Bargain Barrel: This company is short circuiting the usual project life cycle

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

In this week’s look at the bottom end of town, Stockhead takes a closer look at a minerals company that is skipping past the normal steps of finding and developing a resource and heading straight to the refining stage.

We also check out an explorer hoping that early cash flow from its iron ore project could feed its other larger projects.

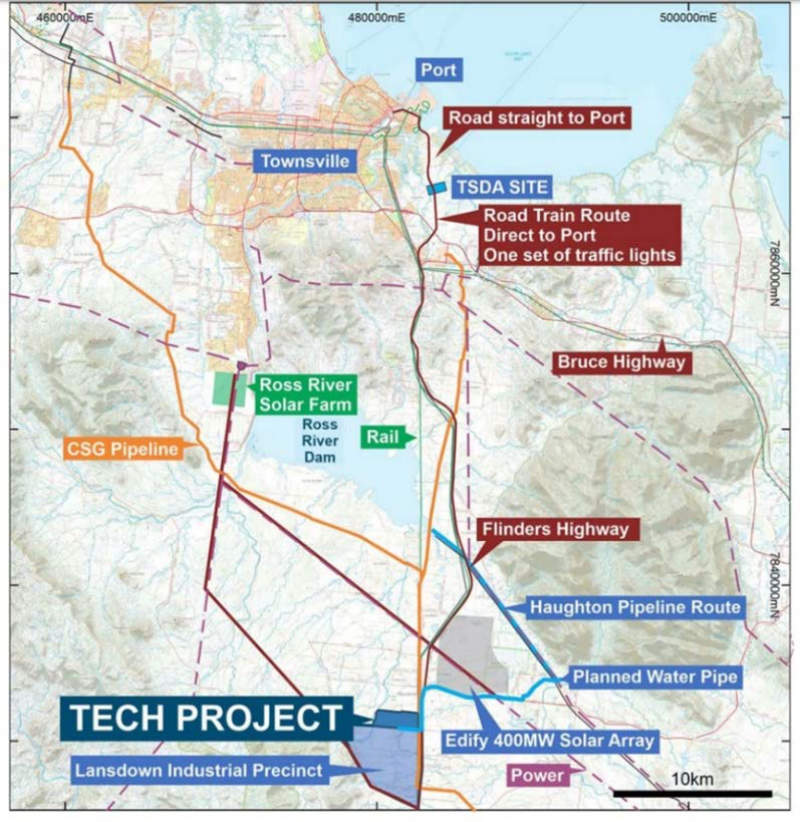

We take a look first at Pure Minerals (ASX:PM1), which is planning to import high-grade limonite type lateritic ore from New Caledonia for processing into battery grade nickel and cobalt sulphate at its Townsville Energy Chemical Hub (TECH) project in northern Queensland.

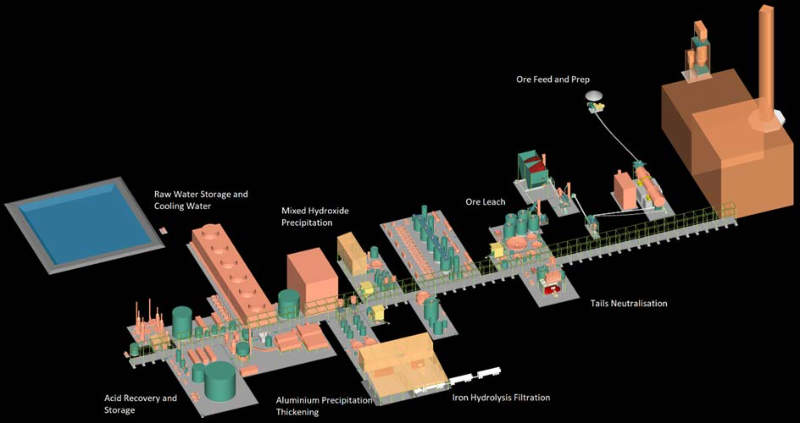

The company already has a scoping study on an operation processing 600,000 tonnes of ore to produce 25,000 tonnes of nickel sulphate and 3,000 tonnes of cobalt sulphate annually along with other valuable co-products.

This had estimated the upfront capital required to build the refinery at $US297m ($429.6m), which includes a contingency of $US65m and could be reduced through further feasibility and optimisation work.

Pure’s TECH project will use processing technology licences from Direct Nickel Projects that is expected to result in lower capital and operating expenditure compared to other nickel laterite processing operations that employ high pressure acid leaching technology.

Direct Nickel’s DNi process uses nitric acid leaching under atmospheric conditions, allowing the plant to be constructed using stainless steel, which lowers capex.

Additionally, the process recycles most of the nitric acid; has the ability to extract co-products such as iron, magnesium oxide and alumina; and has a reduced residue footprint.

