Bargain Barrel: These are some ASX small caps with a steady stream of upcoming news flow

In this edition of Bargain Barrel, we look at two companies that have a solid stream of upcoming news that could provide substantial upside.

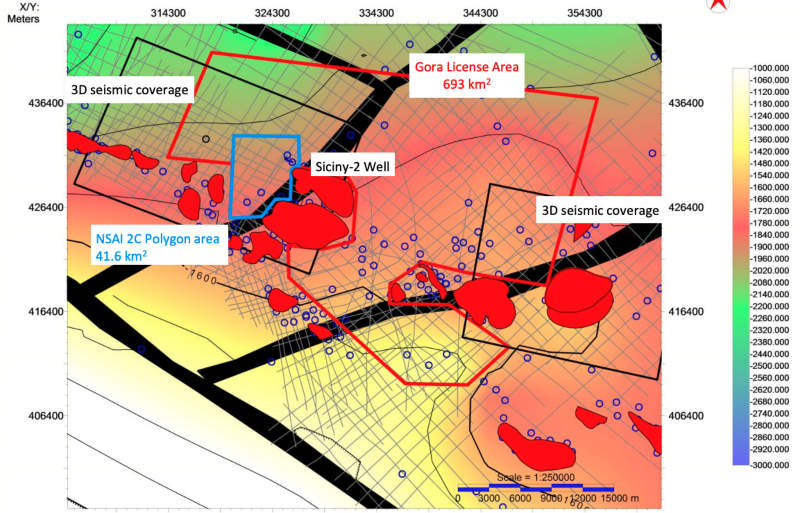

Ansila Energy (ASX:ANA), formerly Pura Vida Energy, recently kicked off the work program for the Siciny-2 gas well in the Gora concession, Poland.

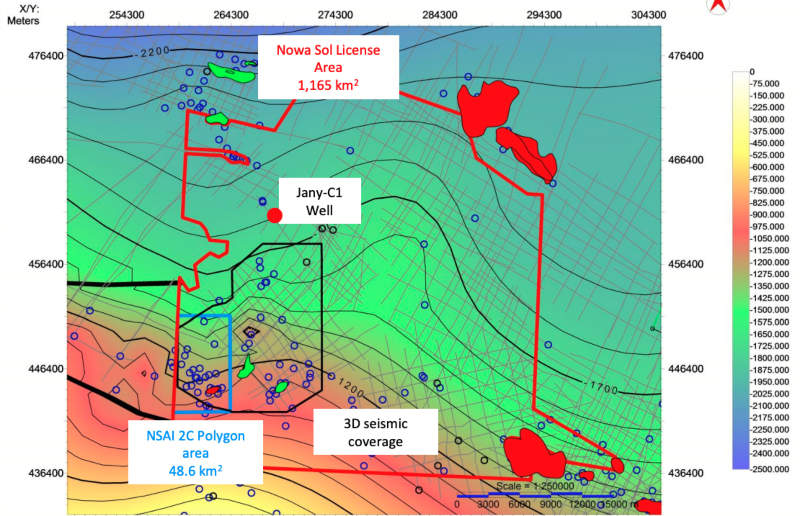

The company is earning up to 35 per cent in the Gora and Nowa Sol concessions by spending a total of $6.15m on fracture stimulation and testwork.

“You have got a lot of news flow to go around, site preparation in October, well integrity and well clean-up, all your different reservoir tests and all the fracking to go, and then you commence the well testing,” CPS Securities representative Tim Neesham told Stockhead.

“And you are funded for 12 months, so you are not going back to the market through any of this positive newsflow and any potential upside.”

He added that Ansila had several different avenues for upside.

“Given the size of what they are looking with the independently assessed 2C resource of 1.6 trillion cubic feet (Tcf) of gas (at Gora) and 36 million barrels of oil (Nowa Sol), you have got the potential for people to start trying to value, research and price all that on potential success,” Neesham said.

Ansila executive director Nathan Lude added that the work programs at both Gora and Nowa Sol were aimed at converting the contingent resources — the potentially recoverable discovered oil and/or gas volumes associated with the project — into proved and probable reserves — the oil and/or gas volumes that are anticipated to be commercially recoverable.

“Establishing a reserve will allow us to attribute a dollar value to our oil and gas, which the company can benchmark,” he told Stockhead.

Lude also noted that the work on both the Siciny-2 gas well and the Jany-C1 oil well was not about discovering resources but rather about appraising their ability to flow gas or oil at commercial rates.

“These vertical wells upon success, we will then undertake development where you will look at production,” Lude said.

Ansila previously said that development of Gora and Nowa Sol would require the drilling of horizontal wells with multiple stage fracks.

“The exciting thing about the unconventional gas play in particular, there is a 9Tcf potential if the play proven up in the block,” Lude added.

