China’s recovery ‘underestimated’ as iron ore imports continue at record levels

China's iron ore imports are a lot stronger than forecasters give the Asian powerhouse credit for. Pic: Getty Images.

China continues to prove the market commentators wrong on the iron ore front, with the Asian heavyweight’s imports still hitting record levels.

In the past three months China’s iron ore imports have climbed 20 per cent year on year, while year-to-date they are up 11 per cent compared to the previous year.

August imports were the third highest on record.

Questioning why #ironore prices so strong? Don't!

Chinese s.a. imports 3rd highest on record Aug (previous record Jun & Jul).

In last 3m, Chinese imports +20%yy.

YTD imports +11% vs yr ago.

Chinese imports = 100% combined Australia/ Brazil exports over last 3m

Need I go on? pic.twitter.com/m910N2ZsZv— Robert Rennie (@Robert__Rennie) September 7, 2020

Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, told Stockhead in May that “a lot of analysts are not bullish on iron ore” and that they’d “underestimated the recovery in China”.

And it was only in late August that Le Page pointed out market forecasters had started playing catch-up.

Mark Eames, non-executive director of emerging South Australian iron ore producer Magnetite Mines (ASX:MGT), agrees, saying market observers had missed the mark on both the demand and supply front.

“We’ve been talking about the same theme for the last 18 months, which is that observers have tended to be quite pessimistic about China’s prospects in iron ore,” he told Stockhead.

“A lot of people were forecasting that iron ore prices were going to fall from where they were 18 months ago, and in fact they’ve almost doubled.”

Eames said demand had risen from around 800 million tonnes up until mid-2017 to about 900 million tonnes in 2018 before hitting close to a billion tonnes last year.

“If you translate that, that extra 200 million tonnes of steel production requires effectively another 300 million tonnes of iron ore,” he said.

“So it was pretty clear from the steel production trend that there was going to be a major increase in iron ore demand.

“In fact, for July and August the imports have been running at an annualised rate of about 1.3 billion tonnes.”

This continued increase in demand is occurring amid declining shipments from major iron ore producer Brazil, which has been hard hit by the COVID-19 pandemic, as well as reduced production from the Australian majors.

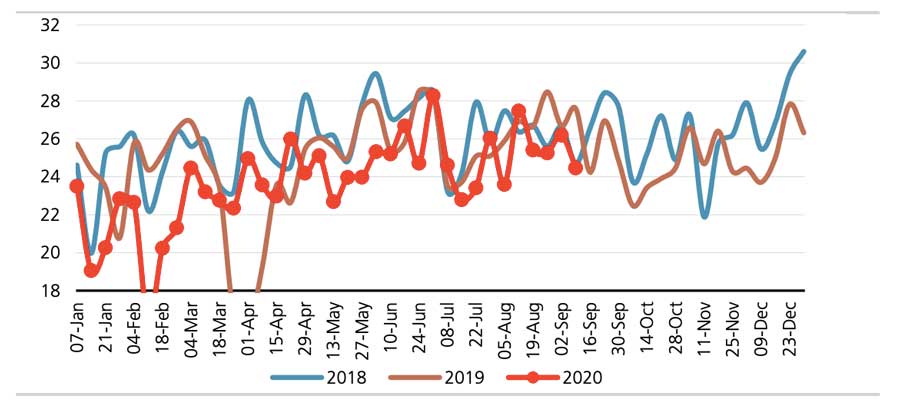

UBS’ tracking of iron ore shipments from key producers in Australia, Brazil and South Africa showed that over the week to September 6, total shipments had fallen 7 per cent week on week to 24.5 million tonnes.

The slide was due to a sharp 16 per cent week-on-week fall in shipments out of Brazil, and Australian shipments remaining broadly flat.

And over the last month a number of Chinese steel producers have restarted blast furnaces (BFs) that were “hot-idled” (temporarily halted when steel demand contracted) due to COVID-19.

“We expect producers to announce further restarts of BFs over the next few months due to operating issues caused by extended outages,” UBS said.

“We estimate in total ~22 BFs are being restarted around the world or ~30 per cent of the total idled. In our opinion, this is not a surprise given the time-constraints of hot idling and as demand is picking up.”

Le Page expects iron ore prices to remain above $US100 ($139) a tonne for “some time to come”.

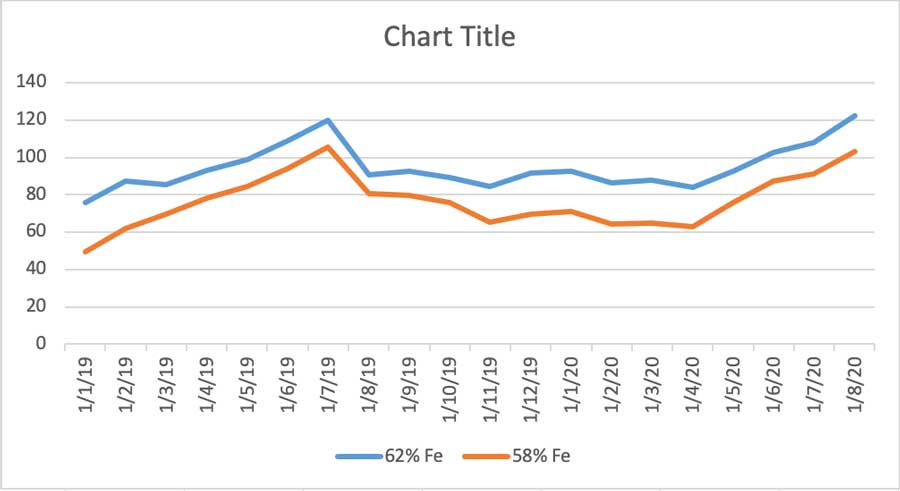

Iron ore is priced on three grades: 58 per cent (low grade), 62 per cent (benchmark) and 65 per cent (premium grade). The higher the grade the more it sells for.

