You might be interested in

Mining

Resources Top 5: Copper in focus as Anax gets the Fitz-pump and TechGen reveals new projects

Mining

Up, Up, Down, Down: Everyone's a winner in an astounding April for major metals

Mining

Mining

Last year, the price of copper rose 33%, but that was just the entree.

Goldman Sachs reckons the red metal will hit a record US$12,000/t over the next month, up from ~$US9,700/t currently. That’s uncomfortably bullish, but even the more mild mannered analysts are revising their forecasts upwards.

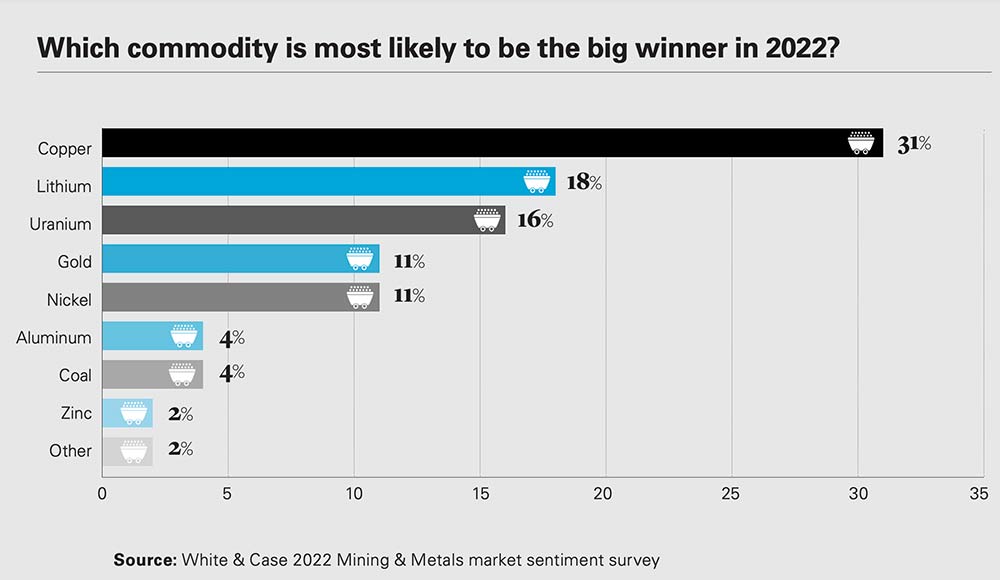

White & Case recently conducted its sixth annual survey of industry participants, with 63 senior decision-makers sharing their thoughts on commodity performance for the year ahead. Copper came out on top.

By a massive margin.

“For the third straight year, our survey has picked copper to be the best-performing metal in 2022, with 31 percent saying it’s set for another year of outperformance,” it said.

“The metal, an economic bellwether and a key material for the energy transition, hit record prices last year, breaking above US$10 thousand per ton.”

White & Case flagged that minor production losses — from both COVID-19 disruptions and water issues in Chile – have combined with strong industrial demand.

“Our respondents’ enthusiasm for the metal is matched by the wider mining industry,” it said.

“The biggest miners remain universally bullish on its prospects, with demand expected to surge this decade and new supplies looking increasingly scarce.”

In this environment producers, and those companies looking to start production in the near term, are sitting pretty.

| Code | Company | Price | % Year | % Six Month | % Month | % Week | Market Cap |

|---|---|---|---|---|---|---|---|

| BOC | Bougainville Copper | 0.89 | 120% | 93% | 170% | 123% | $160,425,000.00 |

| SLM | Solismineralsltd | 0.31 | 0% | 0% | 55% | 55% | $9,469,500.00 |

| FNT | Frontier Resources | 0.037 | 139% | 66% | 85% | 48% | $30,525,073.56 |

| CPM | Coopermetalslimited | 0.535 | 0% | 0% | 123% | 47% | $15,131,200.00 |

| BRX | Belararoxlimited | 0.35 | 0% | 0% | 0% | 40% | $10,482,107.40 |

| AUQ | Alara Resources Ltd | 0.082 | 413% | 382% | 228% | 39% | $57,845,197.60 |

| ARE | Argonaut Resources | 0.004 | -69% | -33% | -38% | 33% | $14,424,819.13 |

| HMX | Hammer Metals Ltd | 0.07 | -18% | -20% | 30% | 25% | $58,679,612.86 |

| ODM | Odin Metals Limited | 0.032 | 33% | 3% | 19% | 23% | $13,523,985.72 |

| CNB | Carnaby Resource Ltd | 1.65 | 588% | 469% | 29% | 21% | $266,975,570.58 |

