Bargain Barrel: Here are seven gold stocks under a $10m market cap

We’ve put together some bargain barrel goldies that could benefit from the bull run. Pic: Getty Images.

- Gold looks set to outperform this year, with the price already passing US$3100/oz

- Investors’ interest in the precious metal usually peaks in times of economic turmoil (we’re looking at you Mr Trump)

- These sub $10m market cap stocks could be set to benefit from the bull run

Gold looks set to outperform this year, after a stellar start to 2025, running up to more than US$3100/oz as Donald Trump shook markets with heavy tariffs on the US’ trading partners.

That sent gold beyond $5000/oz Australian for the first time, with average AISC margins nearing on $3000/oz assuming production is unencumbered by hedges.

Goldman Sachs analysts reckon gold miners’ margins are poised for a ‘two-pronged expansion’, with rising gold prices and moderating unite cost pressures to thank.

And even with ASX and global gold equities lifting 30-40% against gold’s 19% rise in the March quarter, there remains upside as margins grow.

The demand for the precious metal has been accompanied by growing interest in gold companies that has seen the ASX All Ordinaries Gold (Sub Industry) index rise 43.7% from 7493 points a year ago on April 2, 2024 to 10,767 on March 27, 2025.

It has also seen a rise in merger and acquisition activity in the sector with Northern Star Resources (ASX:NST) move to acquire De Grey Mining (ASX:DEG) in an all-scrip deal worth $5 billion in December last year and Ramelius Resources’ (ASX:RMS) $2.4bn cash and share deal to acquire Spartan Resources (ASX:SPR) in mid-March 2025 being standouts.

While most of the interest on the ASX been focused on gold producers, interest has also started to trickle down to explorers thanks to the growing realisation that even companies with relatively small resources or formerly uncommercial ones might have a pathway to quick commercial production – or acquisition by the big miners – if the stars align.

Today we’re focusing on a bargain barrel of sub $10m gold explorers.

Who’s got a market cap under $10m?

Norwest Minerals (ASX:NWM)

Market cap: $4.85m

Norwest is energising its return to the gold market, signing an access agreement with the pastoral lease holder of Marymia Station in WA to progress its Bulgera gold project.

That was followed by the signing of a State Deed for the grant of the mining tenement at Bulgera last month with the approval of the Marputu Aboriginal Corporation, something that should lead to the formal grant of the project’s mining lease.

“I would like to thank the Marputu AC and its representatives Central Desert Native Title Services for their continued support. The execution of the State Deed is a key milestone in advancing the development of the Bulgera Gold Project during a period when the strong gold price has potential to benefit all stakeholders,” NWM CEO Charles Schaus said at the time.

Located just 50km northeast of Catalyst Metals’ (ASX:CYL) Plutonic gold project and mill, Bulgera already has a resource of 6.3t at 1.07g/t gold for 217,600oz, along with oxide stockpiles thought to exceed 2Mt of material from open cuts mined before 2004.

Records suggest gold grading under 1g/t was stored onsite, with the 2Mt estimate assessed via aerial surveys.

Further mapping has been undertaken on base and precious metals targets 10km away at Marymia East.

NWM has additional projects in the West Arunta region, a district famed for its niobium discoveries led by WA1 Resources (ASX:WA1) and Encounter Resources (ASX:ENR), but thought to be prospective for a host of base metals.

So far, they’ve reported some solid results including 28g/t silver, 0.19% copper, 1.6% lead and 5.1% zinc.

And last month, NWM found titanium-rich zones grading between 0.7% to 1% TiO2 at the Malibu and Dales discoveries – which could quickly become highly valued considering titanium is near the top of the USA’s list of critical minerals.

Alice Queen (ASX:AQX)

Market cap: $5.73m

Last month the Fijian gold explorer confirmed the continuity of high-grade epithermal gold at the Dakuniba prospect at its Viana project from surface to 175m depth.

The continuity is the key here, with epithermal deposits sought after globally due to their high-grade – and continuity.

The company has intersected up to 8.52g/t gold and 13.1g/t silver in two diamond drill holes, with a third hold underway to test 100m deeper.

Looking ahead, AQX says the next phase of drilling will test for strike extensions to the mineralisation along the west-northwest, east-southeast zone of veining and gold anomalism.

Given that the surface strike is greater than 3km, the company says it will design its next holes to test the lateral strike extent of the high-grade gold epithermal system at Viani.

Asra Minerals (ASX:ASR)

Market cap: $7.11m

Asra owns 936km2 of highly prospective gold tenure in the Goldfields region, with its Leonora North – Mt Stirling asset immediately surrounded by 12.4Moz gold miner Vault Minerals (ASX:VAU) .

