Up, Up, Down, Down: Which commodities won and lost in January?

Mining

We take a look at the major commodities and what moved them, including winning and losing metals in the month of January.

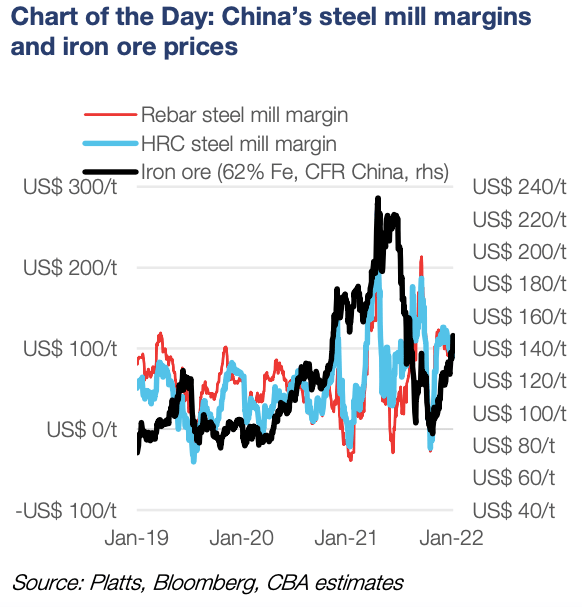

Price: US$141.75/t

%: +18.6%

Iron ore prices are a relatively simple formula of supply v demand complicated by things like grade, product specifications, storms, speculative buying, tailings dams collapses, geopolitical conflicts, trade wars and pandemics.

Analysts have largely tipped iron ore to struggle in 2022 after the wind came out of the Chinese economy last year.

But a few things have thrown the cat among the pigeons.

Brazilian supplies were hit by mass floods, WA’s globally dominant Pilbara iron industry could soon be facing a Omicron wave and China has loosened the belt, allowing struggling investors and businesses to gorge on lower interest rates to stimulate infrastructure and property spending.

This has all come despite muted steel production numbers in China, that are yet to really rebound from the lows of late last year after overall numbers dropped from a record 1.065Bt in 2020 to 1.03Bt in 2021.

Expect activity to be quiet after China shut its doors for the Lunar New Year this week, but apparatchiks in the Communist stronghold have already expressed their discomfort with rising prices, suggesting efforts to suppress them may on on the horizon.

The Pilbara iron ore miners remain in solid profit-making territory at these prices given their minuscule cost base, but BHP, Rio Tinto and Fortescue are all facing uncertainties from the start of the Omicron Covid wave in WA and continued struggles to access labour.

Lower grade producers like FMG and Mineral Resources (ASX:MIN) have seen big gaps emerge between the benchmark Platts index and their realised prices, but FMG’s Elizabeth Gaines sees those as temporary due to more low grade product from majors like Rio Tinto hitting the market and high-grade suppliers like Brazil’s Vale struggling.

On the mid-tier front Canadian iron ore miner Champion Iron (ASX:CIA) is on the cusp of a major expansion at its Bloom Lake iron ore complex in Quebec from 7.4Mtpa to 15mtpa.

Michael O’Keeffe’s iron ore miner is impeccably placed to capture the uptick in interest in high grade iron ores driven by action on climate change from steel makers and short-term factors favouring premiums for quality products.

It produces a 66.2% plus magnetite concentrate, but has lab studies under way to make a product that’s as much as 69% pure.

Champion produced over 2Mt of concentrate in the December quarter, generating EBITDA of C$122.1m on revenues of C$253m despite lower prices thanks to its premium.

Grange Resources (ASX:GRR) is another high grade pick, which owns the Savage River mine in Tasmania.

It was the rare miner which saw its realised prices increase from US$153.09/t ($206.80/t) in the September quarter to US$164.14/t ($226.71/t) in the December quarter. If the current price holds those should be even higher in March.

