2018 sucked for cobalt stocks but here’s why next year could be a cracker

No party here Pic: Getty

The second half of 2018 hasn’t been particularly kind to cobalt stocks, but the prospects for the battery metal look more promising in 2019.

Nearly 90 per cent of the small caps that have exposure to cobalt have wiped off between 0.2 per cent and 94 per cent from their share price in 2018.

>> Scroll down for a list of ASX stocks with cobalt exposure, courtesy of leading ASX data provider MakCorp

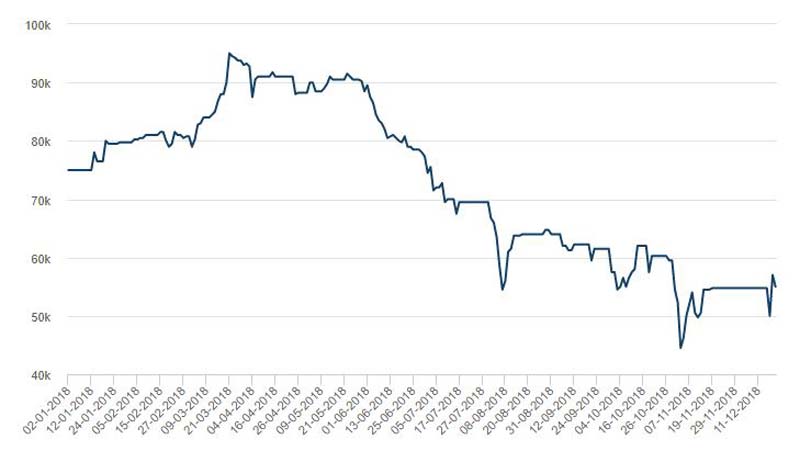

The price of cobalt plunged from a record high of $US95,000 ($132,072) a tonne in late March to a low of $US44,500 a tonne in early November.

“After so much hype, speculation and media attention, market sentiment is now somewhat depressed,” market intelligence firm Roskill said.

Cobalt’s downfall came after Telsa boss Elon Musk publicly stated the American electric car giant wanted to drastically cut its use of cobalt.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This was followed by a similar proclamation by Japanese electronics giant Panasonic.

China’s biggest lithium battery maker – the $150 billion Contemporary Amperex Technology – also made public its plans to halve the amount of cobalt it uses in its batteries.

Cobalt is used to make the cathode, which conducts electricity flows out of a battery or device.

The cobalt price remained steady at just below $US55,000 a tonne in late November and early December, but by mid-December it again started heading south.

Roskill director Jack Bedder says the late pullback in the price of cobalt can be partially attributed to end-of-year destocking.

But an unexpected last minute bounce sent the price up to $US57,000 a tonne on Tuesday before it edged back to $US55,000 a tonne.

It’s not over yet

But Roskill says the cobalt slump “may prove short lived”.

“Despite much publicity over the EV industry’s desire to substitute cobalt out of batteries, the outlook for demand remains very strong,” Roskill said.

Mr Bedder says Roskill expects demand from the battery sector alone to reach nearly 100,000 tonnes by 2020 and the market as a whole to reach over 155,000 tonnes.

“New refined supply will mostly come from capacity expansion in China,” he told Stockhead.

Benchmark Mineral Intelligence said earlier this year it expects the order of magnitude of EV sales growth to “far outweigh” efforts to reduce cobalt in batteries.

It forecasts the use of cobalt in lithium-ion batteries will triple by 2026.

While Roskill believes recent purchasing in China was well in excess of demand requirements, it does expect “mass purchasing” of cobalt oxide and sulphate to pick up again down the track.

“Such a resumption would doubtless improve sentiment,” Roskill said.

The market watcher says recent developments such as the Katanga Mining uranium discovery and the classification of cobalt as a “strategic” metal in the Congo (along with a 10 per cent royalty rate) show how quickly the market can change.

Katanga Mining reported in early November that it detected uranium in the cobalt hydroxide produced from its Kamoto project in the Democratic Republic of the Congo (DRC).

This forced the company, a subsidiary of the world’s largest cobalt miner, Glencore, to halt the export and sale of cobalt for at least seven months.

