Busting the myth that magnetite can’t be profitable

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: Australia has an abundance of iron ore resources, but not all iron ore is created equal and there is a common misconception among investors that they should steer clear of magnetite plays. But in actual fact magnetite can be very profitable for a company.

When you mention iron ore, most people think about the BHP’s and Rio Tinto’s of the world that produce the direct shipping stuff and have made billions doing it. But that’s just one avenue to a profitable iron ore business.

There are two main types of iron ores – haematite and magnetite. Haematite is higher grade in the ground, while magnetite deposits are large and quite low grade – but produce very high-grade products.

But it is actually not that hard to upgrade magnetite to a higher-grade material using magnetic separation – basically you just grind the material and place it under a big magnet that captures the magnetite in a concentrate. And these deposits usually have a very long life.

While a magnetite project is a bit more costly than haematite because of the need for processing, a project with the right ingredients — soft rock, cheap power, access to infrastructure and a plentiful water supply — can be a big money-maker for a company.

Magnetite is actually in demand

About a third of the world’s steel is made from processed or magnetite-rich ores and globally there’s a bunch of big successful mines that have been producing for years.

China, US, Brazil, Canada and Sweden have been producing concentrate for years. Examples include Anglo American’s Minas Rio mine, which has a nearly 50-year mine life, Rio Tinto’s Canadian operations and Québec Cartier Mining Company’s mines, which now form part of the operations of the world’s biggest steel producer, ArcelorMittal, along with Champion Iron which is listed in Australia.

In Australia, the Savage River operation has been operating for over 50 years and the Whyalla blast furnace in South Australia runs on locally produced magnetite.

Mark Eames, director of ASX-listed Magnetite Mines (ASX:MGT), told Stockhead most of the US producers run magnetite operations.

“Places in Europe and Russia also run on magnetite. And, in fact, nearly all of the domestic mines in China, which produce quite a lot of iron ore, are magnetite also. Magnetite worldwide is well understood.”

And there is still plenty of demand for iron ore, with steel production in China actually still growing, not going backwards as some commentators have predicted.

“If you go back three or four years a lot of people were talking about peak steel in China and that China was going to go backwards,” Eames said.

“But in fact, it did exactly the opposite. China in the last three years has increased its steel production by 20 per cent.”

Last year, China notched an all-time record, producing nearly 1 billion tonnes of crudes steel.

“China’s steel market is booming,” Eames said. “It’s actually kept going pretty steadily through the coronavirus outbreak, interestingly enough, and as a result iron ore prices have stayed quite high.”

Eames is pretty knowledgeable when it comes to iron ore, having worked for heavyweights like BHP, Rio Tinto and Glencore.

