High Voltage: EU electric vehicle penetration is about to take off big time

Mining

Mining

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Coming to grips with the EV story can be difficult when every analyst’s projection goes out to 2030 or 2050.

For punters that can feel like an eternity.

But here’s something a little more near term: new data predicts that 2020/2021 is likely the tipping point where “timid growth” ends and EVs become mainstream in Europe.

In other words, about the same time Taika Waititi’s new Thor film is released or Elon Musk’s SpaceX lands on the moon.

Just announced in Hall H at #SDCC, Marvel Studios’ THOR: LOVE AND THUNDER with Chris Hemsworth, Tessa Thompson and Natalie Portman. Taika Waititi returns as director. In theaters November 5, 2021. pic.twitter.com/7RRkOYWTQM

— Marvel Studios (@MarvelStudios) July 21, 2019

It means the number of EV models on the European market will more than triple within the next three years, the new analysis by IHS Markit shows.

EU carmakers will be offering 214 electric models in 2021 – up from the 60 available at the end of 2018.

This will include 92 fully electric and 118 plug-in hybrid models.

If everything goes according to plan (and it never does), 22 per cent of vehicles rolling off the production line could have a plug by 2022.

These near-term forecasts also show EV manufacturing steadily replacing diesel engine manufacturing across Europe, with the biggest production centres set to be in Western Europe – Germany, France, Spain and Italy.

Slovakia, Czech Republic and Hungary will also be significant production centres.

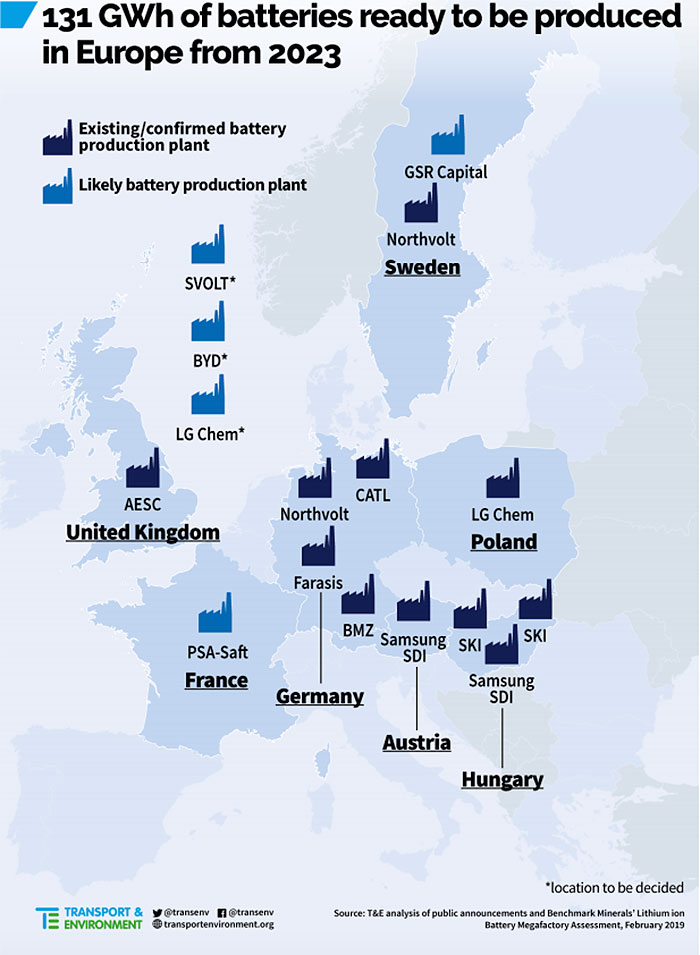

There’s already 16 large-scale lithium-ion battery cell plants confirmed or likely to come online in Europe by 2023, according to Benchmark Mineral Intelligence data.

This is enough to cover the estimated 130 GWh that will be needed by EVs and stationary storage batteries across Europe in 2023.

NGO Transport & Environment (T&E), which published the data, says Europe is about to see a wave of new, longer range, and more affordable electric cars hit the market.

