Ground Breakers: Despite China’s Covid wave, earnings upside remains for iron ore miners

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

- Macquarie continues to see earnings upside for iron ore miners at elevated spot prices

- Steel production and demand should catch up later in the year to help China hit 5.5% GDP growth target

- South32 sees delays to Mozambique aluminium smelter deal

There’s plenty of people who have an interest in Australia’s iron ore earnings remaining buoyant.

Not least the Aussie Government, whose ability to spend larger despite the cautionary winds of inflation is largely due to higher than expected resources earnings against Treasury’s ultra-conservative commodity price forecasts.

They may have got a fright recently when a spate of Covid lockdowns struck China for the first time in two years.

Treasury plans for prices to dip from current levels of US$134/t FOB to US$55/t by the end of September. But there’s major upside if prices remain higher for longer, adding over $132 billion in nominal GDP to FY25 if that crash doesn’t happen until March next year.

Prices remained in the US$145/t territory (CFR China) last week despite Covid cases leading to steel mill closures in Hebei province and logistics disruptions.

And Macquarie thinks upside is there for steel prices, positive for iron ore, with the expectation demand will need to pick up later this year to achieve China’s aims of growing its GDP by 5.5% this year.

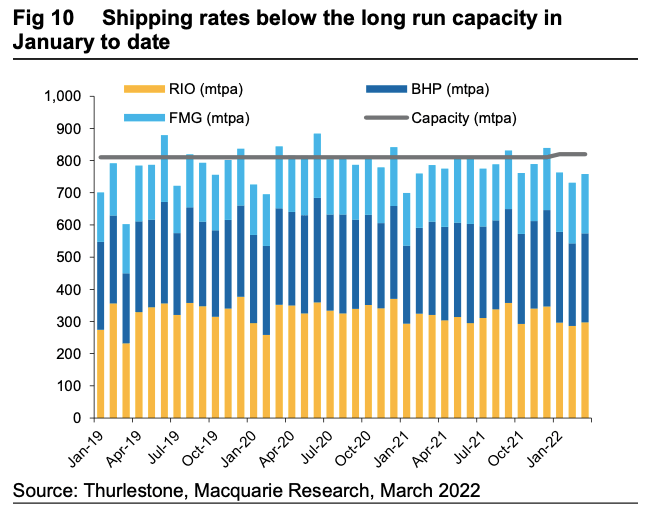

While portside inventories of iron ore remain near record highs despite pretty weak shipping data out of Brazil and some Pilbara producers, mill inventories are sliding.

“As production kept rising, steel inventory drawdown also stalled last week, suggesting increased pressure in the steel market,” Macquarie said in a note to investors.

“Despite the concern of the near term slowing steel inventory drawdown, steel prices find support from the expectation that demand will have to catch up later this year if the GDP growth target is to be met.

“We note mills inventory is now 28% lower YoY, and traders’ inventory is 17% lower YoY, remaining relatively low compared with the prior two years.”

Limited near term upside, but long term earnings look brighter

Iron ore prices are now at US$141/t year to date, 28% higher than the US$110/t average in the December quarter and well above analysts’ previous estimates.

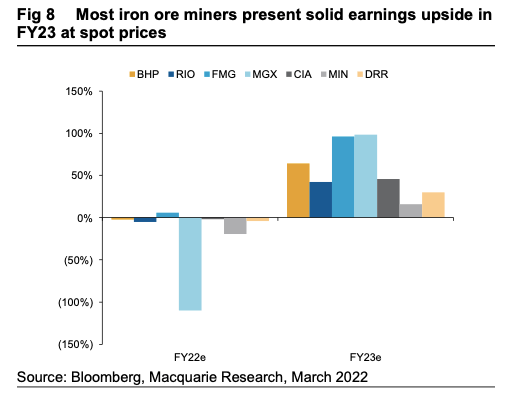

Macquarie remains bullish on prices and the iron ore sector, with all of its picks bar Fortescue Metals Group (ASX:FMG) in outperform territory.

That’s a list that includes BHP (ASX:BHP), Rio Tinto (ASX:RIO), Champion Iron (ASX:CIA), MinRes (ASX:MIN) and Mount Gibson Iron (ASX:MGX).

With prices already in line with Macquarie forecasts the bank thinks there is limited upside over the next six months, but BHP’s earnings potential in FY24 and FY25 contains 147 and 158% upside respectively while Macquarie thinks Rio has upside to improve to 99% and 107% in the same years.

Mount Gibson has been treading water due to large capex at its Koolan Island and Shine mines and the closure of the low grade Shine operation just weeks after the start of production last year due to price volatility and freight costs.

But at spot prices it has the most significant earnings upside potential according to Macquarie as full scale production at Koolan Island begins, with the pure play FMG (speculative hydrogen investments aside) enjoying the largest upside for FY24 and FY25.

From a macro perspective steel mill margins have declined amid rising coke and coal prices to below US$50/t but remain in positive territory, while grade-linked price differentials remain high.

However, price discounts for low-grade 58% low-alumina fines have recovered ground on the benchmark 62% price, a positive for lower grade producers like FMG and MinRes.

Iron ore miners share prices today:

South32 dips on smelter delays

South32 (ASX:S32) shares took a nearly 4% tumble after the diversified miner revealed it was facing delays in its plans to up its stake in the Mozal aluminium smelter in Mozambique.

Aluminium prices have surged amid Russia’s war in Ukraine because of potential sanctions and boycotts against Russian aluminium.

Australia has also ordered its companies to stop supplying alumina to Russia, which along with the closure of the Nikolaev alumina refinery in Ukraine, will take 20% of Rusal’s aluminium feedstock out of circulation.

That could mean supply-side support for aluminium prices for a while to come, with S32 also planning to reopen the mothballed Alumar plant it owns in a 40-60 JV with Alcoa in Brazil.

S32 inked a deal worth up to US$250 million last year with Mitsubishi to acquire its 25% stake in Mozal, bumping its stake in the business up to 72% or 63.7% if South African shareholder IDC exercises pre-emptive rights to up its stake.

It will mean the deal clearing in mid-2022 rather than March, delaying the timing of its ramp up in aluminium production, an area S32 shareholders would surely want to see it strike while the iron is hot.

South32 (ASX:S32) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.