World Marvels as Byron Bay home values crash hardest just months after being crowned Asgard Of the Ultra Rich

News

News

As we breathlessly reported in March last year, Le Byron was declared in Knight Frank’s 2022 Wealth Report the world’s toppest residential gala address for the painfully rich, with the property group predicting Byron’s absurdist luxury appeal would continue to see home values there bulging with the scale and beauty of a Hemsworth pectoral.

KF reckoned Byron had another 35% more of muscle mass to pile on over the next five years.

I mean the portents were all there. Byron’s popularity went ‘nanas as the pandemic came knocking back in April 2020 and the tired, the bored and the semi-elite left the major cities in droves for warmer climes – just not Queensland – and the prices went nutso.

In April 2022 Byron Bay home values were up 212% over the preceeding 20 years – but that’s misleading, because most of that growth has come in since around the time The Hulk’s friend started taking selfies there.

Thor Hemsworth, his sinewy wife, actor, producer, mother and model Elsa Pataky, and their 28 gifted children had already set up shop in the hinter-jungle of Byron-Asgard back in Marvel Phase 1, triumphantly moving into their handmade $30 million Many-Hectared, Mutli-Bedroomed rainforest estate with lashings of media rooms, gymnasiums, spa-sauna, time machines and so forth a few years later in Phase 2.

Thor’s worthless half-brother Loki-Liam still has a rented group flat round the corner, while many other Avengers and Almost Avengers have added lustre to the once sleepy hippy retreat. There’s also been Matt Damon and Zac Efron.

But despite them and perhaps because of Natalie Portman, the Byron Bay council’s annual house price growth peaked 44% in the 2022 March quarter… and then halved in the year to June ’22 to a just fabulous 20%.

In December, Byron copped a more fabulous 20.5% plunge in house values – the average beach hut crashing to a mere $2.3 million, according to CoreLogic’s annual Best of the Best report.

Now the schadenfreude is dripping from the maw as the entire Richmond-Tweed – that’s including Byron Bay and surrounds – suffered the sharpest declines in home values.

So very rapidly reversing some of the steroidal weight gains of the pandemic.

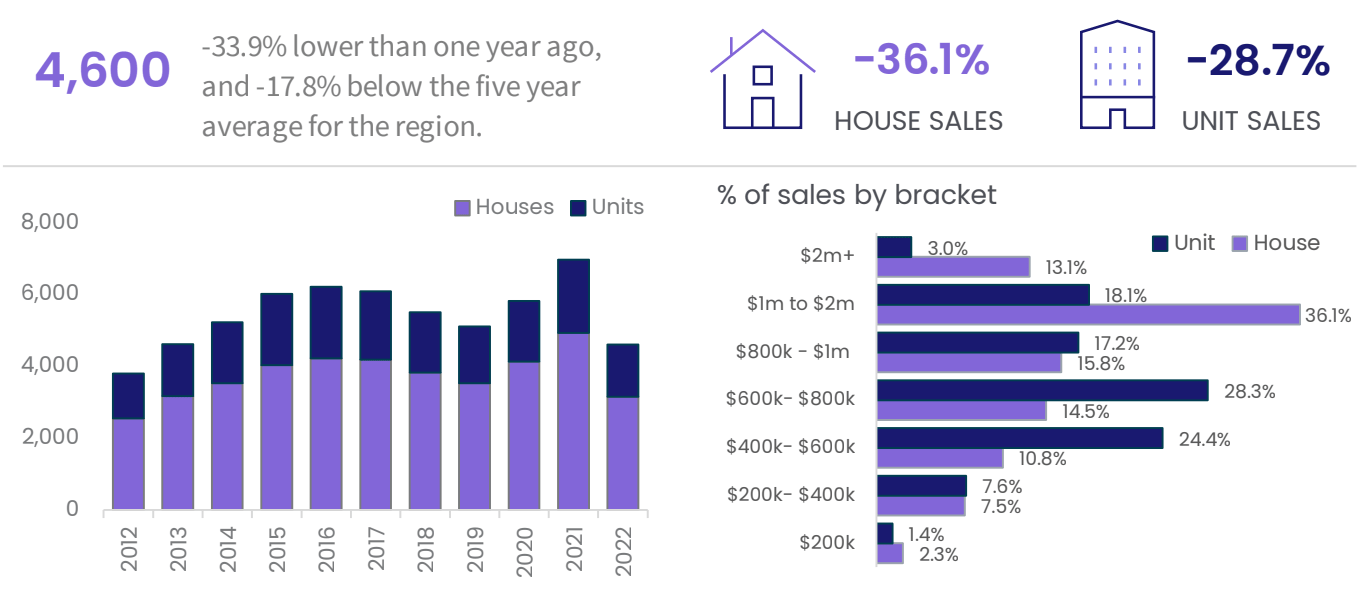

House values sank 18.6% for the year to January 2023, with sales down more than a third.

Properties in the region posted the longest time on the market at 71 days, with vendors offering the largest discounts at -8.3% over the three months to January.

CoreLogic’s Head of Research Eliza Owen reckons it’s no surprise the region recorded the biggest retreat.

“This was the region where values skyrocketed, with houses increasing more than 50% during COVID, taking the median house value to more than $1.1 million.

“Since then much has changed with borders reopening, outbound travel returning, workers returning to the office not to mention the overlay of nine rate rises.

“It’s been a swift and significant shift.”

Straight to Phase 5.