Bulk Buys: FMG fields green queries and banks review iron ore prices

Pic: China Photos/Getty Images via Getty Images

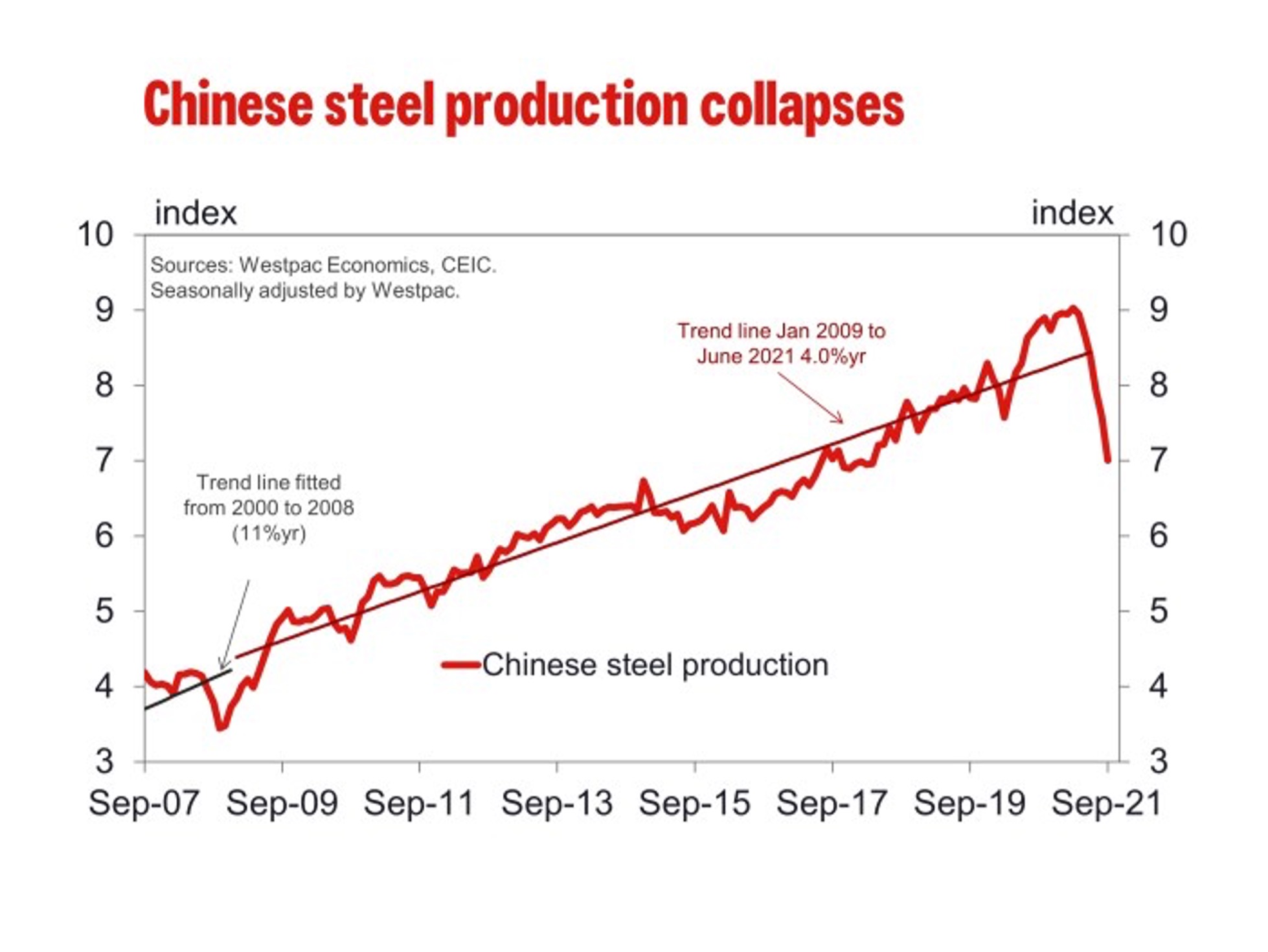

Westpac is the latest major financial institution to knock down its iron ore forecasts after prices dived below US$100/t again on a slowdown in steel production in China it describes as the largest since 2008.

