Bulk Buys: How long will Australia dine out on its iron ore and coal banquet?

Pic: Getty

- Iron ore and coal to drive $425 billion windfall for resources exports in 2021-22 according to Canberra forecasters

- India removes tariffs on Aussie coal exports as part of free trade deal

- Coal prices start to normalise (kinda), with premium hard coking coal off 6.8% to a still very high US$461.62/t on Monday

Iron ore and coal will be the biggest contributors to a bonanza resources windfall of $425 billion in 2021-22, and prices could support large export earnings for a while yet.

While treasury forecasters were understandably nervous last week to be anything less than bearish on future iron ore prices, there are plenty of tidbits in the Office of the Chief Economist’s Resources and Energy Quarterly this week to think the outlook on bulk commodities is actually pretty optimistic in Canberra.

Iron ore is expected to deliver export receipts of US$135 billion in 2021-22 (down from a record US$153b in 2020-21).

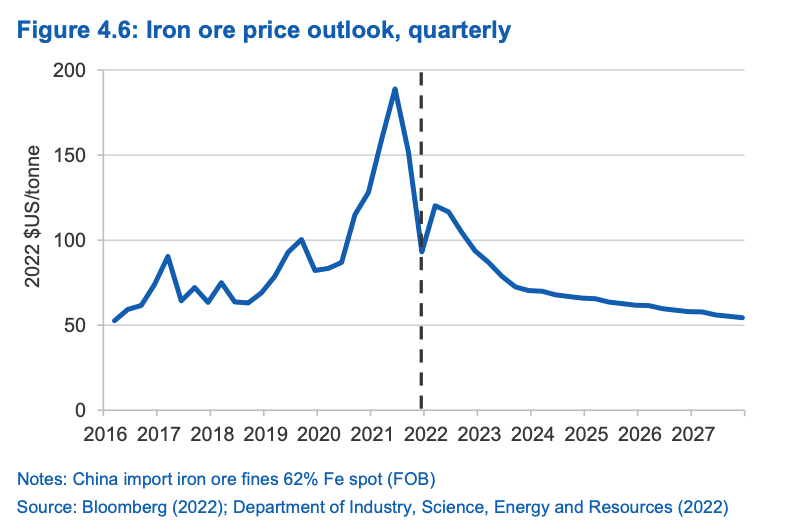

Prices are expected to average US$109/t in 2021-22, but they’ve just risen above US$160/t after averaging US$141/t so far through the second half of the financial year.

Prices are also forecast to fall sharply to US$79/t in 2023 and keep sliding to US$63/t in 2027, prompting iron ore earnings to fall to $105b in 2022-23 and $74b by 2027.

That sounds pretty ordinary, especially for small miners. But there are some unlikely assumptions in there as well.

Iron ore output is forecast to rise from 906Mt in 2020-2021 (872Mt of exports) to 941Mt in 2021-22 and onwards at a CAGR of 3% to 1.08Bt by 2026-27.

The year on year increase in exports in 2022 would be 5% to 919Mt despite a slow start to the year from most of the majors.

In real life iron ore production from the major exporters Australia and Brazil has stagnated in recent times, while the analysts from the Department of Industry, Science, Energy and Resources are also possibly bullish on new sources of iron ore like West Africa.

Iron ore prices exposed to supply shocks, Chinese demand

At the same time, the Resources and Energy Quarterly has optimistic notes for Chinese stimulus later this year.

“China is expected to engage in more expansionary fiscal and monetary policies this year, following a relatively tight stance through 2021. This is expected to bolster steel and iron ore demand in 2022,” forecasters wrote.

In other words, prices could end up much higher than typically risk averse Canberra forecasters are willing to punt on.

Supply shocks are also possible, with Australian producers impacted by labour shortages and delays bringing replacement capacity to market like Rio Tinto’s (ASX:RIO) Gudai Darri mine, and the potential impact of restrictions on steel exports and high grade iron ore from Ukraine and Russia.

“Combined exports for both countries in 2021 were estimated to be around 70 million tonnes (equivalent to around one month’s export volumes for Australia), with major export destinations including China, the EU and Asia,” they said.

“With Russia and Ukraine also accounting for a significant share of global steel supply, increased exports from other major steel producers to fill this shortfall could further boost global iron ore demand in coming months.”

Canberra sees prices fading over the outlook to 2027 due to lower demand as the world transitions to a low emissions environment and as supply grows from Australia, Brazil and Africa.

That may underplay the role steel production will play in a world transitioning away from fossil fuels, a lack of alternative commercial technologies to blast furnace steelmaking and the difficulties iron ore miners have had ramping up supply.

