Chinese iron ore exports earn Aussies a record $12.7bn in May as China investigates the spot market

Pic: Schroptschop / E+ via Getty Images

Australia absolutely raked it in at China’s literal expense in May, posting a new record in iron ore receipts on the back of never before seen prices.

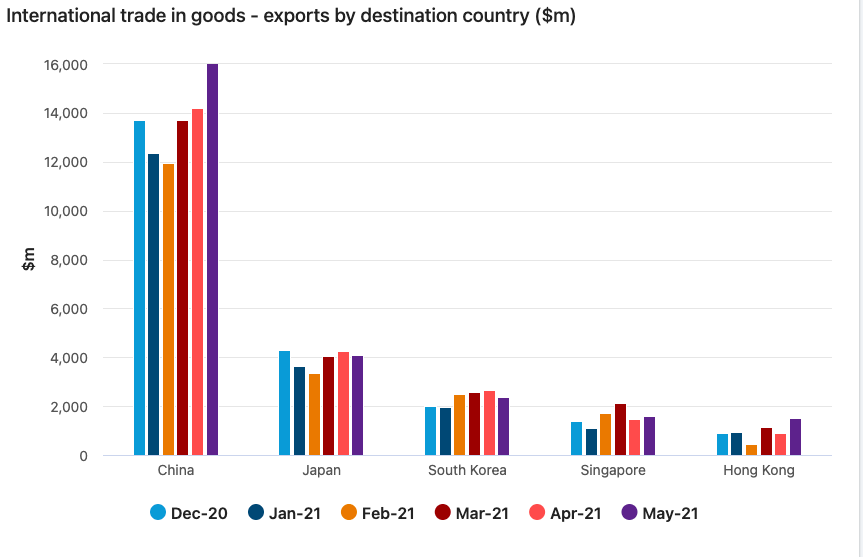

The value of Australia’s iron ore exports to China have soared to a record $12.7 billion in May according to data from the Australian Bureau of Statistics.

It was expected, with a nine per cent increase in prices to a new monthly average record of US$207/t, and an increase in export volumes of 9% drove a $2.1b month on month rise, a roughly 20% increase.

Meat was another strong sector that, despite the ongoing diplomatic tensions between the countries which have hit Australian coal, seafood and wine exports, saw a 28% jump with another $57m flowing from our biggest trading partner.

Metalliferous ores, a category largely comprising iron ore, was responsible for $7.4bn of the $10bn (34%) increase in May exports year on year, an incredible 63% rise on exports from 12 months earlier at the height of the pandemic.

Exports of metalliferous ores to all countries raked in a cool $19.04bn, with iron ore sales outside China also increasing by around half a billion bucks, the third record high in a row.

It all drove Australia to a preliminary record monthly trade surplus of $13.3bn, on an 11% overall rise in exports to an also record high of $39.2bn.

The price did climb above $US230/t by the middle of the month before dropping below $US190/t just days after China announced plans to crack down on speculation it claimed was putting a rocket under prices.

Clearly China’s attempts to smash down iron ore prices have not gone as planned, with the country’s economic regulator, the National Development and Reform Commission, announcing a new iron ore spot market probe on Monday.

It had little immediate impact, with prices dropping briefly before climbing around 6% overnight to return to levels above US$210/t on Tuesday.

Analysts divided over iron ore prices

UBS caused a stir with bearish long term price view seeing it downgrade Rio Tinto (ASX: RIO) to a sell this week.

Around the grounds, other analysts have taken a more positive view on the market, through 2021 at the very least.

RBC Capital Markets has maintained its US$150/t 62% fines price estimate for the current quarter, though with just a week left in the month it seems unlikely.

Analyst Kaan Peker noted Chinese steel profit margins dropped below breakeven for the first time since March 1 last week, however exports from the five biggest miners Rio, BHP, Vale, FMG and Roy Hill dropped below 20Mt for the second week in a row.

JP Morgan this week upgraded its 2021 forecast to US$180/t, falling to US$150/t in 2022.

However, with the majors largely focused on sustaining projects and Brazil’s Vale slow to recover from temporary mine closures, the investment bank predicts supply-demand dynamics will remain tight until the planned development of the Simandou mine in Guinea in 2026.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.