Copper prices are flying, but the best is yet to come

Pic: Schroptschop / E+ via Getty Images

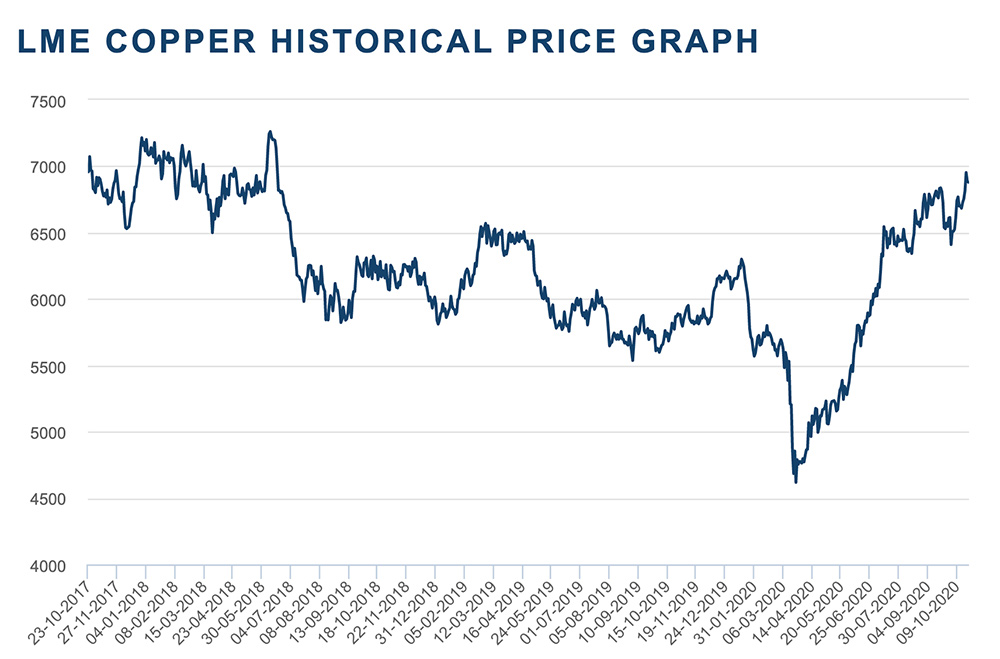

Red-hot copper prices surged 22 per cent in the September quarter — well above pre-COVID-19 levels — for their highest quarterly increase since mid-2009.

By late October prices were at 28-month highs.

Why? Stronger-than-expected demand from China, a lack of recycled scrap, and major pandemic-induced supply disruptions.

China, which consumed 51 per cent of global copper supply in 2019, has responded to the pandemic by encouraging construction activity – which requires a lot of copper.

Meanwhile, South America, which supplied 42 per cent of the world’s primary copper in 2019, has become a new COVID epicentre.

Copper mining operations have been severely impacted.

That’s great news for established local copper producers like Sandfire Resources (ASX:SFR), Oz Minerals (ASX:OZL), and Aeris Resources (ASX:AIS).

“We anticipate [third-quarter 2020] financial results to significantly improve … for the majority of the companies in our coverage, driven by markedly stronger commodity prices and a better operating performance following several COVID-19 related disruptions in [the second quarter],” says Scotiabank analyst Orest Wowkodaw.

The short term outlook is also rosy.

In 2021-2022, the ‘base case’ (most expected) assumption is that government stimulus outside China will underpin a copper market recovery, Wowkodaw says.

World Bank expects copper prices to rise another 4 per cent in 2021.

Which is great — but the big, sustained copper price uplift hasn’t even happened yet.

The underlying positive fundamentals of the copper market haven’t changed for quite some time. Big mines are running dry. Meanwhile, years of low prices dampened any enthusiasm for exploration.

The result? 2010-19 was the worst decade for copper discoveries ever recorded. And yet big copper discoveries are needed right now.

Over the next 10 years demand for copper from traditional end-users will remain solid. Its exposure to the “electrification mega-trend” offers attractive upside, says BHP vice president, Market Analysis & Economics Dr Huw McKay.

One electric vehicle uses about 83kg of copper. Under the IEA’s EV30@30 Scenario, EV sales reach 44 million vehicles per year by 2030.

You do the math.

“…a structural deficit is expected to open in the mid–to–late 2020s, at which point we see some sustained upside for prices,” Dr McKay says.

“Grade decline, resource depletion, increased input costs, water constraints and a scarcity of high–quality future development opportunities are likely to result in the higher prices needed to attract sufficient investment to balance the market.

“Our view is that the price setting marginal tonne a decade hence will come from either a lower grade brownfield expansion in a lower risk jurisdiction, or a higher grade greenfield in a higher risk jurisdiction.

