ASX iron ore companies Fenix and Tombador advance towards first shipments

Tombador Iron has started up its Brazilian iron ore project. Copacabana beach in Rio de Janeiro. Image: Getty

- Fenix Resources expands iron ore project area under farm-in deal

- Tombador Iron completes construction of its iron ore mine in Brazil

- Iron ore prices continue to trade at near decade highs of $US160 per tonne

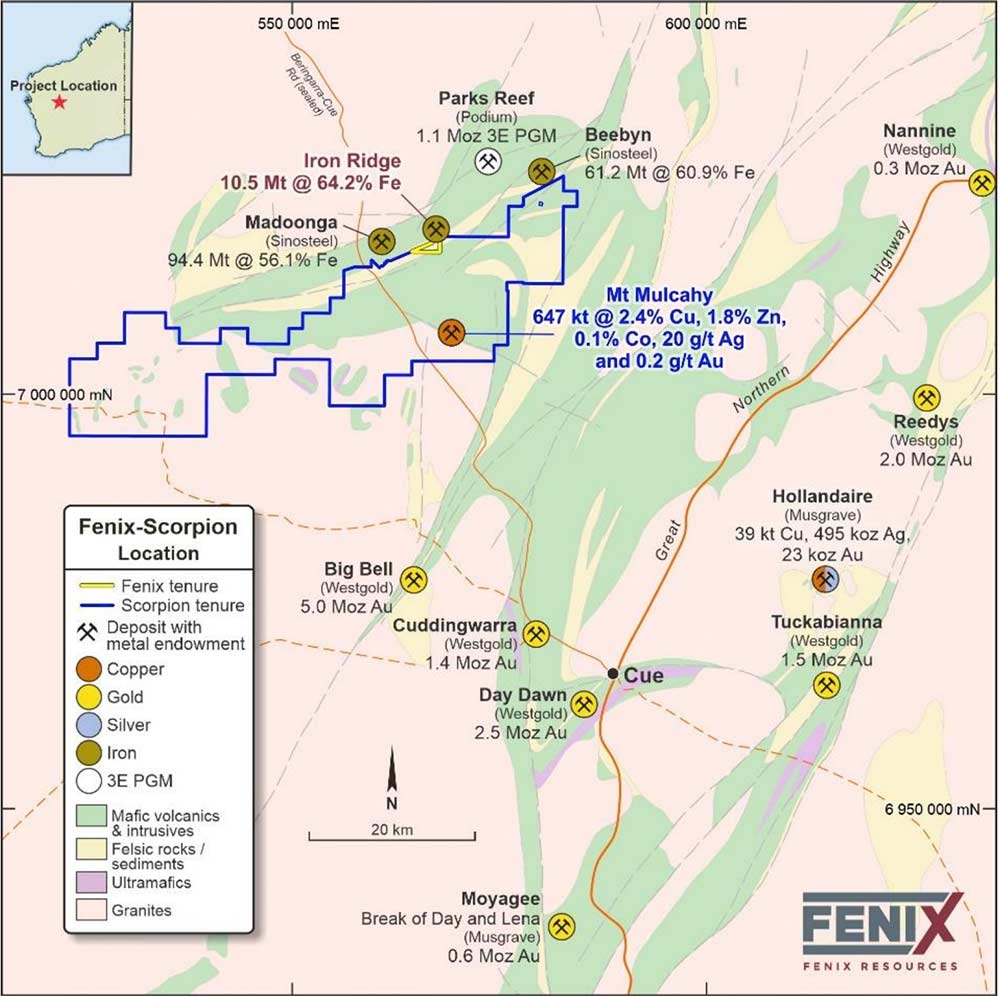

West Australian iron ore producer Fenix Resources (ASX:FEX) has expanded the footprint of its Iron Ridge project for direct shipping ore by teaming up with Scorpion Minerals (ASX:SCN) which has adjacent tenements.

Fenix Resources has activated a farm-in and joint venture agreement with Scorpion Minerals to earn a majority interest in 33,950 hectares of tenements next to its Iron Ridge project.

“Fenix is excited by the opportunity to increase its land holding and, potentially, its iron ore resource to further benefit from the regional infrastructure, ore transport and port facilities already established for the Iron Ridge project,” managing director Rob Brierley said.

Fenix has the right to earn a 70 per cent interest in its iron ore tenements over a four-year period.

Fenix has to fund the cost of drilling for a resource of up to 10 million tonnes of iron ore, and complete a feasibility study for a 1 million-tonne deposit.

The Iron Ridge project for 64 per cent direct shipping ore is 490 km by road to Geraldton port in WA, and its ore requires only crushing and screening before shipping.

Shipping target of 1.25 million tonnes for Iron Ridge

High-grade iron ore such as Fenix Resources’ commands a premium in the seaborne market as Chinese steel mills demand purer product to reduce their emissions.

The company has a production target of 1.25 million tonnes per year, and has secured offtake sales for 50 per cent of its production with Chinese company Sinosteel.

Iron Ridge started production in December, and its first shipment through Geraldton port is scheduled for early February 2021.

Fenix Resources will join GWR Group (ASX:GWR) as WA’s latest iron ore producers, as GWR is on target to ship its first ore from Geraldton port this week.

The project has a capital cost of $12m, all-in cash costs of $77 per tonne, and is forecast to generate $16.4m of annual earnings before interest, taxes and depreciation.

Iron ore prices remain at elevated levels and shipments landed in China are attracting $US160 per tonne ($208.50/tonne), currently.

Tombador Iron closer to starting Brazil mine production

Meanwhile, another ASX iron ore company Tombador Iron (ASX:TI1) has moved closer to first ore production for its eponymous project in Brazil’s eastern Bahia state.

The company has announced the completion of mine construction for its Tombador iron ore project, and has successfully commissioned a crushing and screening plant.

The processing plant has a nameplate capacity of 400 tonnes per hour, indicating total annual production of around 3.3 million tonnes of iron ore from the project.

A first blast was fired at the mine as part of pre-stripping operations to remove overburden and access outcropping ore from the project’s main orebody.

“Now that the key mine infrastructure is constructed and commissioned, we are ready for the site inspection by the environmental bureau of the state of Bahia,” chief executive, Gabriel Oliva said.

The inspection is the final step in the approval process for an operating licence for Tombador, and is awaiting the granting of a mining concession from Brazil’s Ministry of Mines.

Offtake agreement inked with Trafigura

Tombador Iron last Thursday signed off on an offtake deal with international trading company Trafigura Group for 100 per cent of output from its project to export markets.

“With production on track to commence in Q2 2021, we are delighted to have forged a relationship with a company of the calibre of Trafigura,” said chief executive, Gabriel Oliva.

The supply deal for Tombador’s high-grade lump and fines products is for an initial three years, and thereafter will be automatically renewed on an annual basis.

“This partnership provides certainty for sales and working capital support, ensuring a smooth entry to the international market once operations start,” he added.

The offtake agreement has detailed terms relating to pricing, shipment and delivery and includes a pre-delivery partial payment.

Customer interest has been forthcoming from Brazil, South America, Europe and the Middle East, said the company.

High grade lump iron ore is scarce in the Atlantic Basin trading region, said Tombador in a presentation.

Tombador Iron has retained the right to make sales to the domestic market in Brazil either directly or through Trafigura.

The ASX company’s Tombador project has a mineral resource of 10 million tonnes and its hematite lump product has an iron content of 67 per cent.

ASX share price for Fenix Resources (ASX:FEX), Tombador Iron (ASX:TI1)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.