Beijing’s latest five-year plan contains lots of clues on China’s commodities demand

Australian commodities like iron ore and copper have transformed China's cities like Shanghai. Image: Getty

- China’s economic policy for the next five years includes a 20 per cent target for non-fossil fuels consumption, increased nuclear generation

- ‘Markets are priced for perfection at the moment, and 2021 is likely to be a volatile road’ – MineLife analyst, Gavin Wendt

- Higher growth rate and decarbonisation is good news for China’s demand of key Australian commodities

China has just unwrapped its latest five-year plan which contains strong clues on how Beijing will steer its giant economy out to 2025 and the types and volumes of commodities it will need, including many from Australia.

The five-year economic plan, China’s 14th, includes a range of targets that inform government and business behaviour in the Asian country such as its GDP growth target of 6 per cent for 2021.

“China did a tremendous job in 2020, but we are still not out of the woods yet with regard to COVID,” said MineLife founding director and senior resource analyst, Gavin Wendt.

China’s government injected massive amounts of spending into its economy to stave off a devastating recession in the wake of the COVID-19 pandemic.

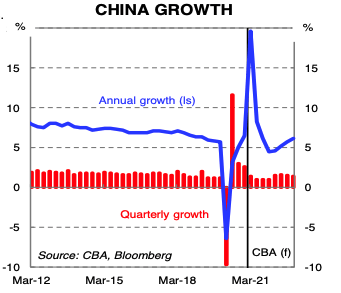

As a result, China managed to achieve an economic growth rate of 2.3 per cent for the 2020 year, and around 6 per cent in the December-ended quarter.

Analysts at Commonwealth Bank of Australia (CBA) believe China’s economy will grow at a staggering 9.2 per cent in 2021, and then go on to slow to an annual growth rate of 5.3 per cent in 2022.

“Our above-consensus growth forecast for 2021 reflects our expectation that the pace in policy normalisation will be very gradual,” said CBA analysts in a recent report.

China’s government will try to avoid a sharp policy tightening that may jeopardise its economic recovery, the analysts said.

This means China’s central bank will gently taper its liquidity injections into the economy.

Uranium required for more nuclear plants

China also wants 20 per cent of its energy to come from non-fossil fuels by mid-decade, an ambition that dovetails with its pledge to reach net zero carbon emissions for its economy by 2060.

The targets have profound implications for Australian-produced commodities and resource projects as China is Australia’s largest trade partner, specifically for commodities.

For example, China’s economic plan states Beijing will increase its electricity generation from nuclear energy to 70 gigawatts by 2025 from 50GW currently.

China’s drive for more nuclear power capacity will require uranium as a feedstock, as well as various metals to build new nuclear power plants.

The uranium market has been in a prolonged slumber for the past several years, although prices are starting to recover after many mines were taken offline because of COVID.

Iron ore, battery metals in demand

Beijing is also to double the size of China’s high-speed rail network to 70,000km by 2035, and policymakers want all new cars to be electric or electric hybrids by 2035.

“A switch in long-distance freight transport from heavy duty diesel trucks to electricity powered railways will help decarbonise the transport sectors,” said CBA analysts in a report.

Increased rail capacity will need steel made from iron ore and coking coal, and greater Chinese demand for electric vehicles will require a range of battery metals, copper and steel.

Evidence that China is seeking to decarbonise its economy can be seen in its trend for coal imports which declined by 39 per cent year on year for January and February.

Less carbon intensive LNG imports for China increased 17 per cent year on year for the January-February period following a colder than expected northern hemisphere winter.

Bullish expectations for China’s commodities demand for the coming year and beyond were underscored by international trading company Glencore.

Glencore’s chief executive, Ivan Glasenberg, told analysts last month that the company had modelled demand for battery metals as the world’s EV revolution unfolds.

Annual copper and zinc demand is forecast to double by 2050, and for cobalt and nickel volumes will need to rise four-fold to meet rising demand by mid-century, he said.

Commodities demand for China could moderate

China’s stunning economic growth in 2020 in the wake of the COVID pandemic not only rescued its own economy, but kept the world at large from falling into a heavy recession.

Central government agencies pumped tremendous amounts of cash into construction projects and infrastructure spending, much of it requiring commodities from Australia.

“China was very clever in purchasing commodities back in March last year, when we saw all commodities cratering in terms of price when the horror of COVID became apparent,” said MineLife’s Wendt.

China was able to buy commodities cheaply with the knowledge it would use these stockpiled raw materials later down the track, he said.

“China seized on that opportunity to stockpile oil, copper and iron ore and other commodities as China wanted to supercharge its economy during COVID to ensure its economy did not retreat,” said Wendt.

Many commodities from base metals through to energy products like oil and gas have shown a remarkable price recovery since their nadir in March last year.

“Commodity prices have been performing strongly, but there is no certainty about demand. I think the outlook with respect to China is moderating,” said Wendt.

In addition to this, speculators piled into rising commodity markets, accentuating rising price trends.

“Hedge funds are major players in commodities markets, taking both long and short positions. Copper has come off from a low base and may have overshot,” he said.

Commodities markets expert Wendt went on to sound a cautious note about China’s demand for commodities this year, and suggested its breakneck demand will moderate.

“Markets are priced for perfection at the moment, and 2021 is likely to be a volatile road,” he said, commenting on commodities markets.

“There have been one or two indications from China’s economic data that the economy is starting to ease, and that is to be expected as China cannot continue to grow at breakneck pace,” he added.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.