Call for US infrastructure spending could drive iron ore demand

The US steel sector has called for infrastructure investment Pic: Getty Images

As the COVID-19 pandemic continues to spread in the US, five major steel industry groups have urged Congress to include infrastructure investment to alleviate the anticipated slow down in the manufacturing and construction sectors.

The five groups said in a letter that while the recent $US2 trillion ($3.3 trillion) stimulus package addressed the immediate crisis, a forward-looking, robustly funded and long-term infrastructure package will create a path forward for jobs and growth.

They noted that 38 per cent of America’s 616,000 bridges were in need of either replacement or rehabilitation.

“With such a staggering backlog of substandard bridges, there is significant opportunity to put Americans back to work and back on the road to economic recovery,” they noted.

The letter added that improving infrastructure would not only put more people back to work, it would drive commerce and supplies across the US by including Buy America provisions and using domestically produced and fabricated steel.

And there might be some support for that forthcoming.

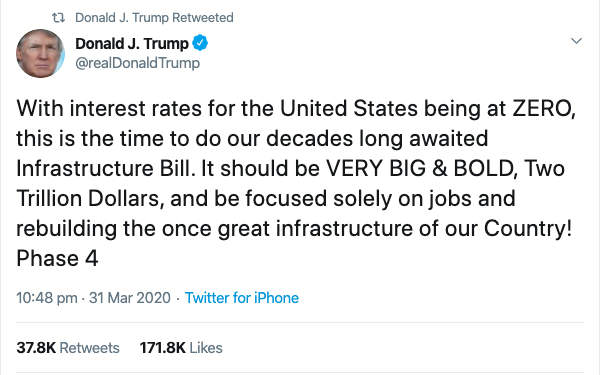

In one of his (in)famous tweets, US President Donald Trump voiced his support for up to $2 trillion in infrastructure spending.

Magnetite Mines (ASX:MGT) director Mark Eames told Stockhead that infrastructure spending was responsible for driving steel demand.

“More than half of steel demand globally is used in construction of buildings and infrastructure. Roads, bridges, tunnels and pipelines all require lots of steel – wherever you see a concrete structure, it is the steel inside that provides the tensile strength,” he explained.

“And incremental steel demand will mainly come from blast furnace iron and steel as recycling levels of scrap steel collection doesn’t change quickly.”

Eames added that a stimulus would only help the industry as steel production had proven to be remarkably resilient to impacts from the COVID-19 pandemic with global production rising 2.8 per cent year on year in February.

Highlighting the value of the iron and steel industry to the US economy, research has indicated that it accounted for more than $520bn in economic output and nearly 2 million jobs in 2017.

“These workers earned over $130bn in wages and benefits, while the industry generated $56bn in federal, state and local taxes,” the five major steel industry groups added.

Investing in infrastructure also boosts overall economic activity and employment, with Eames saying that there have been suggestions that it can deliver economy-wide productivity growth, which is linked to improved employment and wages outcomes.

“So investment in infrastructure can have flow on effects across the whole economy, acting as a platform for firms to invest in growth and jobs,” he added.

Eames also noted that while the US had its own steel and iron ore producers that would benefit in the short-term from an infrastructure stimulus, increased steel demand would mean more imports from international producers, which would benefit Australia.

“Australia supplies well over half the world’s iron ore and is best placed to respond to demand increases,” he said.

“And in the medium-term, an economic stimulus in the US means stronger global growth and demand, which will benefits Australia as the worlds’ largest iron ore exporter.”

Australian Small Caps

While there aren’t as many iron ore juniors as compared to their gold counterparts, those that do exist could collectively benefit more from any infrastructure stimulus by the US, China or both countries.

Magnetite is in the midst of raising up to $1.2m through a rights issue that will be followed by a pre-feasibility study into a small-scale, low capital cost option for its Razorback iron project.

Razorback is a 3.9 billion tonne resource about 240km northeast of Adelaide and just 40km to a 375km rail haul to port.

BCI Minerals (ASX:BCI) recently sold the Buckland project to Mineral Resources (ASX:MIN) and also agreed to share in the cost of extending the mine life of their Iron Valley project by rebating 40 per cent of its net royalties back to Minres.

Meanwhile, Fenix Resources (ASX:FEX) is on the cusp of building a 1.25-million-tonne-per-annum iron ore project.

Fenix says the Iron Ridge project will cost about $11.9m to build – almost half of which will be deferred until the first shipment is made – for average annual earnings before tax of $16.4m.

Strike Resources (ASX:SRK) is also closing in on potential early cash flow at its Paulsens East project in the Pilbara.

At Stockhead, we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.