With a shift in demand for wellness products, China’s reopening suddenly has investors excited again

China’s shift in demand to wellness products and the country’s reopening has investors excited again. Picture Getty

- China’s recent reopening has got investors excited again

- ASX companies like Roolife and EZZ Life Science are expected to benefit

- Stockhead reached out to Roolife’s CEO, Bryan Carr

There’s no sugar coating the fact that Australia’s relationship with China has been fractured since the height of Covid in 2020.

But China remains our largest trading partner and in 2021-22, we did almost $300 billion worth of trade with the world’s second largest economy.

It’s also worth noting that despite the political tensions, our two-way trade with China has actually increased, not decreased, over the last couple of years.

There’s also been encouraging signs that bilateral relations are starting to improve since Labor came to power in May 2022.

Last month, the Albanese government reached a deal that may lead to the removal of Chinese tariffs on Australian barley.

And last week, in the strongest sign yet the iciness is beginning to thaw, more than a dozen Aussie companies including Rio Tinto and Fortescue Metals headed to China. Trade Minister Don Farrell has also been extended an invitation to visit later this month.

It’s been a long two years for investors, but all of a sudden, the market is starting to get excited again about China.

CEO of Chinese focused company Roolife Group (ASX:RLG), Bryan Carr, said the market has a perception of China that’s often different from reality.

“If you look over the last few years, there’s been plenty of negative headlines about the Australia-China relationship,” Carr explained to Stockhead.

“But during that same period, exports to China actually increased despite specific exceptions such as Australian wines. So the actual data doesn’t align with the perception.”

Revenge spending

Carr believes there is now a great opportunity to orientate the story back to China.

“You’ve got a huge country that’s coming out of Covid restrictions, with strong pent up consumer demand and increased savings,” he said.

“And they’re coming out and essentially revenge spending.”

Official Chinese data released in mid April does support that theory.

According to the report, China’s economy grew faster than expected in the first three months of the year, with GDP growing by 4.5%. Meanwhile retail sales, the main indicator of household consumption, also jumped by 10.6% compared to a year earlier.

“There’s definitely surging demand from Chinese consumers, and a greater degree of confidence and optimism from Australian businesses looking to go into China,” said Carr.

Roolife facilitates and accelerates that market entry, providing everything required for a foreign brand (not just Australian) to compete and hit the ground running in the Chinese market.

The company has struck a partnership with the biggest online platform in China, Alibaba, as well as supermarket chain Freshippo Stores (also owned by Alibaba) – allowing its Remedy Drinks range to be available in over 500 physical points of sale across the country.

“What we want people to understand is that the there is still a very strong growth trajectory in China,” Carr said.

“Yes, the growth is not as aggressive as it has been over previous years. But it’s still going to be contributing a third of the world’s growth over the coming year.

“So it’s the right market to be in at the right time.”

Shift to wellness products

Recent data also shows that there’s been a major shift in China’s shopping habits.

