The key driver for 2021 gold prices, in one chart

Pic: Tyler Stableford / Stone via Getty Images

For a key driver of 2021 gold prices, look for clues in the bond market, CBA says.

So far in 2020, the gold price rally has helped support some huge returns for ASX small cap explorers that’ve confirmed big discoveries.

And since USD gold prices hit new all-time highs above $US2,000/oz in August, the macro conversation has centred around whether it can remain elevated at that level.

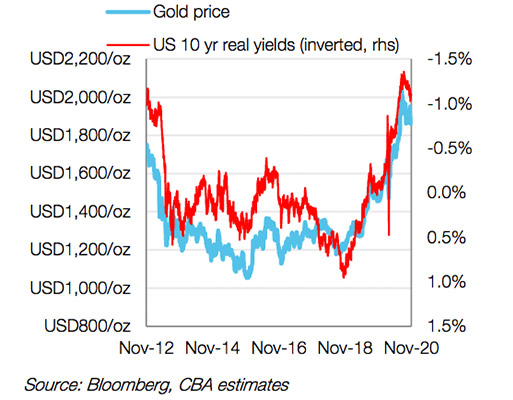

For clues about 2021 prices, CBA commodity strategist Vivek Dhar looked at the 2020 relationship between gold and US 10-year government bonds.

Correlation doesn’t necessarily equal causation. But Dhar noted the ‘real’ yield on US 10-year government bonds “helps explain much of the movement in gold prices this year”.

By real yields, Dhar is referring to the following equation: the nominal rate of interest on 10-year debt, less the expected rate of inflation over the same time period.

With central banks holding the fort in the wake of COVID-19, actual nominal yields have been anchored at historically low levels.

Long term inflation expectations have been slightly higher, which in turn sent real yields negative.

And as this chart from Dhar shows, “the peak in spot gold prices coincided with a bottoming in US 10-year real yields”.

Gold price outlook

Historically, gold prices and real 10-year yields have demonstrated a strong inverse correlation

And sure enough, as real yields began to rise over the last three months the gold price eased back from its highs.

Obviously, the value of the USD itself is also a central factor, and weakness in the greenback through the middle of the year contributed to the August highs for gold.

However, the negative correlation between gold and the USD isn’t as strong as the pairing with real yields.

Looking ahead, Dhar says the outlook for gold prices will be primarily determined by the speed and effectiveness of vaccine rollouts in the new yewar.

“That’s mainly because US 10-year nominal yields will react positively to a successful vaccine,” he said.

If the vaccine rollout is quick and successful, that will weigh on gold prices.

But logistical challenges abound when it comes to mass production and distribution.

As a result, Dhar said it could be “well into 2021” before the global economy will see a material vaccine-based rebound.

And a struggling economy is good for gold because if policymakers are true to form, weaker economic growth = more stimulus.

In addition, US fiscal support is now likely to face a holdup until Joe Biden assumes the presidency on January 20.

That means more monetary support – the primary driver of negative yields – may be required.

“Monetary policy support hinges on a US fiscal package either proving inadequate or too late – both are tangible risks at the moment,” Dhar said.

Weighing it all up, gold investors will have to assess whether a successful vaccine rollout will remove or decrease the need for more stimulus.

For its part, the CBA doesn’t expect gold to climb back above its August peaks.

The bank’s medium-term forecast is for prices to hold steady at $US1,970/oz through September 2022.

However, “the recent pullback in the precious metal raises downside risks to our outlook”, Dhar said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.