“That is good news, but the job is not yet done,” Lucien Mathieu, transport and emobility analyst at T&E, says.

“We need governments to help roll out EV charging at home and at work, and we need changes to car taxation to make electric cars even more attractive than polluting diesels, petrols, or poor plug-in hybrid vehicles.”

Of the companies on our list, 45 lost ground, 65 were ahead and 42 were steady this week.

Liontown Resources (ASX:LTR) +30%

Liontown has been hard rock lithium’s beacon of hope.

In late April the stock was worth a touch over 2c. Now it’s over 16.5c – an impressive gain of +530 per cent over the past few months.

In early July, the explorer significantly boosted the resource at its flagship Kathleen Valley project. But this week it’s all about the emerging high-grade Buldania project in WA’s Norseman region, which is 1.4km long and growing.

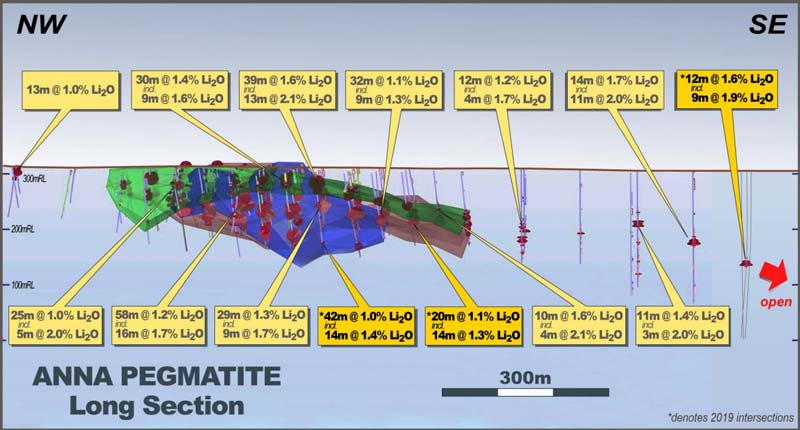

Liontown is currently working toward a maiden mineral resource estimate for Buldania’s Anna prospect, which means most of the drilling has focused on this one particular area.

But the explorer also punched a couple of holes into a fresh target about 5km away, which returned stellar results like 6m at 1.5 per cent lithium oxide from 54m.

Pioneer Resources (ASX:PIO) +33%

Liontown isn’t the only Norseman-based lithium play getting investor love.

Three weeks ago, Pioneer Resources discovered a new spodumene target area – rocks known to contain lithium. Initial rock chip samples have now confirmed high grade lithium up to 3.70 per cent.

Drilling will kick off next month.

Bass Metals (ASX:BSM) +25%

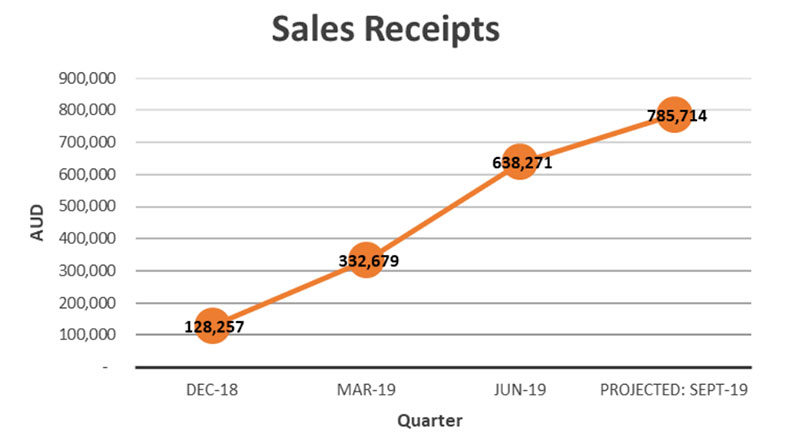

And tiny graphite producer Bass Metals has achieved record graphite production, sales and revenue from its Graphmada mine in the June quarter.

A record $638,000 for the June quarter continues the quarter-by-quarter doubling of revenue since Bass re-commissioned Graphmada.