Meanwhile, the DRC government’s decision to hike royalties on cobalt by almost three times to 10 per cent will make cobalt produced in the country more expensive.

More than 60 per cent of the world’s cobalt is mined in the DRC and there are already issues plaguing the supply of the battery metal from the country because of reports of the use of child labour to mine it.

But Mr Bedder says the DRC will remain the world’s main source of cobalt.

“While there are dozens of cobalt projects out there, few are at advanced stages and few are of a large scale,” he said.

“Those that are, are all in the DRC.”

Roskill expects the cobalt market will get its “fair share of headlines” in 2019.

Here’s a list of ASX stocks with exposure to cobalt courtesy of leading ASX data provider MakCorp.

Swipe or scroll to reveal the full table. Click headings to sort.

| ASX Code | Company | Market Cap | Price Intra-day Dec 18 | Price Jan 1, 2018 | Total Return Year-to-date |

|---|---|---|---|---|---|

| PNN | PEPINNINI LITHIUM | 3433372.25 | 0.005 | 0.082 | -0.939024 |

| MRD | MOUNT RIDLEY MINES | 2047036.125 | 0.001 | 0.0114 | -0.912088 |

| WCN | WHITE CLIFF MINERALS | 3002678.75 | 0.013 | 0.1451 | -0.910386 |

| MTC | METALSTECH | 3508616.5 | 0.03 | 0.275 | -0.890909 |

| MTH | MITHRIL RESOURCES | 1996745.75 | 0.006 | 0.0462 | -0.870164 |

| HCO | HYLEA METALS | 5607747 | 0.001 | 0.006 | -0.833333 |

| G88 | GOLDEN MILE RESOURCES | 7237497 | 0.105 | 0.585 | -0.820513 |

| FCC | FIRST COBALT CORP | 67864368 | 0.215 | 1.19 | -0.819328 |

| NWC | NEW WORLD COBALT | 10623859 | 0.019 | 0.105 | -0.819048 |

| N27 | NORTHERN COBALT | 4166699.25 | 0.09 | 0.49 | -0.816327 |

| VAL | VALOR RESOURCES | 7572769 | 0.004 | 0.021 | -0.809524 |

| FEL | FE LTD | 6304925.5 | 0.014 | 0.073 | -0.808219 |

| RIE | RIEDEL RESOURCES | 7525254.5 | 0.017 | 0.086 | -0.802326 |

| MEI | METEORIC RESOURCES | 6893469 | 0.012 | 0.059 | -0.79661 |

| BSX | BLACKSTONE MINERALS | 11544572 | 0.1 | 0.49 | -0.795918 |

| MQR | MARQUEE RESOURCES LIMITED | 2735634.25 | 0.062 | 0.275 | -0.774545 |

| GTE | GREAT WESTERN EXPLORATION LT | 5521196 | 0.006 | 0.026 | -0.769231 |

