Australia down to two uranium mines after ERA confirms Ranger mine’s production halt

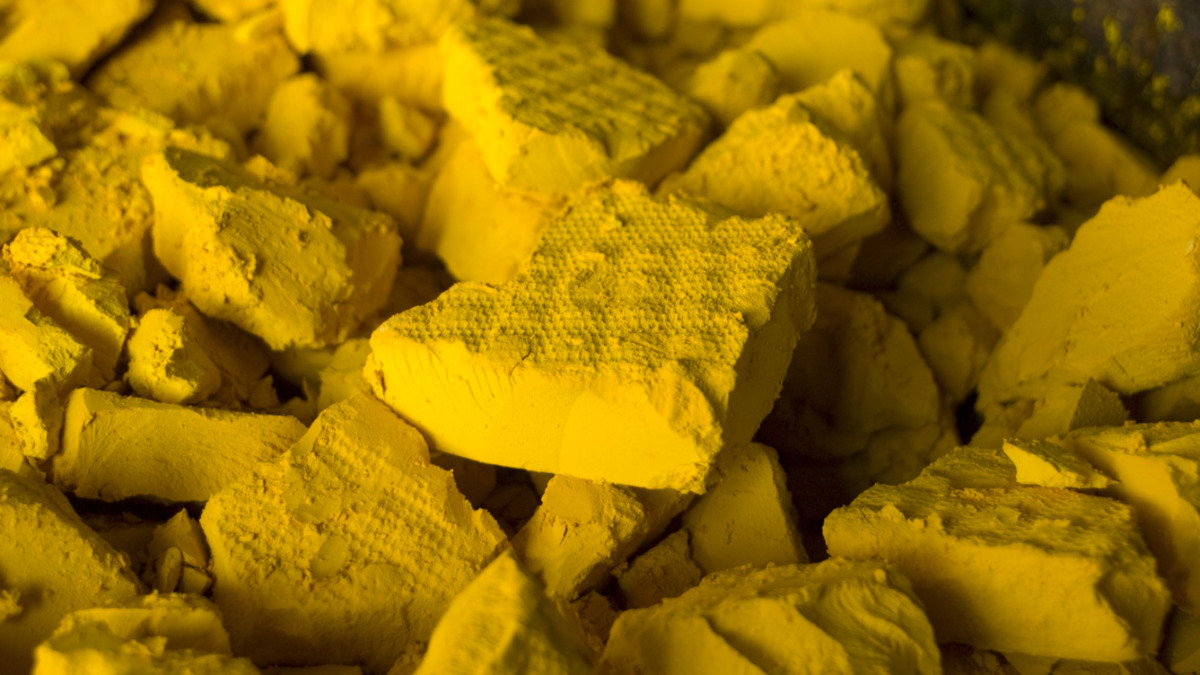

Yellow cake or uranium concentrate is in a supply squeeze as mine production shuts down. Image: Getty

- Ranger uranium mine’s operator ERA has confirmed it has halted processing operations

- BHP’s Olympic Dam and Quasar Resources’ Four Mile are Australia’s only operating uranium mines

- ASX uranium explorers poised to benefit from Ranger’s closure

The uranium market’s supply side tightened by another notch this week with Energy Resources of Australia (ASX:ERA), a Rio Tinto subsidiary, halting uranium oxide processing at its Ranger mine site on Friday.

The move at Ranger is in line with the mine’s planned gradual winding down of production over the past several years as it heads towards a permanent closure.

“Uranium oxide processing at Ranger concludes today, January 8, as required by the Ranger Authority,” said ERA in an ASX statement.

The company said it had enough stockpiled ore on its run-of-mine pad to support processing up to January 8, “at which time processing will conclude in line with the Ranger Authority”.

Energy Resources of Australia produced 390 tonnes (~860,000 pounds) of uranium oxide in the December 2020-ended quarter, a decline of 8 per cent on year.

Production for the 2020 year was 1,574 tonnes (3.47 million pounds) which was toward the upper end of its production guidance, but down 10 per cent on 2019.

Some Ranger spot market sales expected in 2021

The company plans to opportunistically sell some retained inventory into the spot market and to fulfil a number of marketing contracts during 2021.

The Ranger site will be rehabilitated over the next five years. Rio Tinto has a 86.3 per cent stake in Energy Resources of Australia.