Bass anticipates that sales of concentrate are likely to exceed 1000 tonnes for the September quarter, representing growth of about 30 per cent on sales over the June quarter:

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Ticker | Name | Price [Mon July 22 intraday] | 1 Week Return % | 1 Year Return % | Market Cap |

|---|---|---|---|---|---|

| KSN | KINGSTON RESOURCES | 0.019 | 38 | -24 | $25,078,844.00 |

| RIE | RIEDEL RESOURCES | 0.012 | 33 | -80 | $5,016,836.50 |

| PNN | PEPINNINI LITHIUM | 0.004 | 33 | -74 | $3,714,035.25 |

| PIO | PIONEER RESOURCES | 0.016 | 33 | -20 | $24,118,802.00 |

| SRN | SUREFIRE RESOURCES | 0.005 | 33 | -67 | $2,012,614.50 |

| LTR | LIONTOWN RESOURCES | 0.145 | 30 | 460 | $215,513,936.00 |

| CUL | CULLEN RESOURCES | 0.013 | 30 | -37 | $2,203,042.75 |

| SRK | STRIKE RESOURCES | 0.063 | 27 | 0 | $9,010,725.00 |

| IDA | INDIANA RESOURCES | 0.029 | 26 | -48 | $3,317,856.50 |

| KTA | KRAKATOA RESOURCES | 0.025 | 25 | -4 | $2,970,000.00 |

| BSM | BASS METALS | 0.009 | 25 | -64 | $25,288,872.00 |

| CZN | CORAZON MINING | 0.002 | 25 | -69 | $4,076,721.50 |

| RLC | REEDY LAGOON | 0.005 | 25 | -64 | $2,011,358.50 |

| BEM | BLACKEARTH MINERALS | 0.077 | 25 | -34 | $5,652,204.00 |

| MTC | METALSTECH | 0.016 | 23 | -85 | $1,871,262.25 |

| FGR | FIRST GRAPHENE | 0.265 | 23 | 38 | $111,689,800.00 |

| MEI | METEORIC RESOURCES | 0.026 | 22 | -10 | $23,114,086.00 |

| ARL | ARDEA RESOURCES | 0.48 | 20 | -44 | $46,173,260.00 |

| AMD | ARROW MINERALS | 0.012 | 20 | -43 | $3,343,865.50 |

| NXE | NEW ENERGY MINERALS | 0.023 | 20 | -87 | $3,621,490.50 |

| EMH | EUROPEAN METALS | 0.44 | 18 | 17 | $65,255,792.00 |

| AGY | ARGOSY MINERALS | 0.095 | 17 | -54 | $85,218,176.00 |

| EUC | EUROPEAN COBALT | 0.021 | 17 | -62 | $15,233,947.00 |

| CHK | COHIBA MINERALS | 0.016 | 17 | 75 | $8,639,985.00 |

| POS | POSEIDON NICKEL | 0.043 | 16 | 0 | $116,278,880.00 |

| BYH | BRYAH RESOURCES | 0.081 | 16 | -38 | $5,167,031.00 |

| MZZ | MATADOR MINING | 0.33 | 14 | 3 | $32,539,376.00 |

| IRC | INTERMIN RESOURCES | 0.14 | 13 | -24 | $51,357,024.00 |

