Bulk Buys: China’s steel sector lifts iron ore to 10-year high, coking coal stabilises

Iron ore, the lifeblood of steelmaking, is at 10-year highs. Image: Getty

- Iron ore 62 per cent fines prices traded this week at $US182 per tonne, up $US7.45 on a week ago

- Hard coking coal prices were down $US2 on-week at $US105.10 per tonne at Queensland ports

- China’s steel reinforcing bar price is down $US9.55 this week at $US770 per tonne, close to a 12-year high

Iron ore prices have reached their highest level for 10 years as the seaborne market’s main customer, China, cranks up its steel output in line with its strong economic performance.

Cargoes of 62 per cent Fe grade iron ore for delivery to China are trading at $US182 per tonne ($233.55/tonne) this week, according to Metal Bulletin.

The spot price for seaborne cargoes of iron ore has risen 355 per cent from its 2016 low point of $US40 per tonne and is trading at its highest since September 2011.

“Iron ore prices rose to their highest level since September 2011 on steel demand hopes in China,” said analysts at Commonwealth Bank of Australia (CBA) in a report.

“Booming steel production continues to support the iron ore market. China’s steel output rose by 19.1 per cent in March to 94.02 million tonnes,” ANZ Bank analysts said.

“This has helped push China’s iron ore imports back above 100 million tonnes for the first time since October,” they added.

Emissions controls on steel mills in China’s Tangshan region continue to exert upward price pressure on iron ore prices, especially for higher grade iron ore.

“Strong steel prices on the back of pollution-related curbs on steel capacity have also supported iron ore,” said the ANZ Bank analysts.

The price of Brazilian iron ore fines product with an iron content of 65 per cent was trading at $US216 per tonne, up around $US5 per tonne from a week ago.

Rio Tinto’s (ASX:RIO) shipments of iron ore fines product jumped 7 per cent to 77.8 million tonnes in the March quarter compared with the March 2020 quarter, it said in a report.

Production for the period was 2 per cent lower at 76.4 million tonnes due to wet weather conditions in Rio Tinto’s iron ore mines, said the company.

“Tropical cyclone Seroja impacted mine and port operations in April. Full year iron ore guidance remains unchanged,” said Rio Tinto.

Iron ore futures rise after cyclone

Futures prices for iron ore moved higher this week following cyclone weather conditions off the coast of northwest Australia and firmer Chinese steel production.

Dalian Commodities Exchange’s May-settlement iron ore futures contract at ¥1,187 per tonne ($US182.75/tonne) is $US10 per tonne higher than a week ago, according to exchange data.

China’s increased steel production, up nearly 20 per cent year-on-year in March, has revved up futures markets prices for iron ore, a forward-looking indicator.

“Last week’s release of strong steel production numbers in China continues to boost sentiment in the iron ore futures market,” said ANZ Bank analysts.

“The market also seems unperturbed by increasing restrictions on steel capacity amid a crackdown on the industry’s environmental impact,” they added.

China’s demand for iron ore is likely to continue to remain relatively strong for the immediate future, if not the medium term, based on supply and demand dynamics, according to market experts.

“It is an entreprenuerial business. A lot of the steel mills in China are privately owned and they are not centrally controlled and iron ore demand is not centrally managed,” said iron ore market expert and Magnetite Mines (ASX:MGT) director, Mark Eames.

“The government has not had a significant influence on iron ore or steel for more than 10 years now,” he said, adding that the iron ore market in China is effectively deregulated.

ASX iron ore company share prices

| CODE | COMPANY | Price | 1 WEEK RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|

