Fujiwhara Effect: Triple cyclones put Australian commodity producers on high alert

Not one or two, but three cyclones are building off WA's coast for iron ore exports. Image: Getty

- Australian commodity shippers face an intense cyclone season because of La Niña system

- ‘Even with three cyclones the worst-case is 15 days [disruption] in one month and ports can catch up on any shortfall very quickly’

- La Niña system caused severe flooding to Queensland’s coking coal sector in 2009-2010

The appearance of three new cyclone weather patterns off Australia’s northwest coast at the tail-end of the cyclone season has been accompanied by talk of the rare Fujiwhara Effect and disruption to shipments of key commodities such as iron ore and gas.

Cyclone Seroja was tracking south off the coast of WA on Thursday, and was expected to strengthen before making landfall near Coral Bay at the weekend, bringing disruptive winds.

Another low pressure weather system and potential cyclone was heading east towards WA from a position 600km south of Christmas Island, and another was off the Cocos Islands.

“A key upside risk for coking coal, thermal coal and LNG prices over the next six months is the increased likelihood of wet weather in Australia,” said Commonwealth Bank of Australia analysts in a September report issued at the start of the cyclone season.

There is speculation that the three weather systems may combine, leading to the rare Fujiwhara Effect where two cyclones interact with devastating results.

Potential price upside

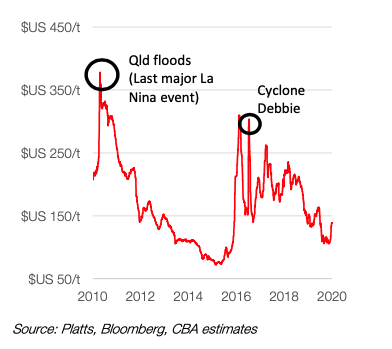

Exceptional cyclone seasons such as ones in 2009-2010 and in 2016-2017 brought widespread flooding to Queensland’s interior that affected coal mines and rail transport.

“Severe flooding of the Bowen Basin in Queensland in early 2011 resulted in seaborne coking coal prices surging as Australian coking coal supply was disrupted,” Combank added.

Half of the world’s seaborne supply of coking coal originates from Queensland’s Bowen Basin coalfield.

“Any extended disruption to coal and rail infrastructure in the region will likely result in coking coal prices spiking,” said the CommBank analysts in their report.

At the height of cyclone Debbie’s impact in March 2017, spot prices for coking coal on the international market soared to $US300 per tonne.

This week cargoes of Queensland hard coking coal destined for the spot market were changing hands at $US110 per tonne.

Iron ore impact possibly short-lived

The impact of any cyclone crossing the coast of WA’s Pilbara region is likely to be short-lived, as its iron ore export ports are designed to withstand such weather events.

“It is rare for a cyclone to cause any damage to ports in WA as the engineering is cyclone rated and the shipping berths are not exposed,” said iron ore market expert and Magnetite Mines (ASX:MGT) director, Mark Eames.

“Realistically, even with three cyclones the worst-case is 15 days [disruption] in one month and ports can catch up on any shortfall very quickly,” he said.

Also, customers in China generally take precautionary steps to ensure they have adequate stocks to see them through any supply disruption such as that caused by a cyclone.

“Steel mills generally build up their stocks of iron ore ahead of the cyclone season,” Eames said.

Current iron ore prices at $US170 per tonne are close to 10-year highs as the market experiences high demand from Chinese steel mills while supply remains tight.

Therefore, any cyclone-related delay to iron ore shipments is likely to be short term and only affect customers with short positions to fill or traders with cargoes at sea.

Key shippers of iron ore from WA are BHP (ASX:BHP), Fortescue Metals Group (ASX:FMG), Rio Tinto (ASX:RIO) and Roy Hill and Mineral Resources (ASX:MIN).

LNG terminals in WA could also be vulnerable

Western Australia’s North-West Shelf is host to several LNG export terminals that mostly ship cargoes to Asian countries such as Japan, Korea, China and Taiwan.

Any impact from a tropical cyclone could trigger a spike in LNG prices, according to market analysts.

LNG cargoes for delivery to Asia are trading at $US7.10 per million British thermal units, down from their January peak of $US32/mmBTU on a winter demand spike.

Oil prices slipped below $US20 a barrel in March, and have made a slow recovery to $US60/barrel ($78.60/barrel).

The Cameron LNG facility in the US state of Louisiana provided a case study into what can happen when such infrastructure is affected by a cyclone or hurricane.

The facility shut down ahead of the passing of hurricane Laura last August, and only resumed shipments in early October, a hiatus period of two months.

La Niña brings severe tropical cyclone season: BoM

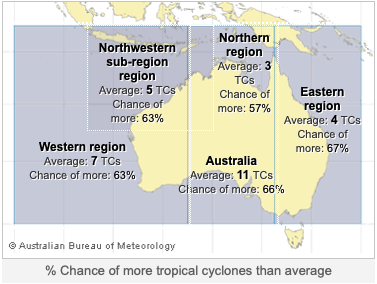

The Bureau of Meteorology has warned that Australia faces a more severe cyclone season from November 2020 to April 2021 because of the appearance of a La Niña weather system.

“La Niña was declared on September 29, 2020. All surveyed climate models suggest ocean temperatures will remain at La Niña levels until early 2021,” said the BoM on its cyclone forecast webpage.

Australia experiences between nine and 11 tropical cyclones in a typical cyclone season, but this year’s number could be higher and the storms more damaging.

The bureau puts the chance of a higher number of cyclones than average this season at around 60 per cent for Queensland, the Northern Territory and Western Australia.

In La Niña years, cyclones develop earlier in the season – usually around December – and tropical low weather systems that do not turn into cyclones can still bring flooding and damaging winds, the BoM said.

The last cyclone to affect WA was Lucas in January 2021 which headed toward Port Hedland as a category three cyclone unleashing flooding and strong winds.

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.