| CAE | Cannindah Resources | 0.335 | 1055% | 468% | 76% | 20% | $167,812,848.32 |

| TTM | Titan Minerals | 0.125 | 0% | 19% | 25% | 19% | $169,166,463.96 |

| STM | Sunstone Metals Ltd | 0.093 | 564% | 365% | -19% | 16% | $219,473,055.94 |

| DEX | Duke Exploration | 0.185 | -40% | -31% | 12% | 16% | $15,786,951.60 |

| AYT | Austin Metals Ltd | 0.03 | 7% | 36% | 15% | 15% | $28,444,490.34 |

| A1M | Aic Mines Ltd | 0.61 | 91% | 122% | 1% | 15% | $197,577,611.52 |

| MLX | Metals X Limited | 0.61 | 230% | 149% | 13% | 15% | $562,504,961.54 |

| C6C | Copper Mountain | 4.58 | 93% | 24% | 22% | 15% | $76,455,905.76 |

| CHK | Cohiba Min Ltd | 0.017 | -58% | -6% | -15% | 13% | $22,268,478.72 |

| HLX | Helix Resources | 0.017 | 31% | -26% | 13% | 13% | $22,652,626.50 |

| SUH | Southern Hem Min | 0.034 | 6% | -41% | -12% | 13% | $7,577,632.47 |

| AKN | Auking Mining Ltd | 0.175 | -56% | 9% | 21% | 13% | $12,304,899.90 |

| TRN | Torrens Mining | 0.18 | -18% | -8% | 16% | 13% | $12,191,364.15 |

| EM2 | Eagle Mountain | 0.685 | 96% | -2% | 19% | 12% | $145,797,640.84 |

| AIS | Aeris Resources Ltd | 0.15 | 67% | -27% | -6% | 11% | $315,641,363.10 |

| MAG | Magmatic Resrce Ltd | 0.1 | -33% | -23% | 3% | 11% | $25,448,679.80 |

| RTG | RTG Mining Inc. | 0.11 | -46% | -31% | -8% | 11% | $83,506,282.97 |

| PEX | Peel Mining Limited | 0.21 | -25% | -13% | -5% | 11% | $85,710,040.19 |

| OAR | OAR Resources Ltd | 0.0055 | -75% | -58% | -45% | 10% | $9,272,823.62 |

| ALY | Alchemy Resource Ltd | 0.013 | -30% | -5% | 8% | 8% | $12,380,483.57 |

| COY | Coppermoly Limited | 0.013 | -24% | -13% | 18% | 8% | $28,521,440.08 |

| CVV | Caravel Minerals Ltd | 0.33 | 100% | -7% | 0% | 8% | $132,549,005.78 |

| AR1 | Australresources | 0.21 | 0% | 0% | 27% | 8% | $45,740,138.68 |

| QML | Qmines Limited | 0.28 | 0% | -18% | -14% | 8% | $18,624,286.91 |

| SFR | Sandfire Resources | 7.31 | 56% | 14% | 5% | 8% | $3,046,165,464.99 |

| XAM | Xanadu Mines Ltd | 0.029 | -15% | -3% | 4% | 7% | $32,853,541.50 |

| ZNC | Zenith Minerals Ltd | 0.365 | 181% | 70% | 26% | 7% | $132,403,099.68 |

| RIO | Rio Tinto Limited | 122.36 | 4% | -4% | 15% | 7% | $44,159,880,817.44 |

| GMN | Gold Mountain Ltd | 0.015 | -63% | -29% | -3% | 7% | $18,192,535.89 |

| DGR | DGR Global Ltd | 0.064 | 12% | 10% | 7% | 7% | $63,029,533.14 |

| ALV | Alvomin | 0.35 | 0% | 0% | 19% | 6% | $25,490,609.90 |

| TLM | Talisman Mining | 0.175 | 84% | -13% | -1% | 6% | $33,793,109.46 |

| BOA | Boadicea Resources | 0.225 | -16% | 0% | -6% | 5% | $17,093,976.90 |

| OZL | OZ Minerals | 25.88 | 34% | 14% | -11% | 4% | $8,751,769,941.79 |

| AZY | Antipa Minerals Ltd | 0.05 | 28% | -2% | 4% | 4% | $156,985,413.10 |

| RDS | Redstone Resources | 0.0125 | -11% | 14% | -4% | 4% | $9,346,987.82 |

| BHP | BHP Group Limited | 48.86 | 8% | -6% | 9% | 4% | $244,408,963,613.20 |

| CPO | Culpeominerals | 0.14 | 0% | 0% | -13% | 4% | $5,939,096.66 |

| ARD | Argent Minerals | 0.029 | -58% | 4% | 0% | 4% | $27,364,637.84 |

