons prices could stay this high for the rest of the year, after a power crunch last month in China’s Sichuan province caused two weeks of electricity cuts and hampered supply – because the province is home to around a fifth of the country’s lithium production.

If China’s power crisis returns this winter, it could lead to new power shortages and add some more pressure to the already stretched supply chain.

Here’s how ASX lithium stocks were tracking today:

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| KGD | Kula Gold Limited | 0.025 | -11% | 19% | 25% | $5,379,390.76 |

| QXR | Qx Resources Limited | 0.036 | 0% | 16% | 16% | $26,640,231.95 |

| ADV | Ardiden Ltd | 0.008 | -11% | 0% | 14% | $18,678,347.49 |

| BMM | Balkanminingandmin | 0.34 | 70% | 26% | 13% | $9,825,000.00 |

| LKE | Lake Resources | 1.05 | -22% | -19% | 13% | $1,292,675,549.37 |

| KAI | Kairos Minerals Ltd | 0.045 | 50% | 50% | 13% | $78,563,739.64 |

| IR1 | Irismetals | 2.33 | 248% | 43% | 10% | $129,044,400.00 |

| CRR | Critical Resources | 0.083 | 41% | 77% | 8% | $114,577,173.40 |

| MMG | Monger Gold Ltd | 0.535 | 73% | 10% | 7% | $20,020,000.00 |

| AOA | Ausmon Resorces | 0.0085 | 42% | 6% | 6% | $6,858,314.74 |

| AS2 | Askarimetalslimited | 0.38 | -3% | 4% | 6% | $16,224,937.20 |

| XTC | Xantippe Res Ltd | 0.0095 | -14% | 6% | 6% | $73,307,068.65 |

| PLS | Pilbara Min Ltd | 4.8 | 51% | 7% | 5% | $13,699,934,232.93 |

| CZL | Cons Zinc Ltd | 0.023 | 5% | -4% | 5% | $8,521,871.89 |

| DRE | Dreadnought Resources Ltd | 0.12 | 36% | 0% | 4% | $349,891,358.37 |

| INF | Infinity Lithium | 0.1825 | 22% | -4% | 4% | $72,802,286.55 |

| CY5 | Cygnus Gold Limited | 0.245 | 2% | -16% | 4% | $34,588,549.03 |

| GSM | Golden State Mining | 0.05 | -21% | -4% | 4% | $5,616,681.79 |

| SRI | Sipa Resources Ltd | 0.052 | 18% | 16% | 4% | $10,251,240.15 |

| BNR | Bulletin Res Ltd | 0.14 | 0% | -7% | 4% | $39,499,798.50 |

| AM7 | Arcadia Minerals | 0.29 | 61% | 5% | 4% | $13,075,409.76 |

| IGO | IGO Limited | 14.5 | 18% | 1% | 3% | $10,616,894,738.26 |

| AML | Aeon Metals Ltd. | 0.031 | 3% | 0% | 3% | $32,802,923.19 |

| GLN | Galan Lithium Ltd | 1.415 | 3% | -1% | 3% | $417,260,736.97 |

| MIN | Mineral Resources. | 68.41 | 13% | -4% | 3% | $12,574,329,800.79 |

| RAG | Ragnar Metals Ltd | 0.037 | -21% | 0% | 3% | $13,650,656.00 |

| LIS | Lisenergylimited | 0.585 | -15% | 1% | 3% | $94,571,086.59 |

| NVA | Nova Minerals Ltd | 0.8 | -8% | -9% | 3% | $143,255,794.50 |

| AKE | Allkem Limited | 15.415 | 23% | -3% | 2% | $9,609,507,356.02 |

| ZEO | Zeotech Limited | 0.05 | -21% | 0% | 2% | $76,533,858.03 |

| EMS | Eastern Metals | 0.1275 | -18% | 6% | 2% | $4,832,031.25 |

| LNR | Lanthanein Resources | 0.055 | 96% | -2% | 2% | $51,992,580.78 |

| WES | Wesfarmers Limited | 45.74 | -5% | -3% | 2% | $51,045,487,694.84 |

| WR1 | Winsome Resources | 0.325 | 20% | 0% | 2% | $43,236,478.08 |

| AAJ | Aruma Resources Ltd | 0.066 | -18% | -1% | 2% | $10,202,497.70 |

| RGL | Riversgold | 0.0385 | 1% | 7% | 1% | $29,457,217.57 |