Iron ore market expert Mark Eames, technical director of ASX-listed miner Magnetite Mines (ASX:MGT), is one observer who thinks the supply growth outlook is less apparent than some analysts believe.

“The ability of the supply side of the industry to respond, I think is very limited,” he said.

“We’re starting to see more interest on the smaller side, we’re seeing some of the smaller producers start to get back into the marketplace, but that’s really not significantly changing the overall supply-demand balance.”

Citi’s lead metal and mining analyst Paul McTaggart expressed a similar view at the Global Iron Ore and Steel Forecast Conference in Perth last week, saying the iron ore industry needs to add 100Mt every year just to replace mines that are running out of reserves.

Analysts from the Department of Industry, Science, Energy and Resources think China’s steel production will flatline, but remain above 1Btpa (a level it has only hit in 2020 and 2021) until 2027, with ex-China growth leading world crude steel production above 2Bt for the first time in 2023 and up to 2.097Bt in 2027, a CAGR of 1.2%.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.06 | 11% | 7% | 9% | -33% | $ 27,961,636.98 |

| ADY | Admiralty Resources. | 0.018 | 0% | -10% | 20% | -22% | $ 19,553,687.30 |

| AKO | Akora Resources | 0.355 | 0% | -4% | 78% | -30% | $ 18,295,506.63 |

| BCK | Brockman Mining Ltd | 0.049 | 17% | 2% | 11% | 48% | $ 399,006,981.63 |

| BHP | BHP Group Limited | 51.95 | 2% | 4% | 41% | 14% | $ 265,569,474,547.40 |

| CIA | Champion Iron Ltd | 8.01 | 8% | 17% | 78% | 42% | $ 4,163,891,720.56 |

| CZR | CZR Resources Ltd | 0.008 | 0% | 14% | 0% | -20% | $ 24,404,262.94 |

| DRE | Dreadnought Resources Ltd | 0.048 | 20% | 20% | 26% | 153% | $ 139,095,494.00 |

| EFE | Eastern Resources | 0.06 | 22% | 22% | 76% | 484% | $ 62,351,635.88 |

| CUF | Cufe Ltd | 0.034 | -3% | -3% | -21% | -15% | $ 32,167,820.41 |

| FEX | Fenix Resources Ltd | 0.28 | 8% | 19% | 33% | 19% | $ 144,539,897.60 |

| FMG | Fortescue Metals Grp | 21.72 | 12% | 13% | 51% | 7% | $ 66,813,538,720.60 |

| FMS | Flinders Mines Ltd | 0.515 | -1% | 10% | -36% | -60% | $ 84,424,288.50 |

| GEN | Genmin | 0.19 | 0% | 0% | -5% | -27% | $ 56,457,570.00 |

| GRR | Grange Resources. | 1.24 | 15% | 12% | 181% | 195% | $ 1,348,299,583.17 |

| GWR | GWR Group Ltd | 0.1775 | 15% | 13% | 31% | -29% | $ 53,000,748.08 |

| HAV | Havilah Resources | 0.195 | 3% | 8% | 3% | -3% | $ 58,863,283.83 |

| HAW | Hawthorn Resources | 0.093 | 27% | 1% | 60% | 86% | $ 31,016,952.01 |

| HIO | Hawsons Iron Ltd | 0.325 | 67% | 76% | 301% | 819% | $ 235,967,473.50 |

| IRD | Iron Road Ltd | 0.1825 | -1% | 1% | 4% | -27% | $ 151,376,835.34 |

| JNO | Juno | 0.1 | 0% | -9% | -33% | 0% | $ 13,565,800.10 |

| LCY | Legacy Iron Ore | 0.02 | 0% | 0% | 43% | 33% | $ 128,136,523.98 |

| MAG | Magmatic Resrce Ltd | 0.081 | 0% | -33% | -19% | -33% | $ 21,376,891.03 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 26% | 1867% | $ 112,672,163.12 |

| MGT | Magnetite Mines | 0.033 | 0% | 0% | 38% | -31% | $ 104,271,647.07 |

| MGU | Magnum Mining & Exp | 0.078 | 5% | -4% | 24% | -26% | $ 37,284,011.70 |

| MGX | Mount Gibson Iron | 0.635 | 0% | 20% | 41% | -21% | $ 750,552,180.46 |

| MIN | Mineral Resources. | 59.67 | 21% | 25% | 39% | 54% | $ 10,662,482,913.06 |