| CYM | Cyprium Metals Ltd | 0.145 | -40% | -40% | -28% | 4% | $84,722,882.10 |

| ENR | Encounter Resources | 0.145 | 23% | 0% | -6% | 4% | $45,938,439.77 |

| AML | Aeon Metals Ltd. | 0.047 | -61% | -18% | 31% | 3% | $42,424,635.51 |

| ALK | Alkane Resources Ltd | 0.835 | 2% | -22% | -6% | 3% | $500,290,072.80 |

| CWX | Carawine Resources | 0.17 | -23% | -21% | 6% | 3% | $23,087,253.12 |

| HAV | Havilah Resources | 0.19 | -10% | 0% | 6% | 3% | $57,314,250.05 |

| TAR | Taruga Minerals | 0.039 | -15% | -28% | 0% | 3% | $19,970,340.23 |

| MEP | Minotaur Exploration | 0.21 | 52% | 138% | 12% | 2% | $115,910,663.26 |

| NML | Navarre Minerals Ltd | 0.087 | -42% | 6% | 12% | 2% | $118,726,477.22 |

| KTA | Krakatoa Resources | 0.049 | -25% | 0% | -2% | 2% | $14,440,785.93 |

| SRI | Sipa Resources Ltd | 0.05 | -17% | -11% | 4% | 2% | $9,636,165.74 |

| IGO | IGO Limited | 12.1 | 87% | 23% | 2% | 1% | $9,337,112,134.29 |

| CHN | Chalice Mining Ltd | 7.93 | 84% | 26% | -7% | 1% | $2,857,938,965.70 |

| DEV | Devex Resources Ltd | 0.44 | 69% | 91% | -5% | 1% | $142,953,705.90 |

| KGL | KGL Resources Ltd | 0.525 | 22% | -9% | -14% | 1% | $198,119,081.06 |

| AOU | Auroch Minerals Ltd | 0.12 | -55% | -33% | 9% | 0% | $46,936,733.87 |

| AQD | Ausquest Limited | 0.019 | -14% | -5% | 6% | 0% | $14,834,686.01 |

| AQX | Alice Queen Ltd | 0.008 | -77% | -38% | -20% | 0% | $12,262,784.08 |

| ATM | Aneka Tambang | 1.1 | 10% | 10% | -4% | 0% | $1,434,013.90 |

| BAT | Battery Minerals Ltd | 0.011 | -69% | -31% | -8% | 0% | $25,822,110.28 |

| COD | Coda Minerals Ltd | 0.865 | 188% | -26% | -11% | 0% | $80,024,203.00 |

| DCX | Discovex Res Ltd | 0.01 | 0% | 100% | -9% | 0% | $30,823,968.91 |

| ERM | Emmerson Resources | 0.13 | 76% | 88% | -13% | 0% | $67,262,196.02 |

| GED | Golden Deeps | 0.011 | -15% | 0% | 0% | 0% | $8,534,365.84 |

| GRL | Godolphin Resources | 0.13 | -45% | -13% | -7% | 0% | $10,934,478.23 |

| IPT | Impact Minerals | 0.014 | -22% | 8% | 0% | 0% | $28,333,128.87 |

| KCC | Kincora Copper | 0.12 | 0% | -45% | -20% | 0% | $8,791,814.28 |

| MBK | Metal Bank Ltd | 0.006 | -48% | -22% | 0% | 0% | $18,254,727.12 |

| NRX | Noronex Limited | 0.08 | -45% | -43% | -2% | 0% | $13,616,782.96 |

| NWC | New World Resources | 0.07 | 37% | -9% | -10% | 0% | $111,625,697.54 |

| ORN | Orion Minerals Ltd | 0.03 | -27% | 3% | 30% | 0% | $129,986,259.54 |

| PXX | Polarx Limited | 0.034 | -17% | 6% | -13% | 0% | $25,033,044.96 |

| REE | Rarex Limited | 0.11 | -8% | 10% | 10% | 0% | $49,675,252.44 |

| RVR | Red River Resources | 0.195 | -15% | 15% | -3% | 0% | $98,508,252.72 |

| SLZ | Sultan Resources Ltd | 0.155 | -18% | -16% | -6% | 0% | $12,909,080.30 |

| VMS | Venture Minerals | 0.042 | -31% | -57% | -11% | 0% | $71,808,176.46 |

| WA1 | Wa1Resourcesltd | 0.235 | 0% | 0% | 0% | 0% | $6,444,001.44 |

| AZS | Azure Minerals | 0.405 | -17% | 72% | 9% | -1% | $132,062,681.43 |

| DVP | Develop Global Ltd | 3.08 | 530% | -18% | -10% | -2% | $448,872,600.66 |

