EV makers are scrutinising their raw material supply chains – this is why it matters for investors

Mining

Mining

Special Report: For battery metals investors, ‘strict sustainability practice’ is more than a buzzword – it has serious implications for the success or failure of any project nearing development.

The auto sector is progressively micromanaging supply chains to ensure a secure, stable supply of battery raw materials.

Those suppliers that don’t make the grade are increasingly overlooked.

“From copper to cobalt, but also increasingly lithium, downstream companies are demonstrating their increasing awareness of responsible sourcing risks beyond cobalt and conflict minerals,” says mineral market advisory firm RCS Global Group.

Tesla boss Elon Musk, for example, says the carmaker could enter the mining business to secure cobalt supplies, which is principally sourced from unstable jurisdictions like the Democratic Republic of Congo.

VW – the largest carmaker in the world — has signed a long-term lithium supply deal with Ganfeng Lithium for the same reason; ethical, stable and sustainable supply.

Over the next 10 years, VW alone intends to launch almost 70 new EV models, or 22 million cars all up.

22 million EVs = a lot of lithium.

The deal with Ganfeng was the result of an intensive analysis of the markets by VW’s e-Raw Material Team, says Michael Bäcker, head of procurement for electric mobility.

“This specialised team focuses on targeted relationship building with companies in the raw materials industry,” he says.

“As well as securing capacity at competitive prices, the group’s particular focus is on sustainability.”

This is having a notable trickle-down effect.

Mining and midstream players must now make sure they remain in step with these downstream expectations for responsible sourcing.

Meeting the expectations of a major player, like Tesla or VW, is crucial if an advanced lithium project is to secure major offtake and finance deals.

For example, VW has highlighted some of the major risks – both supply side and jurisdictional – that come with South American lithium sources right now.

“Lithium extraction in salt lakes – predominantly in Chile, Argentina and Bolivia – is deemed difficult to calculate, since the evaporation process can be severely affected by rain, snow and natural contaminants in the material, and the impact on the environment (for example, on the groundwater level) can be potentially problematic,” VW says.

RCS Global Group says that major risks from South American lithium sources are already being highlighted by German media, and “will be more so by non-profits in the near future”.

This is why ioneer’s (ASX:INR) advanced Rhyolite Ridge lithium-boron project in the US is so well placed.

Not only is Rhyolite Ridge forecast to be bottom of the lithium cost curve due to revenue from the boron co-product, it is a project with very strong sustainability credentials in a highly desirable (and stable) jurisdiction.

Rhyolite Ridge is located close to existing infrastructure in Nevada, which has consistently been ranked in the top three jurisdictions in the world for investment by the Fraser Institute’s annual mining company survey.

That means that it is a good place to do business.

Right now — much like Europe – the US is reliant on China for lithium-ion battery supply.

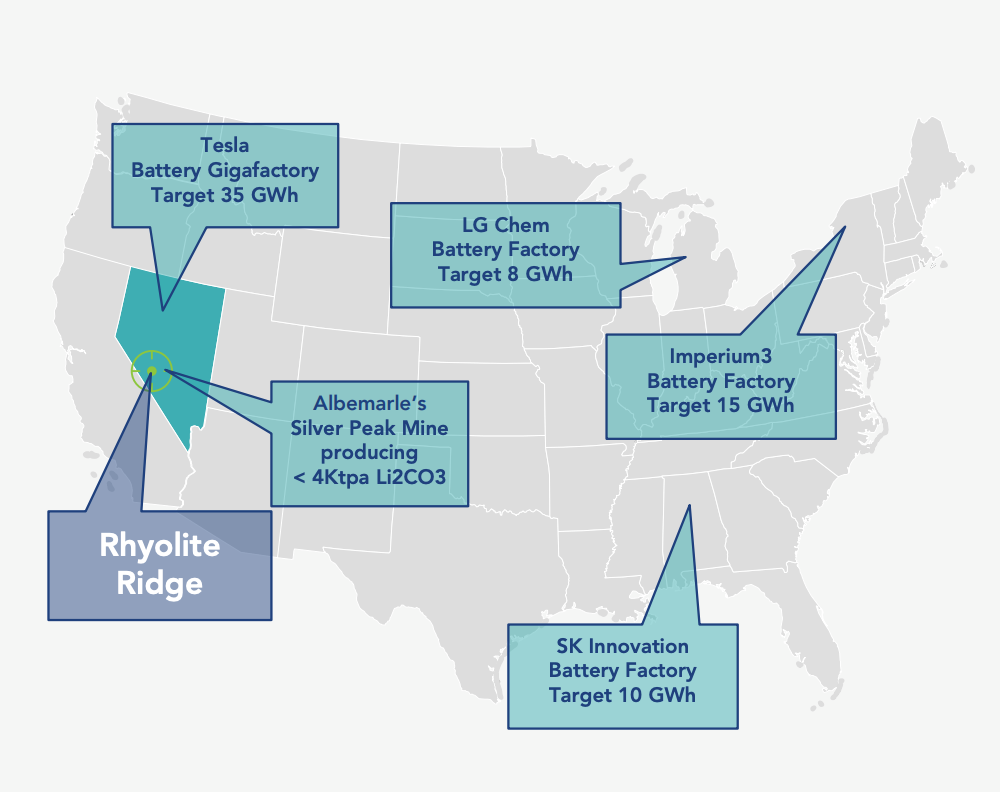

It only produces about 4,000 tonnes of lithium carbonate equivalent (LCE) a year and planned battery factories in the US already require ~55,000 tonnes of LCE.

For US carmakers like Tesla, ioneer makes monitoring supply chains simple and transparent, due to its proximity to the growing number of US lithium-battery makers and the strong regulatory oversight in the US.

Rhyolite Ridge also ticks all the environmental boxes.

Because there’s no large evaporation ponds or tailings dams, the low emission operation will boast a relatively small footprint.

ioneer will ensure low water use by employing mechanical evaporation in a closed circuit.

Ore residue will not contain toxic materials or have the potential to cause acid mine drainage.

And Rhyolite Ridge is located on federal government land that doesn’t have any competing land uses such as agriculture or forestry.

Carmakers dictate that raw materials supply used in lithium-ion battery manufacture – like cobalt, lithium, and graphite – be responsibly sourced from stable jurisdictions.

Companies that embrace ethical and sustainable operations – like ioneer – minimise partner risk and stand out as the more attractive investment option.

LISTEN: The Explorers Podcast with Barry FitzGerald: ioneer