“Neither source of metal is likely to come cheaply.”

This is a powder keg waiting to explode. It’s why Rio Tinto (ASX:RIO) is fast tracking development of its relatively recent Winu discovery in the Paterson Province of WA.

It’s why major miners are throwing huge amounts of cash at copper explorers to form lucrative project joint ventures.

And it’s also why investors are keen to jump into recent, heavily oversubscribed copper IPOs like Coda Minerals (ASX:COD).

The copper explorers to watch

Here’s how a basket of ASX-listed copper stocks has performed over the past year.

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | NAME | 1 WEEK CHANGE % | 1 MONTH CHANGE % | 6 MONTH CHANGE % | 1 YEAR CHANGE % | SHARE PRICE [intraday Friday] | MARKET CAP |

|---|---|---|---|---|---|---|---|

| BAT | Battery Minerals | 79 | 67 | 317 | 178 | 0.025 | $ 34,270,380.27 |

| AOU | Auroch Minerals | 57 | 117 | 170 | 132 | 0.165 | $ 35,843,477.98 |

| GRL | Godolphin Resources | 46 | 83 | 232 | 0 | 0.365 | $ 22,471,638.42 |

| ZNC | Zenith Minerals | 41 | 41 | 187 | 155 | 0.155 | $ 47,097,604.80 |

| HCH | Hot Chili | 37 | 30 | 149 | 49 | 0.052 | $ 115,920,837.41 |

| VXR | Venturex Resources | 33 | 63 | 94 | -13 | 0.14 | $ 45,933,525.24 |

| SLZ | Sultan Resources | 32 | 13 | 286 | 303 | 0.27 | $ 15,828,831.00 |

| CWX | Carawine Resources | 30 | 49 | 67 | 35 | 0.35 | $ 32,731,416.14 |

| SVY | Stavely Minerals | 29 | 35 | 105 | -39 | 0.75 | $ 198,330,703.52 |

| RTG | RTG Mining | 29 | 18 | 221 | 213 | 0.225 | $ 129,745,382.34 |

| CHK | Cohiba Minerals | 29 | 13 | 350 | 38 | 0.018 | $ 18,634,495.00 |

| SGQ | St George Mining | 26 | 32 | 54 | -19 | 0.145 | $ 67,978,355.76 |

| NML | Navarre Minerals | 18 | 88 | 124 | 104 | 0.235 | $ 122,049,483.98 |

| RCP | Redbank Copper | 17 | 35 | 363 | 363 | 0.088 | $ 33,445,388.54 |

| SUH | Southern Hemisphere Mining | 14 | -2 | 387 | 144 | 0.04 | $ 6,355,433.68 |