| AZL | Arizona Lithium Ltd | 0.088 | -12% | 0% | 1% | $209,663,523.81 |

| TYX | Tyranna Res Ltd | 0.0495 | 34% | 10% | 1% | $115,437,172.68 |

| CAI | Calidus Resources | 0.555 | -18% | -10% | 1% | $240,779,937.75 |

| PLL | Piedmont Lithium Inc | 0.8775 | -6% | -7% | 1% | $458,986,596.00 |

| LTR | Liontown Resources | 1.645 | -5% | -9% | 1% | $3,591,171,797.25 |

| RIO | Rio Tinto Limited | 93.01 | -3% | -1% | 1% | $34,318,938,984.30 |

| EUR | European Lithium Ltd | 0.0885 | -1% | 2% | 1% | $123,221,047.40 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| CXO | Core Lithium | 1.44 | -3% | -10% | 0% | $2,501,561,312.64 |

| LIT | Lithium Australia | 0.059 | -28% | -3% | 0% | $71,958,949.39 |

| QPM | Queensland Pacific | 0.16 | 14% | 7% | 0% | $250,178,100.96 |

| PSC | Prospect Res Ltd | 0.092 | -12% | -1% | 0% | $42,527,870.50 |

| RLC | Reedy Lagoon Corp. | 0.015 | -6% | -6% | 0% | $8,361,403.68 |

| TKL | Traka Resources | 0.007 | 0% | 0% | 0% | $4,821,421.93 |

| AX8 | Accelerate Resources | 0.037 | -5% | 3% | 0% | $10,006,979.26 |

| BYH | Bryah Resources Ltd | 0.029 | 4% | 7% | 0% | $8,098,350.75 |

| FG1 | Flynngold | 0.105 | 9% | 11% | 0% | $6,726,410.25 |

| IMI | Infinitymining | 0.24 | 55% | 26% | 0% | $13,800,000.00 |

| MMC | Mitremining | 0.18 | 57% | 9% | 0% | $4,875,318.00 |

| SHH | Shree Minerals Ltd | 0.01 | 0% | 25% | 0% | $12,384,868.92 |

| TSC | Twenty Seven Co. Ltd | 0.002 | -5% | 0% | 0% | $5,321,627.81 |

| WML | Woomera Mining Ltd | 0.018 | 0% | 13% | 0% | $12,362,995.19 |

| MTM | Mtmongerresources | 0.14 | 17% | -3% | 0% | $5,251,404.62 |

| SCN | Scorpion Minerals | 0.08 | 19% | -2% | 0% | $26,546,495.36 |

| AZI | Altamin Limited | 0.088 | 6% | -7% | 0% | $34,471,074.18 |

| ENT | Enterprise Metals | 0.012 | 9% | 20% | 0% | $7,835,768.26 |

| STM | Sunstone Metals Ltd | 0.04 | -18% | -11% | 0% | $103,857,856.76 |

| AVW | Avira Resources Ltd | 0.0045 | -10% | 0% | 0% | $9,534,555.00 |

| RMX | Red Mount Min Ltd | 0.006 | 0% | -14% | 0% | $9,854,183.15 |

| A8G | Australasian Metals | 0.295 | 11% | 5% | 0% | $12,145,295.73 |

| EFE | Eastern Resources | 0.031 | -3% | 11% | 0% | $31,208,651.70 |

| SRZ | Stellar Resources | 0.014 | -18% | -7% | 0% | $13,512,766.76 |

| LSR | Lodestar Minerals | 0.0065 | -19% | -7% | 0% | $11,299,842.76 |

| VKA | Viking Mines Ltd | 0.008 | 0% | 0% | 0% | $8,202,067.45 |

| ZNC | Zenith Minerals Ltd | 0.295 | -5% | -6% | 0% | $101,704,872.31 |

| G88 | Golden Mile Res Ltd | 0.033 | 10% | -3% | 0% | $6,751,461.95 |

| EPM | Eclipse Metals | 0.023 | 0% | -8% | 0% | $46,557,907.50 |

| EVR | Ev Resources Ltd | 0.031 | -9% | 7% | 0% | $28,705,506.20 |

| THR | Thor Mining PLC | 0.0105 | 5% | -13% | 0% | $11,541,214.91 |

| MM1 | Midasmineralsltd | 0.2 | -20% | -5% | 0% | $11,426,352.80 |

| M2R | Miramar | 0.105 | 5% | -13% | 0% | $6,739,599.62 |

| LRD | Lordresourceslimited | 0.26 | 24% | 4% | 0% | $8,654,001.46 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,030.68 |

