Bargain Barrel: These resource juniors are taking the low-cost route to production

Pic: John W Banagan / Stone via Getty Images

In this edition of Bargain Barrel before we take a break for the holidays, we look at two junior resource companies – one focused on gold and the other on rare earths – that have established resources and clear, low-cost paths towards production.

We start with Alt Resources (ASX:ARS), which executive director Andrew Sparke considers as one of the rare breed of ASX-listed resource companies that are making the transition from exploration to production.

“In 12 months, we have drilled about 40,000m and went from zero ounces in the ground to just over 406,000 ounces of gold and just under 4 million ounces of silver. By any metric that’s quite a remarkable effort for a junior company,” Sparke told Stockhead.

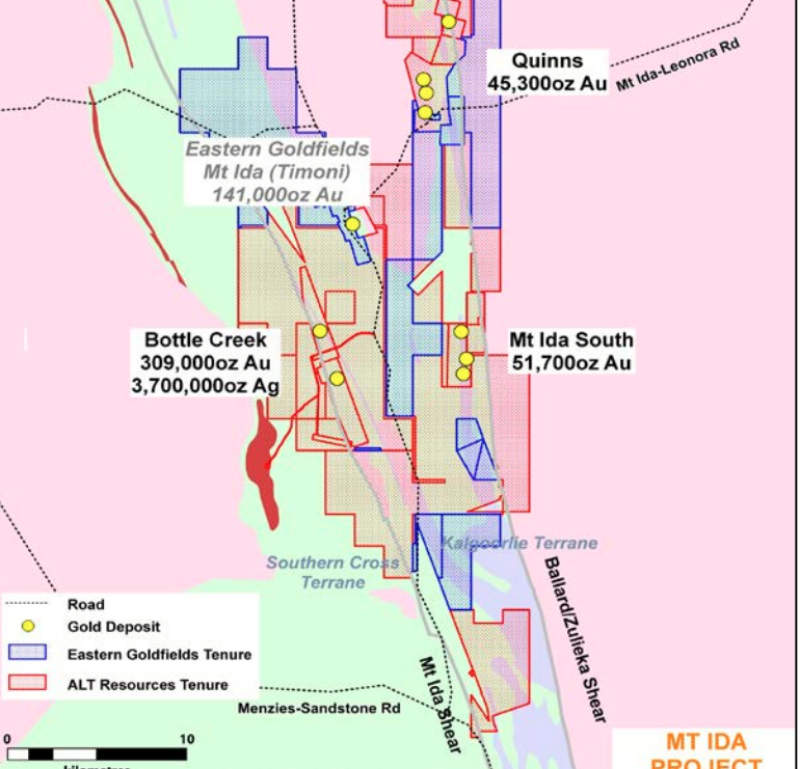

This resource is contained largely within the historic Bottle Creek open pit mine at the company’s Mt Ida gold project in the well-known Goldfields region of Western Australia.

Bottle Creek produced 93,000 ounces of gold in 18 months between 1988 and 1989.

It has existing infrastructure, such as an airstrip and exploration camp, that places it right smack at the centre of a standalone development that will produce 30,000 to 32,000 ounces of gold per annum throughout its six-year mine life under a scoping study that was released in July.

This could generate revenue of just under $350m and earnings before interest, tax, depreciation and amortisation of $132m over its life for a rather inexpensive capex of about $30m.

All this is calculated at a conservative gold price of $1,800 per ounce, well below the current price of $2148.

And there is further room for improvement.

In the first quarter of 2020, Alt will release drill results from its recent 2,500m of drilling and more importantly a resource upgrade for Bottle Creek.

“The number of ounces we produce on an annual basis will grow. The numbers will also improve as we add economics of scale over time,” Sparke said.

Here is where it gets interesting, as development of Bottle Creek is actually the second phase of the company’s entry into production.

Alt plans to start production as early as the second quarter of 2020 with small scale mining at the Tim’s Find deposit to generate cashflow to fund further exploration and development.

Tim’s Find, located 5km east of Bottle Creek, has a scoped mining target of 178,000 tonnes at 2.6 grams per tonne, or 14,718 ounces of contained gold, and is expected to be a low-risk open pit operation.

Ore from Tim’s Find will be treated at a nearby third-party facility and Alt has several to choose from.

The company is also working towards delivering a feasibility study and maiden reserve for Bottle Creek in the second quarter of 2020.