It revised its price forecasts down by US$10/t this week to US$100/t for the end of 2021 and US$80/t for the end of 2022.

That comes off the back of one of the steepest falls in Chinese steel production seen since the nation became the world’s largest steel producer early this century.

“The Chinese steel production correction continued through September. Pig iron production fell 9% to be down 14%yr, the largest annual fall since -16%yr in November 2008 (at that time 62%fe was US$61/t),” Westpac senior economist Justin Smirk said.

“And it is not just the base output of blast furnaces that has fallen.

“Crude steel production fell 11% in September to be down 21%yr, the largest annual fall in the history of the data we have. The next largest fall was -18%yr in September 1994 then -16%yr in October 2008.”

According to the China Iron and Steel Association, its members’ late October steel production figures showed they were turning out just 1.7353Mt a day from October 21 to 31, down 7.43% on mid-October and well below the 3.2Mt/day they were producing at the industry’s peak earlier this year.

Iron ore prices have been extremely volatile in response to these shifts, sliding from a record US$237/t in mid-May to just US$94/t yesterday for benchmark 62% fines.

Will Chinese producers put a floor under prices?

Some quarters of the market believe a floor is coming for iron ore prices.

That is because there are a number of domestic iron ore producers, whose production is rising as the Asian economic powerhouse and its steel mills aim for greater self-sufficiency.

(i.e. They fear their supply has become monopolised by Australian and Brazilian majors BHP, Rio Tinto and Vale).

“In the year to September, Chinese ore production is up 15%,” Smirk noted.

“Chinese iron ore production (on an Fe62% basis) declined from over 500mt almost 10 years ago to less than 250mt in 2018 due to pollution mitigation campaigns along with a focus on health and safety issues.

“From the trough in 2018, Chinese ore production is set to rise to over 320mt this year then continue on to 380mt by 2025.”

These mines are lower in quality but higher in cost, meaning if the Chinese Government allows iron ore prices to fall too far it will start to hurt its own businesses.

“Given the re-emergence of China’s relatively high-cost iron ore mines, what does this imply about the cost base, or floor price, for iron ore?” Smirk said.

“Does the return of these mines mean we are moving up the cost curve resulting in a base cost price? Our current thinking is that this floor price is around US$75-85/t out to 2024 but rising Chinese ore production could push it to US$80-100/t.”

Smirk issued a note of caution though, that Chinese companies and more importantly the Communist Party, could tolerate lower prices to pursue its aims of decreasing its reliance on Australian producers.

“Long time watchers will remember Chinese iron ore supply being somewhat resilient even when prices fall below cost. In 2015, when stimulus packages were reduced just as property activity slowed, there was a collapse in iron ore prices below US$40/t; at that time the estimate cost curve was US$60/t,” he said.

“Furthermore, the CISA has vowed to accelerate the development of domestic and overseas iron ore supplies (e.g Simandou) as part of the 2021-25 Five Year Plan.

“Given that domestic self-sufficiency is easier and faster to implement than offshore green field projects, along with many mines being integrated with domestic steel mills, there is every reason to suspect that high-cost Chinese supply will again be resilient in the face of falling prices.”

FMG sticking with Scope 3 targets

Fortescue Metals Group (ASX:FMG) held its AGM in Perth yesterday and if you’re in the camp that get a little uneasy with Andrew Forrest et. al. and their grandstanding about green hydrogen and missed it, that may be a good thing.

You may be even more uneasy if you’re an investor watching billions of dollars in green hydrogen projects being announced with zero scrutiny outside of its ASX announcements.

So Twiggy punting $FMG $8bn in Argentina isn't worthy of an ASX announcement?