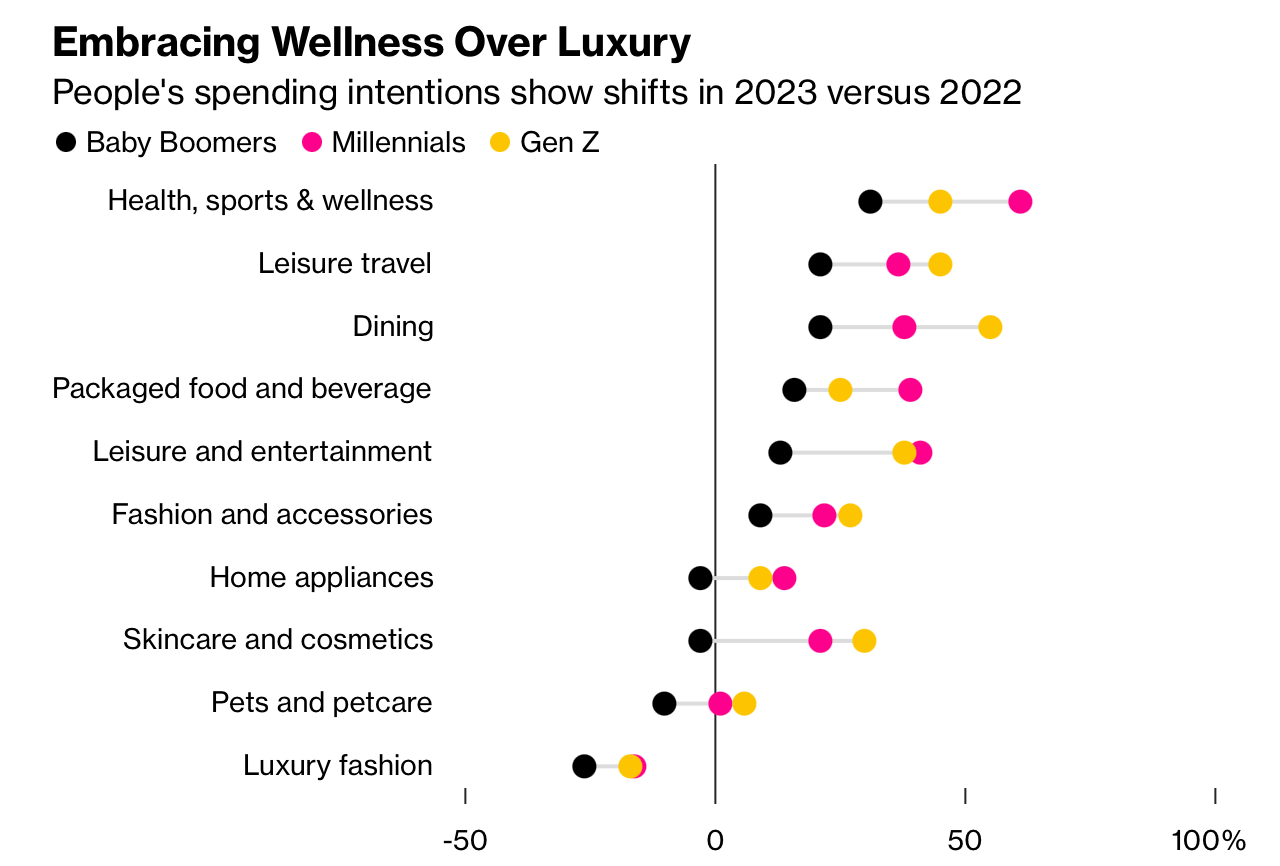

According to international consultancy Oliver Wyman, Chinese millennials — those born between 1981 and 1996 — are embracing wellness over luxury products.

“We’ve very much seen an evolution driven by increased health awareness as a consequence of Covid, where generally people have become more focused on health,” says Carr.

Against that backdrop, Carr is seeing a lot of demand for products like the lower sugar kombucha drink that it sells, as well as supplements and vitamins.

“We’ve also seen very good growth and interest in pharmaceutical products from the Chinese,” he added.

Roolife has made efforts to cash in on this trend by launching its own brand VORA, a 100% plant based protein drink.

“We’ve got the ability to respond very quickly to identify product demand, and to sell it under our own label obviously increases our margins,” Carr said.

Big opportunity in Southeast Asia

Carr also believes the demand in Southeast Asia over the next 20 to 30 years will be extremely strong, and that’s one of the reasons the company launched the VORA label.

Southeast Asia is one of the most significant economic engines in Asia Pacific.

With a total population of almost 700 million people, the so-called ASEAN bloc accounts for a tenth of Asia Pacific’s (APAC) economy in 2021.

By 2030, countries such as Indonesia, the Philippines and Vietnam are poised to see stronger growth than the overall APAC region, including China.

“We see Southeast Asia as a natural extension for us to be able to broaden our offering across the whole of Asia,” said Carr.

“We’re currently looking at Singapore, Thailand, Vietnam and Indonesia for growth opportunities for the particular types of products that we offer.”

Roolife share price today:

ASX companies with markets in China and Southeast Asia

Other ASX companies that are trying to grab market share in China and the fast growing Southeast Asian market include:

EZZ is a life science company that has the exclusive distribution rights for the EAORON brand of skin care products to pharmacies, supermarkets and specialist retailers in Australia and New Zealand.

In 2020, the company launched its own internally developed brand of health care supplement products, which it distributes to retailers across Australia, New Zealand, and China.

The company has recently released three new products with approval from the Therapeutic Goods Administration (TGA) to complement the existing range of EZZ branded products currently in the market.

The three new products are: EZZ Children’s Eye Health, EZZ Magnesium Plus, and EZZ Sugar Metabolism.

EZZ said these new products were developed for both local consumers in Australia and for export, particularly to Asia, following extensive market research.

The company has been successful in selling its branded products on multiple distribution channels in China.

For example, EZZ participated in the world’s largest online shopping event, Alibaba Group’s 11.11 Global Shopping Festival in China in 2022, achieving sales of $2.56m at the 1-day event, an 8-fold increase on the previous year.

EZZ has said that a e-commerce is key to its penetration in key markets like China and other parts of Asia, where it has plans to expand to in the near future.

Pure Foods was formed in 2015 with the aim to enhance and promote Tasmania’s premium food and beverage businesses.

PFT’s brands and businesses include Woodbridge Smokehouse, Tasmanian Pate, Daly Potato Co, Pure Tasmanian Seafood, Lauds Plant Based Foods, The Cashew Creamery and New Pastures.

Outside of the domestic market, PFT has created broader distribution via exports, including e-commerce in Asia, with strategic partnerships in places like Hong Kong.

Other footprints in Asia include Indonesia, Singapore, Malaysia and Vietnam.

The company says it sees a large export opportunity with an Asian customer, but also more broadly a potential to serve Asian customers with its 100% Tasmanian-based meal solutions.

Share prices today:

At Stockhead we tell it like it is. While Roolife Group and EZZ Life Science are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.