Alt believes this provides potential for the company to be re-rated given that its enterprise value hovers between $20-22 per resource ounce, while its developing peers are valued at more than $200 per reserve ounce.

Additionally, further exploration is expected at the Shepard’s Bush prospect, which the company believes has the potential to deliver some bulk tonnage resources.

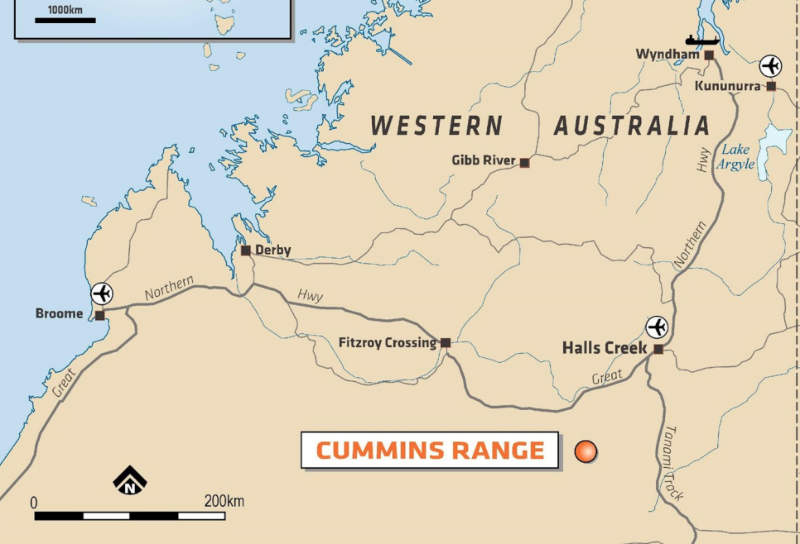

Our other play is RareX (ASX:REE), formerly Sagon Resources, which has a current resource of 13 million tonnes grading 1.13 per cent total rare earth oxides at its Cummins Range project – the fourth largest rare earths resource in Australia.

Cummins Range is believed to contain a high percentage of neodymium and praseodymium, critical elements used in permanent magnets which are critical to the manufacture of things like electric vehicles, wind turbines, and military hardware.

Additionally, about $5m was invested by a previous explorer into Cummins Range on exploration between 2007 and 2012, which allowed the company to skip some of the early exploration steps.

But it is the low-cost approach to development that sets RareX apart from its fellow Australian rare earth companies.

The company is looking to produce a monazite concentrate, a rare earths-rich mineral, which grades 30 to 60 per cent rare earths oxide that is upgraded through gravity and flotation before it is sold to pre-existing downstream processing plants.

And there is a ready market, monazites are already being sold by South African producers into China.

This will allow RareX to commercialise its project without the need to construct expensive processing plants like those developed by rare earths producer Lynas (ASX:LYC).

So just what are some of the milestones ahead for RareX?

The company recently kicked off a passive seismic survey to define further targets that could grow the existing resource.

While this method has never being used at Cummins, it is expected to help identify deeply weathered “channels” that accumulate the rare earth minerals.

Results from this survey will be incorporated into an enlarged exploration program early in 2020.

“Probably around March 2020 we will be drilling at Cummins Range. It will be infill and exploration extension work,” executive director Jeremy Robinson told Stockhead.

“In the June quarter, we will be getting back those assay results and interpreting them, and also kicking off our metallurgical program.

“Then in September quarter, we should get some of our metallurgical results back and also be doing a resource update.

“Following on from that we should be working on the pre-feasibility study and commencing offtake discussions.”

Robinson noted that in terms of the rare earth market, 2020 was expected to be a strong one for the rare earths sector due to the ongoing trade tensions between the US and China.

“Supply and demand fundamentals look stronger than ever with the EV boom,” he said.

Additionally, while the company’s focus is squarely on Cummins Range, it recently acquired the Weld North project that is 84km north of Lynas’ Mt Weld mine in Western Australia.

Evaluation is currently underway to uncover the prospective areas of the overall tenement package.

Now read:

‘Proven resource, metallurgy, and jurisdiction’: Sagon’s Jeremy Robinson on the transformative Cummins Range rare earths project

Australia and the US aren’t messing around, they’re getting even more serious about critical minerals

The government pledges cheap funding for Australian rare earths projects

At Stockhead, we tell it like it is. While RareX is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.