Early signs are promising in Metal Hawk’s treasure hunt for nickel, lithium and REEs

Pic: Getty Images

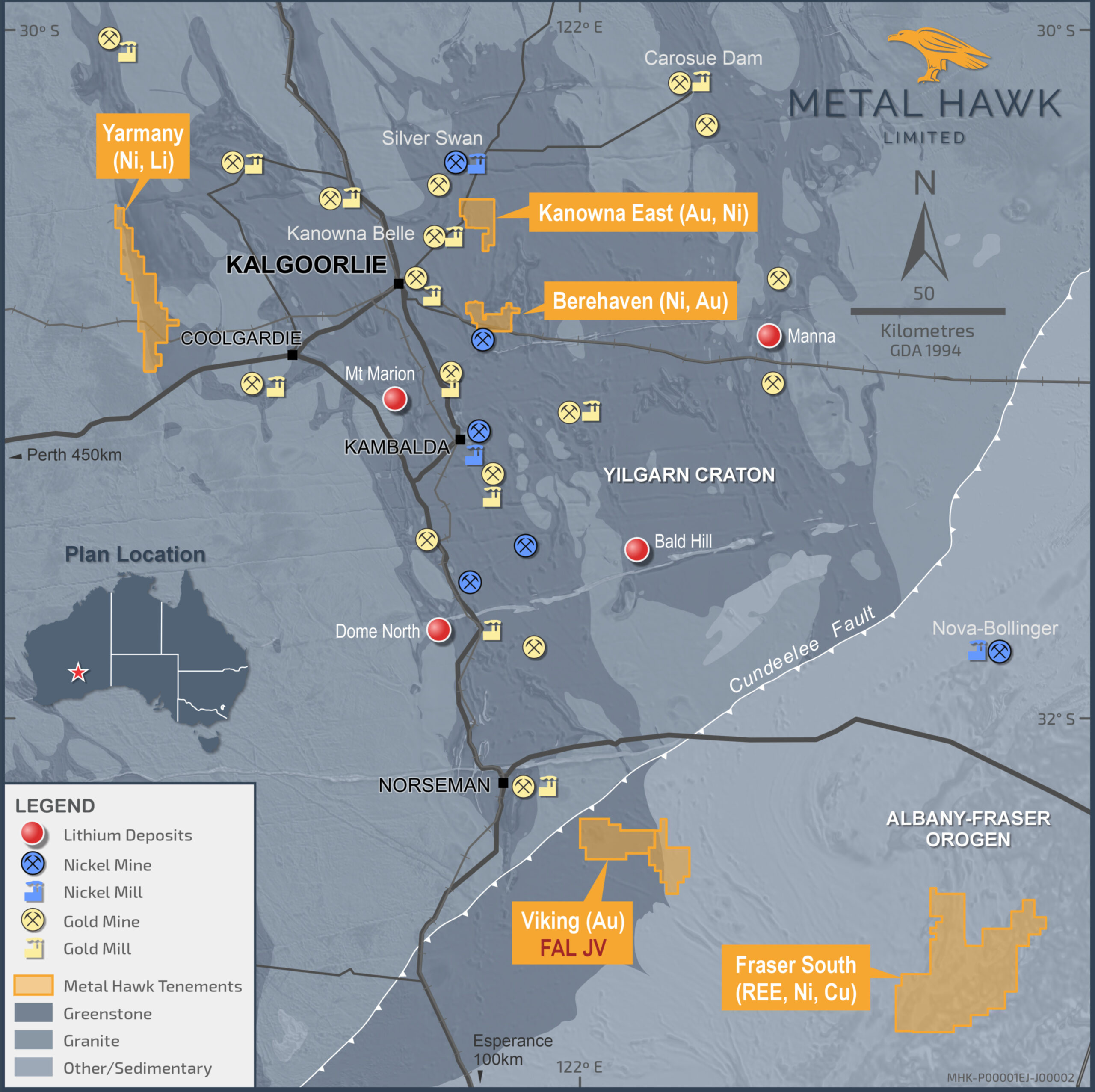

Metal Hawk’s project in an REE hotspot north of Esperance in WA is showing early signs of promise with high grade results from its initial drilling program while its new belt-scale Yarmany project will provide discovery opportunities for lithium and nickel.