| DAF | Discovery Alaska Ltd | 0.076 | 38% | -5% | 0% | $17,041,837.05 |

| DAL | Dalaroometalsltd | 0.135 | 36% | 29% | 0% | $4,033,125.00 |

| INR | Ioneer Ltd | 0.6725 | -4% | -3% | 0% | $1,416,240,501.30 |

| TUL | Tulla Resources | 0.48 | -9% | -8% | -1% | $77,705,182.92 |

| DTM | Dart Mining NL | 0.091 | 14% | -9% | -1% | $14,217,677.70 |

| MNS | Magnis Energy Tech | 0.455 | 3% | -9% | -1% | $446,352,482.18 |

| VUL | Vulcan Energy | 7.91 | -13% | -9% | -1% | $1,146,682,408.00 |

| EMH | European Metals Hldg | 0.84 | -12% | 5% | -1% | $101,777,702.90 |

| AOU | Auroch Minerals Ltd | 0.077 | 15% | 24% | -1% | $28,946,720.32 |

| MQR | Marquee Resource Ltd | 0.069 | -21% | -9% | -1% | $22,093,230.60 |

| LPD | Lepidico Ltd | 0.0285 | -8% | -5% | -2% | $188,708,545.76 |

| NMT | Neometals Ltd | 1.2675 | -9% | -17% | -2% | $712,526,995.32 |

| AGY | Argosy Minerals Ltd | 0.545 | 38% | 15% | -2% | $758,701,173.81 |

| FTL | Firetail Resources | 0.255 | 2% | 2% | -2% | $16,063,450.00 |

| RAS | Ragusa Minerals Ltd | 0.25 | 35% | -2% | -2% | $32,804,237.34 |

| ESS | Essential Metals Ltd | 0.49 | -3% | -5% | -2% | $123,741,217.50 |

| MLS | Metals Australia | 0.049 | -21% | -6% | -2% | $30,351,809.55 |

| WCN | White Cliff Min Ltd | 0.0245 | 104% | -9% | -2% | $18,690,084.05 |

| MXR | Maximus Resources | 0.047 | -16% | -8% | -2% | $15,307,476.86 |

| LPI | Lithium Pwr Int Ltd | 0.595 | -4% | -8% | -2% | $238,632,686.86 |

| JRL | Jindalee Resources | 2.57 | -10% | 0% | -3% | $151,480,470.24 |

| TEM | Tempest Minerals | 0.036 | -18% | -5% | -3% | $18,676,348.51 |

| VMC | Venus Metals Cor Ltd | 0.17 | 0% | 0% | -3% | $28,013,769.53 |

| TMB | Tambourahmetals | 0.165 | -6% | 6% | -3% | $7,002,741.66 |

| KTA | Krakatoa Resources | 0.065 | 5% | 7% | -3% | $23,095,564.44 |

| GT1 | Greentechnology | 0.77 | 0% | -1% | -3% | $151,637,022.44 |

| PAM | Pan Asia Metals | 0.435 | -10% | 4% | -3% | $33,264,108.90 |

| MRR | Minrex Resources Ltd | 0.054 | -8% | -2% | -4% | $60,283,423.37 |

| KZR | Kalamazoo Resources | 0.255 | -7% | 9% | -4% | $39,033,009.11 |

| GL1 | Globallith | 2.67 | 42% | 22% | -4% | $441,181,151.68 |

| TON | Triton Min Ltd | 0.024 | -20% | -25% | -4% | $34,569,604.43 |

| ARN | Aldoro Resources | 0.23 | -12% | -10% | -4% | $23,900,956.08 |

| LRS | Latin Resources Ltd | 0.115 | -8% | -4% | -4% | $234,371,238.24 |

| NWM | Norwest Minerals | 0.045 | -8% | -18% | -4% | $8,488,547.19 |

| ASN | Anson Resources Ltd | 0.3675 | 137% | -6% | -5% | $396,743,085.59 |

| AUN | Aurumin | 0.105 | -34% | -9% | -5% | $13,783,785.18 |

| OCN | Oceanalithiumlimited | 0.625 | -10% | -2% | -5% | $21,958,875.00 |

| LLL | Leolithiumlimited | 0.725 | 28% | 15% | -6% | $764,659,106.80 |

| IPT | Impact Minerals | 0.007 | -22% | 0% | -7% | $18,610,279.17 |

| CHR | Charger Metals | 0.56 | 6% | 6% | -7% | $19,726,651.18 |

| PGD | Peregrine Gold | 0.56 | -38% | -27% | -7% | $23,426,541.38 |

| TKM | Trek Metals Ltd | 0.067 | -4% | 5% | -8% | $22,674,540.95 |

| GW1 | Greenwing Resources | 0.33 | 14% | 18% | -8% | $44,369,045.64 |

| LEL | Lithenergy | 1.14 | 7% | -1% | -8% | $56,211,750.00 |

| SYA | Sayona Mining Ltd | 0.265 | -4% | -18% | -9% | $2,408,254,014.23 |

| FRS | Forrestaniaresources | 0.21 | 27% | -16% | -9% | $7,673,099.92 |

