Bulk Buys: Chinese property bailout brings respite for iron ore, but is it calm before the storm?

Mining

Mining

The iron ore price has been beaten from pillar to post for around four months now, falling from a 2022 high above US$160/t to under US$100/t for the first time this year late last week.

Almost immediately a rebound came because the factors sending iron ore south were harder for the Chinese Communist Party to stomach than the delight they get seeing receipts to Australia’s big miners slide.

Banks have been ordered to bankroll property developers being hounded by mortgagees refusing to pay up as construction grinds to a halt.

Steel demand, or at least the sentiment around it, rebounds.

Iron ore lifted 6.1% to US$102.40/t on Monday. Steel didn’t.

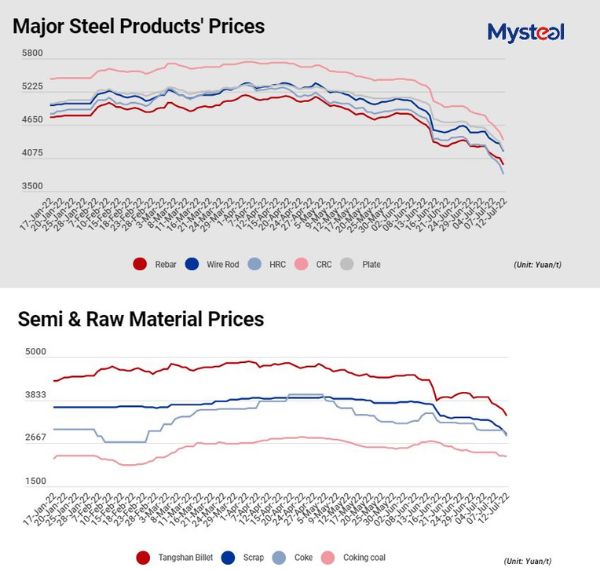

Rebar was down 0.3% to 4208RMB, equivalent to almost US$625/t. The fall in steel prices suggests mills will still be struggling to turn a profit after slipping to US$70/t losses at the end of June.

When iron ore was flying to record levels in May last year Chinese rebar was around US$300/t higher, and factories did not need to contend with coking coal prices in excess of US$400/t.

This remains a wait and see proposition.

Meanwhile, talk is heating up that China is edging towards starting a new state-owned company which would be a central buyer for iron ore, rebalancing what it sees is an uneven power relationship between it and the Pilbara miners.

As with all of these things, China needs to be taken seriously, even if its central premise is a gross distortion of reality.

In theory China says the relatively concentrated nature of the iron ore industry — which means the bulk of production is dominated by Rio Tinto (ASX:RIO), BHP (ASX:BHP), Vale and to a lesser extent Fortescue (ASX:FMG) — gives those companies pricing power.

It’s a claim that only seems to be made when prices are good, but we digress.

Bloomberg reports moves to form the company, which would also manage investments in overseas projects like Simandou, are moving forward with the appointment of Chinalco chairman Yao Lin and Baowu Steel executive vice president Guo Bin to the newco.

It comes amid broader efforts within China to make its 1Btpa steel industry more self-sustaining, a tough ask given the ratio of iron ore tonnes to crude steel is roughly 1.6:1 and China is currently producing less than 300Mt of iron ore off its own bat.

Alongside its efforts to snatch purchasing power, China also wants to increase scrap steel use and electric arc furnace production, something challenged by the youth of most of its infrastructure and high energy prices, increase domestic production and ramp up investments overseas.

A whole lot and not that much at the same time probably.

Commbank mining guru Vivek Dhar says similar plans have failed in the past because of the diversity of China’s steel sector.

While mergers and acquisitions have seen more of the steel sector consolidate in large state-owned companies in recent times, there remain a number of privately owned enterprises who won’t be keen on the state becoming a medium for their iron ore purchases.

“In the early 2000s, a similar plan to unify China’s iron ore purchases ultimately failed when smaller and medium‑sized steel mills opportunistically sought to lower costs for themselves than work as one large buyer,” Dhar said.

