Ground Breakers: Rio faces uphill run to meet guidance as commodity prices smash miners

Pic: Chris Moorhouse/Evening Standard/Hulton Archive via Getty Images

- Iron ore tumbles as property concerns rear their head in China again, other commodities struggle

- Rio Tinto increases production in the June quarter at iron ore mines, but will need more ramp-ups to meet guidance

- Materials stocks fall more than 3% on bad price news

Iron ore briefly tip-toed below US$100/t overnight as Chinese homeowners banded together to give the middle finger to property developers who have stopped work on construction projects.

Those homes ain’t getting built, they ain’t paying their mortgages, property demand crumbles and steel falls with it.

“China Real Estate Information Corporation (CREIC) reported that homebuyers in China have stopped mortgage payments on at least 100 uncompleted projects in over 50 cities on Wednesday – up from 28 projects on Monday and 58 projects on Tuesday,” Commbank’s Vivek Dhar said.

“Reduced confidence that property developers will complete projects is likely a key consideration in the rapid increase in projects facing mortgage repayment issues.

“A number of China’s property developers are in challenging financial positions. It’s worth noting that it is typical in China for homes to be sold before they are built.

“New home prices in China (combining all tiers) have declined for nine consecutive months to May 2022, meaning that the current value of homes being constructed is likely lower than what was committed when the property was sold. Whatever the motivation, it looks likely that further headwinds await China’s besieged property construction sector.”

As Dhar is fond of mentioning, property construction accounts for 30% of Chinese steel demand and 20-30% of its final use in copper, aluminium and zinc. Those commodities are looking a little frail today with copper threatening to break below US$7000/t and gold at 11-month lows.

What a day for Rio Tinto (ASX:RIO) to deliver another quarterly production report which analysts are calling a miss.

Rio will make another late run to meet guidance

We’ve waited long enough to jump on the Kate Bush gravy train brought about by the new season of Netflix’ Stranger Things, a sci-fi and horror series in which the real mystery is how some of its rotten dialogue made it past a ream of script editors.

But Rio is again going to be … ahem … RUNNING UP THAT HILL to make its iron ore guidance in 2022.

Its Pilbara operations shipped 79.9Mt in the June quarter, up 12% on the first quarter and 5% on the second quarter in 2021.

But Rio still needs to produce at a rate of almost 85Mt a quarter through the second half of the year to make the lower end of its 320-335Mt guidance.

It has maintained cost guidance at US$19.50-21/t for the Pilbara operations, but could see pressure on earnings with falling iron ore, copper and aluminium prices across the June quarter.

Rio’s realised iron ore prices came in as US$110.7/t in the June quarter and US$110.9/t in the first half, down from US$154.9/t in the first half of 2021.

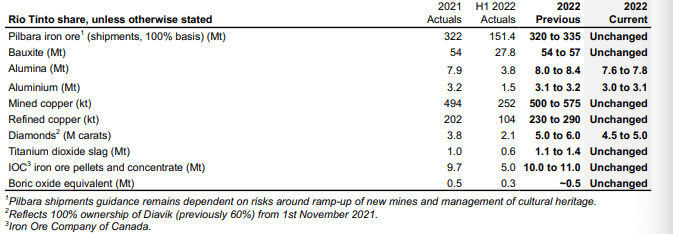

Rio has maintained guidance in key segments iron ore, bauxite, copper and iron ore pellets, its high grade Iron Ore Company of Canada operations.

But the mining behemoth has knocked down guidance for its diamond, alumina and aluminium segments, and added US$300 million to the budget for its Oyu Tolgoi underground development in Mongolia, which will now cost US$7.06b after a June 2022 review.

The key for Rio to meet the lower end of its iron ore guidance will be production increases at Robe Valley and the new Gudai-Darri, which will ramp up to its full 43Mtpa run rate by 2023 and improve the quality of its overall product.

“Gudai-Darri delivered first ore from the main plant in June,” Rio said.

“As Gudai-Darri continues to ramp-up, we expect increased production volumes and improved product mix in the second half. Full year shipments guidance remains unchanged at 320 to 335 million tonnes.”

Rio Tinto shares fall, but don’t we all

Rio’s shares fell 3.22% to $92.92 on the news, with its London stock even further off the mark at a 4.7% decline.

RBC analyst Tyler Broda said the company is starting to move closer to fair value, with its share price falling on weaker markets in recent weeks.

“There might be a positive read on this quarter from costs not moving higher however there isn’t too much else to get too positive on and this was only enabled by the very weak Australian dollar,” he said.

“The lower iron ore realised prices, higher than expected (to consensus), provisional pricing for copper and the guidance downgrades in aluminium all are likely to combine to reduce consensus estimates heading into the half-year results in a week.

“Another period with a lack of operational momentum doesn’t help in this type of market.”

That said, Rio was hardly alone this morning, with crappy commodity price falls dampening the mood in materials, which fell 3.19% this morning.

BHP (ASX:BHP) lost 3.69% while Fortescue (ASX:FMG) dropped 4.88%.

The gold bellwethers were all in the red, with Northern Star (ASX:NST), Evolution (ASX:EVN) and Newcrest (ASX:NCM) all 2% or more lower.

Ground Breakers share prices today:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.