| LRV | Larvottoresources | 0.21 | -18% | -7% | -9% | $9,552,475.00 |

| ALY | Alchemy Resource Ltd | 0.021 | 11% | 5% | -9% | $21,920,746.97 |

| PNN | Power Minerals Ltd | 0.62 | 5% | -5% | -9% | $41,874,474.12 |

| RDT | Red Dirt Metals Ltd | 0.67 | 49% | -2% | -9% | $225,370,275.24 |

| WC8 | Wildcat Resources | 0.036 | 24% | 6% | -10% | $25,810,909.08 |

| 1MC | Morella Corporation | 0.0245 | -13% | -13% | -13% | $161,438,082.01 |

A total of 43 stocks were in the green, 39 were flat and 49 were red.

Who has news out today?

GOLD MOUNTAIN MINING (ASX:GMN)

The company has signed a binding heads of agreement with Mars Mines to acquire up to 75% in a package of Brazilian lithium licences including the Cerro Cora and Porta D’Agua, Custodia, Juremal and Jacurici project areas.

All four projects are located in areas known to host lithium-bearing pegmatites and are along strike from and covering known pegmatite bodies.

“We are excited about the proposed acquisition of up to 75% interest in these highly prospective lithium projects in northeastern Brazil,” CEO Tim Cameron said.

“Over the last number of months, we have been reviewing a range of potential acquisition opportunities to diversify our project portfolio; we believe that, given the location and commodity, these projects offer the company the best opportunity to increase shareholder value.

“Brazil has seen increased interest from junior explorers and major mining houses, with the region being home to a number of lithium projects.”

Last week LKE admitted it was having an argument with tech partner Lilac Solutions re demonstration plant deadlines.

LKE and Lilac are using Direct Lithium Injection (DLE), which promises to produce cheaper, higher quality, and more environmentally friendly lithium than incumbent processes.

DLE has been used in water treatment for decades but its use in the lithium sector is in its infancy.

And today the company attempted to alleviate investor concern about the tech, saying today that “all parties are confident on-site operations will be successful”.

“Lake confirms that construction of the facility to house the Lilac demonstration plant is now complete,” it says.

“Dry commissioning of the demonstration plant commenced on Wednesday September 14.

“Lilac has advised Lake that, subject to completion of dry commissioning, it expects to begin wet commissioning of the plant on September 22; once wet commissioning is complete, Lilac expects to begin onsite processing of Kachi brines in the first week of October.”

The first 2000 litres of lithium concentrate produced from the demonstration plant (a smaller version of the real thing) will be converted into lithium carbonate, which will be qualified by a tier 1 battery maker.

The company says drilling at its McDermitt project in the US has returned 29.2m at 1853 ppm li from 20.8m and 18.5m at 1844 ppm li from 10.5m.

The program is designed to infill and extend the Mineral Resource Estimate (MRE) of 1.82 Bt at 1,370 ppm lithium for 13.3 Mt Lithium Carbonate Equivalent (LCE) at 1,000ppm Li cut-off.

More assay results from the completed drilling are expected to be received early October.

GMN, LKE and JRL share prices today:

At Stockhead we tell it like it is. While Gold Mountain Mining is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.