Oil stocks guide: Here’s everything you need to know

Oil still excites Pic:Getty

Despite all the hubbub surrounding renewable energy, the world is still driven by oil.

And it shows, despite the uncertainty in today’s markets, oil prices have risen over the past 12 months with some significant dips and gains along the way.

During this period, the benchmark Brent Crude climbed 26 per cent to $US68.20 ($97.77) per barrel while the West Texas Intermediate, which is the benchmark for a third of the world’s oil production, rose 36 per cent to $US61.72 per barrel.

What is oil?

We all know oil as the fuel that powers our trucks, ships, planes and cars. Even if you’re one of those folks rocking an electric vehicle, there’s a pretty good chance that the electricity you are using is generated from fossil fuels.

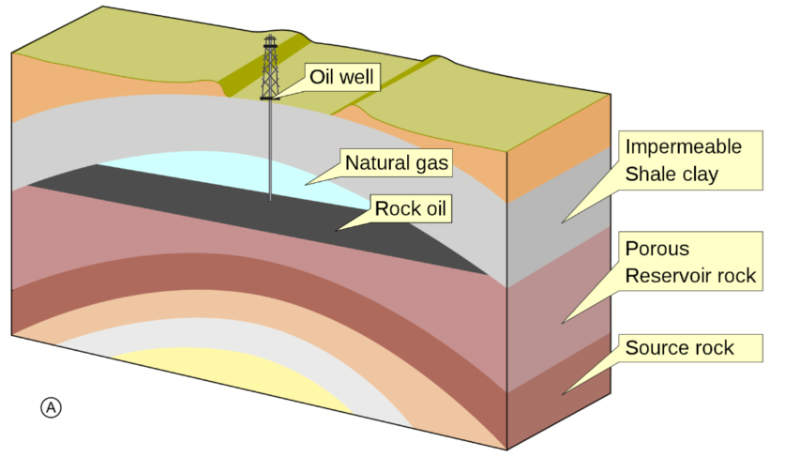

It was formed when large quantities of dead organisms such as plankton and algae were buried underneath sedimentary rock. Over millions of years, this organic matter was subjected to intense heat and pressure to form both oil and its stablemate gas – collectively known as hydrocarbons.

Over time, these hydrocarbons rise up and if the conditions are right, get trapped in areas where permeable rocks – carbonates and sandstones that have lots of pores within them – are covered by rocks with low permeability that prevent the hydrocarbons from escaping.

Some enterprising explorer then comes along and sinks a well into the hydrocarbon reservoir and if all the conditions are right (rocks that are permeable enough, a large enough resource, etc), then oil gets produced to surface where it gets sent to refineries to be converted into a myriad of products.

These include petrol, diesel, aviation fuel, bitumen (which you drive on), and plastics. Basically, all the hallmarks of the modern world.

Australia is estimated to host about 0.3 per cent of the world’s oil reserves according to Geoscience Australia.

Most of this comes in the form of light condensates and liquefied petroleum gas associated with giant offshore gas fields in the Browse, Carnarvon and Bonaparte basins, while oil reserves have also been identified in the Cooper/Eromanga, Gippsland and Perth basins.

Demand driving ASX oil stocks

Oil prices could well continue climbing in 2020 with the International Maritime Organization’s (IMO) looming January 1 deadline requiring all ships to use low sulphur marine fuels.

While some sources have made wild forecasts about prices rising to Armageddon levels, others have taken a more cautious approach, with S&P Global Platts head of analytics Chris Midgley suggesting that oil prices could see modest gains from the influence of the IMO’s decision.

At the other end of the spectrum, the US Energy Information Administration actually expects crude oil prices to be lower on average in 2020 than in 2019 due to forecast increases in global oil inventories – particularly in the first half of next year.

Investing in ASX oil stocks

Carnarvon Petroleum (ASX:CVN) has been one of the success stories thanks to its ground-breaking Dorado oil discovery in the shallow waters off Australia’s northwestern coast that flowed more than 11,000 barrels of black gold per day during testing in October.

Carnarvon’s operating partner Santos (ASX:STO) recently said that a liquids development with gas re-injection was currently the preferred development model for the project.

Senex Energy (ASX:SXY) – and its predecessor Victoria Petroleum – is a veteran of Australia’s oil and gas scene with a focus on the Copper and Surat basins.

While the company has been increasing investment on its gas assets, oil still accounts for more than half of its total production, with about 180,000 barrels of oil produced during the September 2019 quarter.

Red Sky Energy (ASX:ROG) notched a bit of a win earlier this year after it signed up Santos as a partner for its Innamincka Dome projects.

While the agreement will see Red Sky cede the majority of its ownership to Santos, which can earn up to 80 per cent in the various licences such as the Flax and Juniper oil and gas projects, the company will also enjoy a free ride courtesy of the oil and gas major.

Buru Energy (ASX:BRU) has experienced its share of ups and downs since it was founded more than a decade ago in 2008.

Now the company appears to be on the cusp of a major boost to its oil production following the successful tie-in of the Ungani-7H horizontal production well, which almost doubled field production up from about 940 barrels per day in the September 2019 quarter to 1700 barrels per day.

Out of Australia, White Bark Energy (ASX:WBE) looks set to further increase its oil production in Canada with the start of flowback operations from its Rex-3 well at the Wizard Lake project.

It recently cleared debris that was blocking nearly two thirds of the Rex-1 horizontal section, which suggests that the well’s daily production of 340 barrels of oil equivalent was coming from the third of the wellbore that was not obstructed.

Winchester Energy’s (ASX:WEL) push to accelerate exploration and development of its Permian Basin project in Texas continues to pay off with its Lightning prospect discovery well Arledge 16#2 looking set to be a substantial oil producer.

The company is also continuing development of the nearby Mustang oil field with further low-cost and low-risk wells.

Bass Oil (ASX:BAS) is ramping up oil production at its 55 per cent-owned Tangai-Sukananti KSO in Indonesia with the company recently bringing the Bunian 5 well online.

Monthly production in November 2019 averaged 975 barrels per day, up 36 per cent from October.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.