“This remains a key challenge even now. A key detail of the initiative, reported a month ago, is that Chinese steel mills would be told to report their consumption plans for consolidation into a combined figure for negotiation with big overseas suppliers.

“While the larger state‑owned steel mills are capable of this forward planning and accepting the risks that come with that, it is unlikely that private steel mills will be in the same boat. Private steel mills would particularly be hesitant to forward plan if steel mill margins are low to negative.”

Other aspects of the new company’s remit are challenging. Simandou is in a holding pattern, with part owner of the giant Guinean iron ore deposit Rio Tinto still unable to agree on an infrastructure JV with the local military junta and Chinese-Singaporean led consortium SMB Winning.

It’s a multi-billion dollar project supposed to be open, ambitiously, by 2025, an investment that will be less appealing if China succeeds in pulling iron ore prices down to the marginal cost of production.

At the end of the day, the reality is China’s chaotic economy is likely a much larger driver of iron ore prices.

“It’s also worth questioning the assumption that the concentration in the iron ore export sector is the cause of higher‑than‑normal prices,” Dhar said.

“Chinese policy has proven to be the more dominant driver of iron ore prices over the last 18 months.

“The reduced confidence in China’s property sector over the last week, which prompted iron ore prices below $US100/t (62% Fe, CFR China), is a case in point.”

Production reports from two of the three big boys are in the books.

Rio has again got analysts’ tongues wagging about whether it will make guidance.

While finally getting its new Gudai-Darri mine up and running will be a big help, the ~350Mtpa runrate it will have to hit through the second half of the year to make the mid-point of its 320-335Mt target could be a tall order.

BHP made its FY22 guidance in its quarterly review yesterday, and expects a slight lift in FY23.

But cost pressures and global growth warnings also abounded.

Fortescue reports on July 28, with updates on its Iron Bridge magnetite mine to be closely watched after a string of delays and blowouts.

Suggestions it could fall further behind schedule at Iron Bridge have emerged, with investment bank UBS adding to those predictions this week.

FMG has also submitted an application with WA’s enviro department to increase its hematite handling capacity at Port Hedland from 188Mt to 210Mt, an indication perhaps that it doesn’t want any potential issues at Iron Bridge to delay its growth ambitions.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.046 | 0% | -23% | -15% | -10% | $ 21,437,255.02 |

| ADY | Admiralty Resources. | 0.008 | -27% | -33% | -33% | -60% | $ 15,642,949.84 |

| AKO | Akora Resources | 0.185 | -5% | -18% | -29% | -31% | $ 11,672,934.64 |

| BCK | Brockman Mining Ltd | 0.036 | 0% | -3% | -25% | -3% | $ 334,088,356.72 |

| BHP | BHP Group Limited | 36.61 | -4% | -14% | -12% | -21% | $ 187,154,088,334.30 |

| CIA | Champion Iron Ltd | 4.77 | -1% | -21% | -25% | -31% | $ 2,496,684,361.08 |

| CZR | CZR Resources Ltd | 0.015 | -17% | -12% | 67% | 30% | $ 55,781,172.43 |

| DRE | Dreadnought Resources Ltd | 0.048 | 7% | 14% | 17% | 23% | $ 130,579,443.35 |

| EFE | Eastern Resources | 0.025 | -7% | 9% | -66% | 47% | $ 24,860,915.78 |

| CUF | Cufe Ltd | 0.019 | -14% | -21% | -49% | -79% | $ 19,322,247.30 |

| FEX | Fenix Resources Ltd | 0.285 | -3% | -8% | -3% | -35% | $ 147,120,967.20 |

| FMG | Fortescue Metals Grp | 17.01 | 1% | -9% | -18% | -34% | $ 52,003,717,465.02 |