| 4CE | FORCE COMMODITIES | 0.02 | 11 | -64 | $9,731,500.00 |

| SVD | SCANDIVANADIUM | 0.01 | 11 | -61 | $3,166,795.00 |

| PAN | PANORAMIC RESOURCES | 0.355 | 11 | -36 | $188,218,048.00 |

| LPI | LITHIUM POWER INTERNATIONAL | 0.35 | 11 | 19 | $87,942,160.00 |

| TNO | TANDO RESOURCES | 0.073 | 10 | -53 | $15,972,029.00 |

| NVA | NOVA MINERALS | 0.022 | 10 | -29 | $17,580,952.00 |

| INF | INFINITY LITHIUM | 0.079 | 10 | -6 | $15,784,261.00 |

| BSX | BLACKSTONE MINERALS | 0.12 | 9 | -25 | $18,354,572.00 |

| LI3 | LITHIUM CONSOLIDATED | 0.06 | 9 | -54 | $5,659,327.50 |

| GME | GME RESOURCES | 0.054 | 8 | -60 | $26,830,874.00 |

| TAR | TARUGA MINERALS | 0.028 | 8 | -86 | $3,952,682.75 |

| OMH | OM HOLDINGS | 0.86 | 8 | -28 | $601,978,048.00 |

| SYR | SYRAH RESOURCES | 1.0075 | 7 | -64 | $417,508,128.00 |

| BOA | BOADICEA RESOURCES | 0.15 | 7 | 76 | $8,455,228.00 |

| WML | WOOMERA MINING | 0.03 | 7 | -71 | $3,268,428.50 |

| AVL | AUSTRALIAN VANADIUM | 0.014 | 7 | -68 | $29,607,656.00 |

| ASN | ANSON RESOURCES | 0.047 | 7 | -62 | $24,748,280.00 |

| FEL | FE | 0.017 | 6 | -19 | $7,312,559.00 |

| DGR | DGR GLOBAL | 0.105 | 6 | 17 | $64,384,096.00 |

| DEV | DEVEX RESOURCES | 0.053 | 6 | -26 | $7,051,680.50 |

| JMS | JUPITER MINES | 0.37 | 6 | 17 | $724,826,688.00 |

| MLM | METALLICA MINERALS | 0.019 | 6 | -49 | $6,156,901.00 |

| PSC | PROSPECT RESOURCES | 0.19 | 6 | -32 | $41,291,556.00 |

| ZNC | ZENITH MINERALS | 0.078 | 5 | -53 | $16,169,922.00 |

| GBE | GLOBE METALS AND MINING | 0.02 | 5 | 33 | $8,852,525.00 |

| HWK | HAWKSTONE MINING | 0.02 | 5 | -39 | $12,425,724.00 |

| BPL | BROKEN HILL PROSPECTING | 0.021 | 5 | -74 | $3,105,551.50 |

| AXE | ARCHER EXPLORATION | 0.115 | 5 | 5 | $21,680,096.00 |

| HAV | HAVILAH RESOURCES | 0.145 | 4 | -37 | $33,828,604.00 |

| CHN | CHALICE GOLD MINES | 0.155 | 4 | 21 | $41,110,220.00 |

| KOR | KORAB RESOURCES | 0.03 | 3 | 0 | $9,198,785.00 |

| E25 | ELEMENT 25 | 0.18 | 3 | -8 | $17,002,846.00 |

| CLQ | CLEAN TEQ | 0.38 | 3 | -46 | $272,457,984.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | 0.23 | 2 | -37 | $134,449,920.00 |

