Bulk Buys: Iron ore demand still cantering ahead of supply, coking coal prices wobble

China's steel industry is enjoying good profit margin and can afford to pay more for iron ore from Australia. Image: Getty

- Iron ore fines prices traded this week at $US126.80 per tonne, up $US2.80 per tonne on week

- Hard coking coal prices were $US5 lower this week at $US90.50 per tonne at Queensland ports

- China’s reinforcing bar price is at $US629.20 per tonne, up $US10.70 per tonne on a week ago

Iron ore demand is still rising with prices trading closer to the magic $US130 per tonne this week as steel mills again increased their profit margins.

Spot prices have advanced to $US126.80 per tonne ($173.85/t), and shadowing a move up in steel product prices.

A week ago, iron ore cargoes delivered to ports in China were trading around $US124 per tonne, Metal Bulletin said.

“Steel mill margins remain supported by robust steel demand in China’s infrastructure and manufacturing sectors,” said commodity analyst Vivek Dhar at Commonwealth Bank of Australia in a report.

Demand continues to canter ahead of supply in a tight seaborne market for iron ore, despite record output from Australia.

“Australia has been shipping effectively at record run rates,” Lachlan Shaw, head of commodities research at NAB told the Australian Financial Review.

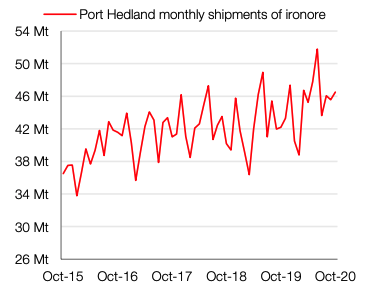

West Australian shipments of iron ore from Port Hedland were 10 per cent higher year on year in October at 46.5 million tonnes.

Shipments of iron ore through the Pilbara region port are forecast to rise to 547 million tonnes in the 2023 financial year.

This is up from current levels of around 525 million tonnes in the 2020 financial year.

Port Hedland is the shipping point for iron ore cargoes from BHP (ASX:BHP), Fortescue Metals Group (ASX:FMG), Rio Tinto (ASX:RIO) and Roy Hill.

China’s steel industry seeing more profit for its products

Steel product prices in China have continued to march upwards, providing an impetus for mills to expand production.

The price of steel reinforcing bar (rebar), which is used in construction, rose to $US629.20 per tonne this week.

This is up from $US618.50 per tonne a week ago, and $US605 in the prior week, according to reports.

Crude steel production in China appears to be accelerating, and grew nearly 12.7 per cent in October.

Output is expected to slow over the year-end, as Chinese blast furnaces are idled as an air pollution reduction measure.

Levels of industrial production in China are now back to where they were before the global pandemic started.

Seaborne iron ore market stays tight on Brazil’s underperformance

Brazil is trying to get back on track with its iron ore production after the COVID-19 pandemic slowed ore output.

Vale, Brazil’s largest iron ore miner, is shipping below its 96 million tonnes per quarter production capacity, with output around 88 million tonnes.

Industrial production has a good track record as an indicator of commodity demand, and it has been rising in Asian countries.

“The V-shape rebound in China’s industrial sector is still powerful enough to carry demand for a number of commodities,” Commonwealth Bank of Australia’s Dhar said.

The bank’s view is that China’s demand impulse for iron ore will continue through 2020 and only weaken later in 2021.

Other iron ore consuming countries such as India or Japan may be able to take up some of the slackening demand.

This rests on hopes of an effective vaccine for COVID-19 which will allow other iron ore consuming economies to recover.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| EUR | European Lithium Ltd | 0.048 | 14 | 33 | -42 | $35.6M |

| SRK | Strike Resources | 0.135 | 13 | 53 | 170 | $29.0M |

| FEX | Fenix Resources Ltd | 0.175 | 9 | 40 | 373 | $68.8M |

| FMG | Fortescue Metals Grp | 18.35 | 4 | 6 | 89 | $56.1B |

| MIN | Mineral Resources. | 32.03 | 3 | 28 | 106 | $6.1B |

| MGT | Magnetite Mines | 0.01 | 0 | 11 | 168 | $28.6M |

| CIA | Champion Iron Ltd | 4.53 | 0 | 35 | 101 | $2.1B |

| MGX | Mount Gibson Iron | 0.74 | -2 | 8 | -8 | $889.4M |

| ADY | Admiralty Resources. | 0.014 | -13 | 8 | 40 | $15.1M |

| MAG | Magmatic Resrce Ltd | 0.175 | -13 | -15 | -3 | $31.2M |

| LCY | Legacy Iron Ore | 0.006 | -14 | -14 | 173 | $37.5M |

| TI1 | Tombador Iron | 0.037 | -20 | 19 | 76 | $30.1M |

Higher iron ore prices flowing to ASX company bottom lines

The continued strength in iron ore prices is flowing into the bottom lines of ASX iron ore producers and exploration companies.

“The current strength in iron ore prices underpins material upside risk to our earnings forecasts for the Australian iron ore miners,” said Macquarie Bank in a report.

Among the strong gainers this week in the ASX iron ore space was Tombador Iron (ASX:TI1) which has a project in Brazil.

The company is aiming to get its high-grade hematite lump project in Brazil’s Bahia state into production in 2021.

Tombador’s lump product is suitable for blast furnace steelmakers and the company has received interest from potential customers in Brazil, South America, Europe and the Middle East.

“High-grade lump iron ore is scarce, particularly in the Atlantic Basin,” said the company in a presentation.

In an update this week, GWR Group (ASX:GWR) said mining operations were due to start in December at its Wiluna West project.