He might as well set the money on fire to generate electricityhttps://t.co/VcwWSh18h5

— 88888 Account (@88888sAccount) November 2, 2021

Forrest himself is still in Glasgow after his sortie at COP26 while other board members remain stuck behind WA’s hard border.

His big-ticket item came when he proudly announced Tom Petty’s family gave him the rights, for the first time ever, to use his music to promote a company. Right on, my dude.

Fortescue is sticking with its ambitious carbon reduction targets in the face of questioning from shareholders who, like the rest of us, are wondering where all the money for Forrest’s projects is going to come from.

FMG’s green energy arm Fortescue Future Industries is currently being funded by sequestering 10% of FMG’s profits each year and is well stocked for its research activities after record iron ore prices broke the company’s bank in 2020-21.

When will it generate profits, one erstwhile shareholder asked yesterday?

“At the core of the activities of FFI is actually the decarbonisation of Fortescue, and we see that as a very important part of FFI’s activities,” CEO Elizabeth Gaines said.

“If you think about our goal to be carbon neutral by 2030 we see that as a significant commercial opportunity for Fortescue to generate more profits, to lower our costs, to get a premium for our iron ore, which will be green.

“So absolutely we see that we will generate significant profits. There is some time between now and then but if we don’t decarbonise, not doing that puts at risk that we’ll lose the diesel fuel rebate, we’ll see a new carbon charge introduced, the cost of offsets will skyrocket.

“So not doing it will have a significant detriment on our overall profitability.”

Fortescue was up 1.8% at the close after announcing it plans to sell green and social bonds to raise funds in line with its new “sustainability financing framework”.

Pearl Gull Iron up on high grade hits

Pearl Gull Iron (ASX:PLG) has wavered since listing, timing its run at the ASX boards to coincide with a big drop in the iron ore price.

The company is exploring for high grade extensions of the Cockatoo Island iron ore mine off WA’s north coast.

While iron ore prices have worked against the explorer it has had a bit of joy, striking grades of as high as 69.5% iron ore (well above standard pricing indices) in drilling so far at its Switch Pit prospect.

Yesterday assays from the project were announced to the market, with Pearl Gull striking 65.9m at 55.5% Fe from surface including an interval of 11.8m at 65.5% Fe.

The company, which listed in late September, has completed an initial 19-hole drill program at its Cockatoo Island targets at the Switch Pit, Magazine Pit and North Bay prospects.

Also in the news at the junior end of the sector yesterday, Magnetite Mines (ASX:MGT) announced it had received access to historical data including data related to over 16,000m worth of drilling for the Muster Dam tenement near its Razorback project in South Australia it was awarded by the State Government in March.

Magnetite Mines plans to assess the data, which boasts a JORC 2004 inferred resource of 1.5Bt, alongside its continued DFS work at Razorback.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| MGU | Magnum Mining & Exp | 0.093 | 37 | 60 | -44 | 94 | $ 40,765,882.95 |