The company also has a 10-year agreement with its New Caledonian suppliers Societe des Mines de la Tontouta (SMT) and Societe Miniere Georges Montagnat (SMGM).

Managing director John Downie told Stockhead that its suppliers probably export 6 million tonnes of ore per year between them to companies such as Sumitomo in Japan and POSCO in South Korea.

However, he noted that the ore bodies had two profiles.

“There’s limonite at the top and a saprolite at the bottom, most of the ferro-nickel people like Posco and Sumitomo generally take the saprolite,” Downie added.

“They (SMT and SMGM) are looking for partners that will take limonite, we are taking the limonite and processing it because typically, the limonite has more cobalt in it but less nickel and has a lot more iron.

“And you have to get rid of the limonite on top before you can get to the saprolite below it.”

Both SMT and SMGM supplied Clive Palmer’s Queensland Nickel from 1989 to 2016, firmly establishing their credentials as reliable suppliers.

This includes a substantial limonite fraction and when Queensland Nickel closed, it left the suppliers in a bit of a quandry.

“That was the catalyst that led us to think that maybe we should be filling that gap,” Downie said.

Looking ahead, Downie said the company was looking to release its pre-feasibility study, run the pilot plant in Perth and secure offtake commitments.

“The first big milestone is the completion of the pre-feasibility study, which we are working on now and are about one or two weeks away from making a related announcement on,” he added.

“The second is running 100 tonnes of ore through the pilot plant in Perth, which is capable of processing about 1 tonne per day, to produce some high-quality nickel and cobalt sulphate that battery manufacturers can test in their laboratories.

“We will then be looking to establish offtake agreements, which is an important step for this project as it is the most likely funding route.

“By the end of 2020 or early 2021, we want to finish the final feasibility study and the firm numbers for building the plant. Hopefully that will signal the final investment decision.”

Listen:

The Explorers Podcast with Barry FitzGerald: Pure Minerals

First the iron, then lithium

Our other highlighted company is Strike Resources (ASX:SRK), which owns the Solaroz lithium project that neighbours Orocobre’s producing Salar de Olaroz project in Argentina, and the Apurimac high-grade magnetite iron ore project in Peru.

However, it is the company’s Paulsens East iron ore project in Western Australia’s Pilbara region that could be the first cab off the rank.

Paulsens East’s currently has a resource of 9.6 million tonnes grading 61.1 per cent iron ore, a high grade that makes the project a candidate for a potential 1-million-tonne-per-annum direct shipping ore (DSO) operation.

DSO refers to minerals that require only simple crushing before they are exported, which keeps costs low.

Metallurgical test work completed last month also highlighted the project’s ability to produce a premium high-grade “lump” product, low levels of harmful minerals such as sulphur, and low degradation during transport.

Lump iron ore typically attracts a price premium compared to iron ore fines of the same grade, which is further supported by the Paulsens East lump material having an average 2 per cent higher iron ore grade than the fines material.

With this objective in mind, Strike also recently appointed former Brockman Resources managing director Wayne Richards and its own alumni Shanker Madan to help bring the project into production.

“The main milestone in the near-term is the completion of our scoping study on the Paulsens East project. We haven’t yet publicly announced when that is likely to be finished, but it is on its way,” managing director William Johnson told Stockhead.

“The scoping study will include an estimation of the economics of the project and likely timing. That will be a big milestone

“From that, we will probably announce a range of agreements that we will be putting in place with potential contractors, service providers around that project.

“We have clearly stated that we would like to fast track the project into production as quickly as we can to take advantage of current iron ore prices.”

He added that the next milestone would be the approval of the company’s environmental permit to start exploration activities at the Solaroz lithium brine project in Argentina.

Solaroz is located in the heart of South America’s “Lithium Triangle”, which hosts the world’s largest reserves of lithium.

Lithium brines are currently responsible for most of the world’s supply, and those producers in Argentina are among the lowest on the lithium carbonate cost curve thanks to their world-leading operating costs and a production process that is both simpler and more environmentally friendly.

To provide some context into the potential that Strike could be looking at, Orocobre’s Salar de Olaroz project has a measured and indicated resource of 6.4 million tonnes of lithium carbonate, which is capable of sustaining current continuous production for 40-plus years, with only 15 per cent of this resource extracted to date.

Strike also owns the Apurimac iron project that has a resource of 296 million tonnes at 57.3 per cent iron at the Opaban deposit.

While this has been on the backburner in favour of the company’s smaller, more easily commercialised projects, the current high iron ore price has led the company to re-examine the project to determine if it can capture some value in the near-term.

“We are still evaluating our options for Peru. One thing that we are still working on is if we can get some small-scale, near-term production from there,” Johnson added.

Read more Bargain Barrel:

These are some ASX small caps with a steady stream of upcoming news flow

These are some of the ASX’s most intriguing small cap stocks

At Stockhead, we tell it like it is. While Strike Resources is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.