| MAG | MAGMATIC RESOURCES | 2579336.5 | 0.028 | 0.1057 | -0.763575 |

| CLQ | CLEAN TEQ HOLDINGS | 294798784 | 0.395 | 1.485 | -0.737374 |

| COB | COBALT BLUE HOLDINGS | 26787610 | 0.21 | 0.795 | -0.735849 |

| CFE | CAPE LAMBERT RESOURCES | 18211228 | 0.016 | 0.068 | -0.735294 |

| RIM | RIMFIRE PACIFIC MINING | 7487326.5 | 0.007 | 0.026 | -0.730769 |

| MRR | MINREX RESOURCES | 1917554.5 | 0.024 | 0.074 | -0.72973 |

| TRL | TANGA RESOURCES | 3819082.5 | 0.002 | 0.011 | -0.728261 |

| CCZ | CASTILLO COPPER | 11548701 | 0.017 | 0.06 | -0.716667 |

| EUC | EUROPEAN COBALT | 33514682 | 0.044 | 0.155 | -0.716129 |

| ARL | ARDEA RESOURCES | 56694824 | 0.54 | 1.9 | -0.715789 |

| HGM | HIGH GRADE METALS | 6341130 | 0.014 | 0.049 | -0.714286 |

| RNX | RENEGADE EXPLORATION | 2850506.5 | 0.004 | 0.014 | -0.714286 |

| CZN | CORAZON MINING | 7591700 | 0.005 | 0.017 | -0.705882 |

| SI6 | SIX SIGMA METALS | 2287515.75 | 0.005 | 0.017 | -0.705882 |

| BMT | BERKUT MINERALS | 3910800 | 0.072 | 0.24 | -0.7 |

| TKM | TREK METALS | 2498429 | 0.008 | 0.026 | -0.692308 |

| BPL | BROKEN HILL PROSPECTING | 4584385.5 | 0.033 | 0.1 | -0.68 |

| BDI | BLINA MINERALS | 4363882.5 | 0.001 | 0.003 | -0.666667 |

| CAD | CAENEUS MINERALS | 14063075 | 0.001 | 0.003 | -0.666667 |

| AUZ | AUSTRALIAN MINES | 115299544 | 0.04 | 0.12 | -0.658333 |

| RMX | RED MOUNTAIN MINING | 5446257.5 | 0.007 | 0.02 | -0.65 |

| SRN | SUREFIRE RESOURCES | 2643921.75 | 0.006 | 0.0171 | -0.65 |

| JRV | JERVOIS MINING | 51350488 | 0.225 | 0.65 | -0.638462 |

| PGM | PLATINA RESOURCES | 15847574 | 0.057 | 0.16 | -0.6375 |

| LRS | LATIN RESOURCES | 8637512 | 0.003 | 0.011 | -0.636364 |

| BMG | BMG RESOURCES | 2852274.25 | 0.007 | 0.019 | -0.631579 |

| CNJ | CONICO | 6331648.5 | 0.018 | 0.051 | -0.627451 |

| RMI | RESOURCE MINING CORP | 2666406 | 0.01 | 0.026 | -0.615385 |

| CAV | CARNAVALE RESOURCES | 3947997.25 | 0.006 | 0.015 | -0.6 |

| DEV | DEVEX RESOURCES | 4137306.75 | 0.045 | 0.1112 | -0.595473 |

| RFR | RAFAELLA RESOURCES (Listed July 2018) | 3119587.5 | 0.082 | 0.20* | -0.59 |