| MIO | Macarthur Minerals | 0.56 | 3% | 40% | 33% | 10% | $ 77,249,348.64 |

| PFE | Panteraminerals | 0.17 | 3% | -6% | -48% | 0% | $ 9,090,000.00 |

| PLG | Pearlgullironlimited | 0.07 | -3% | -4% | -59% | 0% | $ 3,843,161.56 |

| RHI | Red Hill Iron | 3.6 | 4% | 2% | 24% | 1036% | $ 226,589,928.95 |

| RIO | Rio Tinto Limited | 120.24 | 1% | -5% | 23% | 7% | $ 44,790,948,381.24 |

| RLC | Reedy Lagoon Corp. | 0.036 | 20% | 44% | 50% | 64% | $ 20,837,574.74 |

| SHH | Shree Minerals Ltd | 0.016 | 0% | -6% | 60% | 23% | $ 19,555,790.27 |

| SRK | Strike Resources | 0.155 | 15% | 19% | 35% | -23% | $ 43,200,000.00 |

| SRN | Surefire Rescs NL | 0.017 | 42% | 31% | 26% | -37% | $ 21,468,915.27 |

| TI1 | Tombador Iron | 0.039 | -3% | -11% | 0% | -43% | $ 45,835,963.86 |

| TLM | Talisman Mining | 0.175 | 0% | 3% | 9% | 52% | $ 31,915,714.49 |

| VMS | Venture Minerals | 0.065 | 55% | 67% | 33% | 8% | $ 118,566,989.03 |

| EQN | Equinoxresources | 0.22 | 26% | 10% | 0% | 0% | $ 9,000,000.20 |

Trade deal a drop in the ocean for coal sector

Coal miners stood as potential winners from a new free trade agreement signed this week between India and Australia, which will remove India’s 2.5% tariff on coking coal imports from Australia.

Coking coal exports to India were a $12b boon for the land down under in 2021, accounting for 32% of Australia’s coking coal shipments.

India is largely dependent on imports for its coal and is aiming to dramatically ramp up its steelmaking capabilities in the years to come.

While it wants to be self-sufficient, reducing its import dependence from 85% to 65% by 2030, Commbank analyst Vivek Dhar says India probably lacks the quality of coal to achieve that.

At the same time, Australian companies are unlikely to be in a position to lift their coal exports to match India’s steelmaking targets, which will lift its coal import demand from 68Mt to 90Mt at the same time as Australia’s exports of met coal rise from 179Mt to just 185Mt by 2027.

“Australia just won’t be in a position to supply India the additional coking coal tonnes it requires for its growing steel production fleet because supply growth will be limited,” Dhar said in his analysis.

“The only real opportunity is for the composition of Australia’s coking coal imports to shift so that India claims a higher share. However, with the redistribution of Australia’s coking coal exports largely complete following China’s unofficial ban on Australian coal, it’s hard to see this happening any time soon.

“And now given that South Korea, Japan and Europe are looking to diversify away from Russia (~10% of global coking coal exports), it’s even harder to build the case that demand for Australian coking coal will weaken from a major buyer in the foreseeable future.”

Coking coal prices dip below US$500/t as poor sentiment hits Aussie cargos

Prices for Australian premium hard coking coal, which was fetching up to US$670/t in the aftermath of Russia’s invasion of Ukraine, has been retreating fast in recent weeks.

PHCC is the kind of product produced by majors like BHP (ASX:BHP) and Anglo American in Queensland which is highly prized for its quality in steelmaking.

But bids have come off cargos since the peak of the post-invasion supply squeeze, with Fastmarkets reporting a US$33.92/t or 6.8% fall in FOB Dalrymple Bay Coal Terminal prices to US$461.62/t on Monday.

Thermal coal prices have also subsided, with Newcastle Coal prices falling back to the US$260/t territory having climbed to around ~US$440/t around three weeks ago.

Coal miners have been running in place on the bourse over the last week, with prices trending down and little news to report.

Whitehaven Coal (ASX:WHC) was the beneficiary of a growing trend of government approvals to extend the life of coal operations after the Independent Planning Commission recommended the New South Wales Government approve the extension of its Narrabri underground mine in New South Wales from 2031 to 2044.

The decision, which was criticised by some environmental groups, Greens and independent MPs and local farmers, came a little over two weeks after the Federal Court overturned a 2021 ruling that Federal Environment Minister Sussan Ley should have taken the blame for harm caused to young people by climate change caused by the approval of Whitehaven’s Vickery coal mine.

Bowen Coking Coal (ASX:BCB) also received state environmental approval for its Isaac River mine in Queensland’s Bowen Basin last week.

The 8.7Mt mine is expected to produce 400,000t to 600,000t of coal annually over a four to five year period with a total coal yield of 81% split between 49% primary coking coal and 32% PCI coal.

“The EA approval is a major milestone for the project and is now on its way to becoming another one of Bowen’s new mines,” BCB managing director Gerhard Redelinghuys said.