It’s not the only giant in Asra’s orbit. Down the road is $2.4bn gold giant Genesis Minerals (ASX:GMD) and its 2Moz Leonora and Kookynie operations, long mooted as a potential merger partner with Vault. Its Gwalia and Laverton mills are known to be hungry for more ore.

Asra already has a 152,000oz gold deposit in place at Mt Stirling and more than 20 major gold prospects that have never been drill tested.

Further south at the newly acquired Kookynie East gold tenements, a huge amount of historical workings and intercepts such as 6m at 166g/t gold and 9m at 4.3g/t have laid relatively dormant since 1992, before Genesis started drilling on the northern side of the Kookynie structure in 2015.

ASR believes there is a massive opportunity to expand on what has already been done and expects the next six to 12 months to be a busy period for the budding gold junior.

Western Gold Resources (ASX:WGR)

Market cap: $9.48m

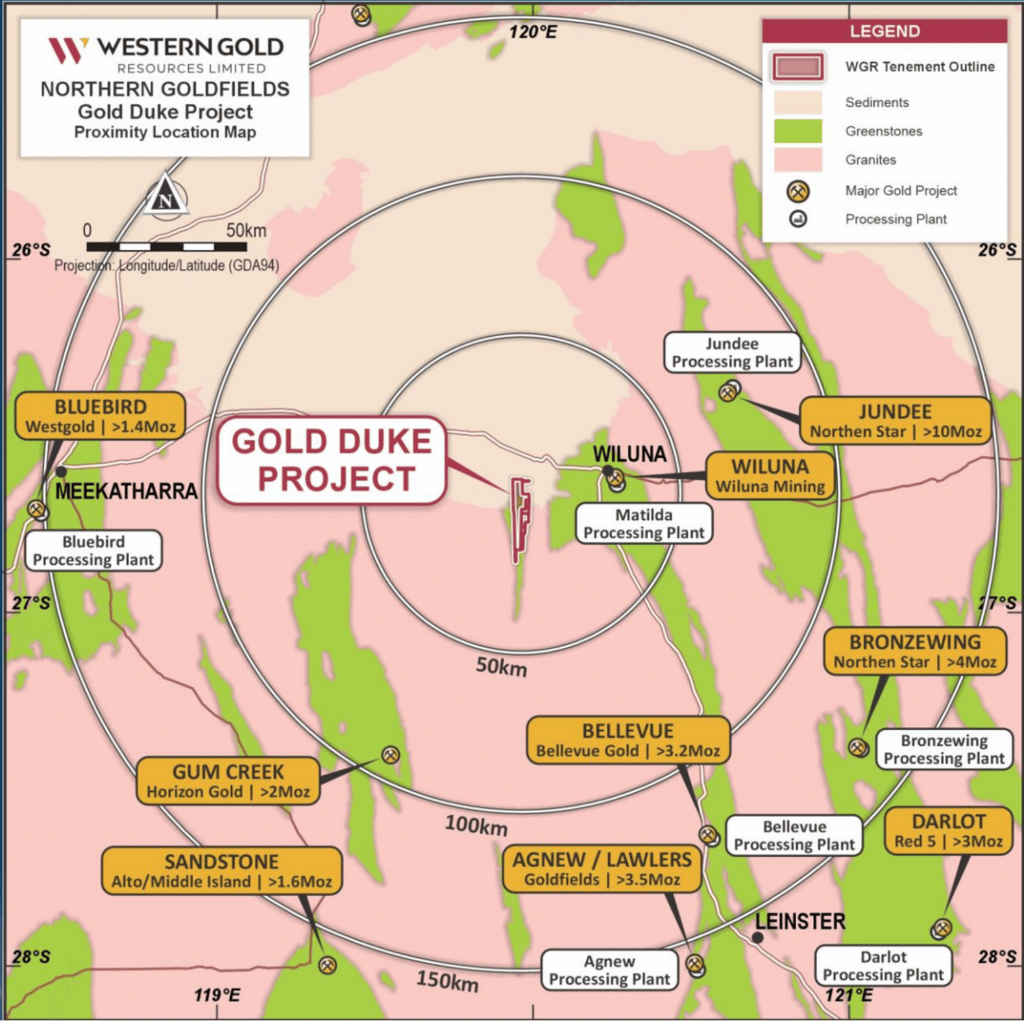

WGR is approaching near-term production of Stage 1 of its Duke Gold project, which hosts a resource of 3.25Mt at 2.1g/t gold for 214,000oz of gold.

Stage 1 production will focus on the four deposits across Eagle, Emu, Gold King, and Golden Monarch, with a production target of 447kt of 2.55g/t for 34,000oz.

