Bulk Buys: Lower steel mill margins pressure iron ore prices, coking coal prices pick up on Atlantic buying

Mining

Mining

Prices for Australian iron ore continued to weaken this week to $US157.05 per tonne ($205/tonne) but remain at decade-high levels underpinned by strong Chinese demand.

Infrastructure spending in China has bolstered its economy and driven demand for steel products in activities like construction leading to a strong pull for iron ore supply.

“China’s boost to infrastructure spending last year is the primary driver of China’s resilient steel demand and production,” said Commonwealth Bank of Australia (CBA) analysts.

“We expect China’s steel demand impulse will remain strong for a few months yet,” they said.

Analysts expect this trend to continue for some time still, but are starting to notice that steel plants in China are easing back on their demand because of price pressures.

The historically high iron ore price is starting to eat into the profit margins of steel producers, and in some cases steel companies in China are seeing losses, analysts said.

“China’s iron ore prospects are also hurt by the Ministry of Industry and Information Technology’s pledge to cut crude steel output this year,” said CBA.

China accounted for around 82 per cent of demand for Australian iron ore last year, making it a leading customer for the steel-making product by a long way.

A short-term factor for iron ore pricing is the appearance of a tropical weather system off the northwest WA coast that could present some disruption to shipping from Pilbara ports.

The low pressure system was traversing the inland Pilbara coast Tuesday and was threatening to turn into a tropical cyclone once it crosses the WA coast later this week.

“The tropical low should continue moving over land parallel to the west Pilbara coast today [Tuesday] and not reach tropical cyclone intensity until after it moves off the Ningaloo coast during Wednesday,” said the Australian Bureau of Meteorology in an update, Tuesday.

The weather system was accompanied by heavy rainfall in the Pilbara region, gusty winds and some flooding, it said.

If the tropical low does develop into a cyclone, ships destined for WA iron ore ports could delay their arrival or move further out to sea as a precautionary measure.

The Pilbara shipping hub includes the ports of Cape Lambert, Dampier and Port Hedland for which the largest shippers of iron ore are BHP (ASX:BHP), Fortescue Metals Group (ASX:FMG), Rio Tinto (ASX:RIO) and Hancock Prospecting’s Roy Hill operation.

Futures prices for iron ore were trading at a lower level than a week ago on the Singapore Exchange, with the month-ahead contract’s price at $US151 per tonne, down $US10 on week.

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| MGT | Magnetite Mines | 0.025 | 19 | 79 | 569 | $74.3M |

| FMS | Flinders Mines Ltd | 1.19 | -2 | 16 | -9 | $200.9M |

| MIN | Mineral Resources. | 36.64 | -6 | -2 | 115 | $6.5B |

| GRR | Grange Resources. | 0.345 | -7 | 17 | 47 | $381.9M |

| MAG | Magmatic Resrce Ltd | 0.145 | -9 | -12 | -61 | $26.3M |

| CIA | Champion Iron Ltd | 5.11 | -10 | 8 | 108 | $2.5B |

| FMG | Fortescue Metals Grp | 22.57 | -11 | -4 | 98 | $68.9B |

| SRK | Strike Resources | 0.225 | -12 | 55 | 389 | $54.4M |

| MGX | Mount Gibson Iron | 0.855 | -13 | -7 | -6 | $1.0B |

| TI1 | Tombador Iron | 0.072 | -13 | 24 | 242 | $52.0M |

| ADY | Admiralty Resources. | 0.013 | -13 | 8 | 117 | $13.9M |

| FEX | Fenix Resources Ltd | 0.225 | -13 | -2 | 350 | $95.3M |

| LCY | Legacy Iron Ore | 0.028 | -15 | -38 | 1767 | $174.9M |

| AKO | Akora Resources | 0.38 | -19 | 9 | 0 | $18.1M |

| EUR | European Lithium Ltd | 0.061 | -27 | 36 | -22 | $58.0M |

The ranks of Australia’s iron ore miners swelled this week with the arrival of GWR Group (ASX:GWR) which has made its first shipment of Pilbara product from WA.

A 30,000-tonne shipment of premium high-grade lump iron ore was loaded on board a vessel this week at the WA port of Geraldton.

Loading of the remaining 25,000 tonne cargo will be delayed until later this week because of a weather event and some maintenance at the port.

“The loading of premium high-grade lump ore on to our cargo ship has progressed well and will resume on the sixth day of this month,” chairman, Gary Lyons, said.

“We now expect the first historic shipment of iron ore to our offtake partner to leave the port of Geraldton on or before February 8, and we look forward to securing a vessel for our second shipment this month,” he said.

GWR Group will stockpile its high-grade iron ore lump and fines products at Geraldton port for monthly shipments under its offtake agreement with Hong Kong trader Pacific Minerals.

The company continues to advance mining activities at its C4 iron ore deposit that includes crushing and screening activities for the first 1 million tonnes of its 21 million tonne resource.

The deposit is part of GWR Group’s Wiluna West iron ore project in WA, and its project partner is Pilbara Resource Group.

The iron ore miner is reviewing its Wiluna West project with a view to increasing its production tonnage to optimise the remaining 20 million tonnes of iron ore in the C4 deposit.

GWR Group has approvals in place to mine other deposits at its Wiluna West project for a combined 7 million tonnes per year.

Meanwhile, another ASX iron ore company, Pathfinder Resources (ASX:PF1) has appointed a drilling contractor for its Hamersley iron ore project to begin work in late February.