Speaking to Stockhead, Metal Hawk (ASX:MHK) managing director and geologist Will Belbin discussed recent results of what he calls a “little program” at its Fraser South project, located 150km northeast of Esperance.

MHK had recently bought out its JV with lithium and nickel miner IGO (ASX:IGO) in the sizeable Fraser South project, which was originally entered into with Western Areas but inherited by IGO following its acquisition of the nickel producer in 2022. Belbin said IGO remains a substantial shareholder in MHK.

“They inherited the joint venture project and have a lot going on so couldn’t really give it the attention that Western Areas might have but they’re supporting us because they’re all about nickel and lithium,” Belbin said.

“They hadn’t done any drilling, so we went out about two weeks after we bought back the interest, and we did a little program and came out with some results.”

The little program at the Fraser South project paid off with MHK recently reporting wide zones of clay-hosted REEs grading up to 4120ppm.

The shallow, 35-hole maiden drill program included three holes with grades above 2000ppm, and nine holes with grades above 1000ppm along a big target.

The holes were drilled in a single line, spaced 400m apart to test a 15km long zone.

“There hasn’t been much exploration out there until recently and it’s an emerging region for rare earths and its early days,” Belbin said.

MHK now plans to do some initial metallurgical test work as well as following up with a more substantial stage-2 drilling program.

Bring in lithium component

While REEs have been at the forefront of MHK’s attention, it is also keen on advancing lithium exploration.

The junior recently inked a binding agreement for an option to buy the Yarmany project tenements from Black Mountain Gold, a wholly owned subsidiary of Horizon Minerals (ASX:HRZ).

The project is 40km northwest of Coolgardie in WA and covers an area of 282km2 with access via the Great Eastern Highway.

The tenure has 50km of strike potential along the Ida Fault and is considered prospective for both nickel sulphide and lithium mineralisation.

“We mainly acquired it for the nickel sulphide potential, but the market and a lot of our investors are excited by the lithium potential as well,” Belbin said.

“It’s positioned along a major structure and has some of the key ingredients you’d want for lithium deposits.”

“With a favourable geological setting along the Ida Fault, this large and contiguous tenement package presents as a tremendous discovery opportunity for the company.”

He said MHK will be applying targeted exploration for nickel and lithium mineralisation and is aiming to fast-track plans for drilling in 2023.

Hancock Prospecting exploring along Ida Fault

At the Yarmany Project, MHK has some impressive neighbours. To the north, Gina Rinehart’s Hancock Prospecting has entered a JV at Mt Ida.

“It’s also along the Ida Fault and they’re also doing greenfields lithium exploration,” Belbin said.

“We’re looking forward to the treasure hunt on this unexplored project with tremendous potential for new discoveries.”

The Yarmany Project consists of seven granted exploration licences with annual expenditure commitments totalling $175k per year.

Belbin said the Yarmany Project has seen very little nickel sulphide exploration activities since the 1970s and limited lithium exploration.

He said most of the historical drilling at Yarmany is limited to regional gold exploration.

“Horizon primarily held the ground for its gold potential, so we’ll be able to give it greater focus for nickel sulphide and lithium,” he said.

Strong support for exploration projects

As MHK grows its exploration projects it is well backed. With an experienced technical team and low overheads, MHK has attracted supportive shareholders since first listing on the ASX in November 2020 as a gold and nickel explorer.

The explorer focused more on nickel after making a massive nickel sulphide discovery at its Berehaven Project, just east of Kalgoorlie.

It now has some market interest in REE following its recent discovery at Fraser South and some lithium exposure at Yarmany.

“I’m geologist and have done mainly nickel exploration in WA and we have a small team who are very technical and hands on,” Belbin said.

“As a junior greenfields explorer where patience is required you need a good capital structure with supportive shareholders who understand the process.

“We’ve also had some good guys come onto the register and we are well supported by our major shareholder IGO who hold more than 8%.”

This article was developed in collaboration with Metal Hawk ,a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.