You might be interested in

Mining

Allens says more lithium M&A activity on the cards next year

Mining

These 14 stock experts give their key mining picks for 2025: Part Two

Mining

Mining

A key agreement with German utility Pfalzwerke Group could fast track production from Vulcan Energy’s (ASX:VUL) namesake geothermal brine project in the Upper Rhine Valley.

In early 2018, Koppar Resources began listed life as a copper-zinc explorer in Germany.

Things were chugging along ok. Koppar listed at 20c per share and traded at a premium from the get-go, peaking around 27c per share before falling off a cliff at the end of the year along with everyone else (it was a small cap bloodbath – never forget).

Still, Koppar was hovering around a very respectable 15.5c when it ditched copper-zinc for Vulcan, a geothermal lithium brine play near Stuttgart.

Scroll down for more battery metals news>>>

Koppar – reskinned as Vulcan Energy – now has a dominant landholding in one of the only geothermal (heat energy stored in the earth) brine fields in the world.

It sounds gimmicky, but a confluence of factors could make this a game changer for the young company, it says.

One –there is an extraordinary ramping up of lithium-ion and associated cathode production in Europe, soon to be the world’s #2 EV manufacturer.

Two – the project in the Upper Rhine Valley brine field is a few clicks from Stuttgart, the home of Germany’s auto industry.

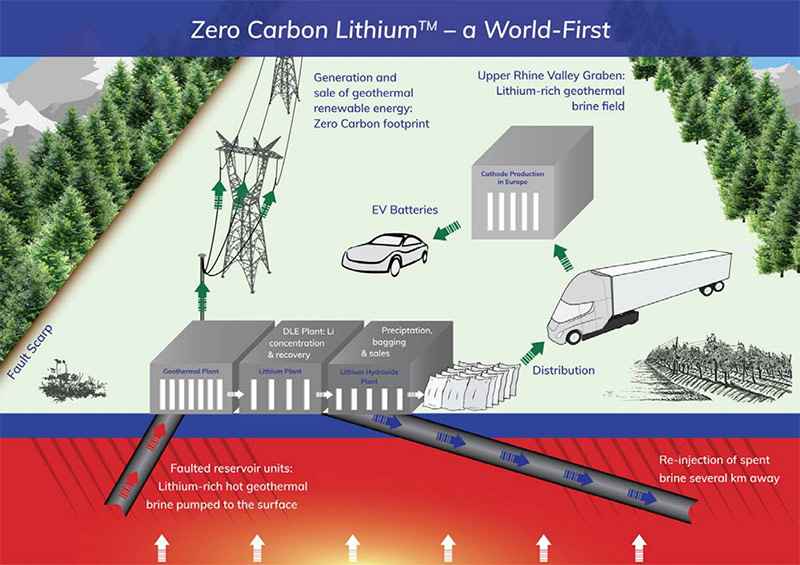

And three – the Vulcan Zero Carbon lithium project is aiming to be Europe’s and the world’s first zero carbon lithium project (as the name suggests).

Which is a great angle, but is it economically viable? Yes, Vulcan says.

Producing battery-quality lithium hydroxide from hot, sub-surface geothermal brines allows Vulcan to use the renewable energy by-product to fulfil all its processing energy needs.

That equals low processing costs which, coupled with its location to end users, gives it big benefits over hard rock and traditional brine extraction, the company says.

“Hard-rock lithium production has a high OPEX and high CO2 footprint due to its inherent energy requirement for mining, crushing and processing to producing battery quality lithium chemicals, as well its transport distance to major global markets,” Vulcan says.

“And in comparison to [brine] ‘evaporation pond’ mining methods, [geothermal project] direct lithium extraction takes hours, not months to produce battery-grade lithium products in one location — with no need for further off-site processing.”

This significantly reduces operating costs while eliminating weather dependency and negative environmental impacts, Vulcan says.

Today, the company signed a joint venture MoU (a precursor to an actual agreement) with major German utility Pfalzwerke Group, which is right next door.

Pfalzwerke’s Insheim plant is currently pumping lithium-rich brine to the surface for energy generation — but isn’t extracting the lithium before the brine is reinjected into the reservoir.

The MoU constitutes an initial collaboration period, during which Pfalzwerke will supply live brine and well data from its operational geothermal power plant for Vulcan to use in its pre-feasibility study.

After that, a legal JV will then be established, under which Vulcan can earn up to 80 per cent of the lithium rights at Insheim by completing a project definitive feasibility study (DFS).

As part of this DFS, Vulcan will construct and implement a demonstration plant at Insheim. Following completion of the DFS, Pfalzwerke can then choose to co-contribute to the construction of a commercial-scale lithium plant on site, or dilute interest to a royalty on lithium production.

“Partnering with the Pfalzwerke group, a well-respected German utility, is a transformational step for the company,” Vulcan managing director Dr Francis Wedin says.

“We now have access to a lithium-rich, producing geothermal brine operation, so that feasibility studies and potentially first lithium production can be achieved in a much shorter timescale, without the immediate need to drill our own geothermal wells.”

Advanced US lithium play Piedmont (ASX:PLL) has snared an all-important Section 404 permit – the only federal permit required to start development at its namesake project in North Carolina.

“We will now move forward with the permitting of our chemical plant operations during 2020,” Piedmont chief exec Keith Phillips says. “Our project is unique in being the only spodumene-to-hydroxide project in the US, and now also stands out as the most advanced American lithium project from a permitting perspective.”

READ MORE: Piedmont under pressure to fast-track development plans

JV discussions with US-based downstream processor Urbix Resources are progressing well, minor graphite producer Bass Metals (ASX:BSM) says. Bass recently attended the ribbon cutting celebration of Urbix’s pilot facility in Arizona.

The JV is looking at building a facility in Madagascar capable of producing a purified high value graphite product, using Urbix’s propriety tech and Bass’ natural flake graphite.

“We strongly believe a growing market exists for purified graphite in order to supply the expected massive growth in the demand for batteries used in EVs and other specialty carbon applications such as expandable graphite,” Bass director Jeff Marvin says. “Bass is committed to exploring and developing this unique and potentially highly successful joint venture.”

READ MORE: Demand for Madagascan large flake graphite is red-hot