“It is a much wider potential that gives the company flexibility in relation to deciding between immediate development or assess the opportunity of this 9Tcf play across the basin.

“That is where you have majors very interested in this opportunity and potential farm-in interest for a basin wide play.”

He also noted that the company had the opportunity to assess other projects in Poland.

“The macro market in Poland is significant because it is in their national interest to develop domestic gas projects as they are a gas importer from Russia,” Lude said.

“There have been significant issues with Russia turning off the gas supply to Europe and Ukraine.”

Read more: Pura Vida is mapping out Poland gas development strategy

Listen: The Wildcatter Podcast with Peter Strachan: Ansila Energy

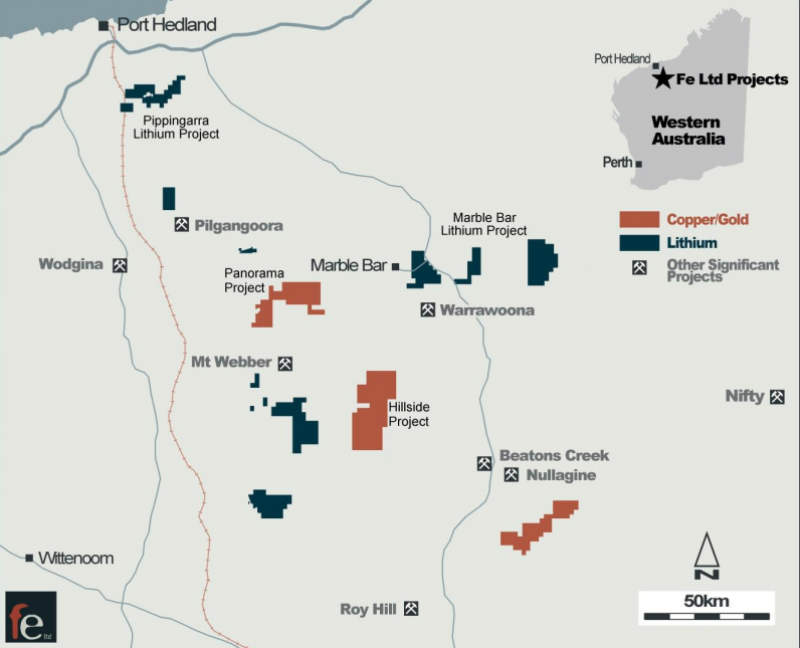

Also featuring in this week’s edition of Bargain Barrel is Fe Limited (ASX:FEL), which recently recovered copper, gold and cobalt samples from outcrops at the Hillside project in WA’s Marble Bar district.

This included a top result of 18.8 per cent copper, 1.2 parts per million (ppm) gold, 77ppm silver, 0.17 per cent zinc and 0.057 per cent cobalt.

The company also recovered rocks with up to 46 per cent manganese content in outcrop from a newly discovered oxide horizon.

Hillside is included in the company’s exclusive option to acquire up to 75 per cent in the Macarthur Minerals lithium and gold tenements in the Pilbara.

Executive director Tony Sage told Stockhead that the Hillside anomaly or ore body appeared to be quite extensive and extended over 14km of strike.

“We have got a program of works approved by the government so we can go in. We are going to cut a road to get drill rigs on site and hopefully we are up and running soon,” he said.

Fe plans to drill 20 exploration holes in the area where it recovered the significant copper samples.

“Once we complete drilling, we will take the core back and get them assayed,” Sage added.

“The next four to six weeks could be very exciting for the company in that regard, just the waiting for the results.”

He also said the company would carry out a mapping program on the manganese find.

“We want to know what the extent of that particular discovery is,” Sage explained.

Adding interest is the company’s iron ore royalty with Mineral Resources (ASX:MIN).

“We kept this ground for many years and when the iron ore price fell, Fitzroy River, who we had the original agreement with, sold their iron ore asset to Mineral Resources,” Sage said.

When iron prices recovered, Mineral Resources went ahead and started mining over the royalty project and subsequently started sending Fe cheques covering its royalty share.

“So far we have received $500,000 in royalties and we expect that number to increase over the next few years,” Sage said.

“It is exciting for the company, it means we don’t have to dilute our shareholders for the current drilling program by using the royalty stream income.

“There is enough ore there for two or three more years.”

Sage also noted that the company held 20 per cent stakes in several areas around Degrussa, Sandfire Resources’ (ASX:SFR) main asset.

“We don’t have to spend any of our money, someone else is drilling and if they find any copper, obviously our share price will grow.”

Read more Bargain Barrel:

These are some of the ASX’s most intriguing small cap stocks

At Stockhead, we tell it like it is. While Ansila Energy is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.