| LCY | Legacy Iron Ore | 0.024 | 85 | 2300 | $ 140,904,247.37 |

| MGT | Magnetite Mines | 0.076 | 43 | 4041 | $ 200,580,133.60 |

| MGU | Magnum Mining & Exp | 0.19 | 27 | 288 | $ 74,423,209.35 |

| FEX | Fenix Resources Ltd | 0.31 | 27 | 574 | $ 143,628,634.80 |

| SRK | Strike Resources | 0.23 | 24 | 448 | $ 56,840,881.64 |

| MAG | Magmatic Resrce Ltd | 0.155 | 15 | -36 | $ 34,773,741.92 |

| SHH | Shree Minerals Ltd | 0.016 | 14 | 700 | $ 17,174,027.16 |

| GEN | Genmin | 0.27 | 10 | $ 76,815,137.58 | |

| MIN | Mineral Resources. | 45.27 | 10 | 167 | $ 8,259,086,572.32 |

| GRR | Grange Resources. | 0.56 | 9 | 168 | $ 648,109,670.88 |

| RHI | Red Hill Iron | 0.51 | 6 | 168 | $ 30,537,855.99 |

| JMS | Jupiter Mines. | 0.33 | 6 | 34 | $ 626,877,130.56 |

| RIO | Rio Tinto Limited | 120.67 | 5 | 32 | $ 44,861,479,461.90 |

| CIA | Champion Iron Ltd | 6.35 | 5 | 238 | $ 3,301,181,389.28 |

| ADY | Admiralty Resources. | 0.023 | 5 | 283 | $ 26,660,098.08 |

| TI1 | Tombador Iron | 0.072 | 4 | 242 | $ 71,455,469.62 |

| FMG | Fortescue Metals Grp | 21.29 | 4 | 89 | $ 65,274,056,261.60 |

| MGX | Mount Gibson Iron | 0.875 | 4 | 25 | $ 1,049,536,702.53 |

| BHP | BHP Group Limited | 47.35 | 3 | 51 | $ 140,104,692,298.64 |

| BCK | Brockman Mining Ltd | 0.029 | 0 | 61 | $ 269,097,731.80 |

| VMS | Venture Minerals | 0.063 | 0 | 425 | $ 81,756,502.88 |

| FMS | Flinders Mines Ltd | 1.3 | -2 | 117 | $ 223,724,364.53 |

| RLC | Reedy Lagoon Corp. | 0.022 | -4 | 1000 | $ 10,340,575.65 |

| GWR | GWR Group Ltd | 0.31 | -5 | 349 | $ 92,349,865.12 |

| AKO | Akora Resources | 0.31 | -30 | $ 16,125,354.00 | |

| ACS | Accent Resources NL | 0.04 | -38 | 700 | $ 18,641,091.32 |

| IRD | Iron Road | 0.24 | 10 | 1160 | $134,490,000.00 |

Champion Iron (ASX:CIA), with its Bloom Lake iron ore mining complex in the Canadian province of Quebec, has joined the US OTCQX Best Market under the ticker CIAFF.

The US OTCQX market provides US investors access to the iron ore company’s shares, and it also trades on Toronto’s stock exchange and the ASX in Australia, and will continue to do so.

Champion Iron ships its 66.2 per cent Fe iron ore concentrate product from its Lake Bloom complex that has a nameplate production capacity of 7.4 million tonnes per year.

Its iron ore goes to markets around the world including China, Europe, the Middle East, South Korea, Japan, India and Canada.

The company also has a number of development projects for iron ore in the Labrador Trough including its Kamistiatusset project and Fire Lake North project.

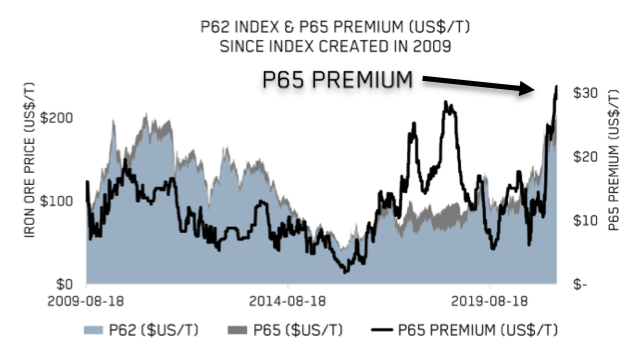

Champion Iron said in its April news bulletin that its higher-grade ore was achieving a premium of $US30 per tonne over market prices for standard 62 per cent Fe iron ore.

“With the global economy accelerating in tandem with an increased focus on reducing greenhouse gas emissions in the steel industry, the 65 per cent high-grade index used to price Bloom Lake’s concentrate product is breaking historical record levels,” said the company.

Chinese rebar prices remain resilient

Chinese-made steel reinforcing bar (rebar) is trading this week at $US770 per tonne and is $US10 per tonne off its record achieved in early April.

Demand for this steel product used in the construction sector remains at high levels, and its price is supported by relatively low inventories which have been sliding for the past month.

“Increased demand from construction sites has prevented rebar prices from dropping further,” reported Metal Bulletin.

China’s steel exports increased by around 16 per cent in March, according to ANZ Bank analysts, reflecting recovering demand for steel in the global economy.

Chinese steel producers are managing to recoup the cost of rising iron ore prices from their customers in the form of higher prices for their steel production including rebar.

“Robust steel margins in China are underpinning the support for iron ore prices,” said CBA analysts in a report.

The bank’s analysts said that the strength of China’s steel sector was “remarkable” and meant it was able to absorb higher input costs for iron ore and non-Australian coking coal.

On the London Metal Exchange, the rebar futures contract for month-ahead settlement is trading at $US637.50 per tonne after it reached a record $US650 per tonne in January.

The LME rebar futures price broke out of its 10-year range of $US400 to $US600 per tonne back in December 2020, and has been trading in new price territory since then.

Queensland hard coking coal price holds up

Australian standard-grade hard coking coal for spot shipment at ports in Queensland has stabilised this week as supply in the Chinese market becomes tighter.