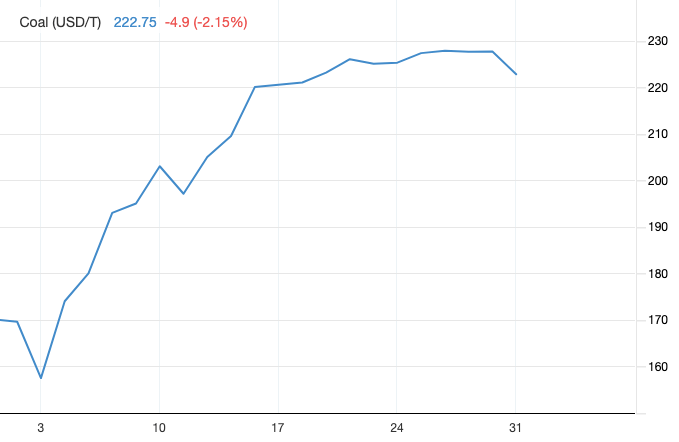

Price: US$222.75/t

%: +31.7%

Indonesia’s ban on thermal coal at the start of January, impacting ~40% of the seaborne trade put a rocket under prices with at least one Australian cargo reported to have been sold for US$300/t.

Official Newcastle coal prices are near last year’s records (US$269/t), which were driven by a sudden energy shortage in the northern hemisphere and an inconceivable number of supply shocks.

Australian met coal for steelmaking also hit record highs numerous times this month amid continued supply shortages, trading at US$442.92/t on January 28.

That’s up from US$355.89/t on December 31.

BHP (ASX:BHP), one of the world’s largest coking coal suppliers, reduced its guidance from 70-78Mt to 68-72Mt for FY22 because of heavy rainfall and Covid absenteeism in the December quarter.

Whitehaven Coal (ASX:WHC) has been forced to knock down guidance by 1Mt for FY22 after Covid and wet weather hit its east coast mines.

But its leadership remain bullish about the prospects for coal prices throughout 2022 and are mulling dividends after paying off hundreds of millions of dollars in debt in recent months.

Stanmore Coal (ASX:SMR) is on track to complete the ambitious US$1.2 billion purchase of BHP’s share in the BMC coking coal business in Queensland.

The deal, announced in November, comes in at almost six times Stanmore’s $300 million market cap, and will require a heady mix of debt and equity to clear in the first half of 2022.

The US$625 million debt package is all sewn up, leaving Stanmore with only the US$600 million equity component, half underwritten by its largest shareholder, the Indonesian owned Golden Energy and Resources to raise the funding for the big buy.

Among the junior miners Allegiance Coal (ASX:AHQ) is continuing its ramp up of the Black Warrior and New Elk mines in the USA, with carbonisation tests showing its Black Warrior Mary Lee Blue Creek seams have the required CSR to qualify as hard coking coal.

That means they should soon be able to lock in premium US high vol A prices, equivalent to US$388/t, with a trial shipment upcoming to a European steel mill.

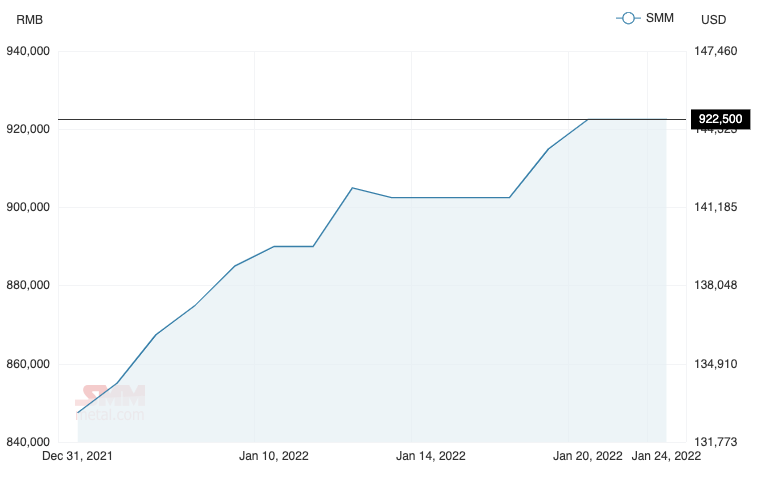

Price: US$57,770/t

%: +32.43

Lithium prices sat in rarefied last year as a sudden supply shortage and rocketing electric vehicle demand sent prices soaring three times over.

