6 reasons why Infinity Lithium should be on your watchlist

Pic: John W Banagan / Stone via Getty Images

Special Report: Advanced battery materials play Infinity Lithium (ASX:INF) is expected to release its pre-feasibility study for the San José lithium project very soon. INF is a must-watch development story – and here are 6 reasons why.

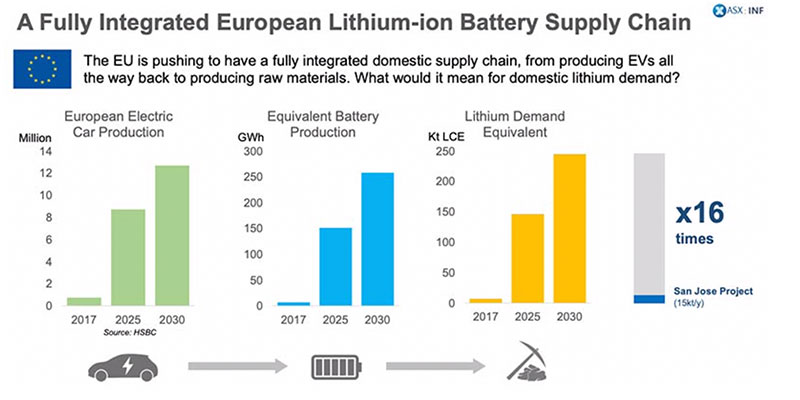

By 2025, the EU will need more than 150,000 tonnes of lithium chemical each year to meet its ambitious EV production targets.

San José in Spain is a previously mined brownfields development which represents one of Europe’s largest lithium deposits.

>> Learn more about Infinity Lithium

It is also one of only a few local lithium chemical projects in the pipeline as the EU works overtime to shore up its local battery supply chains, with San José is expected to produce up to 15,000 tonnes of battery grade hydroxide a year.

#1: Europe is demanding local lithium supply

San Joséis one of only a couple of projects preparing to produce battery grade lithium chemicals within the European Union, which gives Infinity a huge strategic advantage over its peers.

Europe is a car making giant; the German industry alone employed about 820,200 people and generated revenues of $665 billion in 2017.

But to protect this industry amidst the disruptive shift away from combustion engines, there’s a coordinated push to establish internal EV supply chains across the EU.

There’s already 16 large-scale lithium-ion battery cell plants confirmed or likely to come online in Europe by 2023, according to Benchmark Mineral Intelligence data.

But the EU also wants to produce its own lithium chemicals from EU raw materials. Right now, it has no material lithium mining activities or chemical conversion capacity, with about 80 per cent of crucial global lithium chemicals sourced from China. The EU is projected to be the 2ndlargest lithium-ion battery and EV market by 2023 on the back of the rapid adoption and fabrication of EVs.

#2: Infinity is getting crucial support from high places

In June, a meeting between the European Commission and the Board of the European Investment Bank (EIB) called for the prioritisation of EU battery raw material projects, focussing on lithium extraction and in particular the conversion to essential lithium chemicals.

In late June, Infinity met with the EIB and European Battery Alliance (‘EBA’) in Madrid, which has signalled a desire to play a larger role in bringing projects to market.

At the time, Infinity said that the EBA “expressed a desire to visit the San José site and assist in a facilitation of commercial discussions with other industry participants”.

Infinity executive director Vincent Ledoux-Pedailles said at the time the meeting shouldn’t be downplayed.

“This was the first time the EBA had sent representatives to visit a lithium project in the EU, and it is imperative that we continue to work closely with both the EBA and the EIB to achieve their goals of building a €250 billion lithium-ion battery [industry] in Europe over the next six years,” he said.

#3: San José will be an industry leading, vertically integrated operation

The Australian market understands the spodumene concentrate export model, but right now that model is suffering badly.

Which is why major players, like Pilbara Minerals (ASX:PLS), are now moving further downstream into value-adding chemical production.

But that was always Infinity’s plan — to build Europe’s only mine-to-end-product lithium hydroxide operation to feed these local large-scale battery plants currently under construction.

Infinity aren’t just digging up ore, producing a concentrate and then shipping it off to China for processing.

This sets the company apart from other EU-focussed lithium plays like London-listed Savannah Resources, which is currently completing a definitive feasibility study (DFS) on its project in Portugal.

“They have a substantial market cap but they are focused on producing a spodumene concentrate, which is likley shipped elsewhere for conversion,” Infinity managing director Ryan Parkin says. “The EC has made their desire to promote the availability of lithium chemical is the EU clear, and San José has a significant part to play in their ambitions.”

#4 …which gives San José industry leading operating costs

San José will have production of battery grade lithium hydroxide production costs at the very lowest end of the cost curve as a result of the fully integrated lithium hydroxide operations. This means they will be able to pay back to initial start-up costs within 2 and a half years.

Why are costs so low? Infinity will be beneficiating its product on site then, instead of shipping that product all the way to China for conversion, it will truck it 1500m up the road to a purpose-built lithium hydroxide plant, and then onto its EU offtake partners.

“It’s very clear – there’s no transport costs, there no tax leakage and there’s no royalty payable,” says Parkin.

“This, coupled with key infrastructure such as the gas pipeline adjacent to the project, are why our costs are so low.”

#5 Hydroxide producers are in the box seat

Battery manufacturers are rapidly evolving towards nickel-rich NCM 811 batteries (8 parts nickel, 10 parts cobalt and 10 parts manganese) because they have longer lifespans and allow EVs to go further on a single charge.

These higher nickel content cathodes that are used in lithium-ion batteries require hydroxide, says Parkin.

“It’s a much more relevant product for an end market with the highest growth prospects, which is highly aligned to EV production,” he told Stockhead.

“Growth forecasts predict global LCE (lithium carbonate equivalent) demand growing eight-fold by 2030. The global demand for lithium hydroxide is projected to exceed the demand for lithium carbonate, which has traditionally been used in cathodes for EVs, by 2024.”

#6 Infinity are already deep into finance and offtake discussions

2020/21 is likely the tipping point where “timid growth” ends and EVs become mainstream in Europe, according to new data.

If everything goes according to plan, 22 per cent of vehicles rolling off the production line could have a plug by 2022.

This means San José could begin production at the right time to take advantage of a huge upsurge in local demand for battery grade lithium chemicals.

“We’ve already been engaged in long standing negotiations with OEMs – essentially automobile manufacturers and cathode producers within Europe,” Parkin says.

“These companies are trying to lock in their raw material requirements moving forwards to 2023-2025, when their EV production is expected to increase at a significant rate.

They are starting to move quickly now to secure supply, because without those raw materials and in particular refined lithium chemicals, there are no electric vehicles.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Infinity Lithium, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.