| AZS | AZURE MINERALS | 17759998 | 0.165 | 0.39 | -0.589744 |

| MCT | METALICITY | 9639420 | 0.018 | 0.038 | -0.578947 |

| SCI | SILVER CITY MINERALS | 3446943.5 | 0.015 | 0.033 | -0.575758 |

| SBR | SABRE RESOURCES | 2848815.25 | 0.006 | 0.014 | -0.571429 |

| VMS | VENTURE MINERALS | 10932852 | 0.021 | 0.049 | -0.571429 |

| PSC | PROSPECT RESOURCES | 47060644 | 0.023 | 0.053 | -0.566038 |

| NVA | NOVA MINERALS | 15522683 | 0.02 | 0.046 | -0.565217 |

| CAZ | CAZALY RESOURCES | 5298432 | 0.021 | 0.052 | -0.557692 |

| KTA | KRAKATOA RESOURCES | 3055000 | 0.026 | 0.058 | -0.551724 |

| SLZ | SULTAN RESOURCES (Listed Aug 2018) | 3143270 | 0.09 | 0.20 | -0.55 |

| ARV | ARTEMIS RESOURCES | 81099224 | 0.12 | 0.265 | -0.54717 |

| TAR | TARUGA MINERALS | 7058362 | 0.05 | 0.11 | -0.545455 |

| GBR | GREAT BOULDER RESOURCES | 10814866 | 0.135 | 0.29 | -0.534483 |

| MEP | MINOTAUR EXPLORATION | 12429024 | 0.042 | 0.085 | -0.517647 |

| HMX | HAMMER METALS | 6957427 | 0.022 | 0.047 | -0.510638 |

| CGM | COUGAR METALS | 2858408 | 0.002 | 0.006 | -0.5 |

| DKM | DUKETON MINING | 14731202 | 0.125 | 0.25 | -0.5 |

| ELT | ELEMENTOS | 7686655 | 0.005 | 0.01 | -0.5 |

| BAR | BARRA RESOURCES | 16166722 | 0.031 | 0.061 | -0.491803 |

| SGQ | ST GEORGE MINING | 40245688 | 0.13 | 0.255 | -0.490196 |

| PIO | PIONEER RESOURCES | 21057570 | 0.015 | 0.029 | -0.482759 |

| MLM | METALLICA MINERALS | 9028525 | 0.031 | 0.056 | -0.482143 |

| LTR | LIONTOWN RESOURCES | 26081712 | 0.025 | 0.044 | -0.477273 |

| TKL | TRAKA RESOURCES | 6957741.5 | 0.023 | 0.042 | -0.47619 |

| CLA | CELSIUS RESOURCES | 52585428 | 0.065 | 0.125 | -0.472 |

| SPQ | SUPERIOR RESOURCES | 4128262.5 | 0.006 | 0.0111 | -0.461538 |

| GME | GME RESOURCES | 36160516 | 0.075 | 0.1392 | -0.461097 |

| KAI | KAIROS MINERALS | 21306820 | 0.023 | 0.044 | -0.454545 |

| RNU | RENASCOR RESOURCES | 20761638 | 0.017 | 0.033 | -0.454545 |

| GED | GOLDEN DEEPS | 6169708.5 | 0.037 | 0.065 | -0.446154 |

| IPT | IMPACT MINERALS | 14538478 | 0.01 | 0.018 | -0.444444 |

| E2M | E2 METALS | 3946016 | 0.067 | 0.12 | -0.441667 |

| AOA | AUSMON RESOURCES | 2184271.75 | 0.005 | 0.007 | -0.428571 |

| RXL | ROX RESOURCES | 10070245 | 0.008 | 0.014 | -0.428571 |

| AYR | ALLOY RESOURCES | 4731233 | 0.003 | 0.005 | -0.4 |

| TSC | TWENTY SEVEN CO | 5352367.5 | 0.006 | 0.01 | -0.4 |

| TYX | TYRANNA RESOURCES | 9417309 | 0.01 | 0.018 | -0.388889 |

| CLY | CLANCY EXPLORATION | 7008775.5 | 0.002 | 0.004 | -0.375 |

| HAV | HAVILAH RESOURCES | 34919848 | 0.16 | 0.255 | -0.372549 |

| ARE | ARGONAUT RESOURCES | 34196372 | 0.022 | 0.035 | -0.371429 |

| AVQ | AXIOM MINING | 41438416 | 0.089 | 0.14 | -0.364286 |

| GBG | GINDALBIE METALS | 23994192 | 0.017 | 0.025 | -0.36 |

| CZR | COZIRON RESOURCES | 19641064 | 0.011 | 0.017 | -0.352941 |

| SCN | SCORPION MINERALS | 3717515 | 0.021 | 0.032 | -0.34375 |

| AYM | AUSTRALIA UNITED MINING | 2539065.25 | 0.002 | 0.003 | -0.333333 |

| IVR | INVESTIGATOR RESOURCES | 8879664 | 0.012 | 0.018 | -0.333333 |