EV sales doubled across the world in 2021, with demand only set to rise as countries enforce plans to phase out sales of new internal combustion engine cars.

New records were set on a virtually daily basis for lithium carbonate chemicals and spodumene, the concentrate made by Australian producers.

They are seeing prices rise exponentially at the moment, with spodumene fetching US$2,500-2,750/t on the spot market on January 21 according to Fastmarkets, up US$100-150 on a week earlier and 476% higher than the US$450-460/t being paid just 12 months ago.

Pilbara Minerals MD Ken Brinsden said converters are willing to pay “just about anything” to get their hands on spodumene right now, as Pilbara Minerals booked record quarterly cash flow.

Price monitor Platts has seen lithium carbonate changing hands in the past week for as much as 386,000RMB/t, the equivalent of US$60,600/t.

Brinsden said that sort of price was a marker of what the market was willing to pay at the moment, not just a rare “spot sale”.

“What it means is if a chemical converter is receiving US$60,000 or over US$60,000/t for their battery grade carbonate … they have approximately US$50,000 left to spend on their raw materials of which spodumene is obviously a major component,” Brinsden said.

“The chemical conversion industry can afford to pay a lot more for spodumene and my view is they likely will.”

PLS shipped 78,679dmt in the December quarter, banking $115.5 million in operating cash flow in the three months to December 31 and boosting its bank balance up from $137.3m to $245m.

But it has faced delays to major projects and shutdowns from labour shortages caused by WA’s hard border and could reduce guidance for a second time after doing so in December.

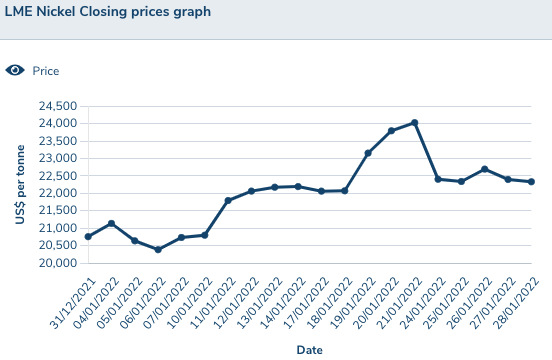

Price: US$22,800/t

%: +9%

Nickel prices charged to 11-year highs of US$24,000/t last week as LME stocks dipped below the psychologically important 100,000t mark before pulling back after Tsingshan announced its first successful shipment of nickel matte from its laterite operations in Indonesia.

The matte product can reportedly be supplied for battery nickel, something that can’t be said of Indonesia’s main export nickel pig iron.

Whether that floods the market for battery grade nickel is unclear and, in the long run, unlikely. Prices are expected from most market watchers to fall back to around the US$20,000/t mark this year as supply increases from Indonesia and Russia (sanctions and war notwithstanding).

Experts say at least 2Mt of nickel will be needed by 2030 to cover a shortfall made up of rising demand from both the battery and stainless steel markets.

Nickel sulphide producers, currently converted downstream into battery material, will likely face issues scaling up, meaning it will be all hands to the pump to find the supply needed to avoid a price shock and potential substitution.

It’s all about the delicate circle dancing going on between billionaire Andrew Forrest and IGO (ASX:IGO) over the fate of nickel miner Western Areas (ASX:WSA).

Forrest just beat BHP to buy Canadian nickel explorer Noront Resources, and his Wyloo Metals brand is becoming a major corporate raider.

Wyloo has a 9.14% stake in WSA after paying more than $31 million on market to buy WSA stock above the $3.36 a share price IGO has offered in its $1.1 billion cash deal.

Like with BHP and Noront, Forrest could block or force IGO into a bidding war. Desperate for longer life nickel assets after ditching its gold portfolio in 2021 to become a battery metals purist, that’s not where Peter Bradford and Co. — who reckon they’ve offered full price for their target — want to be.

