CHART: Here’s why it’s ‘difficult to remain bullish’ on gold

Pic: Sarah Stier via Getty Images

Gold turned heads on Monday when a flash crash sent prices slumping below US$1,700/oz.

While Asian traders responded to the strong US jobs report on Friday night, the selloff was likely exacerbated by thin liquidity with both Singapore and Japan on holidays, CBA analyst Vivek Dhar said.

But the broader underlying catalyst — strength in the US economy — is one of the core reasons why it’s “difficult to remain bullish on gold”, Dhar said in a note this week.

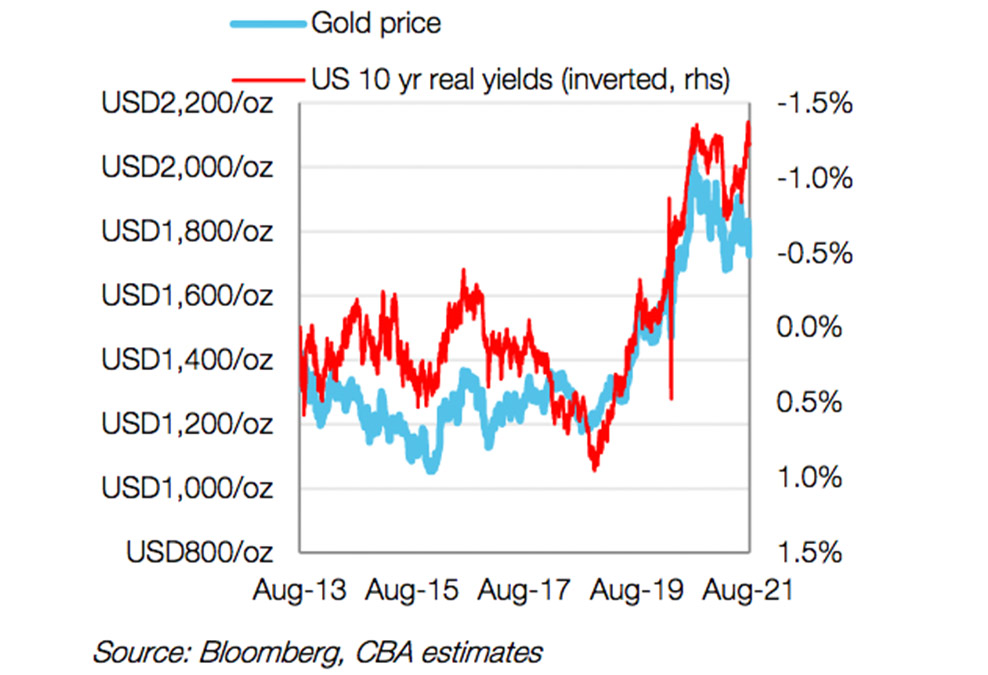

Gold and 10-year yields

In previous research, Dhar has flagged the direction of real 10-year US bond yields as a consistent gauge for the direction of gold prices.

Real yields are defined as the nominal rate of interest — typically on benchmark US 10-year bonds — adjusted for the expected rate of inflation.

This chart shows how gold prices have consistently tracked inversely to real 10-year yields since 2013:

Real yields

As the US economy strengthens, Dhar said the Federal Reserve is beginning to take a “more hawkish outlook” to monetary policy.

CBA doesn’t expect US rates to rise until 2023, but the first item on the Fed’s agenda relates to a potential taper of its asset purchase program.

“A final decision to taper asset purchases would likely keep a lid on gold prices for the foreseeable future,” Dhar said.

CBA expects the taper decision to come as soon as the Fed’s September meeting (or November/December at the latest).

So, where are real yields going from here?

US inflation has become a central topic of debate through the middle of the year, as annualised gains rose above 5%.

Inflation data overnight showed annual CPI rose by more than 5% again, although monthly core inflation rose by just 0.3%, missing analysts expectation.

Nominal bond yields eased back and the US dollar weakened, both of which helped gold climb back above US$1,750/oz.

But if the Fed shifts to a slightly more hawkish lean while the US economy strengthens, the market is now “lowering the implied risk of a breakout of inflation in the US”, Dhar said.

“That reduces the likelihood of US 10-year inflation expectations moving meaningfully higher.”

At the same time, CBA said the Fed’s tapering program and 2023 rate-rise forecasts will underpin a steady move higher in nominal 10-year bond yields.

“We expect US 10-year nominal yields to lift to 1.55% by the end of 2021, before rising to 1.75% by the end of 2022,” Dhar said.

With the combination of higher nominal yields and lower inflation expectations, the result is higher real yields and some extra strength in the US dollar.

In that environment, CBA expects gold to fall back below US$1,700/oz by the start of next year.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.