Drilling on the cards as GTI uncovers 19km of uranium anomalies at Green Mountain

Mining

Mining

Special Report: Geophysics has revealed 12 miles (~19km) of radiometric anomalies indicative of uranium trends at GTI Energy’s Green Mountain project in Wyoming, USA.

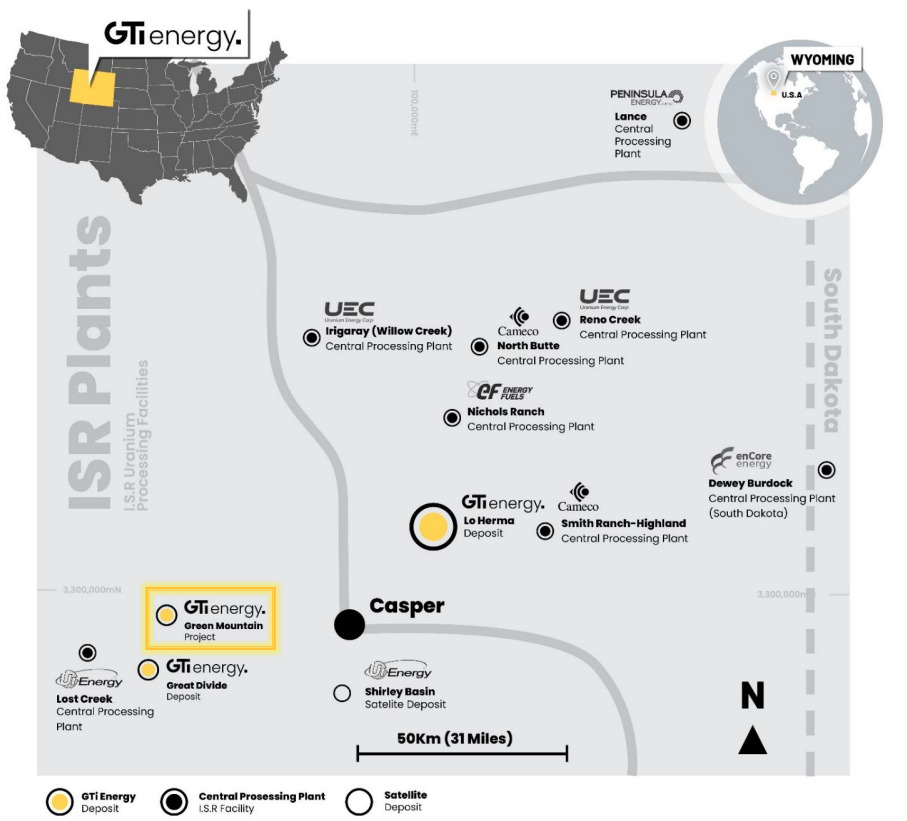

The project is in Wyoming’s prolific Crooks Gap/Green Mountain/Great Divide Basin uranium production district – the same neighbourhood as Energy Fuel’s (EFR) 30Mlb Sheep Mountain deposit, Ur-Energy’s (URE) 14Mlb Lost Soldier in-situ recovery (ISR) deposit and UEC’s (UEC) Jab & Antelope deposits.

It’s also in the vicinity of Rio Tinto’s (ASX:RIO) Big Eagle (past producing), Jackpot, Desert View, Phase II, and Willow Creek deposits.

This area collectively referred to as the Green Mountain uranium district is known to contain in excess of 70 million pounds U3O8.

GTI Energy (ASX:GTR) also holds the nearby Great Divide Basin projects and the Lo Herma project in Wyoming’s Powder River Basin where they’re drilling to validate and upgrade the inferred 5.7Mlb resource grading 630ppm.