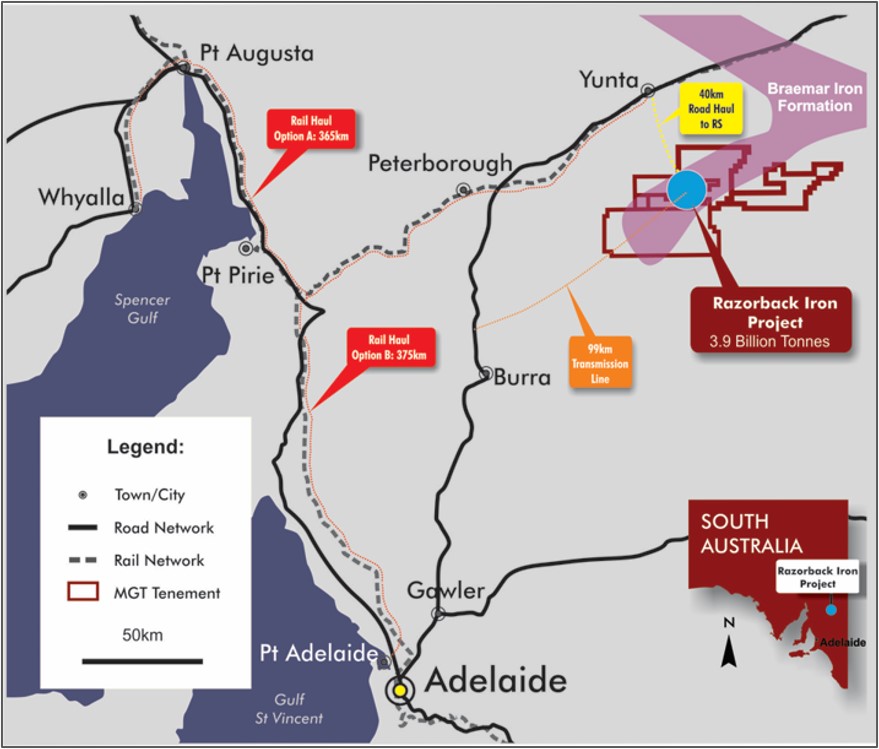

He became a strategic advisor to Magnetite Mines about a year ago to help the company advance the nearly 4-billion-tonne Razorback project in South Australia – where iron ore has been mined longer than any other Aussie state – and has recently joined the board of the company.

Razorback is what Magnetite Mines dubs a “globally unique opportunity” and that’s because it has the potential to produce the highest grade of any iron ore operation in Australia as well as globally.

Lab tests undertaken by Magnetite Mines has delivered grades of nearly 70 per cent.

“To put that into context, most of the ores out of Western Australia, there’s only one ore type or one product which is above 62 per cent which is the standard grade in iron ore,” Eames explained.

“This would be for Australia one of the highest grades sold and, in fact, it would be one of the highest grades of any project in the marketplace.

“Carajas, which is the big Brazilian operation run by Vale, produces at about 65 per cent and so we’re a premium again above that.”

65 per cent is premium-grade product and a product not even Aussie heavyweights BHP and Rio produce.

The right stuff

While there is plenty of iron ore in countries like Africa, there is also plenty of sovereign risk and endless red tape.

However, Australia also has an abundance of iron ore and the industry is a major contributor to the economy — meaning a whole lot less red tape for miners to get caught up in.

“We’ve got a large resource in a low sovereign risk jurisdiction,” Eames noted.

“There’s plenty of iron ore resources in places like Africa that are very large but very difficult to develop, and we know that bringing on mines in South Australia in iron ore is relatively quick.”

The “globally significant” 4-billion-tonne Razorback mine also has all the right ingredients to make it a lower cost development project than other mines. The resource is at surface, so stripping ratios are low.

Eames says Magnetite Mines’ Razorback has some distinct advantages over other magnetite mines, particularly those in Western Australia which tend to be harder rock.

“The rocks [at Razorback] are soft. They’re actually a different geological era than the traditional banded iron formations in Western Australia,” he said.

“They’re much softer rocks and use much less energy to grind.”

And grid-generated electricity (coal-fired and renewables) is much cheaper on the east coast than the west coast.

Razorback also has the advantage of being located close to rail, port and power infrastructure and has access to enough water to sustain a wet processing operation.

What also gives Magnetite Mines a leg up in developing a potentially very lucrative magnetite mine is CSIRO-developed tech that makes it much simpler to sort the low-grade from the high-grade stuff. The company has exclusivity over this technology for Australia.

“Instead of having to feed everything, grind it down, put it in a concentrator, use lots of water and power, what we plan to do instead is use this ore sorter,” Eames explained.

“As soon as we mine the material, we put it across the ore sorter, and it will save all of the expensive concentration cost by effectively giving us a higher head grade for the concentrator.

“So it actually compensates for one of our disadvantages, which is relatively low grade.”

Marching towards production, plenty of upside

Magnetite Mines has already completed a low-cost scoping study that has returned some pretty promising numbers. The focus was on a low capital, staged development and the results of the study confirmed this approach.

The next step is to complete a pre-feasibility study (PFS).

To partially fund that, Magnetite Mines is undertaking a very attractively priced 5-for-4 rights issue to raise up to $1.2m.

Shareholders have the opportunity to top up their holdings by buying more shares at 0.001c per share – a 75 per cent discount to the March 20 closing price of 0.4c.

Shareholders who don’t want to take up their rights also have the option to sell them instead.

“When completed, and assuming full subscription, we will commence a pre-feasibility study of the small-scale, low-capital start-up option for the Razorback iron project which was successfully identified in the second half of 2019,” chairman Peter Schubert said.

Key focus areas of the PFS will be testing high value resource targets, selective mining studies, recovery optimisation through metallurgical test work studies and further trials of NextOre Pty Ltd’s magnetic resonance ore sorting solution.

This story was developed in collaboration with Magnetite Mines, a Stockhead advertiser at the time of publishing. This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.