| RLC | Reedy Lagoon Corp. | 0.041 | 32 | 86 | 116 | 310 | $ 21,601,046.64 |

| DRE | Drednought Resources | 0.044 | 19 | 19 | 76 | 83 | $ 118,938,209.12 |

| HAV | Havilah Resources | 0.21 | 14 | 14 | 0 | 2 | $ 56,661,287.18 |

| SRK | Strike Resources | 0.115 | 10 | -8 | -57 | 10 | $ 32,400,000.00 |

| LCY | Legacy Iron Ore | 0.014 | 8 | 0 | -13 | 75 | $ 89,666,339.24 |

| EQN | Equinoxresources | 0.23 | 7 | $ 11,250,000.25 | |||

| HAW | Hawthorn Resources | 0.0545 | 7 | -3 | 9 | -47 | $ 18,176,600.91 |

| MAG | Magmatic Resrce Ltd | 0.1 | 4 | 0 | -50 | -53 | $ 25,448,679.80 |

| FMG | Fortescue Metals Grp | 14.49 | 1 | 2 | -37 | -12 | $ 44,121,567,274.94 |

| FEX | Fenix Resources Ltd | 0.2275 | 1 | 1 | -36 | 75 | $ 108,609,201.60 |

| BHP | BHP Group Limited | 36.73 | 1 | -3 | -27 | 6 | $ 107,330,145,713.72 |

| SHH | Shree Minerals Ltd | 0.01 | 0 | 0 | -33 | -23 | $ 10,632,368.92 |

| PLG | Pearlgullironlimited | 0.12 | 0 | -17 | $ 5,927,452.19 | ||

| MDX | Mindax Limited | 0.049 | 0 | -2 | 1533 | 1533 | $ 95,246,788.75 |

| JNO | Juno | 0.125 | 0 | -11 | $ 16,957,250.13 | ||

| GRR | Grange Resources. | 0.56 | 0 | 1 | 2 | 138 | $ 642,322,977.39 |

| CZR | CZR Resources Ltd | 0.0075 | 0 | -6 | -38 | -46 | $ 24,404,262.94 |

| AKO | Akora Resources | 0.195 | 0 | 3 | -36 | $ 10,468,691.20 | |

| ADY | Admiralty Resources. | 0.014 | 0 | -7 | -22 | 8 | $ 19,553,687.30 |

| ACS | Accent Resources NL | 0.055 | 0 | 0 | 45 | 450 | $ 25,631,500.57 |

| HIO | Hawsons Iron Ltd | 0.078 | -1 | -6 | 73 | 115 | $ 55,059,077.15 |

| TLM | Talisman Mining | 0.1425 | -2 | -5 | -8 | 30 | $ 26,283,529.58 |

| EFE | Eastern Iron | 0.053 | -2 | 43 | 430 | 416 | $ 44,392,797.88 |

| MIN | Mineral Resources. | 38.35 | -2 | -12 | -19 | 46 | $ 7,249,959,600.29 |

| RHI | Red Hill Iron | 2.79 | -2 | -14 | 276 | 1618 | $ 172,974,283.79 |

| RIO | Rio Tinto Limited | 88.94 | -2 | -11 | -30 | -5 | $ 33,093,925,478.10 |

| GWR | GWR Group Ltd | 0.105 | -5 | -28 | -65 | -32 | $ 31,792,576.52 |

| MIO | Macarthur Minerals | 0.36 | -5 | -20 | -18 | -23 | $ 51,271,845.93 |

| FEL | Fe Limited | 0.033 | -6 | -18 | -40 | 18 | $ 27,555,595.68 |

| FMS | Flinders Mines Ltd | 0.65 | -6 | -16 | -35 | -24 | $ 110,595,817.94 |

| MGX | Mount Gibson Iron | 0.39 | -6 | -16 | -58 | -42 | $ 478,174,373.04 |

| IRD | Iron Road Ltd | 0.19 | -7 | -14 | -12 | 28 | $ 150,972,155.86 |

| MGT | Magnetite Mines | 0.022 | -8 | -12 | -68 | 144 | $ 69,206,431.38 |

| BCK | Brockman Mining Ltd | 0.044 | -8 | 10 | -28 | 83 | $ 408,286,213.76 |

| VMS | Venture Minerals | 0.042 | -9 | -14 | -63 | 20 | $ 60,950,372.30 |

| CIA | Champion Iron Ltd | 4.16 | -9 | -10 | -40 | 9 | $ 2,051,292,097.80 |

| GEN | Genmin | 0.15 | -9 | -23 | -47 | $ 38,108,859.75 | |

| PFE | Panteraminerals | 0.24 | -11 | -21 | $ 9,625,000.00 | ||

| SRN | Surefire Rescs NL | 0.011 | -15 | -21 | -58 | -62 | $ 12,147,414.50 |

| TI1 | Tombador Iron | 0.033 | -18 | -18 | -67 | 10 | $ 35,774,410.82 |

Allegiance Coal soars as Stanmore joins big leagues

With met coal prices around record highs and major mining companies souring on the coal sector it is little wonder juniors are in expansion mode.