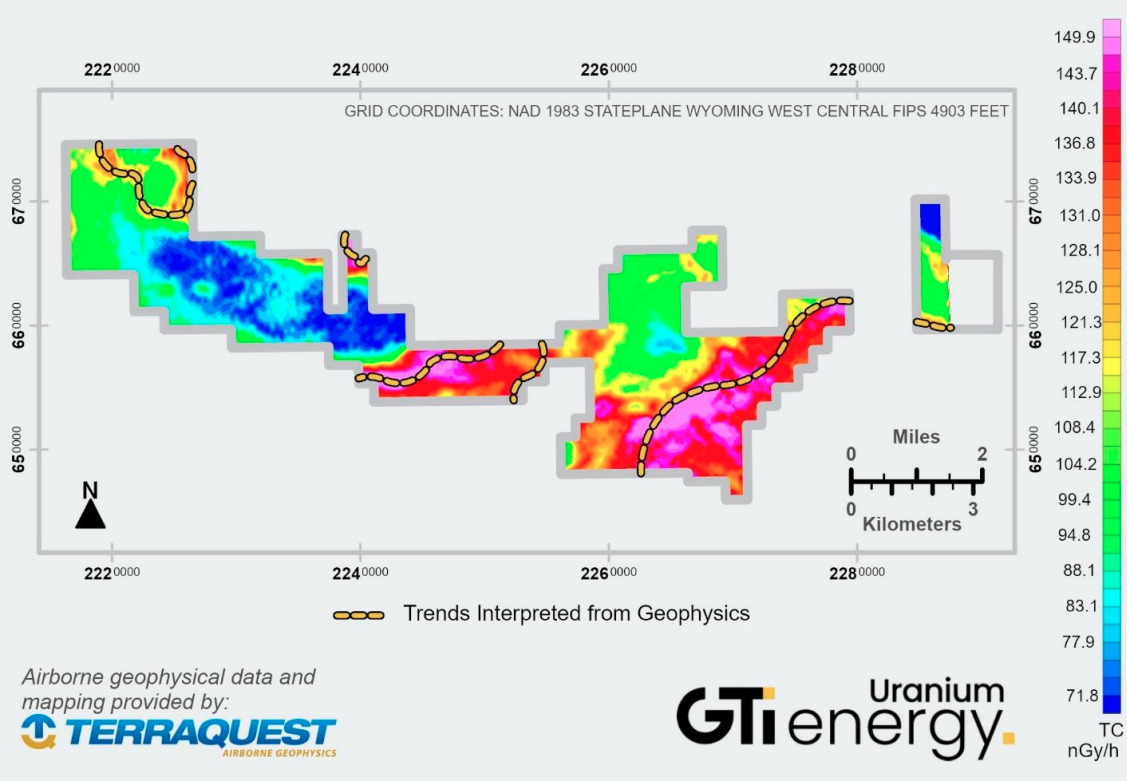

Drilling could now be on the cards for Green Mountain too, after the recently completed airborne radiometric and magnetic survey identified 12 miles of anomalous uranium trends across the project area which will be used to aid targeting for future exploration drilling.

“The aerial geophysical survey has provided us with clear direction as to where to drill at Green Mountain,” GTI Energy executive director Bruce Lane said.

“We have been able to utilise the historical drilling and geological information completed by Kerr McGee Corporation, Wold Nuclear and others during the 1970’s and 1980’s to help interpret and extrapolate significant additional anomalous uranium trends, particularly within the eastern part of the extensive Green Mountain land position.

“The land package is surrounded by significant uranium deposits and resources owned by Rio Tinto, Energy Fuels, Ur Energy and UEC, so we know we are in an area with real potential.

“Our next step is to progress work on refining drill targets and permitting.”

The radiometric survey measures radiometric emanations called gamma rays to determine concentrations of naturally occurring radioelements potassium, uranium, and thorium.

The airborne survey method is limited to near-surface measurements, which means there’s potential for deeper mineralization across the entire survey area that is not shown in the survey due to obscurement by excess overburden and/or overlying gamma emitters.

Of the 12 miles of anomalies identified, six have been flagged for follow up and correlate with historically identified drill holes, interpreted trends, areas of past mining and/or known mineralisation.

The company is currently planning for 50 initial drill holes with an average drill depth of 1,500 feet at the project in mid to late 2024.

In addition, GTR has staked 28 additional claims at Green Mountain – based on results of the geophysical surveys – bringing the total holdings to 697 mining claims spanning roughly 14,000 acres.

“The potential of this area came to GTI’s attention through our review of the geophysical survey and is considered highly prospective for uranium mineralisation within the Battle Springs formation,” the company said.

Why are uranium hopefuls setting up in Wyoming? Why is Bill Gates opening his wallet up in that neck of the woods? and what does in-situ recovery mean?

Stockhead’s Sarah Hughan sits down with Lane to get the answers to these questions and more in the below episode of What the Facts?!

This article was developed in collaboration with GTI Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.