Price: US$150.13/kg

%: +12.35%

Rare earths continue to rise on the back of demand from downstream industries in China and elsewhere.

Most of the market is concentrated in China where the critical minerals are used in applications like permanent magnets and wind turbines.

Prices of the benchmark rare earths product, neodymium-praseodymium oxide, soared across 2021 and have continued their upwards march into 2022.

Lynas Rare Earths (ASX:LYC) has resorted to chartering its own vessels to prevent shipping delays from hindering its ability to capitalise on record NdPr prices.

Prices are in and around levels not seen since the first rare earths boom of 2011.

The company is currently awaiting its key approval to formally begin construction on a $500 million cracking and leaching plant in Kalgoorlie-Boulder, around 400km south of its Mt Weld mine after receiving a recommendation from the WA EPA that the project should go ahead.

Lynas made $202.7m in sales in the December quarter (up from $121.6m in the September term) as prices in China hit US$105.90/kg with customers saying security of supply was more important than price.

It produced 4209t of rare earths oxide and 1359t of NdPr in the December quarter, up from 3166t and 1255t respectively in the September quarter, with $674.2m of cash in the bank as of December 31.

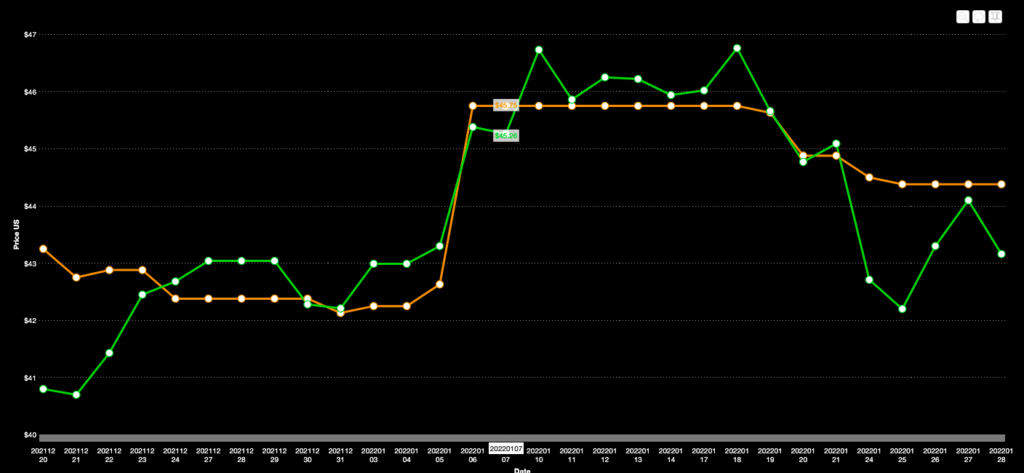

Price: US$43.45/lb

%: +2.2%

Uranium has failed to fire the way it did in 2021 … yet. The market was electrified in August last year when the Sprott Physical Uranium Trust was launched, causing a frenzy of buying of stocks on the lightly traded spot uranium market.

That sent prices for the long-suffering commodity flying to nine year highs above US$50/lb before pulling back to normality, but with an expected shortfall on the horizon yellowcake miners and explorers will be looking back wistfully on the halcyon days of 2007 when prices spiked by US$100/lb in 12 months to record levels.

The spot market has failed to fire so far in 2022 but civil disturbances in Kazakhstan and a continued absence of new supply into a market expected to need an influx of new material from 2024 is giving future participants hope.

Uranium stocks rode the wave of exuberance last year to overshoot the commodity price, but there is growing confidence in the industry there is something more tangible supporting a positive market outlook in 2022.

Plenty of investors understand Energy Resources of Australia (ASX:ERA), owner of the Ranger uranium mine, is a uranium stock.

Whether they understand the sole purpose of the listed Rio Tinto subsidiary is to rehabilitate the remote NT mine with little prospects of ever reopening the operations is unclear.