Stanmore Coal (ASX:SMR) stamped its claim to join Australia’s coal mining big leagues after emerging as the surprise buyer of BHP’s 80% stake in the BHP Mitsui coal joint venture in Queensland.

Allegiance (ASX:AHQ) meanwhile has spent the past year buying up a string of mines in the United States including the Black Warrior operation in Alabama.

It announced late last week that it had completed an agreement for the first 80,000t cargo from Black Warrior to head to an Asian customer.

Allegiance is waiting for a pilot coke oven test to be completed on its premium Mary Lee and Blue Creek Top coals, but has moved quickly to get the Black Warrior coal product onto the seaborne market to take advantage of the current strong pricing environment for met coal.

“The price was agreed at a discount to high-vol B due to the untested nature of the coal pending results of the pilot coke oven tests,” the company said in a statement.

Allegiance, which is also ramping up operations at the New Elk mine in Colorado and last month bought the Short Creek underground mine in Alabama, is up 20% over the past week as lower thermal coal prices have knocked down coal miners selling into energy markets.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AHQ | Allegiance Coal Ltd | 0.56 | 20 | -14 | -2 | 90 | $ 181,454,244.59 |

| TIG | Tigers Realm Coal | 0.023 | 10 | -12 | 229 | 105 | $ 287,467,452.10 |

| PAK | Pacific American Hld | 0.017 | 6 | -15 | -17 | -30 | $ 7,096,470.75 |

| NHC | New Hope Corporation | 2.04 | 4 | -21 | 73 | 91 | $ 1,635,581,666.13 |

| NCZ | New Century Resource | 0.15 | 3 | -3 | -25 | -9 | $ 206,374,402.01 |

| TER | Terracom Ltd | 0.19 | 3 | 27 | 96 | 31 | $ 135,649,373.40 |

| JAL | Jameson Resources | 0.086 | 1 | 1 | -10 | -28 | $ 26,086,542.54 |

| CRN | Coronado Global Res | 1.355 | 1 | -11 | 161 | 74 | $ 2,212,918,923.60 |

| SMR | Stanmore Resources | 1.06 | 0 | 1 | 56 | 44 | $ 319,079,482.38 |

| LNY | Laneway Res Ltd | 0.005 | 0 | 0 | 0 | -29 | $ 19,520,329.67 |

| CKA | Cokal Ltd | 0.16 | 0 | -9 | 150 | 167 | $ 149,933,170.08 |

| NAE | New Age Exploration | 0.011 | 0 | -8 | -39 | -15 | $ 16,512,837.47 |

| WHC | Whitehaven Coal | 2.58 | -2 | -20 | 102 | 137 | $ 2,540,304,810.72 |

| BRL | Bathurst Res Ltd. | 0.77 | -2 | -13 | 126 | 83 | $ 129,068,475.37 |

| BCB | Bowen Coal Limited | 0.17 | -3 | -13 | 164 | 241 | $ 206,070,593.54 |

| AKM | Aspire Mining Ltd | 0.084 | -5 | -20 | 0 | 20 | $ 39,595,684.83 |

| PDZ | Prairie Mining Ltd | 0.225 | -5 | -26 | -9 | 19 | $ 52,054,895.03 |

| YAL | Yancoal Aust Ltd | 2.73 | -7 | -25 | 31 | 43 | $ 3,551,982,085.53 |

| ATU | Atrum Coal Ltd | 0.039 | -9 | -20 | -29 | -86 | $ 27,509,533.44 |

| MCM | Mc Mining Ltd | 0.105 | -13 | -16 | -9 | -54 | $ 16,214,053.28 |

At Stockhead, we tell it like it is. While Magnetite Mines and Allegiance Coal are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.