| C6C | Copper Mountain | 14 | 10 | 160 | 54 | 1.22 | $ 22,597,784.70 |

| NWC | New World Resources | 14 | 39 | 355 | 138 | 0.05 | $ 55,189,516.78 |

| KGL | KGL Resources | 14 | 14 | 57 | 2 | 0.25 | $ 83,937,005.25 |

| AUQ | Alara Resources | 13 | 6 | 42 | -19 | 0.017 | $ 10,793,067.36 |

| AML | Aeon Metals | 13 | -4 | 120 | 18 | 0.13 | $ 84,696,215.88 |

| SCI | Silver City Minerals | 13 | 6 | 125 | 80 | 0.018 | $ 8,747,284.55 |

| AIS | Aeris Resources | 12 | 12 | 107 | 40 | 0.066 | $ 121,409,192.70 |

| CCZ | Castillo Copper | 11 | 11 | 188 | 188 | 0.049 | $ 48,573,058.66 |

| MEP | Minotaur Exploration | 9 | 49 | 124 | 36 | 0.076 | $ 36,511,503.43 |

| PEX | Peel Mining | 8 | 0 | 85 | -3 | 0.26 | $ 88,827,391.64 |

| SRI | Sipa Resources | 8 | 15 | 75 | -8 | 0.084 | $ 14,759,669.88 |

| XAM | Xanadu Mines | 7 | 7 | 50 | 5 | 0.045 | $ 48,041,026.97 |

| OZL | OZ Minerals | 7 | 11 | 88 | 59 | 15.81 | $ 5,290,754,943.23 |

| BOC | Bougainville Copper | 7 | 28 | 25 | 191 | 0.32 | $ 122,324,062.50 |

| FNT | Frontier Resources | 7 | 0 | 129 | 33 | 0.016 | $ 8,803,834.88 |

| AZS | Azure Minerals | 6 | 116 | 419 | 173 | 0.41 | $ 101,720,899.14 |

| GED | Golden Deeps | 6 | 3 | 230 | -39 | 0.0165 | $ 8,615,051.18 |

| RVR | Red River Resources | 5 | 50 | 231 | 26 | 0.195 | $ 103,554,873.40 |

| A1M | Aic Mines | 4 | 16 | 65 | 26 | 0.47 | $ 32,983,208.64 |

| TLM | Talisman Mining | 4 | 9 | 58 | 14 | 0.12 | $ 22,395,406.20 |

| HAV | Havilah Resources | 3 | 27 | 73 | 81 | 0.19 | $ 51,479,679.20 |

| SFR | Sandfire Resources | 2 | 8 | 11 | -28 | 4.52 | $ 828,868,698.45 |

| MLX | Metals X | 1 | 8 | 1 | -62 | 0.08 | $ 74,395,817.49 |

| EM2 | Eagle Mountain | 0 | 54 | 281 | 90 | 0.4 | $ 61,618,356.72 |

| RXM | Rex Minerals | 0 | -6 | 169 | 65 | 0.145 | $ 52,673,262.04 |

| CAE | Cannindah Resources | 0 | 9 | 200 | 60 | 0.024 | $ 5,314,822.74 |

| ARE | Argonaut Resources | 0 | 0 | 75 | 17 | 0.007 | $ 20,390,100.14 |

| CZN | Corazon | 0 | 50 | 55 | 24 | 0.003 | $ 13,013,436.58 |

| KAU | Kaiser Reef | 0 | 0 | 116 | 0 | 0.41 | $ 10,106,500.41 |

| AKN | Auking Mining | 0 | 0 | 0 | 0 | 0.002 | $ 1,865,168.92 |

| ATM | Aneka Tambang | 0 | 0 | 0 | 0 | 1 | $ 1,303,649.00 |

| MCB | MCB Resources | 0 | 0 | 0 | -30 | 0.07 | $ 1,798,548.64 |

| PXX | Polarx | 0 | -33 | 67 | -66 | 0.03 | $ 16,245,621.84 |

| IGO | IGO Limited | 0 | 1 | -2 | -27 | 4.38 | $ 2,593,598,979.26 |

| RIO | Rio Tinto | -1 | -2 | 12 | 7 | 95.4 | $ 35,718,424,111.08 |

| BYH | Bryah Resources | -2 | 13 | 107 | 7 | 0.06 | $ 7,912,430.40 |

| IVR | Investigator Resources | -2 | 2 | 333 | 206 | 0.052 | $ 59,824,523.91 |

| BHP | BHP Group | -2 | -2 | 24 | 2 | 36 | $ 107,464,658,853.12 |

| DGR | DGR Global | -2 | 20 | 45 | 2 | 0.089 | $ 70,598,405.79 |

| CHN | Chalice Gold Mines | -2 | 31 | 188 | 1603 | 2.98 | $ 907,444,141.80 |

| TAS | Tasman Resources | -2 | 21 | 38 | -30 | 0.041 | $ 23,383,378.88 |

| GMN | Gold Mountain | -2 | -11 | -22 | -44 | 0.04 | $ 27,586,496.96 |

| CYM | Cyprium Metals | -3 | -3 | 38 | -8 | 0.165 | $ 9,663,923.28 |

| ORN | Orion Minerals | -3 | -10 | 115 | 4 | 0.028 | $ 94,430,058.45 |

| CBY | Canterbury Resources | -4 | 4 | 69 | -39 | 0.135 | $ 12,167,632.68 |

| GTE | Great Western Exploration | -4 | -11 | 373 | 137 | 0.25 | $ 30,211,495.86 |