| GXY | GALAXY RESOURCES | 1.36 | 2 | -57 | $526,004,896.00 |

| NZC | NZURI COPPER | 0.33 | 2 | 35 | $97,648,816.00 |

| ORE | OROCOBRE | 2.83 | 1 | -46 | $709,147,584.00 |

| KDR | KIDMAN RESOURCES | 1.9 | 0 | 21 | $767,091,072.00 |

| HGM | HIGH GRADE METALS | 0.008 | 0 | -80 | $3,623,503.00 |

| INR | IONEER | 0.185 | 0 | -47 | $265,497,024.00 |

| CGM | COUGAR METALS | 0.001 | 0 | -80 | $1,176,583.25 |

| LML | LINCOLN MINERALS | 0.005 | 0 | -78 | $3,449,902.00 |

| SBR | SABRE RESOURCES | 0.004 | 0 | -71 | $1,627,894.38 |

| LCD | LATITUDE CONSOLIDATED | 0.015 | 0 | -52 | $4,127,685.00 |

| AEE | AURA ENERGY | 0.012 | 0 | -50 | $13,696,622.00 |

| LRS | LATIN RESOURCES | 0.001 | 0 | -86 | $3,892,466.50 |

| BDI | BLINA MINERALS | 0.001 | 0 | 0 | $4,543,882.50 |

| PLL | PIEDMONT LITHIUM | 0.14 | 0 | -24 | $114,153,248.00 |

| BAR | BARRA RESOURCES | 0.022 | 0 | -48 | $11,855,596.00 |

| AJM | ALTURA MINING | 0.11 | 0 | -67 | $223,173,552.00 |

| DTM | DART MINING | 0.005 | 0 | -44 | $5,056,880.50 |

| CZR | COZIRON RESOURCES | 0.011 | 0 | -40 | $16,069,961.00 |

| BUX | BUXTON RESOURCES | 0.115 | 0 | -33 | $14,966,098.00 |

| SEI | SPECIALITY METALS INTERNATIONAL | 0.03 | 0 | 55 | $26,816,424.00 |

| AUZ | AUSTRALIAN MINES | 0.02 | 0 | -76 | $64,751,536.00 |

| KAI | KAIROS MINERALS | 0.015 | 0 | -53 | $12,784,093.00 |

| AZI | ALTA ZINC | 0.003 | 0 | -45 | $5,464,903.00 |

| PUR | PURSUIT MINERALS | 0.009 | 0 | -90 | $2,676,328.00 |

| PSM | PENINSULA MINES | 0.003 | 0 | -70 | $3,038,616.25 |

| MTH | MITHRIL RESOURCES | 0.005 | 0 | -58 | $2,111,946.00 |

| MTB | MOUNT BURGESS MINING | 0.002 | 0 | -71 | $970,258.81 |

| NWC | NEW WORLD COBALT | 0.013 | 0 | -76 | $10,037,611.00 |

| CMC | CHINA MAGNESIUM | 0.011 | 0 | -35 | $5,086,824.00 |

| LIT | LITHIUM AUSTRALIA | 0.053 | 0 | -55 | $27,719,296.00 |

| GLN | GALAN LITHIUM | 0.17 | 0 | -52 | $21,986,828.00 |

| AYR | ALLOY RESOURCES | 0.002 | 0 | -71 | $3,386,555.25 |

| DHR | DARK HORSE RESOURCES | 0.004 | 0 | -76 | $8,098,486.50 |

| CXO | CORE LITHIUM | 0.041 | 0 | -7 | $31,477,666.00 |

| GED | GOLDEN DEEPS | 0.029 | 0 | -37 | $6,150,343.00 |

| KNL | KIBARAN RESOURCES | 0.12 | 0 | -20 | $35,114,516.00 |

| HNR | HANNANS | 0.011 | 0 | -27 | $21,867,500.00 |

| BAT | BATTERY MINERALS | 0.015 | 0 | -58 | $18,453,282.00 |

| CNJ | CONICO | 0.01 | 0 | -66 | $3,517,582.50 |

| N27 | NORTHERN COBALT | 0.036 | 0 | -81 | $2,376,353.00 |

| RMX | RED MOUNTAIN MINING | 0.004 | 0 | -43 | $3,112,147.00 |

| TNG | TNG | 0.1 | 0 | -13 | $107,474,280.00 |

| TKL | TRAKA RESOURCES | 0.015 | 0 | -58 | $5,556,944.50 |

| MCT | METALICITY | 0.009 | 0 | -59 | $4,995,380.00 |

| MZN | MARINDI METALS | 0.001 | 0 | -90 | $2,248,371.00 |

| MIN | MINERAL RESOURCES | 15.38 | -1 | -6 | $2,772,572,928.00 |