The $1.18b capped ERA is up 45% over the past 12 months, despite warning of cost overruns and delays on the rehab project. It is down ~8.5% for the month and is expected out of a trading halt tomorrow to potentially reveal the damage from those overruns.

In the small cap realm Okapi Resources (ASX:OKR) rose sharply this week after snapping up 55,000 hectares of ground in the world class Athabasca uranium district of Canada following several months of due diligence.

Athabasca contains some of the largest, highest grade uranium deposits in the world.

OKR’s projects are along the margin of the Athabasca Basin or in the so-called Carswell Impact Structure where depth to the unconformity is relatively shallow (typically close to 100 metres) — making them ideal for targeting shallow high-grade uranium deposits.

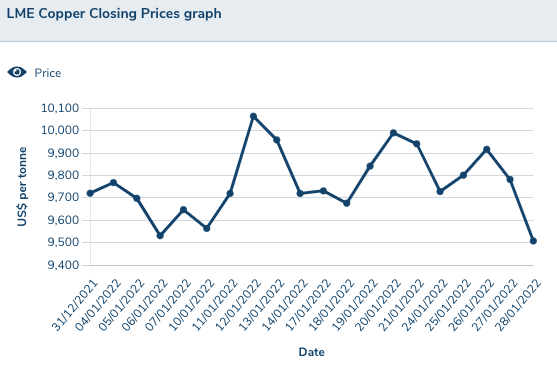

Price: US$9620/t

%: -0.75%

Copper scaled incredible heights in 2021, hitting an all time high of US$10,724.50/t on May 10 with supplies on the LME sagging to their lowest level since the Cruyff turn was invented in 1974.

Supply issues briefly sent the red metal rising above US$10,000/t earlier this month, before it settled back down.

Goldman Sachs reckons copper will hit a record US$12,000/t over the next month. They’re uncomfortably bullish, but other more mild mannered analysts are at least revising their forecasts up.

Along with the whole spiel about electrification, renewables and EV driving “green demand” for the metal, there are some major headwinds facing the supply side of the commodity, despite expectations supply will rise significantly this year.

Resource nationalism in Chile and Peru – suppliers of 40% of the copper market – is the big one. A new mining royalty bill in Chile will levy a 1% sales tax on miners 200,000tpa and under with 1-3% depending on LME prices for miners above that rate.

“Countries around the world are demanding more of miners in terms of revenues that goes beyond Chile and Peru, ranging all the ways from Asia to Central America to Africa. All of these things add into supply constraints at a time when the world needs more copper,” he said.

Sandfire Resources (ASX:SFR) was due to tie the knot last night with its new MATSA operations in Spain.

The one time penny stock and owner of the DeGrussa copper-gold mine in WA is spreading its wings and leaving the nest by making the 100,000tpa complex near the original Rio Tinto mine in Spain’s Huelva region its own.

Sandfire is paying a pretty dowry to Trafigura and Abu Dhabi sovereign wealth fund Mubadala Investments of US$1.865 billion ($2.6b) for the privilege.

SFR MD and CEO Karl Simich, who flew over last week to pick up the keys, told Stockhead last month the deal will make Sandfire a global copper force, setting the company towards its long term 2027-2030 target of becoming a 300,000tpa global mid-tier.

At the small end of the market Cosmo Metals (ASX:CMO) listed this week, aiming for a similar rags to riches success story at its Mt Venn copper-nickel sulphide project in WA’s Goldfields.

It was up 10% or 2c to 22c in its first two days since the spin out of the assets from Great Boulder Resources (ASX:GBR), which retains a 49.5% stake. Cosmo is just a few km west of the Gruyere gold mine, discovered by a team of geos led by Cosmo NED and former Gold Road Resources explorer Ziggy Lubieniecki.

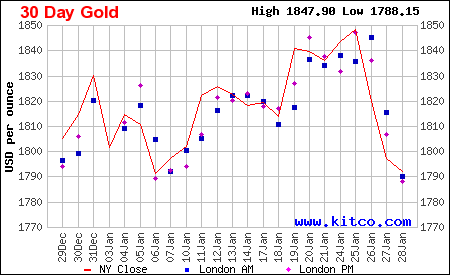

Price: US$1799/oz

%:-0.4%

Gold threatened US$1850/oz only a week ago but settled back into the funk it’s wallowed in since hitting all time highs of US$2038/oz in August 2020.