“The project requires only a modest capital investment as it is planned to leverage off existing third-party infrastructure. Isaac River will contribute additional high quality metallurgical coal to the Company’s sales mix, complementing the Bluff and Broadmeadow East/Burton projects which are on track for near term exports.”

Platts low vol coking coal was fetching US$539/t FOB when the approval was announced with PCI paying US$495/t, though prices have contracted since. The mining lease application and federal environmental approval are expected in the third quarter.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.015 | 15% | 15% | 36% | 7% | $ 21,538,483.65 |

| CKA | Cokal Ltd | 0.185 | 3% | 19% | 23% | 168% | $ 173,705,561.30 |

| NCZ | New Century Resource | 2.19 | 11% | 6% | -6% | -6% | $ 281,630,032.95 |

| BCB | Bowen Coal Limited | 0.29 | 9% | 4% | 71% | 350% | $ 456,067,485.60 |

| LNY | Laneway Res Ltd | 0.0055 | -8% | -4% | 28% | 15% | $ 33,614,711.54 |

| GRX | Greenx Metals Ltd | 0.19 | -3% | -14% | -30% | -7% | $ 48,187,888.16 |

| AKM | Aspire Mining Ltd | 0.09 | -5% | 6% | 7% | -5% | $ 43,656,780.71 |

| PAK | Pacific American Hld | 0.017 | 6% | 13% | -15% | -21% | $ 7,646,038.43 |

| AHQ | Allegiance Coal Ltd | 0.49 | -2% | -5% | -28% | 14% | $ 187,113,667.20 |

| YAL | Yancoal Aust Ltd | 4.6 | -3% | -6% | 30% | 108% | $ 6,245,678,537.01 |

| NHC | New Hope Corporation | 3.47 | -1% | 22% | 42% | 151% | $ 2,879,955,503.72 |

| TIG | Tigers Realm Coal | 0.017 | 13% | 55% | -26% | 127% | $ 222,133,940.26 |

| SMR | Stanmore Resources | 1.555 | -15% | 36% | 79% | 128% | $ 1,442,210,716.80 |

| WHC | Whitehaven Coal | 4.16 | -6% | 4% | 23% | 143% | $ 4,316,452,889.76 |

| BRL | Bathurst Res Ltd. | 1 | -1% | 2% | 16% | 144% | $ 170,951,623.00 |

| CRN | Coronado Global Res | 2 | -7% | 9% | 39% | 133% | $ 3,386,436,534.60 |

| JAL | Jameson Resources | 0.082 | 3% | 12% | 3% | -14% | $ 28,552,671.58 |

| TER | Terracom Ltd | 0.47 | -1% | 12% | 185% | 488% | $ 350,427,547.95 |

| ATU | Atrum Coal Ltd | 0.016 | 23% | -26% | -70% | -69% | $ 8,987,788.37 |

| MCM | Mc Mining Ltd | 0.115 | 5% | 15% | -8% | -12% | $ 17,758,248.83 |

Government forecasts outline path ahead for coal

In last week’s budget the ultra-conservative Treasury predicted prices for met coal would fall from US$512/t to US$130/t by September with thermal dropping from US$312/t to US$60/t.

Any upside to that for even an extra six months would result in massive increases in tax receipts for the Government. If iron ore prices hold at recent levels US$134/t (FOB) as well, it could pull an extra $30 billion over the next three years.

With that in mind the government has not taken long to weaponise record resources exports as an election tool, with Coalition Resources Minister Keith Pitt taking aim at an imaginary Labor and Greens alliance that threatens to hurt the resources sector as he announced the massive 2021-22 forecast on Monday.

The Resources and Energy Quarterly is probably more measured than the budget forecasts (which tend to plan for the worst).

The Office of the Chief Economist expects contract met coal prices to average US$319/t in 2022, delivering a record windfall of $65.33 billion, before dropping to US$170/t in 2023, US$157/t in 2024, US$154/t in 2025, US$152/t in 2026 and US$150/t in 2027.

That gets lower in real terms once inflation is taken into account, but would still deliver strong earnings for most met coal producers. Department analysts expect production to rise from 171Mt in 2020-21 to 185Mt in 2021-22 and remain relatively stable, hitting 190Mt by 2026-27 to power an almost $30b export haul.

Thermal coal production is expected to average US$184/t on spot this year and US$145/t on contract before sliding to US$75/t progressively by 2027.

From a high of $45.14b this year for thermal coal, making the coal sector a $110b cash cow for the Aussie economy at current elevated prices, its earnings are expected to tumble to $17.39b despite consistent output.

At Stockhead, we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.