| IVR | Investigator Res Ltd | 0.058 | -37% | -9% | -9% | -2% | $81,271,133.08 |

| HGO | Hillgrove Res Ltd | 0.053 | 47% | 13% | -2% | -2% | $64,585,898.14 |

| ANX | Anax Metals Ltd | 0.093 | 35% | 29% | 9% | -2% | $34,577,795.25 |

| KAU | Kaiser Reef | 0.2 | -55% | -12% | 0% | -2% | $24,484,142.80 |

| HCH | Hot Chili Ltd | 1.54 | -19% | -27% | -8% | -3% | $166,325,898.16 |

| ESR | Estrella Res Ltd | 0.032 | -56% | -20% | 39% | -3% | $38,421,809.28 |

| LEX | Lefroy Exploration | 0.31 | 44% | -33% | 3% | -3% | $47,409,267.10 |

| TBA | Tombola Gold Ltd | 0.03 | -55% | -35% | 0% | -3% | $21,771,730.50 |

| BYH | Bryah Resources Ltd | 0.057 | -12% | 2% | 8% | -3% | $13,572,430.50 |

| GTE | Great Western Exp. | 0.135 | -54% | -21% | -4% | -4% | $19,067,736.38 |

| CCZ | Castillo Copper Ltd | 0.024 | -60% | -37% | -27% | -4% | $31,152,071.23 |

| RXM | Rex Minerals Limited | 0.22 | 10% | -24% | -6% | -4% | $135,543,811.60 |

| MAU | Magnetic Resources | 1.4325 | 2% | -2% | -5% | -5% | $318,566,802.98 |

| CRR | Critical Resources | 0.1 | 285% | 285% | 61% | -5% | $139,435,181.97 |

| SVY | Stavely Minerals Ltd | 0.47 | -32% | 15% | -9% | -5% | $125,261,496.96 |

| RRR | Revolverresources | 0.44 | 0% | 0% | -4% | -5% | $39,419,190.18 |

| CZN | Corazon Ltd | 0.033 | -37% | -15% | -8% | -6% | $10,380,797.28 |

| AL8 | Alderan Resource Ltd | 0.023 | -77% | -52% | -15% | -8% | $10,639,152.00 |

| SGQ | St George Min Ltd | 0.062 | -41% | -5% | -13% | -9% | $37,708,219.97 |

| AQI | Alicanto Min Ltd | 0.1 | -5% | -26% | -17% | -9% | $38,271,361.70 |

| CNJ | Conico Ltd | 0.0145 | -61% | -79% | -60% | -9% | $15,003,223.11 |

| CBY | Canterbury Resources | 0.071 | -47% | -32% | -19% | -11% | $8,377,500.04 |

| RCP | Redbank Copper Ltd | 0.062 | -30% | -14% | 17% | -11% | $33,209,646.72 |

| REC | Rechargemetals | 0.155 | 0% | 0% | -28% | -11% | $4,497,900.15 |

| TAS | Tasman Resources Ltd | 0.022 | -68% | -33% | -21% | -12% | $16,107,654.38 |

| MCB | MCB Resources Ltd | 0 | -100% | -100% | -100% | -100% | $1,798,548.64 |

Who is producing – and who is getting close?

Rio has copper operations all around the world, and a number under development.

In the December quarter, lower grades, and throughput at the Escondida mine in Chile meant Rio’s copper production increased 6% to 132,000t (from December quarter 2020). Full year production was 494,000t, down 7% from 2020.

Rio is projecting higher production in almost every commodity group in 2022, including copper production of 500-575,000t.

BHP owns and operates several copper mines in Chile, one in South Australia (Olympic Dam), and a proposed mine in Arizona, US.

BHP’s total copper production decreased by 3% to 365,500t during the December quarter, with full year production is trending towards the low end of the guidance range (1.59Mt to 1.76Mt) for the 2022 financial year.

Oz has three operations – two in Australia and one in Chile – plus a handful of near-term developments or expansions.