| LEX | Lefroy Exploration | -4 | 6 | 56 | 28 | 0.25 | $ 24,116,818.80 |

| BOA | Boadicea Resources | -4 | 8 | 44 | 37 | 0.24 | $ 12,231,064.12 |

| ALY | Alchemy Resources | -5 | 5 | 95 | 65 | 0.21 | $ 15,461,599.42 |

| MAU | Magnetic Resources | -5 | 3 | 53 | 122 | 1.22 | $ 259,285,652.40 |

| ALK | Alkane Resources | -5 | -9 | 92 | 82 | 1.32 | $ 776,982,384.00 |

| AQX | Alice Queen | -6 | -17 | 67 | -21 | 0.03 | $ 33,812,895.64 |

| AQD | Ausquest | -7 | -7 | 133 | 115 | 0.028 | $ 18,965,315.07 |

| ERM | Emmerson Resources | -7 | -7 | 9 | -25 | 0.082 | $ 41,042,579.29 |

| COY | Coppermoly | -7 | -32 | 63 | 63 | 0.013 | $ 27,653,781.86 |

| KTA | Krakatoa Resources | -8 | -10 | 200 | 84 | 0.09 | $ 24,283,600.00 |

| ARD | Argent Minerals | -9 | -14 | 269 | 153 | 0.048 | $ 41,105,191.05 |

| HGO | Hillgrove Resources | -10 | 0 | -14 | -46 | 0.038 | $ 22,252,363.68 |

| REE | Rarex | -10 | 92 | 367 | 155 | 0.14 | $ 51,065,809.43 |

| AMG | Ausmex Mining | -10 | -12 | 8 | -57 | 0.043 | $ 24,640,573.95 |

| TAR | Taruga Minerals | -11 | 2 | 540 | 215 | 0.064 | $ 28,346,493.37 |

| AL8 | Alderan Resources | -12 | 0 | 785 | 188 | 0.115 | $ 28,799,500.51 |

| OAR | Oakdale Resources | -12 | -15 | 752 | 97 | 0.023 | $ 38,857,496.28 |

| AQI | Alicanto Minerals | -15 | 0 | 179 | 188 | 0.17 | $ 51,941,268.59 |

| AZY | Antipa Minerals | -16 | -2 | 227 | 227 | 0.049 | $ 121,276,990.28 |

| DEV | Devex Resources | -19 | -10 | 221 | 206 | 0.26 | $ 61,513,460.00 |

| CVV | Caravel Minerals | -19 | -5 | 453 | 176 | 0.105 | $ 26,565,515.87 |

| ENR | Encounter Resources | -25 | 66 | 118 | 71 | 0.24 | $ 57,657,444.13 |

A number of copper-focused explorers saw their share prices surge last week as metal prices hit 28 month highs.

Like Hot Chili (ASX:HCH), which recently unveiled a maiden resource of 451 million tonnes at 0.46 per cent copper equivalent (CuEq) for its Cortadera deposit in Chile.

This resource compares favourably with Winu, which has a resource of 503Mt grading 0.45 per cent CuEq.

Hot Chili now has a globally significant resource of 724Mt at 0.48 per cent CuEq, or a contained resource of 2.9 million tonnes of copper, 2.7 million ounces of gold, 9.9 million ounces of silver and 64,000t of molybdenum.

Near term mine builder Venturex Resources (ASX:VXR) is looking for finance to develop the Sulphur Springs copper-zinc project in WA.

“With the strong increase in the copper price over the past several months, and positive outlook, we are very encouraged by considerable renewed interest in project equity proposals,” said exec director Anthony Reilly in September.

Victorian explorer Stavely (ASX:SVY) is aiming to release a maiden resource for the world-class Cayley Lode discovery later this year.

The September 2019 discovery hole – which returned 32m at 5.88 per cent copper, g/t gold and 58g/t silver – was a rerating event for the company, which is also hunting for a major porphyry at depth.

Porphyry deposits are gigantic. They currently supply ~60 per cent of the world’s copper, most of its molybdenum, and significant amounts of gold and silver.

In South Australia, Cohiba Minerals (ASX:CHK) is drilling the first deep hole at the Horse Well prospect, which borders BHP’s mammoth Oak Dam West discovery.

The 2018 discovery hole at Oak Dam West included a staggering 425.7m-long intercept grading 3.04 per cent copper, 0.59 g/t gold, 346ppm uranium and 6.03 g/t silver.

Godolphin Resources (ASX:GRL) has uncovered a new porphyry system at the Copper Hill East project in NSW.

“The results from the first two holes at the Turrawonga prospect suggest we are on the margins of a copper-gold porphyry system and as such this is a new discovery within the Molong Volcanic Belt which also hosts [Alkane’s] Boda discovery to the north,” Godolphin chief exec David Greenwood says.

“We are moving quickly to follow up these initial encouraging results with three deeper holes with the objective of vectoring into the core of the porphyry system.”

African Energy Resources (ASX:AFR) was up +30 per cent last week after applying for exploration ground in WA “prospective for large porphyry copper-gold deposits and/or intrusion related orogenic gold deposits”.

Philippines-based explorer RTG Mining’s (ASX:RTG) main game is the development of the high grade Mabilo copper gold mine project.

But the junior is also eyeing the redevelopment of the Panguna mine, which has an incredible resource of 5.3 million tonnes copper and 19.3 million ounces of gold with an inground value in excess of $US60 billion.

In May, explorer Zenith Minerals (ASX:ZNC) uncovered a brand new, very high-grade copper prospect called ‘Snook’ at the advanced Develin Creek project in Queensland.

The project already has a 2.57 million tonne resource grading 1.76 per cent copper and 2.01 per cent zinc, but Zenith’s ultimate goal is a 1mtpa operation for at least 10 years – which means finding a lot more metal.

Snook will be drilled for the first time within the next month.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.