| SO4 | SALT LAKE POTASH | 0.74 | -1 | 37 | $183,853,392.00 |

| TMT | TECHNOLOGY METALS AUSTRALIA | 0.21 | -2 | -68 | $19,261,916.00 |

| NMT | NEOMETALS | 0.205 | -2 | -24 | $108,887,640.00 |

| AML | AEON METALS | 0.2 | -2 | -37 | $137,979,296.00 |

| JRV | JERVOIS MINING | 0.21 | -3 | -37 | $55,981,184.00 |

| PLS | PILBARA MINERALS | 0.485 | -3 | -54 | $870,167,616.00 |

| CRL | COMET RESOURCES | 0.029 | -3 | -31 | $8,047,500.00 |

| COB | COBALT BLUE | 0.145 | -3 | -76 | $21,735,866.00 |

| LPD | LEPIDICO | 0.026 | -4 | -23 | $109,622,048.00 |

| CAZ | CAZALY RESOURCES | 0.022 | -4 | -46 | $6,332,967.50 |

| VRC | VOLT RESOURCES | 0.021 | -5 | 5 | $31,002,802.00 |

| HXG | HEXAGON RESOURCES | 0.095 | -5 | -51 | $27,719,422.00 |

| TON | TRITON MINERALS | 0.056 | -5 | -10 | $49,138,320.00 |

| PM1 | PURE MINERALS | 0.018 | -6 | 21 | $7,388,180.00 |

| TLG | TALGA RESOURCES | 0.43 | -6 | -28 | $89,102,616.00 |

| CLA | CELSIUS RESOURCES | 0.031 | -6 | -75 | $21,959,324.00 |

| MLL | MALI LITHIUM | 0.15 | -6 | -66 | $39,676,516.00 |

| VMC | VENUS METALS | 0.145 | -6 | 5 | $16,418,547.00 |

| BKT | BLACK ROCK MINING | 0.077 | -7 | 82 | $46,844,068.00 |

| IEC | INTRA ENERGY | 0.013 | -7 | 18 | $5,040,412.50 |

| SVM | SOVEREIGN METALS | 0.125 | -8 | 32 | $44,909,208.00 |

| JRL | JINDALEE RESOURCES | 0.37 | -9 | 17 | $12,265,669.00 |

| CFE | CAPE LAMBERT RESOURCES | 0.011 | -9 | -70 | $10,199,278.00 |

| ARE | ARGONAUT RESOURCES | 0.005 | -9 | -76 | $7,771,903.00 |

| GPX | GRAPHEX MINING | 0.215 | -10 | -4 | $21,154,850.00 |

| RNU | RENASCOR RESOURCES | 0.017 | -11 | -15 | $20,761,638.00 |

| WKT | WALKABOUT RESOURCES | 0.31 | -11 | 224 | $120,382,904.00 |

| SI6 | SIX SIGMA METALS | 0.004 | -11 | -71 | $2,247,512.50 |

| POW | PROTEAN ENERGY | 0.008 | -11 | -74 | $2,491,498.00 |

| HIP | HIPO RESOURCES | 0.008 | -11 | -62 | $3,092,083.75 |

| MQR | MARQUEE RESOURCES | 0.11 | -11 | -60 | $5,441,888.00 |

| AVZ | AVZ MINERALS | 0.047 | -12 | -62 | $105,990,832.00 |

| VML | VITAL METALS | 0.011 | -12 | 28 | $20,911,336.00 |

| PGM | PLATINA RESOURCES | 0.043 | -12 | -52 | $11,093,302.00 |

| SYA | SAYONA MINING | 0.007 | -13 | -85 | $12,058,020.00 |

| THR | THOR MINING | 0.013 | -13 | -69 | $9,859,762.00 |

| MRR | MINREX RESOURCES | 0.01 | -17 | -76 | $958,777.25 |

| SUH | SOUTHERN HEMISPHERE MINING | 0.032 | -20 | -47 | $2,831,023.00 |

| WCN | WHITE CLIFF MINERALS | 0.005 | -20 | -94 | $1,881,399.50 |

| ANW | AUS TIN MINING | 0.007 | -22 | -50 | $15,227,549.00 |

| ADV | ARDIDEN | 0.004 | -25 | -75 | $5,071,560.50 |

| MLS | METALS AUSTRALIA | 0.002 | -25 | -75 | $4,390,796.50 |

| LKE | LAKE RESOURCES | 0.063 | -28 | -44 | $31,085,468.00 |

| GPP | GREENPOWER ENERGY | 0.002 | -50 | -82 | $1,943,207.13 |