Infinity wants to build the EU’s first fully integrated lithium chemical plant

Pic: Schroptschop / E+ via Getty Images

Special Report: Alarmed that it is slipping behind EV frontrunner China, Europe is supercharging development of its own battery supply chains – and Infinity Lithium is set to benefit.

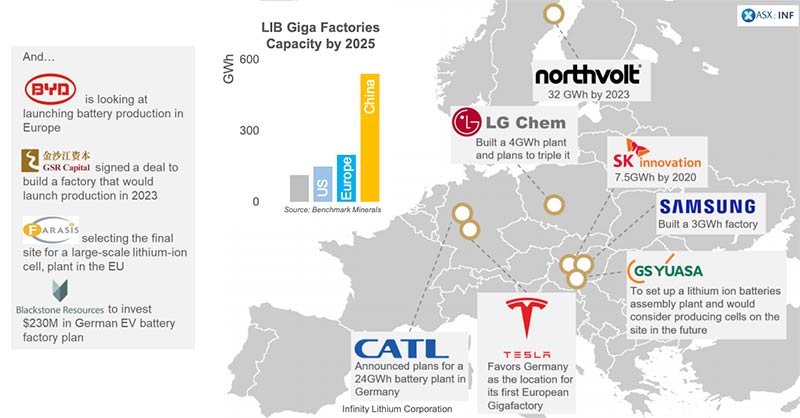

A slew of EU battery projects has been announced in recent months, all designed to reduce dependence on Asia.

Northvolt and Volkswagen Group, for instance, are focussing on the entire battery value stream — from raw material production, to cell technology and cell production processes through to recycling.

Then just last week, France and Germany announced a joint 5-6 billion Euro ($8 billion to $9.5 billion) investment in European battery production.

According to InnoEnergy, Europe’s battery value chain could be worth €250 billion ($400 billion) a year by 2025.

Infinity Lithium (ASX:INF)is developing its San Jose project in Spain – a low cost, long life integrated lithium hydroxide operation in the heart of the EU.

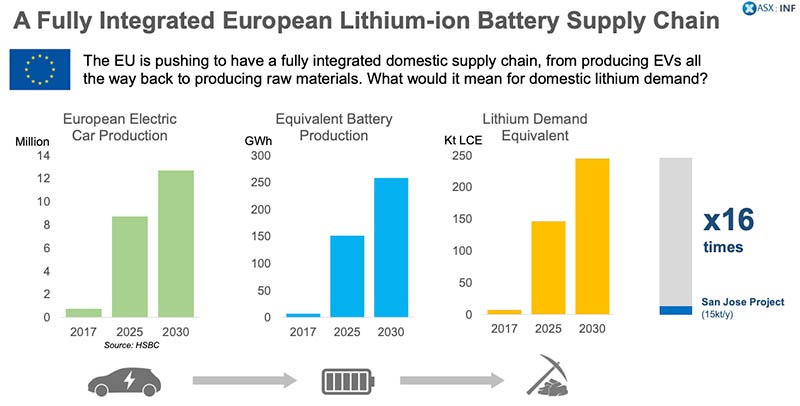

Infinity managing director Ryan Parkin says Europe is poised to become the second largest EV maker in the world, behind China. But to achieve this they are going to need lithium chemicals and other raw inputs.

Right now, about 80 per cent of crucial lithium chemicals are sourced from Chinese conversion plants.

“The EV industry is ultimately very important for Europe, because it’s such a large industry; particularly for Spain, which is the second largest car manufacturer within the EU,” Parkin told Stockhead.

Infinity attended the European Battery Association’s EBA 250 conference earlier this year, with the Vice President’s of the European Commission and the European Investment Bank, in addition to VW’s senior management, flagging the importance of critical raw materials required for lithium-ion battery production and in particular the availability of battery grade lithium chemicals.

The risk of the reliance on China was further reinforced on 7thMay when VW CEO Herbert Diess backed an EU alliance for battery cell production amid fears that the region will lose out to Asian rivals as EV sales take off and technology advances.

“In the last couple of years, Europe has been more focussed on EV production, battery assembly and battery cell production, but now they are really starting to move backwards through that value chain,” he says.

“They are starting to move into cathode production — and the biggest risk to cathode production is the availability of lithium chemical.”

San Jose: a low cost, integrated lithium hydroxide project

The Australian market understands the spodumene concentrate export model, but right now that model is suffering.

Spodumene prices are dropping significantly and major players, like Pilbara Minerals (ASX:PLS), are now moving further downstream into value-adding chemical production.

That was always Infinity’s plan — to build Europe’s only mine-to-end-product lithium hydroxide operation that feeds the large-scale battery plants currently under construction.

The advanced, long life and low-cost San Jose project is a previously mined brownfields development which represents one of Europe’s largest lithium deposits.

After released an extremely robust scoping study late last year, Infinity is currently accelerating through a pre-feasibility study, which it expects to deliver by the end of June.

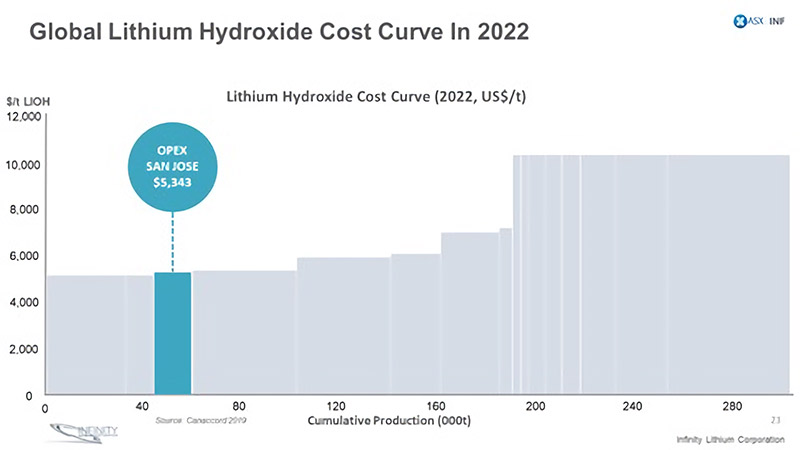

“That’s not even utilising half the resource,” Mr Parkin says.

“And our cash costs will be less than $5350/t, which is at the very lowest end of the cost curve.”

Check this out:

Why are San Jose production costs so low? Consider this.

WA spodumene concentrate exporters must pay a 5 per cent royalty to the state as they mine. Then further transportation costs are incurred as that concentrate is shipped to China, where more duties are paid before the concentrate is converted into hydroxide.

If this hydroxide is exported to Europe, there’s an additional 16 per cent tax leakage in top of all the other taxes and transport costs.

There’s also the very real risk that this 16 per cent tax rate will increase as China seeks to ‘ringfence’ it’s EV supply chain, says Parkin.

“Infinity will be beneficiating its product on site, and then instead of shipping that product all the way to China for conversion we will transport it 1500 metres up the road to our purpose-built lithium hydroxide plant,” he says.

“It’s very clear – there’s no transport costs, there no tax leakage and there’s no royalty payable. This coupled with the availability of key infrastructure such as the gas pipeline adjacent to the project provide as to why we see our C1 costs at the lowest end of the cost curve.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Infinity Lithium a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.