Early findings from Hardey’s Argentina adventure are better than expected

Pic: Schroptschop / E+ via Getty Images

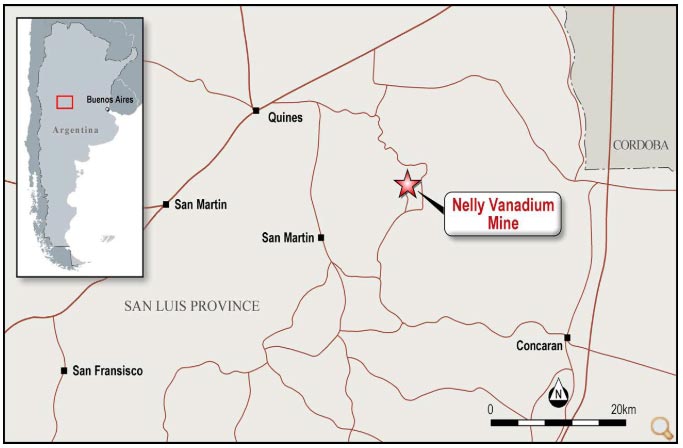

Special report: An early survey at Hardey Resource’s prospective Nelly vanadium mine in Argentina has found more stockpiles than expected and major veins untouched by past production.

Hardey has fast-tracked due diligence on the once-operating mine, after announcing a plan to buy it in July.

The Nelly mine in the San Luis province historically produced grades of up to 1.9 per cent vanadium pentoxide (V2O5).

Teams from SRK Consulting and Condor Prospecting — appointed to review the mine as part of a strategy to fast-track pre-acquisition due diligence — found partially unmined veins within historic workings, and significant exploration possibilities thanks to mineralised vein outcropping away from historic workings.

The early news is good

Key initial findings included the discovery of nine stockpiles around the main open pit which are readily accessible and could be easily processed as a potential direct shipping ore (DSO) product.

DSO typically requires only simple crushing before it is exported, which keeps costs low.

There are portions of mineralised veins up to 1.5m wide left untouched from historic mining operations within the open pit and shafts.

There is a possible extension to the main open pit vein evidenced by surface outcropping circa 250m to the south-west, with no visible legacy workings.

And there are numerous examples from across the project area that highlight vanadium mineralisation prevalence at surface.

“Without question, SRK Consulting and Condor Prospecting have moved rapidly to mobilise their teams to Nelly Vanadium Mine to progress preliminary due diligence,” said Hardey Resources chairman Terence Clee.

“Having reviewed the initial findings, the board is highly encouraged to have confirmation the stockpiles are readily accessible and visible evidence of unexploited mineralisation. The board looks forward to receiving further news-flow from site as it materialises.”

The mine has ready access to mains power and water supplies, while nearby towns can provide supporting services and a skilled labour pool.

There is also good transport infrastructure, including a rail network, from the mine to key ports.

A processing plant on-site once produced V2O5 and ammonium metavanadate – a sand-like powder used in dyes, inks, varnishes and paints, and as a photographic developer and reagent.

Good time to buy

Hardey is picking up the project at a time when vanadium prices are at all-time highs.

Prices have been driven up over the last three years by rising demand from the battery sector and supply bottlenecks.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Vanadium is used in steel-making, but demand is rising as a key component of vanadium redox flow batteries (VFRBs), an alternative to lithium ion batteries for industrial-scale projects.

Industry insiders believe VFRBs could make up 30 per cent of the battery market in the next 10 years.

On the supply side, China, which supplies around 50 per cent of global vanadium, is using more of its output internally following new rules to double steel-reinforcement of concrete following recent earthquakes.

This special report is brought to you by Hardey Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.