Based on a then gold price of $3500/oz, the operation would cost just $2.1-2.5m to bring into production and generate an estimated undiscounted accumulated cash surplus of $38.1m, which highlights the upside at current gold prices.

And with gold prices already climbing well above those levels, it could be perfect timing for the company to come into production.

On the metallurgical front WGR reported recoveries of up to 95.1% from testwork at the project – highlighting the potential for excellent gold recoveries through a conventional crush, grind and carbon in leach (CIL) treatment.

That bodes well for the plan to be in production within seven to eight months of signing a toll treatment or ore purchase deal.

The company is already in discussions with multiple plant owners in the region, the closest being Wiluna, less than 50km away.

TG Metals (ASX:TG6)

Market cap: $7.45m

While still focused on their Lake Johnston lithium project, the company just picked up an 80% stake in the Van Uden gold project, adding four granted mining leases to its portfolio on the Forrestania greenstone belt, about 90km northeast of Hyden.

The project is strategically located to the south of the operating Marvel Loch gold processing plant and to the north of TG6’s established Burmeister lithium deposit, where an exploration target of 15.6Mt to 20.1Mt grading 0.97% Li2O and 1.19% Li2O resides.

TG6 CEO David Selfe said at the time that the acquisition provides the company with opportunities for near term cash flow, at a time of record prices for gold.

“The Van Uden Gold Project has historically only been subject to shallow drilling, providing enormous exploration upside through testing the known mineralisation down dip along its entire plus 2,000m strike length,” he said.

“There are several near-term high priority opportunities, including defining a JORC mineral resource estimate from the extensive historical database, and assessing the viability of existing ore stockpiles for toll treatment.”

Miramar Resources (ASX:M2R)

Market cap: $1.82m

The company recently raised $1.8m in a placement to sophisticated investors, returning to exploration at its Gidji JV just 15km north of Kalgoorlie, which sits adjacent to deposits held by Northern Star Resources.

While it would have been an understandable decision to divest gold tenements through the heights of the battery boom, Miramar saw some future benefit in playing the dragon and sitting on its gold portfolio until investor interest turned.

There are multiple walk-up drill targets to investigate, including several shallow high-grade gold results, that require infill and/or extensional aircore drilling followed by systematic bedrock testing.

This placement will enable M2R to kick-start those drilling programs in a record gold price environment.

Plus, the company has also just found several new gold targets on recently submitted tenements at the Randalls project east of Kalgoorlie.

First off the rank is likely to be the Lone Pine Dam target, where results to the tune of 4m at 6.07g/t gold from 4m remain open along strike for several hundreds of metres.

The Venetian and Campese targets likewise had gold anomalism defined over significant stretches of strike but similarly had recommended follow ups which never occurred.

It allows the company to now walk up and drill surrounded by major deposits and into record gold prices.

Infill and extensional drilling is planned at Randalls, with systematic bedrock testing scheduled at Gidji.

Mt Malcolm Mines (ASX:M2M)

Market cap: $5.43m

The company’s namesake project hosts numerous gold and nickel mines dotted along its entire length including the historical Gwalia deposit now owned by Genesis Minerals and Northern Star’s Carosue Dam operations.

Earlier-stage projects like Bulletin Resources (ASX:BNR) Lake Rebecca asset and Nexus Minerals (ASX:NXM) Wallbrook tenement package are also in the area, as are a number of processing facilities such as Vault Minerals‘ King of the Hills mill, where an $80m expansion to 6Mtpa is underway.

The Golden Crown deposit is a historical producer, and recent bulk sampling has produced 2972g (or 95.54 ounces) of gold doré from the processing of 200 wet metric tonnes (WMT) of high-grade material.

Metallurgical questions were also answered, with the company treating Mt Malcolm ore alongside the bulk sampling, which further de-risked the asset.

Overall, a cumulative recovery of 6780g (or 218oz) of gold doré was processed from 812 WMT of high-grade material, validating the effectiveness of wet gravity recovery for the coarse nature of Golden Crown mineralisation.

An exploration target for the stockpiles from the bulk sampling program is estimated at 2200 to 2500 WMT tonnes of material, with a grade ranging from 2.6g/t gold to 3g/t gold.

Doré sales to The Perth Mint generated $835,462 with gold purity ranging from 85.6% to 94.5% gold.

M2M is now looking to use these insights gained from the bulk sampling to guide upcoming drilling programs focused on advancing resource estimations and setting forward the groundwork for an economic study.

At Stockhead, we tell it like it is. While Norwest Minerals, Alice Queen, Asra Minerals, Western Gold Resources, TG Metals, Miramar Resources and Mt Malcolm Mines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.