Located 260km east of Darwin in the Northern Territory, the Ranger mine has been in production for more than 35 years and produced 132,000 tonnes of uranium oxide during its operation.

Uranium oxide prices have rebounded strongly from their March 2020 low of $US24 per pound and were trading around $US30.65 per pound this week.

Several ASX uranium companies have hailed the recent rise in uranium prices as an apparent turning point for the industry.

The uranium market starts to go into significant deficit in 2025, and by 2028 the gap between uranium demand and supply starts to widen dramatically, according to Bannerman Resources (ASX:BMN).

“There is a period of deficit that we are in at the moment, that has been exacerbated by supply disruption caused by COVID-19, but we are in a period of inventory drawdown,” said Bannerman Resources chief executive Brandon Munro in a recent presentation.

Canada’s Cigar Lake mine in care and maintenance

Compounding uranium industry supply issues is a production stoppage at Canadian producer Cameco’s Cigar Lake mine in Canada’s Saskatchewan province.

Cameco said in mid-December it was temporarily suspending production at Cigar Lake and had put the mine on to care and maintenance because of risks posed by the COVID-19 pandemic.

“The timing of the restart and the production rate will depend on how the COVID-19 pandemic is impacting the availability of the required workforce at Cigar Lake, how cases are trending in Saskatchewan, in particular in northern communities, and the views of public health authorities,” said Cameco.

The Canadian uranium company said it will go into the spot market to buy uranium oxide for its customers, adding further upward pressure to prices.

“Due to the suspension, we plan to increase our purchases in the market to secure uranium we need to meet our sales commitments,” the company added.

Cigar Lake had produced 2.3 million pounds of uranium oxide in the January-September 2020 period, way below its target for the 2020 year of 5.3 million pounds.

Market analysts said the production halt at Cigar Lake was likely to impact uranium market prices.

“As Cigar Lake is one of the largest uranium mines in the world, its output, or lack thereof, can materially affect the uranium spot price,” Cantor Fitzgerald metals and mining analyst, Mike Kozak, said in a report last month, reported S&P Global Platts.

“The longer the mine remains down, the more upward pressure will build in the uranium spot and term markets,” Kozak added.

Kazakh producer Kazatomprom warns of looming production cut

Meanwhile, the world’s largest producer of uranium, Kazatomprom, with around one-quarter of global production, has maintained its production guidance.

Kazatomprom’s production guidance for the 2020 year was unchanged in November at 19,000 to 19,500 tonnes of uranium from its mines in Kazakhstan.

In the nine-month period ended September 2020, the company’s production of uranium oxide was 15,090 tonnes, down 11 per cent on the same 2019 period.

The London-listed company said, however, that it was sticking with a decision announced in August to ‘flex down’ its production by 20 per cent by the year 2022.

“The full implementation of the decision to extend the reduction for an additional year will remove up to 5,500 tonnes of uranium from anticipated global primary supply in 2022, with uranium production in Kazakhstan staying similar to the level expected in 2021,” said the company.

ASX uranium stocks poised to benefit from Ranger mine’s closure

The Ranger mine’s scheduled closure leaves Australia with only two operating uranium mines, BHP’s (ASX:BHP) Olympic Dam operation and Quasar Resources’ Four Mile, both in South Australia.

Olympic Dam produced 3,678 tonnes of uranium oxide in the year ended June 2020, up 3 per cent on 2019 financial year levels.

There are around a dozen ASX companies with uranium projects including, Alligator Energy (ASX:AGE), Deep Yellow (ASX:DYL), and Toro Energy (ASX:TOE).

Marenica Energy (ASX:MEY) raised $5.4m through capital raisings in November and is developing projects in Australia and Namibia.

Another ASX company with a uranium project in the African country of Namibia is Bannerman Resources with its Etango-8 flagship.

A pre-feasibilty study is on track for the Etango-8 project with a production output for uranium oxide of 3.5 million tonnes per year.

Alligator Energy’s shareholders are funding an upgrade and expansion of the company’s Samphire project in South Australia’s Gawler Craton.

ASX share prices for Alligator Energy (ASX:AGE), BHP (ASX:BHP), Bannerman Resources (ASX:BMN), Energy Resources of Australia (ASX:ERA), Deep Yellow (ASX:DYL), Marenica Energy (ASX:MEY), Toro Energy (ASX:TOE)

At Stockhead, we tell it like it is. While Marenica Energy is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.