Exchange rates mean Australian gold producers are still raking in around $2500/oz for their product right now, but inflation is bringing challenges for a number of producers trying to get investors onside.

Evolution Mining (ASX:EVN) boss Jake Klein, who chairs Australia’s third largest gold miner, reckons we should be more constructive.

“The gold price is over $2500/oz. I did reflect on the fact that when I started in the industry it was $300/oz, so if we’re not happy at $2500/oz we need to find another sector to operate in,” he said.

The biggest issue for gold is rate rises, with US Fed chair Jerome Powell indicating it is now virtually certain to lift interest rates in March, a move that is generally bad for gold demand.

Three to four rate rises could occur this year to rein in runaway inflation.

Newcrest Mining (ASX:NCM) says it will hit guidance despite a tough start to the year which has seen its production fall well shy of 2021 levels to date.

Australia’s largest gold miner was hit for 6.4% by shareholders on Friday after delivering 436,000oz of gold at AISC of US$1127/oz, a margin of US$588 on every ounce sold.

Newcrest is, like many gold producers, promising a second half rush to meet guidance after increasing its production rate from 396,214oz in the September quarter.

The company expects to produce 1.8-2Moz gold and 125-130,000t of copper in FY22, having delivered just 832,298oz of gold and 50,945t of copper in the first half against 1.04Moz and 69,320t at the same period in FY21.

It is closing in on a US$2.8 billion deal to buy Canada’s Pretivm Resources and its Brucejack mine in British Columbia, but beware the North American frontier.

Many Australian gold miners are still in reno mode in Canada and the US with Northern Star’s (ASX:NST) Pogo, Evolution’s Red Lake and St Barbara’s (ASX:SBM) Atlantic Gold Operations all requiring a little TLC from management at the moment.

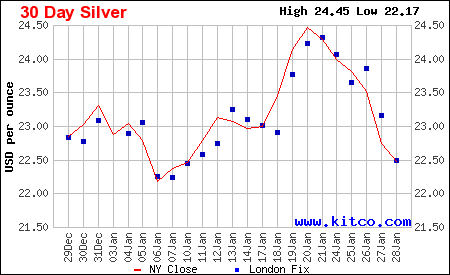

Price: US$22.40/oz

%: -3%

Another “store of wealth” asset in the doldrums, silver has pretty much followed gold’s trajectory this month.

It has a bright future as an industrial metal given it is essential in the production of solar panels, but the commodity is yet to be decoupled from its shinier cousin.

South32 (ASX:S32) has bumped up guidance at its Cannington mine in North-West Queensland, the world’s largest silver operation, after strong underground performance through the first half of the year.

Cannington delivered 6.71Moz of silver through December 31, 12% more than the same period in FY2021, 32,700t of zinc and 60,200t of lead.

The diversified mining giant expects to deliver 12.3Moz of silver, 117,900t of lead and 66,700t of zinc in FY22, 5% more than previous guidance.

At the junior end, Thomson Resources (ASX:TMZ) says it is moving towards resource estimates at its Mt Gunyan and Twin Hills silver-gold deposits, part of the New England Fold Belt hub and spoke strategy in New South Wales after combing through thousands of metres of historic drilling data.

The deposits are located within the Texas silver project, which historically produced 4.2Moz of the precious metal.

Tin

Price: US$42550/t

%: +7.35%

Zinc

Price: US$3675/t

%: +1.24%

Cobalt

Price: $US70,715/t

%: +0.74%

Aluminium

Price: $3076/t

%:+9.62%

Lead

Price: $2289/t

%:-1.73%

At Stockhead, we tell it like it is. While Cosmo Metals, Allegiance Coal, Thomson Resources and Okapi Resources are Stockhead advertisers, they did not sponsor this article.