According to S&P Global Platts, the August average for 62 per cent and 58 per cent iron ore was $US122.53 and $US103.07 respectively. That’s a 46 per cent and 64 per cent increase, respectively, over the average prices in April this year.

“Most observers were saying that China steel production would collapse … it’s actually gone up dramatically,” Magnetite Mines’ Eames said.

“It’s gone up by 26 per cent year to date on five years ago, and then when we look at iron ore supply from Fortescue, Rio and BHP, their iron ore production on the numbers for 2015, so five years ago, is up only 4.6 per cent.

“So essentially when you take into account grade changes and everything else, production of iron units is essentially where it was five years ago from those three players.”

High-grade players few and far between

There are very few juniors that can produce high-grade direct shipping ore (DSO), but there are a handful getting much closer to production.

DSO refers to minerals that require only minimal processing such as crushing before they are exported, which keeps costs low.

Already in production, Mt Gibson Iron (ASX:MGX) ships DSO from its Koolan Island operation and lower grade iron ore from its Mid-West operations in Western Australia.

The company recently reported a positive first year of high-grade production and sales from the restarted Koolan Island operation.

In FY20, the company shipped a total of 4.9 million wet tonnes, which included 2.3 million wet tonnes of Koolan Island high-grade fines. This pushed net profit before tax up 70 per cent to $121.1m.

Mt Gibson received an average iron ore price for FY20 of $84 per wet tonne, up from $73 a tonne in FY19.

Fenix Resources (ASX:FEX), meanwhile, is one of the players nearing production.

The company recently signed a marketing agent for 50 per cent of its high-grade iron ore from the Iron Ridge project in Western Australia, and this week gave the project the green light.

Fenix’s goal is to produce a high-grade product approaching 65 per cent iron content from the mine, which hosts a total resource of 10.5 million tonnes at 64.2 per cent and a reserve of 7.8 million tonnes at 63.9 per cent.

The company is aiming to make its first shipment in early 2021.

Strike Resources (ASX:SRK) is another ASX-listed junior that is well advanced down the path to production, having recently received the key mining lease for its Paulsens East DSO project.

The company is close to releasing a feasibility study.

“We expect iron ore prices to remain high for quite some time, due to expected increasing Chinese demand (driven by government stimulus) and likely continued supply constraints from Brazil,” managing director William Johnson told Stockhead.

“Strike is ideally placed to take advantage of this current environment, with our Paulsens East direct shipping ore (DSO) project being located close to existing infrastructure and having just received the grant of our mining lease for the project.

“With travel and other COVID related restrictions effectively putting our South American projects on ice for the time being, having a high-grade iron ore project located here in the Pilbara in this current environment has presented us with a fantastic opportunity.

“We have held this project for many years and now is the perfect time to bring it into production.”

Magnetite building market share

While high-grade iron ore is still very much in hot demand, the declining tonnes coming out of Australia’s iron ore rich Pilbara and from Brazil is seeing Chinese steelmakers increasingly blend low and high-grade ores or pivoting to processed ores like magnetite.

“Higher grade has been supported by supply tightness out of Brazil but mills have been blending it with lower grade FMG material,” Paul Bartholomew, head of metals news & insight, Asia-Pacific for S&P Global Platts, told Stockhead.

“A shortage of key products like Pilbara blend has been supporting 62 per cent prices and very strong steel production.”

This is where magnetite has found its place in the market. Magnetite deposits are large and quite low grade – but produce very high-grade products.

It is actually not that hard to upgrade magnetite to a higher-grade material using magnetic separation – basically you just grind the material and place it under a big magnet that captures the magnetite in a concentrate. And these deposits usually have a very long life.

About a third of the world’s steel is made from processed or magnetite-rich ores and globally there’s a bunch of big successful mines that have been producing for years.

Magnetite Mines is advancing the nearly 4-billion-tonne Razorback magnetite mine in South Australia – where iron ore has been mined longer than any other Aussie state.

Razorback has the potential to produce the highest grade of any iron ore operation in Australia as well as globally, according to the company.

Lab tests have shown Magnetite Mines can produce grades of nearly 70 per cent.

“We have a vision for developing high-grade products out of Australia, out of South Australia in particular, and unlocking the potential of the Braemar,” Eames said.

“As the Pilbara deposits reach exhaustion and resources are limited there, we think that South Australia is going to be the next place in Australia we need to develop if we’re going to maintain our exports.”

At Stockhead, we tell it like it is. While Strike Resources and Magnetite Mines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.