| OAR | OAKDALE RESOURCES | 1372091.375 | 0.021 | 0.031 | -0.322581 |

| GML | GATEWAY MINING | 11242151 | 0.013 | 0.019 | -0.315789 |

| TAS | TASMAN RESOURCES | 30178530 | 0.066 | 0.0888 | -0.313382 |

| RAG | RAGNAR METALS | 3447664.75 | 0.011 | 0.016 | -0.3125 |

| SUP | SUPERIOR LAKE RESOURCES | 27420162 | 0.03 | 0.043 | -0.302326 |

| MLS | METALS AUSTRALIA | 7025393.5 | 0.0035 | 0.005 | -0.3 |

| HIG | HIGHLANDS PACIFIC | 80862304 | 0.075 | 0.105 | -0.285714 |

| MAT | MATSA RESOURCES | 23883844 | 0.155 | 0.21 | -0.285714 |

| PMY | PACIFICO MINERALS | 8148856.5 | 0.004 | 0.007 | -0.285714 |

| CWX | CARAWINE RESOURCES | 10609396 | 0.17 | 0.25 | -0.28 |

| TLG | TALGA RESOURCES | 89337288 | 0.41 | 0.56 | -0.276786 |

| RDM | RED METAL | 22287132 | 0.105 | 0.145 | -0.275862 |

| ARN | ALDORO RESOURCES (Listed Sep 2018) | 5151125 | 0.145 | 0.20 | -0.275 |

| ENR | ENCOUNTER RESOURCES | 15480130 | 0.059 | 0.081 | -0.271605 |

| ALY | ALCHEMY RESOURCES | 6165872.5 | 0.013 | 0.0178 | -0.268636 |

| DGO | DGO GOLD | 18731940 | 0.745 | 1.0184 | -0.268483 |

| HLX | HELIX RESOURCES | 12309534 | 0.029 | 0.042 | -0.261905 |

| E25 | ELEMENT 25 | 14273940 | 0.17 | 0.23 | -0.26087 |

| PRX | PRODIGY GOLD | 32682678 | 0.068 | 0.092 | -0.26087 |

| STA | STRANDLINE RESOURCES | 31427614 | 0.098 | 0.13 | -0.246154 |

| AOU | AUROCH MINERALS | 7702776 | 0.078 | 0.1 | -0.22 |

| NZC | NZURI COPPER | 82853536 | 0.275 | 0.345 | -0.202899 |

| AML | AEON METALS | 149804784 | 0.245 | 0.305 | -0.196721 |

| SFM | SANTA FE MINERALS | 6553691 | 0.09 | 0.11 | -0.181818 |

| GAL | GALILEO MINING (Listed May 2018) | 20463568 | 0.17 | 0.20 | -0.15 |

| KRX | KOPPAR RESOURCES (Listed May 2018) | 5556250 | 0.17 | 0.20 | -0.15 |

| ERM | EMMERSON RESOURCES | 28233058 | 0.068 | 0.083 | -0.144578 |

| TNG | TNG | 115616096 | 0.12 | 0.14 | -0.142857 |

| ZEN | ZENITH ENERGY | 67130000 | 0.64 | 0.75 | -0.133333 |

| FIN | FIN RESOURCES | 4375371.5 | 0.016 | 0.0183 | -0.127273 |

| POS | POSEIDON NICKEL | 110993480 | 0.042 | 0.049 | -0.122449 |

| WKT | WALKABOUT RESOURCES | 28903726 | 0.09 | 0.105 | -0.114286 |

| KOR | KORAB RESOURCES | 7671399.5 | 0.024 | 0.028 | -0.107143 |

| IAU | INTREPID MINES | 13785992 | 1.02 | 1.1 | -0.090909 |

| ORN | ORION MINERALS | 46843336 | 0.024 | 0.026 | -0.076923 |

| PAN | PANORAMIC RESOURCES | 182975360 | 0.375 | 0.3984 | -0.058735 |

| AMG | AUSMEX MINING GROUP | 28766530 | 0.068 | 0.069 | -0.014493 |

| AXE | ARCHER EXPLORATION | 13400000 | 0.07 | 0.13 | -0.5% |

| AX8 | ACCELERATE RESOURCES | 5200000 | 0.11 | 0.195 | -0.4% |

| A4N | ALPHA HPA | 56700000 | 0.1 | 0.14 | -0.3% |

| CLZ | CLASSIC MINERALS | 7800000 | 0.003 | 0.004 | -0.3% |

| CDU | CUDECO (Suspended since Mar 2018) | 92000000 | 0.235 | 0.31 | -0.2% |

| CTM | CENTAURUS METALS | 16134875 | 0.0065 | 0.007 | 0% |

| LEG | LEGEND MINING | 61330524 | 0.032 | 0.03 | 0% |

| AZY | ANTIPA MINERALS | 37900000 | 0.21 | 0.21 | 0% |

| HAR | HARANGA RESOURCES (Suspended since Jan 2018) | 1500000 | 0.003 | 0.003 | 0% |