In FY21, the company met its copper guidance for the seventh year, producing 125,486t for record revenue of $2.1 billion. It ended the year with $215m in the bank.

FY22 guidance is between 127,000t and 149,000t copper at higher all-in sustaining costs of 135 to 155 US cents per pound.

Earlier this month Sandfire officially became the owner of MATSA copper complex in Spain, capping its transition from an Australian mid-tier to a global producer of the red metal.

The 100,000tpa operation, which includes a 4.7Mtpa central processing facility surrounded by three underground mines, will become the cornerstone of Sandfire’s business over the next decade – and potentially more.

While it has an initial mine life of 12 years based on known reserves and resources which can be converted, Sandfire boss Karl Simich has been open in his belief additional resources around the MATSA project could establish a mine life of 20 years or more.

The closure of the $2.6 billion deal comes as the company’s flagship DeGrussa mine in WA enters its final nine months as an economic mine barring a major new discovery.

“Our vision for Sandfire is to become an international diversified and sustainable mining company, and the completion of this transaction represents a major step closer to realising this aspiration,” Simich said at the time.

“With the acquisition of MATSA, Sandfire immediately becomes one of the largest copper-focused producers on the ASX, with high-quality operations in Spain and Australia and an impressive growth pipeline and exploration portfolio that we believe will continue to drive our growth for many years to come.”

Sandfire also owns the Motheo copper-silver project in Botswana, where first production is due next year.

It’s safe to say the $3b market cap company is on track to reach its long-term 2027-2030 target of becoming a 300,000tpa global mid-tier.

This dual listed (ASX-TSX) $850m market cap producer is up almost 100% over the past year.

The flagship asset is the 75%-owned Copper Mountain mine in British Columbia, which currently produces ~45,000t of copper equivalent per year – with average annual production expected to increase to approximately 63,500 tonnes of copper equivalent.

It is also advancing its development-stage Eva copper project in Queensland, which is expected to add over 45,000t of copper production per year.

In December a feasibility study update highlighted the project’s after-tax net present value (NPV) of $622 million – that’s a 42% increase compared to the May 2020 feasibility study which the company said was mostly due to higher metal prices.

Total initial development capital is estimated to be ~A$836 million.

Detailed engineering is currently underway, a final investment decision is expected this year, and commissioning is flagged for late 2024.

Late last year the company picked up the ‘Eloise’ copper mine for ~$25m in cash and shares – and made the move from explorer to miner.

Eloise is a high-grade operating underground mine in North Queensland which has produced 339,000t of copper and 167,000oz of gold since production kicked off in 1996.

December quarter production totalled 8,597dmt of concentrate containing 2,392t of copper at an AISC of A$3.05/lb and AIC of A$3.29/lb for November and December 2021.

This meant an immediate strong cashflow for the company, with sales of 1,818t copper, 945oz gold and 19,654oz silver generating net revenue of $25 million.

And the company’s exploration strategy to extend known resource areas, discover new satellite lodes and extend the mine life beyond five years is paying off – with AIC reporting a 58% increase in contained copper and 55% increase in gold in the quarter.

The updated mineral resource now totals 4.4 million tonnes grading 2.3% copper and 0.7g/t gold containing 103,500 tonnes of copper and 93,300 ounces of gold.

The AIC share price is up almost 100% since this time last year. It ended the December quarter with $29.3 million in cash.

The Tritton copper mine in the Cobar Basin produced almost 23,000 tonnes in FY21, giving Aeris exposure to record prices for the base metal.

Shareholders have also piled into the stock on the back of the high-grade ‘Constellation’ discovery 45km away, where drilling has struck ripper intersections like 61.6m at 5.12% copper and 12.5m at 11.14% Cu.

It also has exposure to Helix Resources’ (ASX:HLX) emerging discovery at ‘Canbelego’, also in the Cobar.

FY22 production is expected to be lower at between 18,500t and 19,500t.

The company is kicking off the first of three “life extension” projects this year at a cost of $50m, which it hopes will extend mine life to the back end of the decade.

These include the Budgerygar deposit – an extension of the Tritton underground mine – the Avoca Tank underground mine, and Murrawombie Pit cut-back.

Earlier this month the small Queensland copper producer nabbed a $21 million prepayment facility and offtake deal with Glencore.

From the second half of 2022, Glencore will take 40,000t of copper cathode from Austral’s Anthill mine, covering the project’s initial 10,000tpa, four-year life.

Not bad considering mining only kicked off on the January 7.