The contractor will be carrying out a program of in-fill drilling to increase the estimated resource for the Hamersley project in WA’s Pilbara region.

The project’s ore resource is estimated at 343 million tonnes at a grade of 54.5 per cent iron, and is located 50km northeast of Tom Price, and southeast of FMG’s Solomon project.

China’s production of steel increased for a fifth consecutive month in December 2020, bringing the annual growth rate to 5.8 per cent, as its share of global steel output rose.

The Middle Kingdom produced 58 per cent of world steel output in 2020, and increased its market share from about 54 per cent in 2019.

Outside of China, global steel production increased by 3.5 per cent last year, and marked a stronger finish for the year after a period of stagnant growth.

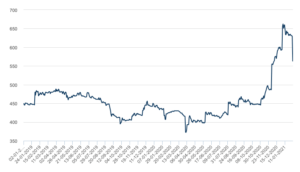

Steel reinforcing bar prices in China have picked up again and were trading at $US671.50 per tonne at the Shanghai steel trading hub.

This week’s price equals the highest price reached in the market’s heyday in mid-2011, and is close to the record high for rebar prices in China of around $US700 per tonne in 2008.

Rebar prices in China appear to have decoupled from those in the rest of the world which have started to plummet.

After peaking at an all-time high price of $US660 per tonne in early January 2021, the LME steel rebar contract price for month-ahead delivery fell steeply last week.

Steel rebar was trading at $US560 per tonne on Monday, down from $US630 per tonne on Friday, a decline of $US70 in a matter of days.

The reason for this is not immediately clear, although it could be linked to the considerable dislocation in the European and US economies related to COVID-19 lockdowns.

China’s steel production traditionally slows in the lead-up to the Asian country’s Lunar New Year holiday, which this year occurs in the middle of February.

This trend is usually reflected in lower trading activity for steel products in China, which may become more evident in the next week or two.

The spot market for Australian coking coal has seen an increase in trading activity with the arrival of buyers from Europe, South America and India.

At Queensland ports, spot shipments of standard quality coking coal were changing hands at ~$US130 per tonne this week, up from about $US120 per tonne a week ago.

Chinese buyers are still paying more than $US200 per tonne for premium-grade coking coal on a delivered-China basis, as they prefer more expensive US and Canadian cargoes.

Higher prices for North American coking coals brought on by China seeking out cargoes from Canada and the US has changed trade patterns for Australian coking coal.

European buyers that traditionally booked North American cargoes have lately switched to Australian as the absence of Chinese buyers has made it cheaper.

“Higher coking coal prices in the Atlantic Basin finally reached a point where Australian coking coal prices were attractive to buyers in Europe, South America and India,” said analysts at CBA.

2020 was a mixed year for Australian coking coal shipments to China, with a surge in exports in the first half of the year, followed by a collapse in the second half of 2020.

“While China’s coal import quotas may have played a role initially, we think the steep fall in Australia’s coking coal exports to China from August was largely attributable to China’s restrictions on Australian coal imports,” said analysts at CBA.

China’s media has been largely silent on Beijing’s policy intentions for Australian coal imports in the near future, leading to ongoing uncertainty for the market.

Analysts said it is their expectation that China’s import restrictions on Australian cargoes of coking coal are set to stay for some time yet.

Shippers have been redirecting Australian coking coal cargoes to other Asian countries such as Japan, Korea and India, and to South America.

“With steel output picking up in countries like India, Japan and South Korea, there is hope that any volumes lost from China can be bought elsewhere,” said CBA analysts.

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| BCB | Bowen Coal Limited | 0.053 | 18 | 15 | -10 | $46.9M |

| PDZ | Prairie Mining Ltd | 0.28 | 12 | 56 | 40 | $57.1M |

| AHQ | Allegiance Coal Ltd | 0.089 | 11 | 11 | -30 | $75.8M |

| MCM | Mc Mining Ltd | 0.15 | 3 | -12 | -68 | $23.1M |

| YAL | Yancoal Aust Ltd | 2.4 | 0 | -1 | -16 | $3.2B |

| CRN | Coronado Global Res | 1.29 | 0 | 13 | -33 | $1.8B |

| TIG | Tigers Realm Coal | 0.01 | 0 | 0 | 29 | $130.5M |

| MR1 | Montem Resources | 0.24 | 0 | 2 | 0 | $39.1M |

| TER | Terracom Ltd | 0.15 | 0 | -12 | -53 | $113.0M |

| NAE | New Age Exploration | 0.014 | 0 | 40 | 333 | $14.2M |

| CKA | Cokal Ltd | 0.08 | -1 | 5 | 67 | $71.2M |

| ATU | Atrum Coal Ltd | 0.25 | -2 | -12 | -23 | $151.0M |

| WHC | Whitehaven Coal | 1.54 | -3 | -7 | -39 | $1.6B |

| PAK | Pacific American Hld | 0.023 | -4 | 5 | 0 | $7.3M |

| JAL | Jameson Resources | 0.11 | -5 | -5 | -45 | $31.8M |

| SMR | Stanmore Coal Ltd | 0.79 | -5 | -2 | -12 | $216.3M |

| LNY | Laneway Res Ltd | 0.007 | -7 | 0 | 0 | $26.4M |

| AKM | Aspire Mining Ltd | 0.097 | -8 | -16 | -19 | $49.2M |

| BRL | Bathurst Res Ltd. | 0.046 | -16 | 18 | -58 | $82.1M |

| NCZ | New Century Resource | 0.185 | -18 | -23 | -16 | $299.9M |