| FMS | Flinders Mines Ltd | 0.47 | 12% | 15% | -13% | -54% | $ 79,358,831.19 |

| GEN | Genmin | 0.23 | 5% | 35% | -2% | 12% | $ 65,156,205.50 |

| GRR | Grange Resources. | 1.175 | 2% | -18% | 43% | 60% | $ 1,388,806,437.60 |

| GWR | GWR Group Ltd | 0.12 | 0% | 32% | -35% | -71% | $ 38,545,998.60 |

| HAV | Havilah Resources | 0.24 | -2% | -11% | 26% | 7% | $ 75,983,810.40 |

| HAW | Hawthorn Resources | 0.082 | 1% | -14% | -22% | 64% | $ 27,348,280.27 |

| HIO | Hawsons Iron Ltd | 0.415 | -10% | -6% | 89% | 152% | $ 314,947,503.75 |

| IRD | Iron Road Ltd | 0.14 | -3% | -7% | -28% | -49% | $ 111,858,782.56 |

| JNO | Juno | 0.13 | 18% | -7% | 8% | -42% | $ 18,992,120.14 |

| LCY | Legacy Iron Ore | 0.019 | 3% | -5% | -17% | 19% | $ 115,322,871.58 |

| MAG | Magmatic Resrce Ltd | 0.072 | -3% | 13% | -27% | -52% | $ 18,323,049.46 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 69% | -18% | $ 113,911,163.12 |

| MGT | Magnetite Mines | 0.024 | 9% | 4% | -32% | -42% | $ 91,002,333.74 |

| MGU | Magnum Mining & Exp | 0.039 | -5% | -7% | -63% | -78% | $ 18,602,507.95 |

| MGX | Mount Gibson Iron | 0.485 | 0% | -18% | 7% | -49% | $ 568,966,975.51 |

| MIN | Mineral Resources. | 45.14 | -2% | -13% | -30% | -25% | $ 8,545,771,360.32 |

| MIO | Macarthur Minerals | 0.15 | -30% | -35% | -58% | -74% | $ 25,800,558.08 |

| PFE | Panteraminerals | 0.1475 | 9% | 13% | -30% | 0% | $ 7,448,750.00 |

| PLG | Pearlgullironlimited | 0.054 | 8% | -10% | -30% | 0% | $ 3,019,626.94 |

| RHI | Red Hill Iron | 3.31 | -3% | 5% | 8% | 310% | $ 211,909,454.68 |

| RIO | Rio Tinto Limited | 95.71 | 0% | -11% | -13% | -27% | $ 35,365,768,707.78 |

| RLC | Reedy Lagoon Corp. | 0.019 | 6% | 6% | -56% | 12% | $ 10,591,111.33 |

| SHH | Shree Minerals Ltd | 0.008 | -11% | 0% | -47% | -47% | $ 11,146,382.03 |

| SRK | Strike Resources | 0.105 | -5% | -13% | -25% | -66% | $ 29,700,000.00 |

| SRN | Surefire Rescs NL | 0.021 | 0% | 5% | 91% | 50% | $ 33,208,633.02 |

| TI1 | Tombador Iron | 0.022 | -8% | -21% | -50% | -77% | $ 24,691,157.44 |

| TLM | Talisman Mining | 0.14 | 4% | 4% | -15% | -22% | $ 26,283,529.58 |

| VMS | Venture Minerals | 0.028 | -3% | -10% | -39% | -78% | $ 48,646,270.17 |

| EQN | Equinoxresources | 0.135 | -4% | -25% | -44% | 0% | $ 5,850,000.13 |

BHP and Whitehaven Coal (ASX:WHC) have signalled a major public relations war could be coming over coal royalties in Queensland.

“Queensland metallurgical coal delivered strong underlying performance for the quarter in the face of significant wet weather,” BHP CEO Mike Henry spat yesterday.

“BHP is assessing the impacts on BMA economic reserves and mine lives as a result of the increase in coal royalties by the Queensland Government. The near tripling of top end royalties has worsened what was already one of the world’s highest coal royalty regimes, threatening investment and jobs in the state.”