Austral CEO Steve Tambanis said the deal would shield Austral’s finances over the ramp up phase and enable the company to accelerate exploration activities.

“Together with this offtake agreement, a A$21m prepayment facility enables us to accelerate our planned exploration programme and importantly, provides a solid financial buffer for Anthill’s start-up phase over the next five months,” he said.

“Glencore underwent a lengthy due diligence process to assess our production capabilities and is pleased with the high quality of Austral’s copper cathode.

“Going forward, there is potential to review other copper development opportunities in the region.”

The new miner says the recently acquired Mt Carlton operation is already outperforming forecasts.

The Queensland project produced 14,603oz of gold, 100,781oz of silver and 610t of copper during the December quarter.

If NML sustains this for FY22 it places Mt Carlton’s performance above the top end of the vendor’s forecast in August 2021.

The small copper-gold mine developer is now +300% year-to-date.

The company has been plugging away at the 51% owned ‘Al Wash-hi–Majaza’ copper-gold project in Oman for well over a decade and now production is in sight – with first concentrates scheduled for late 2022/early 2023.

Early mining has now kicked off, comprising pre-stripping of waste from the first stage of the open pit.

Pre-stripping will continue through the first quarter of calendar 2022, with ore mining projected to begin during the June 2022 quarter.

This work is being undertaken by 35% owned primary contractor Alara Resources LLC – which inked a preliminary 10-year, $167.83m deal to provide mining services to the project.

A revised DFS envisaged a smallish open pit operation producing 35,000tpa concentrate a year for ~80,000t copper and 21,800oz gold over 10 years. It will cost about US$60m to build.

At a $US9,500/t copper price, project EBITDA is ~$US370m, AUQ says.

Boasting resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 232,000 tonnes of cobalt, Kalkaroo is one of the “largest undeveloped open pit copper deposits in Australia”, the company says.

The mine would cost $332m to build and produce 30,000t copper and 72,000oz gold every year over an initial 13-year period.

Havilah wants to start mining a low cost open pit gold mine from 2022 before moving into the main copper orebody later on – but this may change if a financier with deep pockets decides to bankroll the whole shebang.

The company expects to secure final approvals from the SA Department for Energy and Mining early this year for the West Kalkaroo open pit mining operation to kick off during 2022 – subject to a final investment decision by the Havilah Board.

KGL’s main game is the 426,200 tonne (and growing) Jervois copper project in NT, where the plan is to produce 30,000 tonnes of copper per year, plus silver and gold.

A final feasibility study is underway with completion targeted for the March Quarter.

An updated resource estimate for the Rockface deposit is expected in Q1 and will complete the resource updates planned to be included in the FS – which include new resources at Bellbird and Reward.

The updated total resource will be used to refine the mine plan and to estimate the Jervois Ore Reserve.

The $198m market cap company is also drilling to extend mine life to a minimum 10 years.

The company is aiming to produce first copper from its Prieska copper-zinc and Okiep copper projects in South Africa within the next two years.

In its December quarterly, MD and CEO Errol Smart said the company is moving to capitalise on current positive market conditions.

“With copper prices close to record highs and demand set to outstrip production for the foreseeable future, the timing is perfect for Orion,” he said.

“We have fast-tracked our assessment of an early production strategy for the Prieska Copper-Zinc Project based on moving the open pit development to the start of the mine plan.”

Advanced feasibility studies for the Flat Mines at the Okiep project are due for completion by June 2022.

An initial 12-year operation at Prieska is targeting 22,000 tonnes of copper and 70,000 tonnes of zinc per year.

The company is aiming to produce first ore in 2022 from its mothballed Kanmantoo mine in SA.

The underground economic assessment from the December quarter has detailed strong project economics for Stage 1 of the project, including:

A solid profit margin at current prices.

It helps that existing infrastructure has been maintained, enabling a fast restart, with first copper sales expected within 7 months of a final investment decision.

It contributes to the low capital costs of only A$26 million, which makes the Kanmantoo Underground one of the lowest capital intensity projects in the world – at just US$1,550 per tonne of annual copper produced.

The $34m market cap company’s main game is the ‘Whim Creek’ copper-gold-PGE project in the Pilbara, where a scoping study predicts ~11,000tpa copper production (Cueq) over an initial 5-7 years for free cash flow (profits) of ~$196m.

It would cost about $52m to build. A DFS is due to be released in H2 and, if that goes well, a final investment decision is pencilled in for Q3 – with produced slated for mid-2023.

ANX already has $US20m in debt funding locked in from global miner Anglo American, subject to the results of the DFS.