Initial production will target 1 million tonnes of direct shipping ore at the Wiluna West site with a 60 per cent iron content.

“We have made significant progress since development operations began in early October, and with the current buoyant iron ore price we are eager to meet our target of first ore shipment in January 2021 and exploit this strong commodity cycle,” chairman, Gary Lyons, said.

Australian coking coal prices slip as trade to China slows

Hard coking coal at the Queensland shipping terminal of Dalrymple Bay traded $US5 lower week on week at $US90.50 per tonne.

The trade in coking coal shipments to China has thinned significantly as year-end quotas loom.

China sets annual quotas for coal imports into the Asian country, and at 270 million tonnes for 2020, they have mostly been filled.

There is heavy downward pressure on hard coking coal prices at Australian ports on account of slowing trade to China.

For standard-grade hard coking coal for shipment from ports in Queensland, prices are around $US90 per tonne this week.

Moreover, the spread between prices for coking coal at Australian ports and those for cargoes arriving in China is starting to widen.

This is because buyers in China are taking delivery of more expensive cargoes of coking coal from North America.

Cargoes of coking coal for delivery to ports in northeastern China were heard at $US144 per tonne, up $US3 on week.

Buyers in China appear willing to pay a slight premium for cargoes of North American origin.

This is despite the higher sulphur levels in North American coking coal which is not ideal for blast furnaces.

Australian coal shippers and their Chinese customers will likely be focussing on cargoes for delivery in the new year.

This is because China’s imports quota for coal resets on January 1 each year.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| NCZ | New Century Resource | 0.2125 | 29 | 15 | -31 | $255.8M |

| WHC | Whitehaven Coal | 1.4 | 19 | 35 | -54 | $1.4B |

| CRN | Coronado Global Res | 0.97 | 13 | 15 | -51 | $1.3B |

| CKA | Cokal Ltd | 0.07 | 13 | 8 | 56 | $68.3M |

| BCB | Bowen Coal Limited | 49 | 2 | -9 | -25 | $44.5M |

| YAL | Yancoal Aust Ltd | 2 | 1 | 1 | -32 | $2.6B |

| SMR | Stanmore Coal Ltd | 0.68 | 0 | -6 | -34 | $185.2M |

| PDZ | Prairie Mining Ltd | 0.2 | 0 | 0 | -17 | $45.7M |

| MCM | Mc Mining Ltd | 0.19 | 0 | 81 | -58 | $29.3M |

| LNY | Laneway Res Ltd | 0.007 | 0 | -13 | 8 | $26.4M |

| JAL | Jameson Resources | 0.125 | 0 | 0 | -32 | $37.9M |

| BRL | Bathurst Res Ltd. | 0.04 | 0 | 8 | -65 | $71.2M |

| AKM | Aspire Mining Ltd | 0.072 | 0 | -3 | -40 | $37.1M |

| MEY | Marenica Energy Ltd | 0.091 | -4 | 2 | 1 | $13.0M |

| TER | Terracom Ltd | 0.14 | -7 | 4 | -62 | $105.5M |

| PAK | Pacific American Hld | 0.023 | -8 | -21 | -22 | $7.6M |

| NAE | New Age Exploration | 0.0125 | -11 | -22 | 317 | $13.3M |

| AHQ | Allegiance Coal Ltd | 0.053 | -12 | -16 | -58 | $45.7M |

| NCZ | New Century Resource | 0.2125 | 29 | 15 | -31 | $255.8M |

The share price of Whitehaven Coal (ASX:WHC) ticked higher this week to a near four-month high at ~$1.40 per share.

This was two weeks after a significant investor in the company sold 33 million shares worth $34.7m.

The on-market sale by Hans Mende, a former director of Whitehaven Coal, occurred on November 11, according to an ASX notice.

Mende is a well-known investor in coal companies and has been a director of other Australian coal producers such as Felix Coal.

He is a co-founder with Fritz Kundrun of AMCI, a specialist investor in natural resources projects, that has grown into a multi-billion dollar enterprise.

Kundrun still holds a significant equity stake in Whitehaven Coal at 7.74 per cent representing around 79.9 million shares.

Whitehaven Coal’s net profit after tax shrank to $30m in the 2020 financial year, from $595m in the 2019 financial year.

The company’s costs on a per tonne basis increased to $75 in the 2020 financial year from $67 per tonne in the year earlier period.

Coking coal futures prices pick up as cyclone season looms

Futures contract prices for Australian coking coal on the Chicago Mercantile Exchange (CME) trended higher this week.

For December settlement, the futures price is US$110 per tonne, up $US7 on a week ago; while for January 2021 settlement the price has advanced $US2 on-week to $US125 per tonne.

The steeper futures price curve suggests the market for coking coal is becoming tighter, as Australia’s cyclone season looms.

Australia’s tropical cyclone season traditionally starts in November and lasts through to April the following year.

The Bureau of Meteorology in its Tropical Cyclone Outlook said it is expecting a higher than average number of cyclones this season.

Cyclone activity in Australia generally takes place above the Tropic of Capricorn, at a latitude of 23 degrees south of the equator.

This includes northern Queensland, designated the Eastern region for the Bureau of Meteorology’s Tropical Cyclone Outlook.

“The average number of tropical cyclones for this region is four, and about a quarter of tropical cyclones in the eastern region make landfall,” said BoM.

Cyclones can be devastating to the coal industry in Queensland, as they can result in flooding of rail and mining infrastructure.

Tropical cyclone Debbie in 2017 delayed the export of 15 million to 20 million tonnes of coking coal valued at $3bn.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.