Queensland introduced three new coal royalty tiers which could net billions in additional income this year, with coal miners now being forced to cough up 40% of revenue on each dollar of coal sold at a price above $300/t.

BHP says at spot met coal prices its pre-tax royalty at the 58Mtpa BMA mines will increase 7% to 19% before federal company tax is paid.

Whitehaven, which is set to boast a 15 times rise in earnings to $3 billion in FY22 on ridiculous coal prices, is warning the NSW Government against making any changes where it operates in the Hunter Valley.

“We hope certainly there’s no change to the position in New South Wales,” MD Paul Flynn said on an earnings call.

“And we’ll be making sure that the New South Wales Government leading up to the election in March next year understands the critical role that the resources sector plays in New South Wales and that the need for further investment requires certainty in that regard.

“The unpredictable nature of things such as occurred in Queensland, don’t really foster the confidence necessary to commit the billions of dollars of capital to the like of projects that this industry typically spends.”

Queensland coal companies largely mine metallurgical coal used for steelmaking, something which was the flagship export product for the Australian market until recent weeks.

But a major energy shortage globally means the thermal coal largely shipped from Newcastle is now garnering a significant and historically rare premium.

Newcastle thermal coal futures for 6000kcal low vol energy coal are collecting US$396.05/t today, while premium hard coking coal continues to trade in the US$250/t range.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.007 | 17% | 0% | -59% | -46% | $ 10,051,292.37 |

| CKA | Cokal Ltd | 0.155 | -3% | 24% | -3% | 104% | $ 145,537,091.90 |

| NCZ | New Century Resource | 1.455 | -8% | -18% | -47% | -57% | $ 193,866,255.24 |

| BCB | Bowen Coal Limited | 0.285 | 30% | -17% | 63% | 329% | $ 370,337,642.88 |

| LNY | Laneway Res Ltd | 0.005 | 0% | 25% | -25% | -13% | $ 28,359,073.85 |

| GRX | Greenx Metals Ltd | 0.23 | 15% | 18% | -10% | 5% | $ 50,724,092.80 |

| AKM | Aspire Mining Ltd | 0.089 | 11% | 2% | 2% | 22% | $ 45,179,691.67 |

| AVM | Advance Metals Ltd | 0.012 | 9% | 33% | -33% | -24% | $ 5,256,651.42 |

| AHQ | Allegiance Coal Ltd | 0.18 | -65% | -65% | -65% | -74% | $ 218,299,278.40 |

| YAL | Yancoal Aust Ltd | 5.9 | 16% | 12% | 95% | 174% | $ 7,724,570,706.45 |

| NHC | New Hope Corporation | 4.45 | 18% | 21% | 85% | 135% | $ 3,579,135,452.60 |

| TIG | Tigers Realm Coal | 0.0175 | 3% | -3% | -13% | 94% | $ 222,133,940.26 |

| SMR | Stanmore Resources | 2.03 | 12% | -7% | 95% | 226% | $ 1,811,777,212.98 |

| WHC | Whitehaven Coal | 6.21 | 22% | 24% | 116% | 188% | $ 5,642,002,746.80 |

| BRL | Bathurst Res Ltd. | 1.125 | 13% | -7% | 41% | 42% | $ 200,927,769.00 |

| CRN | Coronado Global Res | 1.66 | 10% | -9% | 28% | 95% | $ 2,799,677,729.10 |

| JAL | Jameson Resources | 0.07 | 0% | -7% | -1% | -30% | $ 24,374,231.84 |

| TER | Terracom Ltd | 0.78 | 23% | 10% | 290% | 457% | $ 606,367,216.76 |

| ATU | Atrum Coal Ltd | 0.007 | 0% | -13% | -78% | -89% | $ 4,839,578.35 |

| MCM | Mc Mining Ltd | 0.135 | 8% | 17% | 69% | 17% | $ 24,706,858.75 |