May shipments were fetching $US105.10 per tonne in the spot market, excluding freight costs which are usually met by the customer and vary according to destination.

Prices for imported coking coal in the Chinese market were described as “stable at elevated levels” at $US200 per tonne on a delivered cargo basis including freight, said Metal Bulletin.

Most of the coking coal delivered into the Chinese market is from North American mines including some in Canada and the US and is fetching premiums above Australian prices.

“In the cost and freight market, imported coking coal prices were supported by positive market sentiment due to expectations of short supplies and rising domestic coking coal and metallurgical coal prices, while buying interest has started to revive,” reported Metal Bulletin.

ASX coal company share prices

| CODE | COMPANY | 1 WEEK CHANGE % | 1 MONTH CHANGE % | 6 MONTH CHANGE % | 1 YEAR CHANGE % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| PAK | Pacific American Hld | 0.025 | 19 | 19 | 25 | 70 | $ 6,371,698.00 |

| NAE | New Age Exploration | 0.019 | 58 | 6 | 23 | 850 | $ 23,171,315.29 |

| TIG | Tigers Realm Coal | 0.008 | 0 | -34 | 14 | 55 | $ 104,533,618.94 |

| MCM | Mc Mining Ltd | 0.13 | 4 | 18 | 13 | -26 | $ 20,074,542.15 |

| MR1 | Montem Resources | 0.135 | -7 | -29 | 13 | $ 23,573,029.32 | |

| TER | Terracom Ltd | 0.1 | 20 | -33 | 9 | -17 | $ 71,592,724.85 |

| AHQ | Allegiance Coal Ltd | 0.12 | 40 | 82 | 4 | 69 | $ 120,700,341.41 |

| NCZ | New Century Resource | 0.195 | 15 | 40 | 3 | 30 | $ 235,935,968.97 |

| CKA | Cokal Ltd | 0.064 | -4 | 0 | 2 | 60 | $ 59,173,268.03 |

| JAL | Jameson Resources | 0.099 | -1 | -21 | 0 | -29 | $ 30,029,857.11 |

| YAL | Yancoal Aust Ltd | 2.28 | -3 | 21 | 0 | 7 | $ 2,984,193,127.62 |

| PDZ | Prairie Mining Ltd | 0.26 | 24 | 13 | 0 | 100 | $ 59,372,323.14 |

| LNY | Laneway Res Ltd | 0.006 | 9 | -25 | 0 | 50 | $ 22,650,395.60 |

| BCB | Bowen Coal Limited | 0.066 | 10 | 16 | 0 | 32 | $ 62,829,509.29 |

| AKM | Aspire Mining Ltd | 0.093 | -7 | 26 | -2 | 7 | $ 47,210,239.61 |

| BRL | Bathurst Res Ltd. | 0.39 | -5 | 5 | -3 | -46 | $ 66,671,132.97 |

| NHC | New Hope Corporation | 1.31 | -1 | 14 | -3 | -19 | $ 1,094,549,562.83 |

| SMR | Stanmore Coal Ltd | 0.75 | -6 | 4 | -5 | -24 | $ 205,508,819.16 |

| CRN | Coronado Global Res | 0.78 | -25 | -5 | -14 | -39 | $ 1,162,458,276.00 |

| ATU | Atrum Coal Ltd | 0.056 | -78 | -80 | -15 | -80 | $ 33,752,035.87 |

| WHC | Whitehaven Coal | 1.42 | -16 | 39 | -19 | -21 | $ 1,497,334,136.40 |

Australian Tin Mining (ASX:ANW) has completed the first stage of its acquisition of the Ashford coking coal project in NSW and extended an option to acquire another in Queensland.

The company said it has satisfied all of the conditions for the completion of part one of the Ashford coking coal acquisition from Laneway Resources (ASX:LNY).

It now owns a 40 per cent stake in Renison Coal Proprietary, the owner of the Ashford coking coal project, and Laneway Resources has a 20 per cent holding in Australian Tin Mining.

Renison Coal has lodged an application with the NSW government for the renewal of one of two exploration licences for the Ashford coking coal project.

Ashford is located 50km west of Australian Tin Mining’s Taronga tin project, and 100km west of a proposed railway, and comprises two exploration licences.

The project has a coal resource of 14.8 million tonnes which is semi-hard coking coal, a type of coal suitable for producing steel.

Laneway Resources has the right to issue up to 500 million additional Australian Tin Mining shares provided its stake in the company does not exceed 20 per cent.

Australian Tin Mining has secured an extension to July 2022 for the completion of its acquisition of another coking coal project in Queensland, Mackenzie in the Bowen Basin coalfield.

Mackenzie is adjacent to the coking coal mines of Jellinbah and Yarrabee that produce low volatile pulverised injection coal used in steel production.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.