| WFE | WINMAR RESOURCES | 58200000 | 0.024 | 0.0045 | 0.0433 |

| ACB | A-CAP ENERGY | 43594244 | 0.052 | 0.049 | 0.061225 |

| MGU | MAGNUM MINING AND EXPLORATION | 18172624 | 0.058 | 0.06 | 0.083333 |

| DGR | DGR GLOBAL | 82779552 | 0.13 | 0.115 | 0.130435 |

| HIP | HIPO RESOURCES | 6957188 | 0.015 | 0.0147 | 0.160318 |

| RDS | REDSTONE RESOURCES | 8375702 | 0.016 | 0.0135 | 0.187384 |

| MGV | MUSGRAVE MINERALS | 30737948 | 0.095 | 0.079 | 0.189873 |

| VMC | VENUS METALS CORP | 15256738 | 0.16 | 0.13 | 0.230769 |

| AIV | ACTIVEX | 35445680 | 0.2 | 0.16 | 0.25 |

| CZI | CASSINI RESOURCES | 30750132 | 0.089 | 0.071 | 0.253521 |

| CHK | COHIBA MINERALS | 9969214 | 0.014 | 0.01 | 0.4 |

| ANW | AUS TIN MINING | 33628904 | 0.017 | 0.011 | 0.545455 |

| ADY | ADMIRALTY RESOURCES | 18465850 | 0.016 | 0.007 | 1.285714 |

Hitting bottom

The biggest loss of the year goes to PepinNini Lithium (ASX:PNN), which has wiped off 94 per cent.

Though that probably has more to do with its key focus being lithium and the fears of oversupply that surround the battery metal at the moment.

PepinNini has exposure to cobalt through its wholly owned NiCul Minerals subsidiary, which is exploring for nickel, copper and cobalt in the Musgrave province of South Australia.

Mount Ridley Mines (ASX:MRD) is down 91 per cent since the start of 2018.

The company is exploring for nickel, copper, cobalt, silver and gold in the prolific Fraser Range region of Western Australia.

The Fraser Range region shot to fame back in 2012 when Sirius Resources uncovered the Nova-Bollinger nickel, copper and cobalt mine that eventually sold to larger rival Independence Group (ASX:IGO) for $1.8 billion.

This prompted a mad scramble by other explorers to pick up land in the area, followed by Independence striking numerous deals with the juniors to stitch up a large chunk of prospective ground.

Successful prospector Mark Creasy, who was also a partner in the Nova-Bollinger discovery, recently made a new nickel, copper and cobalt discovery called “Silver Knight”.

This prompted Mount Ridley to review the data for its namesake project to identify targets for further testing.

The company revealed in August that drilling at the project had been delayed due to “drilling difficulty”.

White Cliff Minerals (ASX:WCN) is also facing a few problems, including an attempt to have one of its directors evicted.

The stock has fallen 91 per cent, starting its downhill slide back in April.

White Cliff announced in August that it was divesting non-core projects and undertaking a share consolidation.

The company wanted to crystallise the value of its Australian cobalt and nickel projects.

But in mid-December White Cliff received a “249D” notice calling for a meeting to be held to allow shareholders to vote on the removal of director Rodd Boland.

At the same time, the company announced the exit of chairman Jack Gardner and the appointment of Nicholas Ong and Daniel Smith as directors.

On a tear

Just 13 of the 153 ASX listed small caps that have exposure to cobalt increased in value during 2018.

The biggest gainer was diversified explorer Admiralty Resources (ASX:ADY), which added 126 per cent to its share price since the start of the year.

The company’s key focus is its Mariposa iron ore mine in Chile, but it also has a cobalt and nickel project known as “Pyke Hill” in Western Australia.

Admiralty’s shares spiked in April after it received long awaited approvals to start mining iron ore in Chile.

The company took out seventh spot in Stockhead’s Top 10 resources small caps for 2018.

Cohiba Minerals (ASX:CHK) has climbed 40 per cent since January.

The company acquired Cobalt X in mid-2017 which has several cobalt exploration licences in Queensland.

But its shares took off in late November in response to news of BHP’s (ASX:BHP) big copper discovery, 65km southeast of its mammoth Olympic Dam operations in South Australia.

Cohiba has land right next door and told investors it was stepping up its exploration effort in light of BHP’s spectacular find.

Stockhead is proud to use MakCorp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to MakCorp’s website.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.